- The US Internal Revenue Service issues Microsoft with additional tax demand for US$28.9 billion.

- National’s proposed foreign buyers tax, new data from the ATO on the Australian experience.

A couple of weeks back I spoke to Susan Edmunds regarding the state of child support debt which as of 31st August amounted to $1.079 billion, $488 million of which represented penalties. I made the point that in my view the Child Support late payment penalty regime is ineffective and it’s time to rethink the system. At present Inland Revenue keeps having to write off a substantial amount of uncollectable debt.

RNZ subsequently contacted me about this issue and on Thursday morning, together with Tauranga’s Bay Financial Mentors manager Shirley McCombe, I spoke to Kathryn Ryan on Nine To Noon about the matter.

It so happens I first spoke to Nine To Noon about child support debt back in 2013 and for the year ended 30th June 2013, child support debt amounted to just under $2.8 billion, of which over $2.1 billion or 76% represented penalties. The system underwent a bit of a tweak that year, and it’s also subsequently gone through further revisions. The penalty regime which now applies is that if you miss a payment, there’s an initial 2% penalty and then if the payment is not made in full within a week a further 8% penalty is applied. Just for the record, those penalties are double what would be charged if you missed a tax payment.

To reiterate what I told Nine To Noon and Stuff, this is really odd because Inland Revenue’s role in the child support regime is acting as an intermediary. It collects the payments from what are called the “liable parents” and then passes it on to the relevant parents who have care of the children. Why therefore should late payment penalties for missed child support be twice that for someone not paying their tax on time? This was a question I was asking ten years ago and it still hasn’t been answered satisfactorily even if the level of penalties have changed.

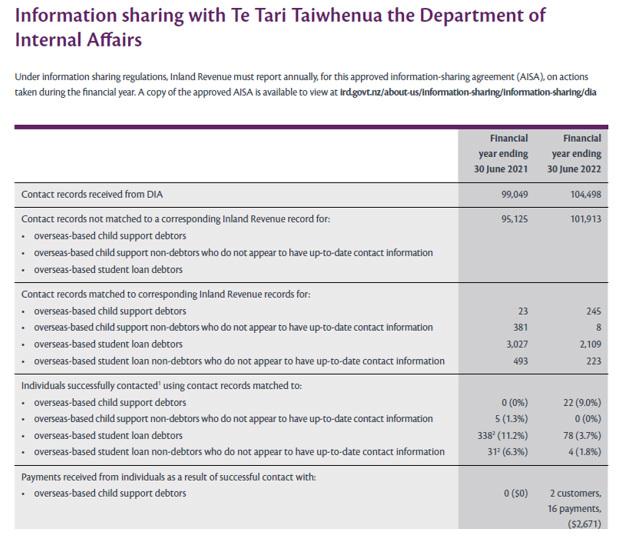

When I was preparing for the call, I came across some quite startling statistics which indicate that Inland Revenue really has not been doing enough in this space for well over four years. Each year Inland Revenue’s Annual Report includes a report on the information sharing it has done with the Department of Internal Affairs. The latest report can be found on page 209 of the report for the year ended 30th June 2022. (The June 2023 report is due any time now).

The report sets out the number of “contact records’ received from the Department of Internal Affairs. Inland Revenue then tries to match this information with its own information regarding overseas based child support debtors. (The same principle also applies for overseas based student loan debt).

Once you start digging into the annual reports, not just for the June 2022 year, but looking back, it becomes very apparent quickly that Inland Revenue really hasn’t been doing an awful lot in this space. Keep in mind the current amount of Child Support debt is well over $1 billion and that’s after substantial amounts of debt have been written off over time.

What’s happening with chasing overseas debtors?

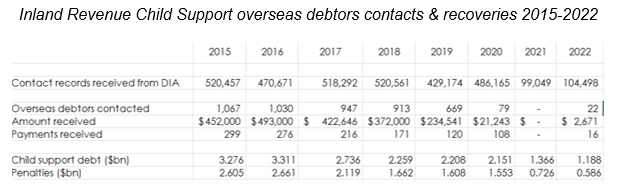

This report showing contacts from the Department of Internal Affairs started being first recorded in 2015, which is also when Inland Revenue acquired the ability to share and exchange data with Australia. Going through Inland Revenue’s annual reports, what we can see is for the year ended 30th June 2019, 669 overseas debtors were contacted by Inland Revenue, which was a 47% hit rate, but that resulted in the grand total of $234,541 in overdue child support. Again, keep in mind for that year the amount of child support debt at 30th June was $2.2 billion, of which $1.6 billion was penalties.

However, for the year to June 2020 only 79 overseas debtors were contacted resulting in payments totaling $21,243. In the year ended 30th June 2021 no overseas debtors were contacted, so Inland Revenue received nothing. To be fair, throughout the whole of that year Inland Revenue was very heavily engaged with the Government’s COVID 19 response. On the other hand, as things began to normalise during the year ended 30th June 2022 Inland Revenue managed to contact just 22 overseas debtors which resulted in payments totaling $2,671.

To put it simply, Inland Revenue’s enforcement in this area seems to have fallen off a cliff. Yes, the pandemic has caused enormous disruption to their systems and it’ll be very interesting to see where they’ve got to in 2023. I know they’ve been more active in the student loan debtors area, so I would expect to see a big uptick in these numbers.

Not just a COVID-19 problem

But if you go back before the pandemic, for example, for the year ended 30th June 2018, 913 debtors were contacted, which resulted in payments of $372,000. However, remember that for June 2019 that number fell to 669, resulting in $234,000 being collected. So Inland Revenue efforts in this space have been declining.

In fact as the following graph illustrates incredibly the highest amount of child support debt recovered from overseas debtors was $493,000 in the June 2016 year when the total debt was $3.3 billion, of which $2.66 billion or 80% represented penalties.

(Source Inland Revenue Annual Reports June 2015-2022)

Inland Revenue also has the ability to issue deduction notices, which we’ve talked about earlier, where they can tell someone who’s making payments to the child support debtor, to deduct 10%, 20% from any payment made to that person and pay it to Inland Revenue. In some cases, Inland Revenue can tell a bank to take money directly from a bank account and pay it to Inland Revenue.

Inland Revenue can also, as a last resort, apply to the Family Court for a warrant for the arrest of a person to prevent them leaving New Zealand until the debt is either paid or put on to an arrangement. 22 such warrants were issued for the year ended June 2018. But for each of the June 2019 and June 2020 years only four such warrants were issued. No such arrest warrants were issued in either of the years ended 30th June 2021 and 30th June 2022. In fairness that’s probably because the pandemic made moving in and out of the country very difficult in both years.

Nevertheless, you can still see that there’s a decline in the use of these tools by Inland Revenue. And that seems to underscore my belief it has not been as across this debt issue as much as it should have been. Inland Revenue declined to be interviewed by RNZ for Nine To Noon, and I have no doubt they will say that they have been very busy with dealing with the pandemic, but that’s only since March 2020. As I explained the decline in action pre-dates that.

Notwithstanding the impact of the pandemic the question arises whether Inland Revenue has ever had the right resources dealing with this issue? Remember with Child Support running into billions of dollars and a substantial number of people apparently moving overseas and not continuing to pay their child support has Inland Revenue devoted enough resources to the problem? From the numbers I can see the answer would be no, it hasn’t.

In my view the penalty regime doesn’t work. Looking at it overall I think there’s quite a big “Please explain” to be asked by whoever becomes Revenue Minister following the election.

Time to rethink child support generally

The current Child Support system was set up in 1991, and it was designed to speed up the process and bypass the cost of going to family court to get court orders for support and maintenance when the parents can’t agree. This is why Inland Revenue was introduced as the intermediary and I think this is a good principle.

About 30% of all child support is not paid on time. One of the other issues which emerged when researching this is that apparently the majority of those using the regime are beneficiaries. And it does appear to be that if this is the case, what will be interesting to know is how much of the debt relates to beneficiaries. As I told Nine To Noon older statistics suggested it well over 50%. This debt issue is perhaps a by-product of something that’s been talked about a little bit during the election campaign that the level of benefits we are paying are insufficient for people to support themselves.

Through the combination of a means testing programme and an ineffective penalty regime we’ve created an administrative headache where the Government is charging penalties on debt it will never recover. It seems to me that after 30 years we’ve got enough experience to see that it’s time to for a rethink. This is something for a new government to pick up. However, I was speaking about these very same issues ten years ago, so I’m not holding out much hope for rapid improvement happening anytime soon.

Uncle Sam demands US$28.9 billion from Microsoft

Moving on, overnight it emerged that the United States Internal Revenue Service, the IRS, has issued what are known as Notice of Proposed Adjustments against Microsoft in relation to underpaid tax of US$28.9 billion (plus interest and penalties) for the 2004 to 2013 tax years. These were issued on 26th September and Microsoft made the news public as part of its regular public filings.

The primary issues relate to intercompany transfer pricing. Microsoft’s response is that it thinks its allowances for income tax contingencies are adequate, it doesn’t agree with the proposed adjustments and will contest them. However, it acknowledges the dispute is going to take more than 12 months to be resolved.

Microsoft has a market capitalisation of nearly US$2.5 trillion so $28.9 billion plus interest in penalties is perhaps small change in the scheme of things. But it is interesting to see that this has developed, including the period of time involved, we’re talking about transactions which occurred 19 years ago. It just shows how slow these tax dispute processes are.

I imagine Inland Revenue and other tax jurisdictions (particularly the Australian Tax Office) will be watching this very carefully. It may even be that they have been contacted by the IRS as part of this process. The information sharing which goes on between tax authorities is extensive but not well known by taxpayers. Microsoft’s transfer pricing practices will be under review ,and I guess it might have a ripple effect for other huge multinationals. The action highlights the need to find a new international tax framework. This is what the OECD is trying to do with its BEPS and Pillar One and Pillar Two initiatives. This case will be watched very closely and I will keep you up to date with developments as they arise.

Australian data on overseas purchases – a clue for National?

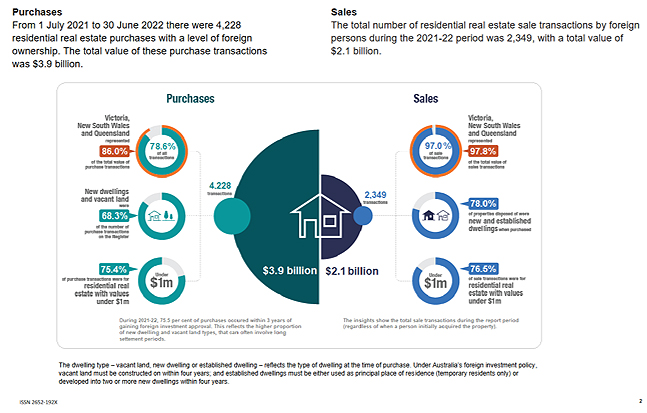

And finally, tax has been a fairly controversial headline throughout the election campaign for various reasons. One of the proposals which stirred up a bit of controversy was National’s proposal for a foreign buyers’ tax which would allow foreign non-resident buyers to purchase properties worth more than $2 million but they would have to pay a 15% tax for doing so. There’s been quite a bit of dispute over exactly how much revenue that will raise. I’m in the camp which thinks the numbers are very optimistic.

It so happens that the Australian Tax Office has just released some data relating to the number of residential real estate sales and purchases by foreigners throughout all of Australia for the year ended 30th June 2022. According to this report, there were a total of 4,228 residential real estate purchases, with a total value of A$3.9 billion. In the same period there were 2,349 real estate sales by foreign persons, realising a total of A$2.1 billion. By the way, those sales would have been subject to capital gains tax up to a pretty hefty 45%. Unsurprisingly, the majority of these transactions took place in Victoria, New South Wales and Queensland. About 86% of all purchases were in those states with 97% of all sales in the same states.

This is interesting data to see, in terms of pointers about the viability of National’s proposal, these Australian numbers may be pandemic affected. But it seems to me that given the relative size of Australia and the greater variety of property of interest to foreign buyers, I would have thought those numbers indicate National’s proposed numbers are on the whole optimistic. We shall have to see how the policy pans out.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.