- Should the New Zealand Superannuation Fund become tax exempt? Inland Revenue is under scrutiny for its use of social media.

- A bad week for Apple and Google in the European courts.

- Inland Revenue releases an intriguing consultation on GST and management services supplied to managed funds.

In the past few weeks, the question of taxing capital has reappeared on the agenda featuring across a number of news stories. It probably kicked off initially when Inland Revenue’s long term insights briefing consultation document raised the question of whether the tax base should be expanded to meet what is the anticipated growing fiscal costs of superannuation, health and climate change.

“New ways of generating revenue”

Then a couple of weeks back, the outgoing chief executive and Secretary to the Treasury, Caralee McLiesh, commented to the New Zealand Herald that New Zealand needs new ways of generating revenue and cutting expenditure. She suggested a capital gains tax and a more efficient superannuation scheme.

Labour leader Chris Hipkins has been in the news talking about the Labour Party’s internal discussions around the question of taxing capital. And then at the start of the week, Bruce Plested billionaire co-founder of Mainfreight, raised the idea of wealth tax. Understandably he caveated it with a question around whether the funds raised would be spent wisely.

But the point is, across the whole spectrum the question of taxing capital is back on the agenda. It never actually goes away to be perfectly honest. Like spring it comes around at least once every year. Anyway, it’s interesting to see this debate carried on. I think a driving factor is a growing recognition that the present tax base probably isn’t sufficient to meet the coming demands of rising superannuation, rising health costs and climate change. Sure, managing government expenditure more efficiently will help, but it will only go so far.

The Treasury has talked about a structural deficit of 2% of GDP which is $8 billion. That’s a fairly sizable sum, and with the best will in the world, cuts in government spending aren’t going to fill that gap. So, a discussion has to be had on how this gap is to be filled.

Given we will need to find extra revenue, taxation of capital is the obvious point. We should be considering whether it’s a wealth tax, land tax, capital gains tax or even restoration of estate and gift duties, which were once quite a substantial part of the New Zealand tax base. It could be a combination of all or some of those, but the debate isn’t going away.

Time to make the New Zealand Superannuation Fund tax exempt?

Moving on, and talking about the rising cost of superannuation, the New Zealand Superannuation Fund (NZSF) was established more than 20 years ago by Michael Cullen, to help smooth the cost of superannuation. It has been an enormous success. The NZSF has now grown to well over $70 billion and along the way it has been paying tax.

This is quite unusual for sovereign wealth funds because most are tax exempt. New Zealand has two other sovereign wealth funds, ACC and the Reserve Bank of New Zealand, and neither of those are taxed. They have between them another $60 billion of assets. But when the NZSF was established back in 2003, the decision was taken that it would pay tax. Part of the reason for doing so was to provide a commercial incentive so the NZSF made decisions around investments on strong commercial grounds, rather than because of a tax-exempt status.

But this has created a sort of slightly odd money-go-round. The government would contribute capital to it based on a formula, and then the NZSF would then pay part of that back in the form of tax. This is before its designated drawdown date, which is coming up towards the latter part of this decade, when it’s expected that regular withdrawals will be made to start funding superannuation.

For the period to June 2024, the Super Fund received contributions of roughly $1.6 billion overall and paid nearly $1.5 billion in tax. It is by far and away the largest single taxpayer in the country, a reflection, by the way of our Foreign Investment Fund regime rules. Finance Minister Nicola Willis is now seeking advice as to whether in fact it should become tax exempt, on the basis now that its tax bill is beginning to outgrow crown contributions.

Now that the Government has contributed $16.9 billion after accounting for $9.6 billion in tax paid since the fund was set up, the Finance Minister will be thinking whether it’s now time the Government can wind back the contribution. Ultimately, this should have the same effect as also removing its taxable status. We shall see how this develops, but it’s interesting to see the discussions in this space, which are also a by-product of the question of how do we fund superannuation?

Inland Revenue under fire

Moving on, Inland Revenue is in a little bit of hot water after it emerged that it’s giving hundreds of thousands of taxpayers’ details to social media platforms as part of its various marketing campaigns. These campaigns are intended to target taxpayers who might owe taxes.

Unpaid student loans are one particular area that that pops up here. The controversy revolves around the anonymisation tool which is used to ensure that whatever information the social media companies get, the details are minimised as far as possible to protect the privacy of the taxpayers involved.

The question has been raised as to whether that tool is sufficient.

The horns of a dilemma

There are two issues here. One is the technical question about how effective is the anonymisation tool. But the bigger question is whether Inland Revenue should be doing that. It faces a problem that if it wants to reach out to the general public – or certain sectors of the public – to remind them about their tax obligations. The best outreach method is through social media platforms. Inland Revenue is on the horns of a dilemma.

I will say this, that in my 20-30 years’ experience watching and working with Inland Revenue, it has an exemplary record around disclosure of private details. It has strong processes in place, and I cannot recall over that time a data breach scenario similar to those we’ve seen with both ACC and MSD where private data of taxpayers has been emailed to persons outside the agency.

Notwithstanding Inland Revenue’s record, the practice seems questionable because of the fact that social media sites are constantly under attack from hackers. Supplying private information to social media companies, no matter how laudable the intentions, puts that data at risk. It would be interesting to hear from the Privacy Commissioner on this.

Then there is the huge irony that these social media companies are amongst the most aggressive exponents of tax planning in in the world. For the year ended 31st December 2023 Facebook New Zealand, for example, reported taxable income of $9.1 million, but we know from its accounts that it paid over $157 million offshore to related entities. And Google’s numbers are even bigger. The extent of the advertising now going offshore has absolutely gutted local media and the implications of this loss of revenue for our media landscape are still being worked through.

Inland Revenue has to work through the dilemma as to how far it should go with providing information to social media companies. Ideally, you’d say it should not. But if you want to reach out to taxpayers about their obligations, you have to go where you might find those taxpayers. And at the moment that’s the social media companies.

Apple and Google lose bigly in Europe

Speaking of the big tech companies, over in Europe, Google and Apple had a week to forget. The European Union’s top court the Supreme Court of the European Court of Justice (the ECJ) ruled that Google must pay a €2.4 billion fine for abusing its market dominance of its shopping comparison service. This fine had been levied by the European Commission in 2017, and Google has been fighting it since then but has now lost in the ECJ, the highest court in Europe.

But that news was overshadowed by a major tax decision by the ECJ the same day, ordering Apple to pay Ireland €13 billion. That’s an eye watering $23.3 billion the equivalent of just over 12. 5% of Ireland’s total tax revenue for 2023.

What’s particularly interesting about this case is that Ireland was also a defendant alongside Apple. Ireland had been accused by the European Commission of having given Apple illegal tax advantages in the form of state support. The European Commission ruled the state support was illegal in 2016. Apple appealed and won in the lower court of the ECJ in 2020. But now the ECJ’s Supreme Court Justice has ruled that there was illegal state support which must be repaid.

A major transfer pricing decision

This is going to be a key transfer pricing case which will be analysed for many years to come because it revolves around the way profits generated by two Apple subsidiaries based in Ireland were treated for tax purposes. The ECJ ruled these arrangements were illegal because only Apple was able to benefit from them. Other companies based in Ireland could not.

This is just the latest instalment of the general crackdown that Europe is going through right now about transfer pricing and other profit shifting mechanisms led by the European Commission. The decision is an enormously important case in the transfer pricing world.

It actually leaves Ireland in a little bit of an embarrassing case because, as I said, it’s an enormous sum of money, so people will be naturally saying, well, what are we going to do with this? The Irish Treasury has warned against using this for anything other than perhaps a one-off major capital project or debt repayment.

But the Irish also appear to be quite concerned about how their low tax regime (they have a corporate tax rate of 12.5%) will be perceived by other companies who would like to invest in Ireland which has pursued a long-term policy of attracting investment. Its industrial strategy was shaped in the late 50s, but really only started to come to fruition once Ireland joined the European Economic Community in 1973.

I would be very interested to see how this massive decision plays out in other jurisdictions and what lessons are taken by transfer price practitioners.

GST and managed funds – round two?

Finally this week, Inland Revenue has been busy releasing a number of draft consultations on a range of subjects, including Commissioner of Inland Revenue’s search and information gathering powers, the income tax treatment of short stay accommodation, arrangements involving tax losses carried forward under the business continuity rules, and a big paper on the income tax company amalgamation rules.

However, the one that’s got me a little bit intrigued because of its back story is a consultation on the GST treatment of fees paid in relation to managed funds. If you recall back in August 2022, the then Labour government introduced a tax bill which included a measure which would impose GST on management services supplied to managed funds.

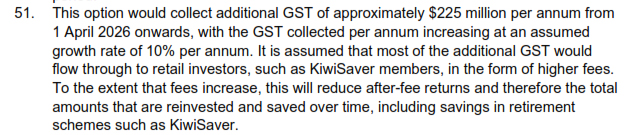

According to the supporting Regulatory Impact Statement that measure was to tidy up an anomaly that had been identified by a GST issues paper released by Inland Revenue In February 2020, just before COVID arrived. It was projected to bring in an estimated $225 million a year starting from 1 April 2026.

A furore erupted after the same regulatory impact statement noted that was according to modelling by the Financial Markets Authority, the impact of imposing GST on management fees would mean that the amount available for KiwiSaver investors would be reduced by an estimated $103 billion by 2070. For context, it’s worth pointing out that the KiwiSaver funds were projected to be valued at nearly $2.2 trillion. In an unprecedented move, Labour backed down and withdrew the bill within 24 hours.

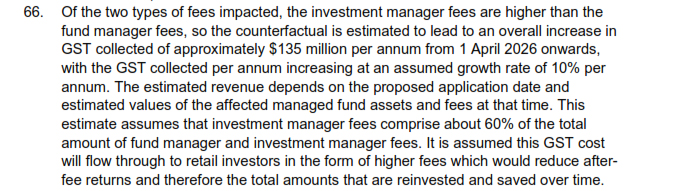

Against that background, it’s interesting to see Inland Revenue’s final consultation on the same topic. And this is where I’m intrigued to know a little bit more about what’s changed. Basically, it seems that Inland Revenue is going back to a default position where manager fees are treated as exempt, but investment manager fees become subject to 15%. The proposal in 2022 was all fees become subject to GST at 15%.

An intriguing counter-factual

What intrigues me is that the 2022 Regulatory Impact Statement noted as the counterfactual that this would probably result in something like an overall increase in GST collectible of approximately $135 million per annum from 1 April 2026 onwards. That’s not an insignificant sum of money.

Although Inland Revenue’s job is to provide interpretation and guidance, my thoughts on this are if this is a sum that’s going to potentially raise $135 million dollars of tax annually, maybe that’s something that Parliament should legislate.

There is also a subsidiary issue here which is a long-standing issue in our tax system at the moment. It is surprising, given that this was a controversial point, that this issue had not reached the courts, or that no one has taken a test case.

So, although Inland Revenue is doing its job, given the sums apparently involved I think that is something that should be put into legislation and go through the Select Committee process. But for the moment though, Inland Revenue is consulting on the issue until 25th October. As always, we will bring you any news and developments as they emerge.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.