28 Mar, 2022 | The Week in Tax

- Inland Revenue’s proposal for a big stick to counter top tax rate avoidance

- Potential tax changes make a difference to the cost of living

- What you should do to get ready for tax year end

Transcript

Last week I mentioned that Inland Revenue had released a discussion document, Dividend Integrity and Personal Services Income Attribution, which set out its proposals for measures to limit the ability of individuals to avoid the 39% or 33% personal income tax rate through use of a company structure. This is what we call integrity measures designed to support the integrity of the tax system. In this case, the proposals are to support the objective of the increase in the top tax rate to 39% and to counter attempts to avoid that rate by diverting income through to entities taxed at a lower rate.

Now this paper is pretty detailed and runs to 54 pages. There’s a lot in here which will get tax agents and consultants sitting upright and reading the fine print as in some cases they will be affected directly. It’s actually the first of potentially three tranches in this area. Tranches two and three will consider the question of trust, integrity and company income retention issues, and finally integrity issues with the taxation of portfolio investment income. And the reason for the last one is that portfolio investment entity income is taxed at the maximum prescribed investor rate of 28%, which is undoubtedly attractive to taxpayers with income which is now taxed at the maximum tax rate of 39%.

The Inland Revenue discussion document has three proposals. Firstly, that any sale of shares in the company by the controlling shareholder be treated as giving rise to a dividend for that shareholder to the extent the company and its subsidiaries has retained earnings.

Secondly, companies should be required on a prospective basis, i.e. from a future date, to maintain a record of their available subscribed capital and net capital gains. These can then be more easily and accurately calculated at the time of any share cancellation or liquidation. That’s a relatively uncontroversial proposal.

And thirdly, the so-called “80% one buyer test” for the personal services attribution rule be removed. This one will probably cause a bit of a stir.

The document begins by explaining these measures are required to support the 39% tax rate. There’s a lot of very interesting detail in this discussion, for example it notes that with the top tax rate of 39%, the gap between this and the company tax rate of 28% at 11 percentage points is actually smaller than the gap in most OECD countries.

But then, as the document says, “However, New Zealand is particularly vulnerable to a gap between the company tax rate and the top personal tax rate because of the absence of a general tax on capital gains.”

And so to repeat a long running theme of these podcasts, this lack of coverage of the capital gains has unintended consequences throughout the tax system. And this question of dealing with this arbitrage opportunity between differing tax rates is, in essence, a by-product of that.

As Inland Revenue notes, one answer would be to align the company, personal and trust tax rates. This was the case until 1999, when the rate was 33% for companies, individuals and for trusts. But this ended on 1 April 2000 when the individual top rate went up to 39%. And since then, the company income tax rate has fallen to 28%.

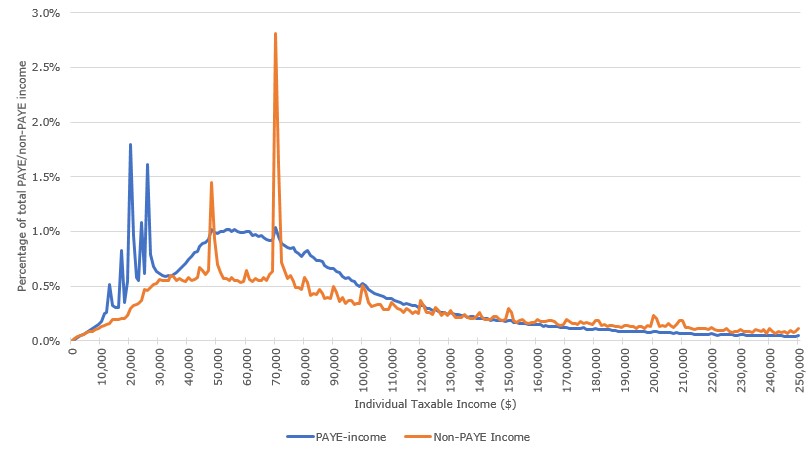

So this is a matter which needs to be addressed. There’s a really interesting graph illustrating the distribution of taxable income and noting there’s a huge spike at around $70,000, where the tax rate rises to 33%.

Taxable income distribution: PAYE and non-PAYE income

(year ended 31 March 2020)

There’s also some interesting data around what high wealth individuals pay in tax. For the 2018 income year, Inland Revenue calculated the 350 richest individuals in New Zealand paid $26 million in tax. Meanwhile the 8,468 companies and 1,867 trusts they controlled, paid a further $639 million and $102 million in tax respectively, indicating a significant amount of income earned through lower rate entities.

It appears to Inland Revenue that tax is being deferred through retention of dividends in companies.

The opportunity in New Zealand is that a sale of the shares under current legislation would bypass the potential liability on distribution. The shareholder is basically able to convert what would be income if it was distributed to him or her, to a capital gain. And clearly, the Government wants to put an end to that, but can’t because it doesn’t have a capital gains tax. The discussion document therefore proposes that any sale of shares in the company will be deemed to give rise to a dividend. This will trigger a tax liability for the shareholder.

The paper goes into detail around this particular issue, and I think this is going to be quite controversial. Because although I could see a measure where a controlling shareholder sells shares to a related party such as, for example, someone holding shares personally sells them to a trust or to a holding company, which they control. You could see straight away that Inland Revenue could counter this by arguing it’s tax avoidance.

But the matter gets more complicated where third parties are involved. And this is where I think the rules are going to cause some consternation because it proposes transactions involving third parties would also be subject to this rule. That, I think is where most pushback will come in on this position. Without getting into a lot of detail on this there could be genuine commercial transactions resulting in some might say is a de facto capital gains tax.

The proposal is not all bad. If a dividend is triggered, then the company will receive a credit to what is called its available subscribed capital, ie, its share capital, which can later be distributed essentially tax free.

In making its proposals, the paper looks at what happens in Australia, the Netherlands and Japan and draws on some ideas from there. It’s interesting to see Inland Revenue looking at overseas examples. All three of those jurisdictions, to my knowledge, have capital gains tax as well, but they still have these integrity measures.

But the key point is this question that any sale, will trigger a dividend. There’s no de-minimis proposed. This could disadvantage a company trying to expand by bringing in new shareholders. It might have to use cash reserves it wants to keep to pay the withholding tax on the deemed dividend. The potentially adverse tax consequences for its shareholders might hinder that expansion. I expect there will be a fair degree of pushback as a lot of thought will go into responding to this proposal. It will be interesting to see exactly what comes back.

Cleaning up tracking accounts

Less controversial and something probably overdue, is the proposal for what they call tracking accounts to cover the question of a company’s available subscribed capital, and the available capital distribution amounts realised from capital gains. Both of these may be distributed tax free either on liquidation or in a share cancellation in the case of available subscribed capital. But the requirement for companies to track this is rather limited, and these are very complicated transactions.

As the paper points out, the definition of ‘available subscribed capital’ runs to 40 subsections and 2820 words. So, there’s a lot of detail to work through, and if companies haven’t kept up their records on this, then confusion may arise if, say, 10 years down the track they’re looking to either liquidate or make a share cancellation.

I don’t see this proposal causing much controversy. I think Inland Revenue’s proposals here are fair and probably something that should have been done a long time ago. They will apply on a prospective basis, as I mentioned earlier on.

Personal services income attribution – a 50% rule?

And then finally, the third part deals with personal services income attribution. And what this part does is picking up the principles from the Penny and Hooper decision. This was the tax case involving two orthopaedic surgeons, which ruled on the tax avoidance issues arising from the last time the tax rate was increased to 39%.

The discussion document is basically trying to codify that decision. The intention is to put an end to people attempting to use what you might call interposed entities, lower rate entities, to avoid paying tax personally. The particular issue it’s driving at is when an individual, referred to as a working person, performs personal services and is associated with an entity, a company usually, that provides those personal services to a third person, the buyer.

Inland Revenue is now looking at a fundamental redesign of this personal service attribution rule, which was designed to capture employment like situations. It was really designed where contractors might be providing services to basically one customer (the ‘80% one buyer rule’) and in effect, they were employees. However, they could potentially avoid tax obligations by making use of an interposed entity with a lower tax rate.

Inland Revenue thinks that 80% rule is too narrow. The proposal is to broaden its application and by doing so it can at the same time deal with the issue that arose with the Penny and Hooper case.

Under current legislation, Bill is an accountant who is the sole employee and shareholder of his company A-plus Accounting Limited. The company pays tax at 28% on income from accounting services provided to clients and pays Bill a salary of $70,000, just below the 33% threshold. Any residual profits are either retained in the company or made available to Bill as loans.

The proposal is to remove that 80% one buyer rule and so that now Bill’s net income for the year, if it exceeds $70,000 will all be attributed to him where 80% of the services sold by that company are provided by Bill. Sole practitioners and smaller accounting firms and tax agents will find themselves in the gun. In fact, the discussion document suggests maybe this threshold of 80% should be lowered to 50%.

Now, you might think that the bigger issue is not the 33% threshold at $70,000, but the $180,000 threshold, so why do we want such a low threshold for this rule to apply? The discussion document points to the evidence that shows that there is income deferral going on. It appears to be at the $70,000 threshold (see the graph above) and wants to put an end to that.

So that’s a more detailed look at what is a very important paper. It’s likely to generate quite a lot of controversy and feedback from accountants and other tax specialists. It’s also another part in the long running tale of the implications of not having a capital gains tax. But certainly, this one will run and run. Submissions are now open and will run through until 29th April. I expect all the major accounting bodies and firms will be responding.

Using tax to mitigate cost of living impacts

Moving on briefly, there’s been a lot to talk about what tax changes could be done to help the increased cost of living. And Daniel Dunkley ran through some of the proposals.

One idea that pops up regularly is the question of removing GST from food. My view, which I expressed to Daniel and is also probably that of most tax specialists, is that this would undermine the integrity of GST, because we don’t have any exemptions on that.

I also don’t think it would achieve the objective that is hoped for. There is, regardless of what people might say, an administrative cost to splitting out tax rates, having zero rate for food and standard rate for other household goods in your shopping trolley. And that differential, that cost involved, will be passed on to customers.

So the full effect of the GST decrease will never flow through to customers. To be perfectly frank; supermarkets and operators will play the margins around this. I suggest you have a look at what’s happened with the fuel excise cut. It was 25 cents, but in every case did the pump price fall by 25 cents? And how could you tell because prices move around so much?

As I said to Daniel, and has been a longstanding view of mine, if the issue is getting money to people who have not enough money, give them more money. The Welfare Expert Advisory Group was staunch when it said that there was a desperate need to raise benefits. We also saw how the temporary JobSeeker rate was increased when COVID first hit. So, this issue of increasing benefits hasn’t gone away.

The best position would not be to tinker with the tax system. You could perhaps look at tax thresholds, definitely, but they still would not be as effective as giving people an extra $30-40 or more cash in hand.

End of year preparations

And finally, the end of the tax year is fast approaching, so there’s plenty of tax issues that you might want to get done before 31st March. A key one to think about is if you’re going to enter the look through company regime, you need to get the election in before the start of the tax year. In some situations you might have more of a bit of a grace period for dropping out of the regime, as part of the Government’s response to the Omicron variant. But it you are electing to join the regime, I suggest you file the election on or before 31st March.

Coming back to companies and shareholders another important issue is the current accounts of the shareholders. You should check to see if any shareholder has an overdrawn current account (that is more drawings than earnings). If so, then either see about paying a dividend or a salary to clear that negative balance, although of course, you’re up against the issue of the higher tax rate I discussed earlier. If that’s not possible, charge interest at the prescribed fringe benefit tax rate of 4.5%.

Companies may have made loan advances to other companies, look at those carefully because you may need to charge interest there to avoid what we call a deemed dividend.

Another very important matter is if there are any bad debts. If so, then consider writing them off before 31st March in order to claim a deduction. And then if you’re thinking about bringing forward expenditure to claim deductions such on depreciation, then do so.

Companies should check their imputation credit accounts balances and make sure these are positive. There are mechanisms through tax pooling to manage this problem if you miss a negative balance.

Well, that’s it for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax tax or wherever you get your podcasts. Thank you for listening, and please send me your feedback and tell your friends and clients. Until next time, ka pai te wiki, have a great week.

15 Mar, 2021 | The Week in Tax

- Business loss continuity test and tax loss carry back

- A review of working for families is underway and how abatement levels impact beneficiaries

- Pre 31st March tax planning tips

Transcript

Last week, I discussed the Government’s new proposed business continuity test for losses. Subsequently, a reader from Inland Revenue kindly got in touch to confirm that the new test would indeed be retrospectively applicable from the start of the current tax year, 1st April for most taxpayers.

He also pointed out that the new regime will allow losses from the 2013-2014 year to be carried forward. So that means the losses that were occurred in those years, they can continued to be used if there’s a change of shareholding, resulting in a breach of continuity and you wish to use the business continuity test to preserve those losses. So, thank you very much for that, Barry.

But in the spirit of the Lord giveth and the Lord taketh, we’ve also heard that the Government has decided not to proceed with a permanent iteration of the temporary loss carry back scheme introduced last year as part of its initial response to Covid-19. That’s disappointing news as it would have been a useful addition to the loss regime.

These regimes exist in other jurisdictions. And ironically, the British Budget, which I also discussed last week, included a measure relating to its carryback regime, temporarily extending the loss carryback period from one to three years.

Now, the official reason for the decision to not proceed with the permanent iteration of the scheme is the potential fiscal cost. That’s perhaps understandable, but it would be good to see the decision revisited sometime in the future, because I think this is an important measure to have as part of the loss regime.

A poverty benefit trap

Moving on, it emerged this week that the Government is undertaking a review of the Working for Families regime. This is a quite significant undertaking because Working for Families pays out approximately $3 billion a year. And this came out as part of a decision to increase main benefit abatement thresholds from 1st April.

Now, something which is not generally well known and appreciated is the real problem with the interaction between tax and the social welfare system and the impact of abatement thresholds. Basically, and understandably, as a person’s income increases, then the need for social assistance is reduced. And what we have is an abatement threshold above which benefits are abated.

These formulas vary quite significantly and can be actually quite savage. The decision that the Cabinet made related to the Minimum Family Tax Credit. Now, the abatement here is once you cross the threshold, you lose a dollar of credit for every dollar above the threshold. This means that the effective marginal tax rate for people who cross the threshold is effectively greater than 100%. (The dollar of income is taxed AND a dollar of benefit is lost).

And this is an area that’s always problematic because Governments must choose the threshold at which it kicks in and what abatement rate applies. The Working for Families abatement rate is currently 25% for family income above $42,700. And one of the other problems that this paper indicated is that the amount beneficiaries can earn before their benefit reduces has declined substantially over time because benefit abatement thresholds have not been increased in line with wage growth.

And so a poverty benefit trap has emerged because the financial incentives to enter the labour market and work part time are substantially reduced. To give you an idea how bad that has become, a person currently receiving the Jobseeker Support for being unemployed could work about 11.8 hours on minimum wage in 1997 before their benefit was abated. By 2019, that had reduced to around 4.5 hours on the minimum wage.

These problems exist across all of the social welfare network and one of the Welfare Expert Advisory Group’s recommendations was it needed serious overhaul. There’s always been talk about perhaps integrating a tax and welfare systems with a universal basic income seen as a solution to this particular issue. So anyway, there’s going to be a lot of work going on in that space and it will be very interesting to see what comes out of it.

Ideas to prepare for March 31

And finally, this week, the tax year end is fast approaching. So here’s a few ideas which may require action before 31st of March.

A big one, obviously, for businesses is to write off any bad debts before 31st of March. Take a good look at your debtor ledger and be realistic. And if those debts are written off before the 31st of March, you can claim a deduction for those bad debts.

Similarly, look to see what stock is obsolete, write it down to market value. Fixed assets which are no longer in use should be scrapped or otherwise disposed of to ensure you can have any available deductions. At the same time, you might want to accelerate certain types of expenditure, such as repairs and maintenance.

And one thing important to take note of is that the temporary increase in the low value assets to $5,000 ends tomorrow (Tuesday, 16th March). From Wednesday, 17th March, it will be $1,000. So now is the time to take a quick look at your fixed assets and think, do I need a new laptop, new computers, any any matters like that? And if so, try and take advantage of this $5,000 concession now.

There’s a lot of matters to think through at year-end, and I’ll come back to a few of these next week as well. One important one, which is tied into the increase to the 39% tax rate, which will take effect from 1st of April, is to look at imputation credit account balances. Make sure that all imputation credits are correctly recorded and perhaps consider paying a year-end dividend before March 31st particularly if you are likely to be affected by that 39% threshold change.

If you’re considering entering or leaving the look-through company regime, you need to have made the election before the start of the new tax year. So again, review your position there and make sure the relevant election is filed by March 31st.

By the way, I wouldn’t say Inland Revenue is a huge fan of the look through company regime, but it seems to want to direct individuals into that regime. There’s been one or two things I’ve seen going on, which has made me wonder that there may be a change of policy towards the use of look-through companies coming.

A very important thing to consider is to review whether the shareholders in a company have overdrawn current accounts. If so, look to take steps to either bring the current accounts into credit or charge interest on those overdrawn current accounts. And similarly, if companies have made loan advances to other related companies, then consider charging interest on those loans.

And finally, the last GST return for the tax year is also called the adjustment period for GST, such as change of use adjustments. And that’s when you need to calculate the impact of the change of use for GST purposes and account for this to Inland Revenue. So, for example, this would affect people that may have changed their Airbnb properties, to long term residential accommodation because there’s no tourists now.

They may have claimed an input tax credit and now they have to do a change of use adjustment and that obviously can cause some cashflow issues. So this is the period you need to think carefully about whether you want to do that and then look to make sure the calculation is filed in time. This is an area where I’m seeing quite a bit more work coming through as it is not well known and trips up a lot of people.

Well that’s it for today, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next week Ka kite āno and go Team New Zealand!

23 Feb, 2021 | The Week in Tax

- An overview of the new Covid Resurgence Support Payment

- What could be the implications of Facebook’s actions in Australia

- Pre-31st March year end tax planning

Transcript

On Wednesday, the Government passed under urgency, the Resurgence Support Payments bill.

This was introduced in the wake of the move to level three and then level two lockdowns in the Auckland region. This had been in the works for some time, but then just got pushed through under urgency following what we might call the Valentine’s Day mini outbreak.

Resurgence supports payments may be applied for if there is an increase in the alert levels from Level 1 to Level 2 or higher and the alert level remains higher than Level 1 for seven days or more.

It’s going to be available to all businesses in New Zealand each time it activates. So even though Auckland went into a Level 3 Lockdown and then back down to Level 2, because a lot of tourism is currently dependent on tourists from Auckland, the resurgent supports payments will apply nationally. This is a wise move, which cuts down a lot of administration, but also reflects the fact that Auckland is a prime source of tourism for the very weakened tourist industry.

Businesses are able to apply if they’ve experienced a revenue decrease or a decrease in capital raising ability of at least 30% due to the increase in the alert level. And they need to measure their revenue for that 30% fall over a continuous seven-day period where the first day is on or after the first day of the increased alert level. All seven days must be within the period of the increased alert level. The affected revenue period then needs to be compared against a regular seven-day revenue period that starts and ends in the six weeks prior to the increased alert level.

This scheme is going to be administered by Inland Revenue rather than the Ministry of Social Development as happened with the wage subsidies. Applications should be made through myIR and Inland Revenue is expecting that people receive the resurgence support payment within five working days of their application.

The payment must be used to cover business expenses such as wages and fixed costs. Note that this isn’t a wage subsidy per se, it’s a support payment. And that possibly explains the slightly unusual change from the previous wage subsidy in that this payment is subject to GST now.

Although no income tax deduction will be available for expenditure relating to use of the resurgence support payment, GST registered businesses will be able to claim input tax deductions for any expenditure funded by the resurgence support payment. In other words, if you pay the rent using the resurgence support payment, you won’t get an income tax deduction for it, but you will still be able to claim a GST input tax credit.

The payment consists of a base amount of $1,500 dollars per applicant, plus $400 per full time equivalent employee, up to a cap of 50 full time employees. Although payments are capped at 50 full time employees, businesses with more than 50 full time employees may still apply.

There is a further cap in that the amount an applicant may receive will be the lower of the base amount and four times the amount their revenue has declined, as declared by the applicant as part of the application. And I can see Inland Revenue having a bit of work going on in years for larger scale applications here.

Anyway, the measure is now in place and fortunately everyone within the Auckland region, because they are still in level two, will be able to apply for this because they have been at an Alert Level higher than Level 1 for the required seven-day period. I imagine there will be further tweaks to the scheme as we go forward in the event of further outbreaks.

Facebook gives Australia the fingers

Moving on, yesterday across the Ditch, Facebook announced that …

“due to new laws in Australia from today, we will reluctantly restrict publishers and people in Australia from sharing or viewing Australian and international news content on Facebook.”

And with that, it stopped any sharing of Australian news media sites and indirectly, some New Zealand sites could be affected as well.

Now, this stoush has been brewing for some time. The Australian Government is trying to force Google, Facebook and other tech giants to pay more for the media content. Google has played along with this proposal. Microsoft, which runs the Bing search software, is also playing along. But Facebook has pushed back very hard and decided to go very hardball with this move.

Now, barely two years ago, Facebook literally made blood money about live streaming the Christchurch massacre and then wrung its hand about the difficulties of taking down such abominations. But yesterday it basically was able to switch off all of Australia’s major media sites on Facebook just like that. And I’m sure there will be a few pointed comments made about that.

I can’t see how such outrageous behaviour will not draw a strong response. And this is where I think from a tax perspective, things may go. The Australian government has previously been lukewarm about a Digital Services Tax, but Facebook’s actions might prompt a rethink. The Australian Tax Office has done some work on this, and there might be a bill lying around which could be introduced at the drop of a hat in effect saying, “Here, stick this up you”.

If Australia does move forward with a Digital Services Tax, then I think our government will surely follow. Now I’m in the “ get into the Tax Tech Giants hard” basket and

have been for some time, particularly since what happened in Christchurch. Yesterday’s actions by Facebook underscore my belief in that approach.

Incidentally, during this whole run up to this stoush erupting, at least one tech commentator suggested that a DST would be a better approach instead of what the Australian government was trying to do. We’ll see how this all plays out and it’s going to be very interesting to watch. Facebook just lifted the stakes considerably.

There are, according to the OECD, about 40 countries either with an active DST or considering introducing one. Maybe Australia is about to become number 41.

KiwiSaver makeup

Now, briefly following up from last week’s podcast, Inland Revenue is to pay approximately $6.6 million to compensate over 640,000 KiwiSaver members whose employer contributions were delayed in getting to the providers. Now, this happened last April, when Inland Revenue moved KiwiSaver to its new Business Transformation START platform. And for some reason there was a delay in passing on employer contributions to people’s KiwiSaver accounts.

This story reports delays of as much as six months or more. So people lost out on investment performance over that time. And during that time, the use of money interest rate paid by Inland Revenue dropped to zero which would have been the usual way of compensating for the delay.

Instead, what’s going to happen is Inland Revenue has been given approval to make ex gratia payments of about $6.6 million in total. This is a slight bit of a disappointment for Inland Revenue because as I said, by and large, the Business Transformation programme, controversial as it is, has worked relatively smoothly and improved processes. It’s certainly not a Novopay scale disaster, but it’s just another sign that sometimes with IT projects things go wrong.

End of year planning

And finally, the 31st March tax year end is fast approaching. So it’s time to start thinking about what steps could be done in advance of that. Now, there’s a couple of things in particular people might pay attention to.

Firstly, you have until 16th March to make use of the $5,000 threshold for “low value assets”. Under this you get a full write off for assets up to the value of $5,000 acquired on or before 16th March.

This is an emergency measure introduced a year ago as part of the Government’s initial response to Covid-19. So now’s a good time to see if there’s equipment you want to replace or upgrade and take a full write off.

For assets purchased on or after 17th March, that threshold of $5,000 will be reduced to $1,000 going forward.

Now, the other thing to think about is tied in with the forthcoming increase in the personal tax rate to 39%. And the suggestion would be that companies might want to think about paying dividends out to use imputation credits prior to that date so that the shareholders are taxed at 33% rather than 39%.

Sometimes you might pay a year-end dividend anyway because that’s just part of the regular distribution pattern. But you might also do so because the shareholders might have an overdrawn current account which you want to get into credit.

The thing that complicates matters this year is whether such a move might represent tax avoidance. I don’t believe so. But one thing people must keep in mind is that as part of the increase in the tax rate to 39%, trusts have to provide more information about distributions they’ve made in prior years. So as the commentary on the tax bill said, “this is expected to assist in understanding and monitoring the changes in the use of structures and entities by trustees in response to new 39% rate.”

And that’s what gives me pause for concern about paying large dividends before 31st of March. If there isn’t a regular pattern of large dividends before the increase and then a large dividend isn’t repeated after the rate increase, Inland Revenue may look to argue tax avoidance and effectively tax retained earnings. So approach that one with caution.

I think this is a point where Inland Revenue really needs to come out and be very clear about what is going to happen with dividends paid by companies to trust shareholders, which aren’t then distributed. I think you’ll have a problem if the pattern was previously such dividends were distributed by the trust, maybe less so if that wasn’t the case. Again it’s a question of watching this space. And we’ll bring you developments as and when they happen.

Well that’s it for today, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next week Ka kite ano!