- Inland Revenue’s proposed long-term insights briefing

One of the unseen revolutions in international tax over the last decade has been the adoption of the automatic exchange of financial account information. Also known as the Common Reporting Standards https://www.ird.govt.nz/crs this was developed by the Organisation of Economic Cooperation and Development, the OECD, in conjunction with G20 countries. It requires the automatic exchange of information on financial accounts – which is bank accounts, other investments held by taxpayers outside their jurisdiction. Financial institutions are required to provide information on such accounts to their respective tax authority which then sends that information to the jurisdiction in which that taxpayer is resident.

This project began in 2017. For the latest year, the tax authorities from 111 jurisdictions have automatically been exchanging information on financial accounts. And as I said, it’s a very broad range of investments, not just bank accounts. It’s all forms of investments. By and large, the public is pretty unaware of what’s happening here even though the numbers are significant.

€130 billion in tax interest and penalties so far

According to the latest peer review from the OECD, information from over 134 million financial accounts was exchanged automatically in 2023, and that covered total assets of almost €12 trillion. As a result, over €130 billion in tax interest and penalties have been raised by the jurisdictions through various voluntary disclosure programmes and other offshore compliance programmes.

Now the interesting thing here is that as a consequence of the introduction of the CRS, financial investments held in international finance centres or tax havens have decreased by 20% since the introduction of CRS in 2017. That’s a significant change. It means investments are moving into jurisdictions where they will be taxed. Over the long term that’s going to be quite significant for increased tax revenue around the world.

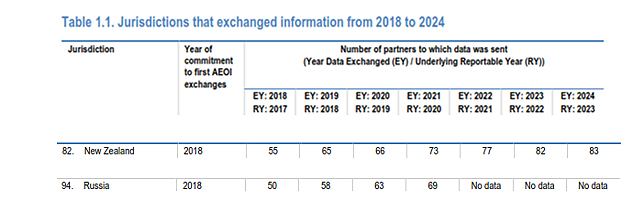

The full OECD report, which also discusses methodologies, runs to 248 pages, but the bulk of what people will be interested in is covered in the first chapter. Table 1.1. gives a summary of how many jurisdictions have been exchanging information, starting in 2018. According to the latest report the time of this report, 118 jurisdictions including New Zealand have started exchanging information.

Now the interesting thing to notice is the steady growth in the number of partners to which data has been sent. For example, the tax haven Anguilla in 2017 sent data to four countries but by 2023, it’s up to 67. The Cayman Islands, another key tax have sent data to 83 jurisdictions.

CRS and New Zealand

New Zealand began swapping data in 2018 when it sent information to 55 partners. For the latest year that’s grown to 83. Based on the early data exchanges Inland Revenue began a review programme in late 2019 which was then interrupted by COVID. However, it has now resumed its review programme, and I have one case at the moment which involves the taxpayer making the relevant disclosures after Inland Revenue enquiries based on data received through CRS. They won’t be the only one.

I was rather amused to see that Russia began exchanging data in 2018 when it sent data to 50 jurisdictions. But for the last three years no data is available. Wonder what’s happened there.

By the way the United States is not part of the CRS. That’s because it has something called the Foreign Account Tax Compliance Act, which basically was the model on which the current global CRS was built, and so it reports data separately.

How much data is Inland Revenue sharing?

I’ve tried unsuccessfully to obtain more detailed information on the data exchanges using the Official Information Act (the data exchanges are outside the OIA because of international treaty obligations which is fair enough). Notwithstanding this the impression I have is there are some huge numbers involved.

You have been warned…

What people should be aware of is that there’s a massive amount of data being circulated by tax authorities around the world right now. Many people may be oblivious to what’s going on. The likelihood is if you have an overseas financial account and you haven’t declared it for whatever reason, then it is quite likely that you will soon be asked a few questions about that by Inland Revenue.

Inland Revenue’s controversial long-term insights briefing proposal

Speaking about Inland Revenue, earlier this year they asked for consultation on their proposed long-term insight briefing (LITB). To quickly recap, LITBs are

“…future focused think pieces that government departments produce every three years. They provide information on long term trends, risks and opportunities that could affect New Zealand in the future, and policy options for responding to these matters. Their purpose is to help us collectively think about and plan for the future. They are developed independently of ministers and are not current policy.”

Back in August Inland Revenue proposed that its next long term insight briefing will explore what would be a suitable structure of the tax system for the future, and invited submissions by early October.

Inland Revenue has now published a summary of those submissions. In total, there were 35 submissions from 12 groups and 23 individuals. Most submissions were generally supportive of the topic. The rest, either suggested something completely different or were either ambivalent about it or did not actually specify whether they supported the project or not.

Seven themes in feedback

Inland Revenue’s picked out seven themes that came through from those submissions. Firstly, the fiscal pressures arising from superannuation and healthcare are a key trend and that’s one of the reasons behind Inland Revenue wanting to do a long term insight briefing on this topic. Most agreed with that, but several also added the question of increasing fiscal pressures arising from climate change.

My belief is its climate change that’s going to be the trigger point around changes to the tax system because that’s happening right now. And as damage from the floods grows and costs and insurers look increasingly wary about insurance, people will be looking to the Government for support.

The second theme was keeping flexibility in the tax system. In its submission EY commented

“We agree improvements to system flexibility should be the focus for this LTIB. In particular, working through options for system integrity in the context of tax rate increases is in our view, important.”

The devil is in the detail

A third theme was the analysis needs to consider policy design details and looking at first principles. Chartered Accountants of Australia and New Zealand made the comment that “Sometimes it is the detail that can make things unworkable. The framework should consider the merits of expanded tax bases with different design parameters”.

Another theme – and this is something I think I would endorse – the analysis needs to consider the tax and transfer system interaction. There were a few submissions pushing very strongly on that point.

A fifth theme proposed considering corrective taxes. The Young International Fiscal Association Network suggested that environmental taxes would fit well with Inland Revenue’s proposed topic because of the long term environmental trends.

The impact of technology

Another theme was the question of technological change and how that will affect the sustainability of tax bases. Earlier this year an IMF report on the impact of artificial intelligence suggested changes to tax systems could be needed.

Some submitters emphasised that it was important to consider how the tax system impacts a wider range of social outcomes. These included Doctor Andrew Coleman who was broadly in support of what was in the proposed LTIB. He suggested that they need to look at a wider range of retirement savings reforms, which would be no surprise to anyone who listened to the podcast with Gareth Vaughan and myself earlier this year. Several other submissions suggested how tax system could support productivity.

Finally, there were suggestions about considering progressive consumption taxes, which hasn’t really been looked at in any detail in New Zealand.

How Inland Revenue will proceed

Following this feedback Inland Revenue has said the LTIB will discuss the arguments for lower taxes on savings and the question of the tax treatment of retirement savings as part of a discussion about social security taxes. This is an interesting development because as the consultation noted generally, most jurisdictions have social security taxes which represent somewhere around 25% of total tax revenue. Whereas we don’t have them at all. This was a point Dr Coleman made in the podcast so it’s good to see Inland Revenue will be looking at that.

No to considering financial transaction taxes

As part of managing the whole scope of the LTIB Inland Revenue believes it “could reduce the discussion of some tax bases are less likely to be subject of significant public discussion such as financial transaction taxes.” This makes sense. Financial transaction taxes or Tobin Taxes are something that pop up in discussions about tax reform. I’m ambivalent about whether in fact they will achieve what people make out for them. I think they would add complexity and they would drive all sorts of different behaviour.

They’re not going to do a full review of the interaction of the tax and transfer system. And to be fair to Inland Revenue, I think that would be an entire long-term insight briefing of itself. But their chapter on consumption taxes discussed using transfers to offset GST rate increase somewhat similar to what Andrew Paynter proposed last week. (Just to repeat Andrew’s proposal is his alone and does not reflect any Inland Revenue policy). According to Inland Revenue the tax regimes chapters “will largely focus on how to make our main tax bases more flexible to rate changes, including considering options to support system coherence and integrity.”

Providing an analytical base

In summary Inland Revenue’s intention

“…is to provide an analytical base to provide further consideration of these issues in the future. For example, our focus on tax bases is on understanding the relative costs of taxing different underlying factors and what the overlaps and differences are in those tax bases. Our focus on tax regimes is on exploring how to make our tax based main tax bases more flexible to rate changes without undermining equity or efficiency goals.”

All of this seems perfectly reasonable to me.

From here there will be a future opportunity to provide feedback when Inland Revenue releases a draft of its briefing for public consultation in early 2025. It will then be finalised and given to Parliament in mid-to-late 2025.

Sir Roger Douglas’s radical proposals

Inland Revenue have also published all the submissions, from those who gave permission to do so, adding up to 175 pages of submissions, from individuals and organisations alike. It’s interesting to dip in and see what is being suggested on the topics. Sir Roger Douglas was one of the submitters and as you might expect, the old warrior is still looking for something radical.

Part of his proposal is a tax-free threshold of $62,000. But the trade-off is most of that gets put into retirement and health accounts. With the proposed retirement account, he’s probably reflecting the thinking of Andrew Coleman about the need for the current generation to start saving in earnest because of the various pressures coming towards us. Can’t say I agree fully with Sir Roger’s proposal but full marks for boldness.

Feedback on Andrew Paynter’s proposal

And finally, this week, to pick up a little bit from last week’s podcast with Andrew Paynter and his proposal to increase GST by 2.5% points to 17.5%, but then with a rebate for low- and middle-income earners. The transcript has been very well read and generated a phenomenal number of comments, over 150 at last count, and I thank all the readers and commenters for that.

What about the self-employed?

One commenter asked a question which we didn’t cover off during the podcast; how would Andrew’s proposal apply to the self-employed? The answer is it would use something similar to the provisional tax system. A person’s income would be uplifted from last year and if you’re in the range then you qualify for the proposed payments.

Last week Tax Management New Zealand and the Young International Fiscal Association network ran a joint presentation for the two winners, Andrew and Matthew to come and present their proposals. If you recall, Matthew proposed expanding the withholding tax regime to contractors. Andrew and Matthew both made excellent presentations to a very engaged crowd, and I can see why the judges had a difficult time splitting the pair. So well done again.

Left-to-right Matthew Seddon, Terry Baucher and Andrew Paynter

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.