- Plenty to consider in Inland Revenue’s latest Interpretation Statement on tax avoidance

- Working from home allowances updated

- GST and Donation Tax Credit fraudsters convicted

Last year, I covered the Supreme Court decision in Frucor Suntory New Zealand Ltd v Commissioner of Inland Revenue. To recap, Frucor had entered into a series of arrangements mainly for the benefit of its overseas parent. However, in the eyes of the Commissioner these arrangements represented tax avoidance. By a majority of 4 to 1, the Supreme Court ruled that the arrangements did indeed represent tax avoidance, and they also met the threshold for the imposition of shortfall penalties totalling $3.8 million. What was also of particular note here was the very strong dissenting judgement from Justice Glazebrook, which was completely at odds with the majority opinion.

Following the Supreme Court decision, Inland Revenue have now released an updated Interpretation Statement IS23/01 Tax avoidance and the interpretation of the general anti avoidance provisions of sections BG 1 and GA 1 of the Income Tax Act 2007. This 138-page Interpretation Statement is accompanied by a nine-page fact sheet and two Questions We’ve Been Asked covering income tax scenarios on tax avoidance, which amount to another 50 pages or so. A fair amount of material to work through.

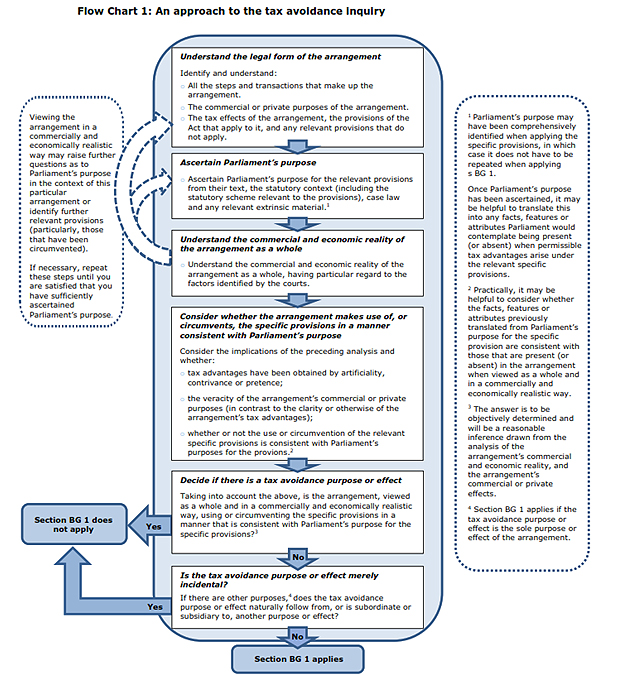

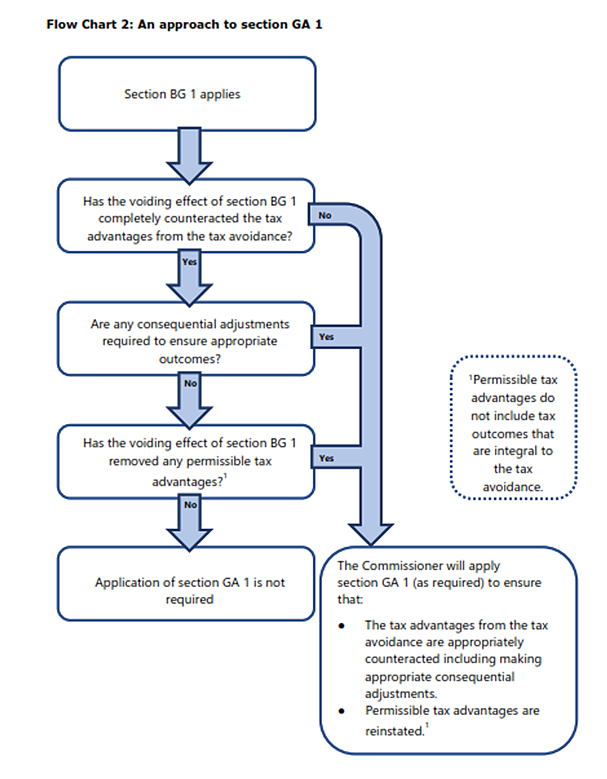

The statement sets out the Commissioner’s approach to the application of Section BG 1 and then explains how under the related section J1 the Commissioner may act to counter it. And counter any tax advantage that a person has obtained from a tax avoidance arrangement. This Interpretation Statement is also relevant to the general anti-avoidance provisions in section 76 of the Goods and Services Tax Act 1985. This Interpretation Statement also replaces the previous Interpretation Statement is 13 zero one issued on 13 2nd June 2013.

The statement sets out the Commissioner’s approach to applying section BG1 and then explains how under the related section GA1 the Commissioner may act to counteract any tax advantage that a person a obtains from a tax avoidance arrangement. The Statement is also relevant for the general anti avoidance provision in Section 76 of the Goods and Services Tax Act 1985. It replaces the Commissioners previous Interpretation Statement IS13/01 issued on 13th June 2013

For those unfamiliar with these provisions, section BG1 is the main anti avoidance provision in the Income Tax Act. If applicable it will void a tax avoidance arrangement for income tax purposes. The related section GA1 then enables the Commissioner to make adjustments where an arrangement voided under section BG1 has not “appropriately counteracted” any tax advantages arising under the tax avoidance arrangement.

The key case relating to these anti avoidance provisions is the Supreme Court decision in Ben Nevis Forestry Ventures Limited in 2008. In that decision the Supreme Court adopted the principle of Parliamentary Contemplation in determining how the anti-avoidance provisions were to be applied. In brief Parliamentary Contemplation requires deciding whether the arrangement when viewed as a whole and in a commercially and economically realistic way makes use of or circumvents specific provisions in a manner consistent with parliament’s purpose. If not, the arrangement will have a tax avoidance purpose or effect. Subsequent to the Ben Nevis decision this principle of Parliamentary Contemplation was applied in the well-known Penny and Hooper case, and again in the Frucor decision.

It would be foolish to think these tax avoidance provisions only apply to major corporates. as I’ve just mentioned the principles were relevant in the Penny Hooper decisions and at last week ATAINZ conference the point was made that section BG1 could be applied in circumstances where a person’s lifestyle appears to rely on payments and distributions from a trust because it is in excess of that person’s reported salary.

Just as an aside, apparently in March 2021, almost $11 billion in dividends were paid prior to the increase in the top personal tax rate to 39%, with effect from 1st of April 2021. Now, that is more than four times greater than the usual amount of dividends paid at that time of year. I understand Inland Revenue is discussing the pattern of distributions with some tax agents.

The issue tax agents, advisers and clients should be aware of is where there is no regular pattern of distributions, even though profits were available, but suddenly there’s a very big distribution in this particular year. You could be vulnerable to Inland Revenue looking at that and saying, “Well, you paid a big dividend in March 2021, but you haven’t paid similar dividends in March 22 or March 23. Why is that? Nothing to do with the new 39% personal tax rate?” So just to reinforce these tax avoidance provisions, the case law may generally involve large corporates, but they are very relevant to small and medium enterprises.

Fortunately, there’s some good examples accompanying the Interpretation Statement and give you guidance as to where the Inland Revenue think the boundary might apply. For example, and this is a very common scenario, a company is wholly owned by a family trust. Over some years the trust has advanced $1 million to the company as shareholder advances on an interest free repayment on demand basis. The company has then used these funds to finance its business operations for the purpose of deriving assessable income.

The trustees decide to demand repayment of the full amount of the loan. In order to make that repayment the company borrows $1 million from a third-party lender at market interest rates secured over the assets of the trust. The $1 million loan is then used to repay the shareholder advances. The company deducts the cost of borrowing from its income. Meanwhile, the trustees have used the funds to purchase a holiday home for the trust’s beneficiaries.

As I said, this is a not uncommon scenario. But does it represent tax avoidance? No, according to the Commissioner. Which is a relief but be careful of relying on that particular set of circumstances, there may be a little twist in your tale, which may interest the Commissioner.

Another example is where a taxpayer with a marginal rate of 39% invests in a portfolio investment entity where the maximum prescribed investor rate is 28%. This would not constitute tax avoidance because the tax advantage of the maximum prescribed investor rate of 28% is within Parliament’s contemplation.

On the other hand, an example is given of an investor whose tax rate is 39%. He borrows funds from a bank to invest in a Portfolio Investment Entity (PIE) sponsored by the same bank. The policy of this PIE is to invest all funds in New Zealand dollar interest-bearing two-year deposits with the bank.

In this situation, this arrangement would represent tax avoidance. The key facts being the somewhat circular nature of the investment, but critically the fact the return is less than the cost of borrowing, resulting in a pre-tax negative, i.e. a loss position, but a post-tax positive net return. Once you look at the interest earned and the tax rate 28% tax rate, there’s a deduction available to the investor at 39% effectively. But the PIE income is only taxed at 28%.

This got me thinking because it suggests the well-known practice of negative gearing to purchase investment properties might in some circumstances represent tax avoidance. Now, this is less likely following the introduction of the loss ring-fencing rules and interest limitation rules in 2019 and 2021, respectively. But it’s another case where you ought to think carefully about how Inland Revenue might view a particular transaction.

As you can see, there’s a considerable amount of material and reading to work through including some useful flow charts (see below). At a minimum, I would suggest reading the Fact Sheet and the two Questions We’ve Been Asked which accompanied the Interpretation Statement.

You can also find some excellent commentary by the Big Four accounting firms. They’re always worth reading on these matters as they’ve got the resources to really go in and consider what these Interpretation Statements might mean. (And no doubt it’s particularly relevant for their clients).

Like some, I have my reservations about the Parliamentary Contemplation test. I think it was Rodney Hide who remarked about the principle “When I was in Parliament, most of the time I was contemplating what I was going to have for dinner”. Joking aside, I feel we should be approaching the test with some caution. I also think Justice Glazebrook’s dissent in Frucor raised valid concerns about how these provisions would apply. As I mentioned at the time, she comes from a very experienced commercial and tax background which is one reason why her dissent was raised a few eyebrows in the tax world.

Notwithstanding all of that, the Frucor and Ben Nevis cases are the law. And with the release of this Interpretation Statement and related material, taxpayers now should have a clearer idea where the boundaries lie. More examples from Inland Revenue around where they see the boundaries applying would be a great help in continuing to clarify the position. As always, we’ll bring you developments as they emerge.

Reimbursement for working from home

Now, moving on, we’ve discussed in the past how the impact of the pandemic and the resulting shift to more people working from home meant Inland Revenue had to quickly reconsider the treatment of reimbursing payments made to employees who work from home and for using their own phones and other electronic devices as part of their employment. Inland Revenue released a series of determinations giving some guidance as to the appropriate level of reimbursement.

Inland Revenue has just issued an updated determination which will, once it’s gone through consultation, apply from 1st April. It basically updates these previous determinations and gives a little bit more leeway in terms of the amounts allowed. The reimbursement allowance for employees working from home has increased from $15 per week to $20 per week. The previous limit of $5 per week for person use of telecommunications tools is now $7 a week. I feel these amounts are on the low side, but at least Inland Revenue is revisiting the matter and updating them to take account of inflation. So that’s welcome.

Jail for tax fraud

And finally this week news about convictions involving tax fraud. Firstly, a former developer who apparently lived in Manhattan before he migrated here in 2016 on an entrepreneur residency visa, has just been jailed for tax fraud relating to $1.5 million in fraudulent GST refunds. He had bought a vineyard in Canterbury and then filed fraudulent GST returns between April 2017 and April 2021 in relation to the purchase and operation of this vineyard. He received over $1.3 million in GST refunds, but a further $175,000 was withheld once Inland Revenue realised what was happening in April 2021.

He’s been jailed for a total of three years and seven months. One other thing of note is Inland Revenue has taken court action to recover what was fraudulently obtained. Unusually it also took a high court freezing order out and had a receiver appointed over the assets of the vineyard owning company. So good move from Inland Revenue. That’s what we expect them to be doing.

The case does raise an issue though, because it was four years before Inland Revenue detected this fraud. And so, again, you just wonder that hopefully this was because during this period it was going through its Business Transformation program. So, you would hope that now Inland Revenue, with its enhanced capabilities, is picking up on these frauds much quicker.

In a related release, five members of the Samoan Assembly of God Church in Manukau have been sentenced to community detention and ordered to repay the money they received after they made false donation tax credit claims worth almost $170,000. They apparently used not only false donation credits for themselves, but also asked other individuals, usually members of their own congregation for personal information, including their IRD numbers. They then using these details issued a series of false donation receipts. The fraud was detected by Inland Revenue and the five were charged. All have pleaded guilty and received various sentences mostly involving community detention but also reparations and repayment of the funds claimed.

I often see a lot of feedback around the charitable exemption particularly in relation to businesses. It’s a touchy point. One of the areas where the Tax Working Group had concerns was about whether the donations once received were actually being applied for charitable purposes.

Now, I don’t know whether this particular case is just one of those scenarios where Inland Revenue came across it and acted or it’s part of a general operation where it’s looking more closely at what’s happening with charitable donations and whether in fact, they’re being applied to charitable purposes. We’ll find out in due course.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!