- How did Inland Revenue fare during the year?

- What challenges lie ahead for it and the incoming minister of revenue, whoever that might be?

This is the first year under the leadership of new Commissioner of Inland Revenue, Peter Mersi, who took over from Naomi Ferguson on 1st July 2022. It’s worth noting that Inland Revenue hasn’t had the easiest of 12 months. It did finalise its Business Transformation programme in the June 22 year, but during that period it was tied up very heavily with this and then the various COVID support programs. Those have wound down in the June 2023 year, but it got landed with the Cost of Living Payments program, which the last Government introduced in its May 2022 budget.

At first sight, the structure of the Annual Report seems similar to that of previous years, but there are several subtle differences in the presentation and layout and in the department’s apparent focus. Overall, the report feels a lot more readable and digestible than in previous years.

One of the first signs of a change of approach is the lack of reference to a mission statement. Instead, there’s a clear emphasis on Inland Revenue’s role and the benefits for everyone that it delivers. As one of the online bookmarks to the Annual Report notes, “the tax and social policy system is a major national asset which underpins the well-being of all New Zealanders.” Under the headline, “We deliver three long term outcomes for Aotearoa New Zealand” page ten of the report summarises these long-term outcomes as Revenue, Social policy payments and Collaboration.

A more collaborative approach

Now, the last point about collaboration is interesting because this is a point picked up in other places in the report. In fact, the reference to collaboration is new. The word was never used in last year’s report, but this year it is a clear theme and I think it’s a welcome development. The report also talks about partnerships noting,

“We work with many other parties to help manage and run the tax and social policy systems such as tax agents, employers, KiwiSaver providers, financial institutions and community groups such as Citizens Advice Bureau.”

The report also references the international cooperation, such as with the OECD and tax agencies in other jurisdictions. And it notes that it exchanges financial account information under the Common Reporting Standards and the automatic exchange of information with almost 100 jurisdictions. As I’ve said in previous podcasts, the depth and extent of the international information sharing exchanges that go on are not well understood by taxpayers. In fact, probably are underestimated by many.

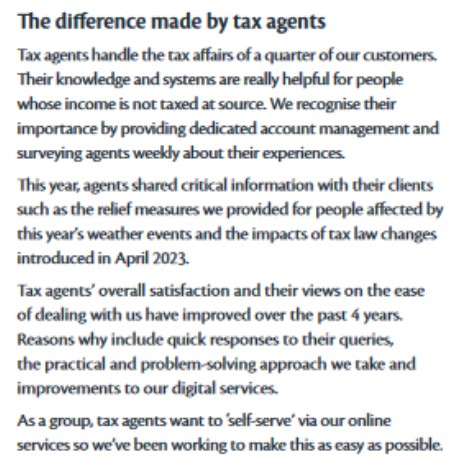

Reviewing last year’s report, I thought Inland Revenue had a bit of a bumpy relationship with tax agents, but I noted Peter Mersi was busy meeting representatives of professional bodies, clearly with the intention of addressing this particular point. And on the ground as tax agents we can see there’s been progress in this field, and we feel that there’s a definite shift in the attitude towards ourselves with greater cooperation.

It’s also made clear in the report that Inland Revenue sees tax agents as a vital part of the tax ecosystem.

This is a very welcome development in my mind and, as I said, mirrors what we’re experiencing on the ground. We certainly would like more support, such as easier phone access and definitely an updated playlist when we are put on hold. There are only so many times in the day I can hear Sierra Leone.

Overview of report

As I said, there’s a fresher feel to this year’s report which looks better organised and more readable for the general reader. If you’re wanting to dip into the report, page 11 sets out a good overview and then pages 14 to 38 summarise its work. There’s plenty of graphics and it’s very readable.

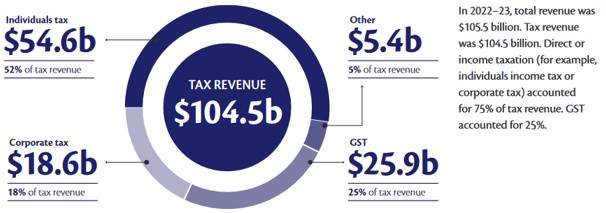

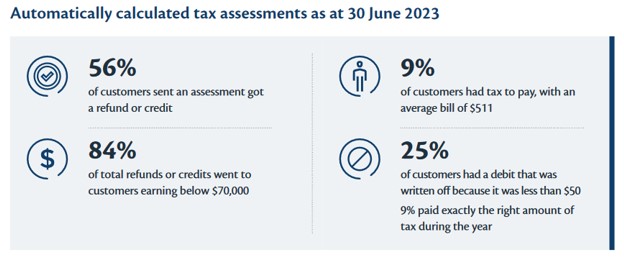

99% of income tax, GST and employment information returns are filed digitally, pretty near identical to the June 2022 results. It currently costs $0.43 to collect every hundred dollars of tax revenue. Back in 2015, that figure was $0.80 per hundred dollars of tax revenue.

Investigations and assurance – a mixed bag

I’m always interested about specific programs Inland Revenue has been running in the compliance space and I think this is a bit more of a mixed bag. According to the report it “identified or assured $973 million in revenue through our interventions.” This covers a number of initiatives. There is reference, for example, to advanced pricing agreements, which are prepared by multinationals in relation to agreements between a New Zealand subsidiary and its offshore affiliates. The idea is to make sure that Inland Revenue is satisfied that the transfer pricing regulations have been met and revenue is not being stripped out of New Zealand. Apparently 92 multinationals have active advance pricing agreements as of 30th June representing tax assured of about $440 million a year.

Real-time reviews

One of the other great things that the Inland Revenue has got as a result of business transformation, is the ability to pretty much live track applications that are being made. This topic is probably worth a podcast on its own to explain its capability. We understand from Inland Revenue presentations that it very carefully watched what was going on when applications for COVID support payments were being made.

With real-time reviews, if Inland Revenue sees something which on the face of it, looks incorrect it can take immediate action to defer payment or put that application under additional scrutiny before it’s paid out. According to Inland Revenue’s report, real time review of returns stopped, “$145 million of incorrect or fraudulent refunds or of or tax deductions at the time of filing”. Real-time reviews mean if a person is filing online and is constantly correcting a return and it appears this is because the person is after a certain result that will be identified by Inland Revenue for review.

International compliance

As I mentioned earlier, Inland Revenue is party to over 100 international information sharing agreements. According to the report Inland Revenue it received more than 600 voluntary disclosures over the last three years, resulting in more than $74 million in omitted overseas income now being assessed. That’s a bit of a surprise in my view and is probably on the low end in my view. We see quite a bit of movement in this area with people coming forward when they realise they haven’t complied with their obligations and we help them make the right declarations and pay the correct amount of tax.

In fairness this was an area, prior to the pandemic where in the wake of the introduction of the Common Reporting Standards on the Automatic Exchange of Information Inland Revenue was gearing up to throw quite a bit of resources at perceived non-compliance. Of course, that all went sideways, but with things sort of settling back down to a new normal, we may see Inland Revenue activity pick up again depending on resourcing.

Scope for more investigation work?

$397 million of the $973 million “assured” in the year stemmed from investigation work. Comparisons are not clear, but it appears well down on previous years. So, this is an area for improvement. By a perhaps slightly unfair comparison, the Australian Tax Office recently announced that it had picked up and collected an additional A$6.4 billion in the year to June 23 as a result of its tax avoidance taskforce.

This was a specific ATO initiative which scrutinised the tax returns and outcomes of the largest 1100 businesses and multinational groups in Australia to verify that they were paying the right amount of tax.

I expect Inland Revenue looked at that program and considered what lessons and opportunities a similar program might present. But it should be said that the Australian economy being bigger it also presents more opportunities for the ATO. The other thing about the Australian economy in transfer pricing terms, is it’s further up the value chain. In other words, more value can be created and captured in Australia, whereas New Zealand is more typically a price taker. Nevertheless, I think there’s room for improvement in the investigation space.

Increase in outstanding tax debt

As of 30th June, the total amount of general tax and Working for Families debt amounted to $5.8 billion. That’s up $600 million from the June 2022 year. At year end more than 524,000 taxpayers had a tax payment that was overdue although 315,000 owed less than $1,000. During the year Inland Revenue wrote off or remitted $754 million of debt compared with $689 million in 2022.

$231 million of the $754 million written off related to penalties and interest for taxpayers affected by COVID 19. In the wake of the pandemic if a taxpayer fell into debt as a result of COVID 19 Inland Revenue adopted a sympathetic view and was prepared to write off interest and penalties on such debt.

The rise in debt is a concern, but it’s a reflection of a number of things going on, not least of which the fact the economy is slowing down. Consequently, there are 44,000 more taxpayers with tax debt than in 2022. As ever, Inland Revenue’s working with those in debt to set up arrangements to pay off the debt. As I’ve said many times previously, if you’re in debt approach Inland Revenue and if you show serious intent to deal with the debt, it is generally willing to enter into an arrangement.

During the year they entered into 163,000 such debt arrangements. That’s up nearly 20% on the 140,000 for the previous year. As of 30th June 2023, there were still 77,000 active arrangements involving tax and student loan debt, which covered about $1.6 billion or just over a quarter of all debt.

Incidentally, on the measurement of tax debt to tax revenue, tax debt is about 5% of tax revenue, which isn’t bad by international comparisons, and certainly is an improvement on the 2013 year when it was nearly 10%.

More legal action

Inland Revenue also started to play harder with defaulters. It threatened legal action or issued notice of legal proceedings against 2850 taxpayers and 35% of those promptly settled in full or set up an arrangement. It’s also issued a thousand statutory demands involving other defaulters. I think we can continue to see expect to see the level of legal action continue to rise during in the current year.

More new hires

The key to any organisation is its people. And after the upheaval of business transformation which saw Inland Revenues workforce fall by 25% between June 2018 and June 2022 this is the first year since June 2015 that there were actually more new hires than exits. Inland Revenue’s total workforce rose by a net 203 persons, or 5.2% to 4,130. Staff turnover was 10.1%, which is a big improvement on last year’s 18.7%.

As for the profile of Inland Revenue, two thirds of its workforce are women. The average age of staff is 45.3, with an average length of service of 13.7 years. Now, the length of service has fallen in recent years, but it’s an improvement on the 11.1 years’ average service in the June 2014 year.

How much does all of this cost?

What’s interesting is that Inland Revenue didn’t spend all the appropriations it received from the Government for the year. The appropriations budgeted for the year was $735 million, but it actually only spent $691 million. That underspend of $44 million was partly due to challenges recruiting staff in the tight labour market and the timing of residual transformation activities. That underspend is going to be transferred to the current year subject to confirmation by ministers.

The operating expenditure on contractors and consultants fell to $42 million from $75 million in the previous year. And apparently the ratio of contractors and consultants operating expenditure to workforce spend was 10.3% this year, compared with 17.6% now.

Last year I noted that the Department had devolved authority to Madison Recruitment Ltd to provide extra staff, which didn’t terribly impress me because I think delegating authority outside the public service is not something a revenue authority should do lightly.

Inland Revenue engaged Madison Recruitment again in June 2022 to provide contingent labour to help with the roll out of the Cost of Living Payment scheme and wrap up of the COVID 19 support work. This engagement finished on 16th December 2022.

Areas for improvement

There are three specific areas where I think there is potential for improvement. Firstly, underspending by $44 million even allowing for a tight labour market is a bit of a concern. And so, I’d want to make sure that the appropriations are fully utilised to build the appropriate capacity.

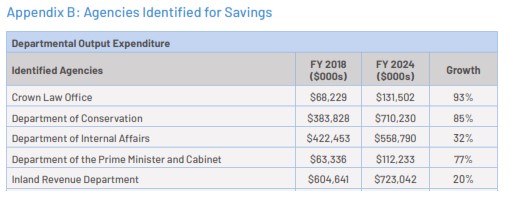

And on this I would just say that during the election campaign, National campaigned on cuts to civil service and Inland Revenue is one of those departments identified for savings. As I’ve noted, Inland Revenue has lost a quarter of its staff since 2018. In fact, if you look at the numbers National used for their policy, you can see that the increase in Inland Revenue’ spend since 2018 was 20%, whereas inflation since June 2018 is 23.4% (based on the Reserve Bank’s inflation calculator).

In other words, Inland Revenue has not been increasing its staff and spend above inflation. The Business Transformation program has delivered quite a lot and the report has some very interesting commentary on this. The estimated cumulative reduction in compliance costs for SMEs is thought to be around $925 million. The cumulative additional Crown revenue was expected to be $1.86 billion for the year and next year it projected a $2.8 billion. Internal Revenue is achieving its goals, but there’s always room for improvement. If the incoming Government’s finances are going to be tight which is what we’ve heard, it seems odd to be proposing reductions for a department which is actually very efficient and which gets a very good return on investment.

Getting better returns on investment

That said two of the areas where added investment measures return between $7 or more per dollar invested would be investigative capacity and debt management. In the area of debt management generally, we appear to be in the downside of the economic cycle so debt is bound to rise and to some extent there’s little Inland Revenue can do about that.

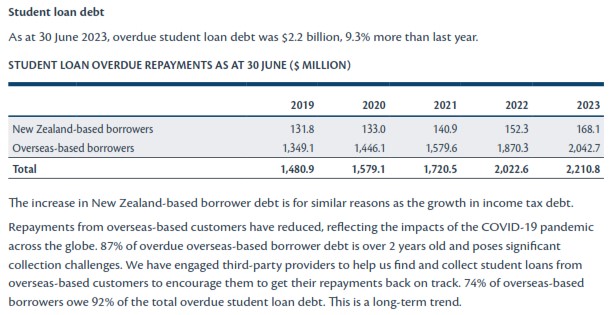

Student Loan debt a major area for concern

But there is an area where I think Inland Revenue really should and could be doing a lot more, and that’s in the student loan debt sector because the numbers are really quite large. The total amount of student loan debt rose by over 10%. And it’s particularly increasing in relation to overseas based borrowers.

Inland Revenue ran a specific campaign in May this year to remind those overseas based borrowers who had missed payments due on 31st March. It contacted nearly 75,000 such borrowers resulting in over 3000 instalment arrangements. But at this stage, the amount of overdue student loan debt now stands at $2.2 billion and over $2 billion of that is overseas based borrowers.

And this is where Inland Revenue does not seem to be as on top of the issue as it should be. I talked previously about the agreement with the Department of Internal Affairs in relation to child support. The same information sharing agreement is used to track down student loan debtors. During the year Inland Revenue received nearly 237,000 contact records from the Department of Internal Affairs. Through cross-checking its records for overseas based student loan defaulters, it managed to get hold of 88 defaulters resulting in 108 payments totalling $16,421. That’s pretty average, to put it mildly.

Time to rethink the Student Loan scheme?

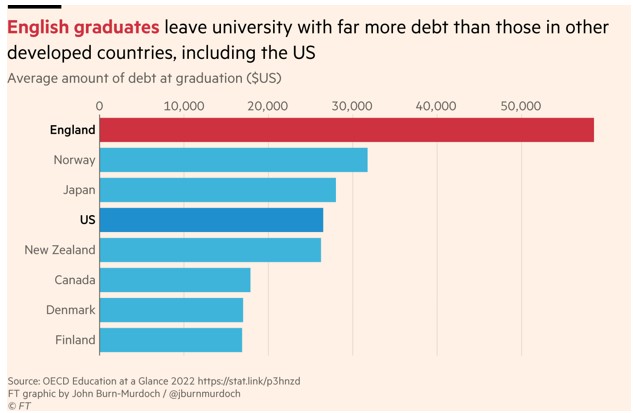

If we are looking at where to put extra resources, then there’s something else we need to think about in this area. Just adopting a big picture approach here maybe we should ask whether in fact the student loan scheme is achieving what we want. I came across a graph in the Financial Times which noted that English graduates leave university with far more debt than those in other developed countries, including the US. English graduates were leaving with debt in excess of USD50,000 (NZ$85,000). New Zealand graduates are just below the US with USD26,232 or NZ$45,550 on graduation.

And we have a large diaspora with over a million Kiwis overseas. We have a large amount of overseas student loan debt, but we also have a skills shortage. I just wonder whether as well as trying to find a better way to manage that debt we should be thinking more about encouraging people who’ve taken on student debt to stay here to meet those skills gaps maybe through debt moratoriums.

I would say overall for Inland Revenue it’s been a good year mostly, a difficult one at times, but it’s done a good job. However, I think the issue of debt management needs to be addressed swiftly and be properly resourced.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.