A proposal for a simplified fringe benefit tax regime for small businesses.

- My guest this week is Claudia Siriwardena one of the four finalists for this year’s Tax Policy Charitable Trusts Scholarship.

- We discuss her proposal for a simplified fringe benefit tax regime for small businesses.

My guest this week is Claudia Siriwardena, a tax consultant with Deloitte and another of the four finalists for this year’s Tax Policy Charitable Trust Scholarship competition. The Tax Policy Charitable Trust was established by Tax Management New Zealand and its founder Ian Kuperus to encourage future tax policy leaders and support leading tax policy thinking in Aotearoa.

Claudia is suggesting a simplified fringe benefit tax regime for small businesses. I should make it clear here that everything in Claudia’s proposal and what is in this podcast represents her views and not those of Deloitte. Kia ora Claudia, welcome to the podcast. Thank you for joining us.

Claudia

Hi, Terry. Thanks very much for inviting me on.

Terry

Fringe benefit tax is a very controversial tax and one where there based on anecdote people seem to be shall we say, pushing the envelope. I think the main controversy around fringe benefit tax is around the charge that’s that payable for the private use of public company vehicles.

That’s by far and away probably the largest single component of FBT’s and the advent of the twin cab ute, with people thinking that it qualifies for a work-related vehicle seems to have magnified the issues here. There was an Inland Revenue Stewardship Review of FBT a couple of years back and that had a lot of interesting stuff.

What caught your eye about FBT into thinking “Oh there’s something here to consider.”?

Claudia

Yes, like you say, Terry, it can be a very complex regime. There’s a lot of rules that that go into it and my initial inspiration for this simplified FBT regime came through my personal experience of undertaking tax due diligence. A common topic of discussion throughout tax due diligence is FBT, but particularly the FBT rules regarding motor vehicles provided to employees for private use.

I was thinking about ideas for the tax policy competition so I took that personal experience and I thought there was a real opportunity here to simplify these rules and to increase compliance. And aside from that, I think like you’ve said, there is a commonly held view that the FBT rules are relatively complicated and hard to understand. And that was something that was discussed in that Stewardship Review that you mentioned, and also a 2003 government discussion document. So what my proposal is intended to do is to simplify these rules and make it understandable.

A tax with a lot of non-compliance?

Terry

Yes, that Stewardship Review was very interesting, one of the numbers that interested me was that it raised $592 million for the 2019-20 year. But there are only 21,885 filers

When you think there’s several hundred thousand companies around, that does point to a seeming mismatch. I think also, like the old 80/20 rule, the majority of FBT is paid by a few groups. When you look at it like that, you think, gosh, that does point to something of an inconsistency? You can put it like that.

Claudia

Yes, totally agree. And I think throughout that sort of report, there’s a lot of comments in there from interviewees around non-compliance, or this perception that there is a lot of non-compliance.

Terry

Yes, because that undermines the integrity of the tax system because people feel that they’re complying with the rules, but others aren’t. Then the incentive to keep complying is diminished.

It wasn’t in the Stewardship Review, but I had seen other somewhat offhand comments from Inland Revenue along the lines of “Well, we don’t know if it’s worth our while doing that.” And I always thought that’s not necessarily why you enforce the rules for collection purposes. It’s also about maintaining the integrity of the tax system.

And just to digress slightly, FBT is one of those regimes that was introduced to encourage compliance because with the high income tax rates in the early 80s, people were being provided with vehicles instead. And that was thought to bypass the high tax rates and that was why FBT was introduced in 1985.

How do you propose addressing these issues?

Claudia

The cornerstone of my proposal is introducing a default private use percentage for motor vehicles based on 175 days of private use. And the idea of this is essentially if employers apply this default private use percentage, they can use that to calculate the FBT liability. And then what it means is they don’t then have to go and track the actual days of private use. We can sort of cut down time and costs having to actually track all of that, because for a lot of small employers, that is quite a large exercise. So what my proposal does is set a fixed percentage and apply that as the filing position.

And then obviously if people said, well, that’s not good enough for us, we want more accuracy because our use is lesser. They would then have to produce evidence or file on that basis. Inland Revenue would know they’ve moved off the 175 day default basis and then could ask for an explanation.

Terry

Just coming back to those 175 days, how did you arrive at that?

Claudia

So, the 175 days is calculated by treating Friday to Sunday of regular working weeks, the statutory annual leave entitlement and annual public holidays, as available for private use. Which in another way is essentially saying that Monday to Friday is treated as not being available for private use, and what I’ve done again for simply. What that does is it assumes that the Friday to Sunday of regular working weeks, your annual leave annual public holidays will typically confer a greater private benefit to employees then use on Monday to Thursday.

Terry

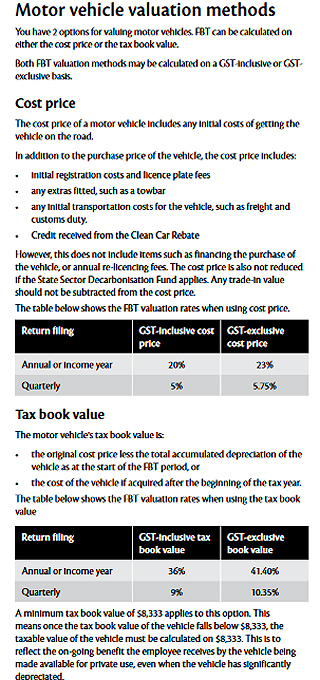

Thanks. But you wouldn’t change the basis of how FBT is calculated. To recap , quickly on a car, it’s 20% of the GST inclusive value of the vehicle when new or when acquired. Alternatively, you can use 36% of the depreciated tax book value.

Claudia

No, I don’t propose changing the basis of calculating FBT.

Terry

The availability of alternative calculations reinforces your point about the complexity of FBT. If you’re a small business, it’s another compliance headache.

Eligibility thresholds

Terry

Your proposal would not be available to all employers as you’re targeting smaller businesses. What are the relevant thresholds?

Claudia

I’ve got three main criteria. So firstly, the business has to employ less than 50 full time equivalent employees. The business has got to have an annual turnover of the preceding income year of less than $10 million. And the company also is providing fewer than 10 motor vehicles to employees, which were available for private use.

My thinking in terms of that criteria, is that the small businesses, the compliance costs that they incur, are typically out of proportion to the larger businesses. So, what this is doing is focusing on smaller businesses who can actually get the most benefit from this, and who may not have sort of the processes in place or the scale of resources available to larger enterprises.

You’ve got to find some sort of threshold or middle ground. So, these criteria are where I landed in terms of deciding who falls in and out, because when we are considering revenue integrity and maintaining that. And what I don’t want is my proposal to then decrease revenue integrity by allowing, say, a lot more businesses than desirable into sort of this regime.

Increased Inland Revenue activity & the integrity of the tax system

Terry

You see your proposal as encouraging compliance, but you also expect Inland Revenue to increase its activity in this field?

Claudia

Yes, when you look at the Stewardship Review together with recent comments from the Minister of Revenue around FBT and you put that together with the increased funding that Inland Revenue have recently received in terms of audit activity, then I don’t really think anything is off the table in terms of looking at FBT. Especially when there is this common view that there is potentially non-compliance either intentionally or because of the complexity.

Terry

Yes, this is the thing it is all about. Protecting the integrity of the tax system always matters but I think FBT is an area where I would have said a risk has developed. there. Do we know about how many companies that could be affected in your proposal?

Claudia

No, no, I haven’t come across that detail, which then also makes it quite hard to quantify potential impacts. But I think a lot of it this also goes back to the recent Inland Revenue Improvement Performance review which talks a bit about the tax gap. It doesn’t analyse what that FBT tax gap might be, which can make the benefit of this proposal quite hard to quantify.

Terry

That’s a very interesting point. One of the things I took away from the Performance Improvement Review was commentary that although Inland Revenue, is a high performing organisation it probably could be doing a lot better for small and micro businesses.

Just to tie up this point about non-compliance is I think twin cab utes have been in the top 10 selling new vehicles in New Zealand for several years now. I must admit when I see a web company advertising on a twin cab ute, I’m thinking “Don’t be trying to tell me you’re a work-related vehicle.” So yes, I’d be wanting to focus resources on that.

The pros and cons of simplifying the tax system

Earlier we talked about how you calculate the FBT and straight away we got into a lot of detail. I guess there’s got to be scope as well for perhaps thinking further about can we how can we make this easier?

But Inland Revenue is reluctant to create options that people might use for simplification, for fear that it might be abused. I would point to the accounting income method as an example of a good idea made over-complicated. It means that the same standard of compliance is imposed on a small company with two or three employees and one or two vehicles as for a District Health Board. What’s your thoughts on that? About maybe simplifying the regime further on the grounds of integrity and maybe compliance?

Claudia

I think general simplification of regimes is an interesting question and it definitely is the core of my proposal. I think what can be good with simplified tax regimes is it just makes it understandable; it makes it simple which I think is really important for ensuring taxpayer compliance and maintaining that revenue integrity.

I think, for example, I’m not too sure how many clients respond positively when we start discussing the FBT rules, and we need to review this and that because it’s complicated. On the other hand, a critique could be that you will lose revenue. Often with a simplified regime you sort of can strip back the detail, which is sort of what my default private use percentage is doing. But that potentially introduces is an under reporting or under collection of potential revenue.

But how I’ve sort of approached this, especially in the context of FBT and motor vehicles, is well, when you consider the current non-simplified regime is that actually losing revenue itself because of its complexity, because of people not complying? It’s a tricky one to balance and my proposal is definitely hoping that by simplifying the regime we increase compliance. I think it has its place in certain in certain regimes.

Terry

That’s very well put. I think sometimes the perfect is the enemy of the good. Everyone should comply, but what is making it difficult for everyone to comply is because for small businesses it’s an enormously expensive compliance burden. With compliance there is an irreducible minimum requirement which I think we’ve reached in many cases. But that’s still a lot for small businesses and, micro businesses in particular.

I think a lot more support could be made available to businesses turning over between $3 and $30 million, and it would pay off in terms of increased compliance.

I come from Britain and the fringe benefit tax regime there, the value of the benefits, is included in an employee’s income at the end of the year and then taxed that way. When I came here and saw how New Zealand taxed fringe benefits I thought the approach here was much sounder in terms of revenue collection.

When you think that with a 39% personal income tax rate FBT is now 63.93% on the value of the benefit unless you get into calculating it in more detail. Have we reached a point that a better alternative for, say, larger companies to apply the fringe benefit to employees and tax it through PAYE rather than the company taking the hit. What’s your thoughts on that?

Claudia

Yes, when I was going through my initial process of brainstorming FBT issues and potential proposal ideas, I did consider the case of whether employees should bear different benefit tax costs through PAYE.

I think like you say, times have sort of moved on and they continue to, but based on some initial research that I found, it actually appeared that it was questionable whether making such a change would simplify the FBT regime and reduce compliance costs, which was my key focus.

I mentioned earlier the government discussion document from 2003. It noted that changing who pays the tax is unlikely to result in any material compliance savings for employers and may in fact actually increase compliance costs on employers.

Which for my proposal and just in general, that’s not something that I would want to put forward. So, in this respect, who pays the tax doesn’t necessarily remove the issues that are associated with the FBT rules at present. So yes, noting that it was 2003, that’s probably still my view at the moment, based on that initial research.

Terry

I think that’s a good point to leave it there for now, Claudia. What’s next for you in terms of the scholarship?

Claudia

I’ve got my final 4000-word submission in a few weeks on the 16th of September. So over the next few weeks, refining my idea, sort of fleshing it out, answering my key points and then down to Wellington last week of October to do a 10 or 11 minute presentation to an audience and answer a few questions.

Terry

That sounds quite intimidating.

Claudia

Yes, but excited by it. It’ll be good fun.

Terry

Well, good luck and thank you so much for coming along. It’s been great to have you on the podcast. It’s a very interesting proposal, full of merit in a space which I think needs initiatives like this.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.