- Tax Policy Charitable Trust Scholarship.

The just concluded UK general election was the first general election held in July since 1945, when coincidentally the Labour Party also won by a landslide ending Sir Winston Churchill’s wartime prime ministership. Before he became Prime Minister again in 1951, Churchill started writing his monumental six volume history of the Second World War, the first volume of which was titled The Gathering Storm.

And if you’ll pardon the somewhat laboured analogy, this is very much what’s happening with Inland Revenue at the moment. There’s a very clear gathering storm approaching as Inland Revenue pulls together and beefs up its investigation resources. We saw signs of this a couple of weeks back with its commentary about targeting smaller liquor outlets. Now last Wednesday, an Inland Revenue media release announced it is “honing in on customers who are actively dealing in crypto assets but not declaring income from them in their tax returns.”

By way of background, back in 2020, Inland Revenue updated its guidance on the tax treatment of crypto assets. Clearly that was part of a plan to follow through and check on who was trading and investing in crypto but not reporting the income. However, first COVID and then the cost-of-living crisis got in in the way of Inland Revenue’s intentions to follow through up its guidance.

Targeting non-compliance

But those immediate crises have passed now, and it appears that Inland Revenue has been busy investigating potential non-compliance because according to the media release late last year, it wrote to “a group of high-risk customers and gave them the chance to fix any non-compliance issues before facing audit.” This is a standard tactic of Inland Revenue. It basically puts it out to taxpayers without being too specific that it is aware of potential non-compliance and “invites”, that is the terminology used, the taxpayers involved to come forward and make a voluntary disclosure. If the taxpayers do so, then the potential to be charged shortfall penalties is likely to be greatly reduced.

Following on from these “invitations”, the next stage if the taxpayers don’t come forward is directly targeted follow up action. This appears to have just happened, as Inland Revenue is saying it has “just sent another round of letters to those Inland Revenue believes are not complying.

According to Inland Revenue it has data which has enabled it to identify “227,000 unique crypto asset uses in New Zealand undertaking around 7 million transactions with a value of about $7.8 billion.” There’s a potentially sizable sum of tax on the line here.

Pay up, or else…

The media release continues with a rather veiled threat

“Cryptoasset values have reached new highs, so now is a good time for people to think seriously about tax on their crypto asset activity. The high value also means customers are well positioned to pay their tax for the 2024 tax year and earlier.”

In other words, Inland Revenue is saying as values have recovered that means taxpayers can’t plead poverty when it comes to paying the tax due on their profits.

The media release goes on to explain something that we’ve said frequently; Inland Revenue has more data available to it than people realise.

“We want customers and tax agents to know that we are stepping up our compliance activity for customers with cryptoassets. Despite popular thinking – people are not invisible on blockchain and we have the tools and analytics capabilities to identify and expose cryptoasset activities.”

So there it is, very clearly stated ‘We know more than you think we know and we are coming for you.’ Part of this, by the way, is that New Zealand and therefore Inland Revenue has signed up to the new Crypto-Asset Reporting Framework (CARF) recently developed by the Organisation for Economic Cooperation and Development. This is yet another example of the growing international cooperation on the exchange of information, a regular topic on this podcast.

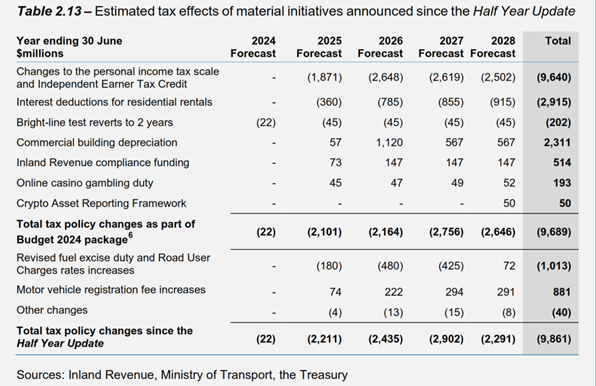

Under CARF the first set of reporting is due to apply from the 2026/27 tax year which will lead through to increased tax revenue. In fact, according to the Budget, the expectation is that CARF will deliver $50 million of additional tax revenue in the June 2028 year..

That’s in the future. What’s happening right now is that Inland Revenue has used its existing network of information exchanges and data sharing almost certainly by tax treaty partners such as Australia, the UK and the US, to obtain data about transactions carried out by New Zealand based crypto-asset investors and traders. It’s now going to put the squeeze on those it considers non-compliant.

It’ll be interesting to see what comes out of it and we will watch with interest and bring you news of developments. In the meantime you have been warned and this is of course the latest sign of the gathering storm of Inland Revenue investigations.

Inland Revenue kilometre rates for 2023-24

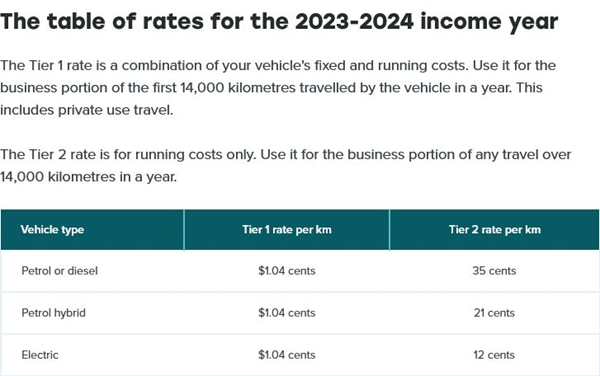

Moving on, Inland Revenue has just published its kilometre rates for the 2023-2024 income year. Unsurprisingly, given the recent rise in fuel prices, the so-called tier one rates show an increase in vehicle running costs that are allowable for the year. These rates may be used to calculate the deductible running costs for a vehicle.

Note that the Tier 1 rate of $1.04 for the first 14,000 kilometres applies to all vehicles whether petrol, diesel, hybrid or electric. The Tier 2 rates above the first 14,000 km DO vary between vehicle type.

This is good to know, but I do wonder whether it might be a bit more useful to have this sort of information earlier in the relevant tax year. Inland Revenue obviously wants to be accurate, but a different approach perhaps might be to adopt an interim rate and index that for inflation. Anyway, these are the rates that are now applicable for the 2023-24 tax year if you wish to claim the relevant deduction.

Are we raising enough tax?

And finally, this week, the Tax Policy Charitable Trust held an event on Thursday last night to announce its four finalists for this year’s Tax policy scholarship prize. The first half of the event was a panel discussion on New Zealand’s tax revenue sufficiency. Ably chaired by Geof Nightingale, a member of the last two Tax Working Groups, the four panellists that joined him were Talia Harvey and Matt Wooley, joint winners of the scholarship prize in 2017, Nigel Jemson, the winner in 2020 and Vivian Lei, the winner in 2022. You may recall Vivien, have previously been a guest on the podcast.

L-R Matt Woolley, Geof Nightingale, Vivien Lei, Talia Harvey and Nigel Jemson

Now, this was a fascinating panel discussion conducted under Chatham House rules, focusing on the scale of fiscal challenges for the next few decades and how could we meet those? Does this mean for example, some new taxes might be required such as capital gains tax? What about boosting Inland Revenue’s investigation efforts? And then on the spending side of the equation what do we do about rising health care and superannuation costs? Do we perhaps increase the age for eligibility or (re)introduce some forms of mean testing for New Zealand Superannuation? All these points were raised for discussion.

The panel discussed ‘the tax gap’, the gap between what we think the tax collection should be and what’s not being collected. There’s a lot of work to be done in this space, because we really don’t have a clear handle on the extent of this particular issue. Some work carried out several years ago by Inland Revenue suggested that when you look at the consumption patterns between self-employed persons and employees, there might be as much as a 20% gap. In other words, self-employed people appear to have about 20% higher levels of consumption than employees on ostensibly similar levels of income. This is a topic which actually might be worth a podcast episode in itself.

And the finalists are…

It was then followed by the announcement of the four finalists of this year’s Tax Policy Charitable Trust scholarship prize. Every two years the Tax Policy Charitable Trust invites young professionals (anyone under 35 on 1 January 2024) to submit proposals for review, improving any aspect of New Zealand’s tax system. Entrants submit a 1500 word overview proposal on any part of the tax system from which the judges choose four finalists will be selected to go through for the final main scholarship prize, which is worth $10,000.

Submissions are judged for their creativity, original thinking and sound and reasoned research and analysis. In addition the judges take the following factors into consideration:

- Impact on the New Zealand economy, including GDP and business growth.

- Social (including distributional equity) and environmental acceptability.

- Feasibility of introduction, including political and public acceptability.

- Impact on simplicity of tax system.

- Ease of administration by taxpayers and Inland Revenue, or other relevant government agencies, and impact on compliance costs.

This year, there were 17 entrants and the four finalists chosen are

Matthew Handford, who proposes an Independent Tax Law Commission aimed at improving the Generic Tax Policy Process, or GTPP. The GTPP is a cornerstone of tax policy and is internationally well regarded, but it’s now 30 years old, so is due a reconsideration. I look forward to hearing more about Matthew’s proposal.

Claudia Siriwardena, who is suggesting a simplified FBT regime for small and medium enterprises. This gets a big tick from me, and I’m very interested in hearing more about this one.

Matthew Seddon, who proposes extending the independent contractor withholding tax regime. Mathew’s suggestion picks up the point just raised about the tax gap and deals with it by improving compliance. Again, another interesting proposal.

Finally, Andrew Paynter who is putting forward a proposal to increase the GST rate from GST but also tackle the regressivity of GST with a rebate for low and middle income earners. I’ve seen some international papers on this particular topic, so I’m very, very interested to hear more about what Andrew’s proposing here.

My intention is to get all four scholarship finalists on the podcast to talk about their ideas before the winner is announced in October, so stay tuned for developments. In the meantime, congratulations to Matthew, Claudia, Matthew and Andrew and to everyone else who entered. No doubt there were some interesting ideas put forward that did make the cut this time, but overall, it’s a great sign of the healthy state of tax policy debate in New Zealand.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

(Originally loaded to Soundcloud 6 July 2024. On interest.co.nz 8 July 2024).