Terry Baucher crunches the numbers around corporate tax and says anybody expecting the Tax Working Group to suggest a cut in the tax is going to be disappointed

Anyone who thinks the Tax Working Group will suggest a cut in company income tax in its interim report due to be released next month is going to be disappointed. Recently released papers prepared for the TWG concluded a cut was “unlikely to be in New Zealand’s best interests.”

The papers also contain some fascinating data about the size and profitability, or otherwise, of various industry sectors.

To cut or not to cut

At 28% New Zealand’s company tax rate was the 10th highest in the OECD in 2017. It is also above the unweighted OECD average of 24.9% for the same year. However, this doesn’t take into account the imputation regime which means the final tax rate for New Zealand tax resident investors is the shareholder’s marginal tax rate. As a result of the imputation regime the effective tax rate for New Zealand resident shareholders is the sixth lowest in the OECD.

Unless a company tax rate cut was accompanied by a reduction in personal income tax rates, the main benefit for New Zealand resident investors would be the opportunity to accumulate income taxed at a lower rate before distribution at which point it would be taxed at personal income tax rates. According to Inland Revenue the existing five percentage points gap between the company tax rate and top individual tax rate has encouraged “a variety of arrangements that…allow taxpayers to avoid the intended taxation of dividends on the distribution of income or assets from companies to their shareholders”. (As the same paper later notes some of these “integrity issues would be reduced if a capital gains tax were introduced.”)

These integrity issues plus additional complexity are also cited as reasons against a lower tax rate for small businesses. In addition, officials consider a small business tax rate is likely to reduce overall productivity, a long-standing problem for New Zealand. There is also the possibility that a small business tax rate might act as a disincentive to growth for businesses, a criticism the Fraser Insitute in Canada raised of a recent Canadian government proposal.

Nevertheless, New Zealand’s comparative position within the OECD is likely to worsen following the dramatic cut in the United States corporate tax rate from 35% to 21% with effect from this year. A cut in company tax rates is sometimes suggested so that New Zealand can remain “competitive”, so at first sight it seems likely pressure for a corporate tax cut may increase as company tax rates fall internationally.

Conversely, one of the key arguments against a company tax cut was the issue of “location-specific economic rents.” Economic rents are the returns over and above those required for investment in New Zealand to take place. As the paper notes these returns are “likely to be larger in a geographically isolated market like New Zealand where supply of certain goods and services is likely to require a physical presence in New Zealand.” In short, such returns can be taxed without discouraging investment as New Zealand’s location means investment remains viable despite taxation. In other words, if overseas investors are making a return with a 28% company tax rate, there is no need to incentivise them to invest with a lower tax rate. In fact as officials noted doing so would not be in New Zealand’s interests as more of the benefit would flow to non-residents.

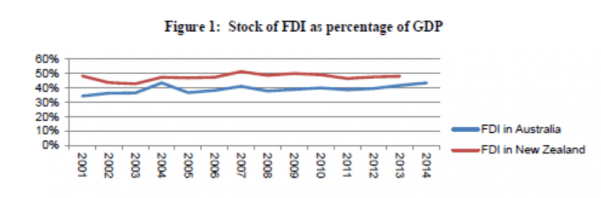

Another revealing insight was that there appears to be little correlation between a cut in company tax and an increase in foreign direct investment (FDI). Despite a cut in the company tax rate from 33% to 30% in 2008 and then to 28% with effect from 1 April 2011, there was no surge of FDI into New Zealand either absolutely, or relative to Australia as the following graph illustrates:

There may have been other factors at play but as officials noted “it should at least cause us to question any assumptions that company tax cuts are likely to be a silver bullet for increasing the level of FDI into New Zealand.”

A narrow base?

Separate from the issue of company tax rates, another background paper analysed the effective tax rates for companies. Although results were advised as “indicative only” the paper threw up some interesting and at the same time potentially alarming statistics.

The analysis focused on “significant enterprises” (groups of entities with annual consolidated turnover greater than $80 million) over the 2013 to 2016 tax years. Apparently, there are only about 500 such enterprises in New Zealand and between them they are responsible for about 51% of the total income tax paid by companies ($12.6 billion for the year ended 30 June 2017). Furthermore some 20% of these enterprises have either a tax or accounting loss and therefore did not have effective tax rates calculated for the purposes of the paper.

Overall the unweighted average tax rate for those profitable enterprises was 28%, or exactly in line with the company tax rate. However, once adjusted for the relative size of the enterprises, the weighted average rate fell to 20%. That in itself masked substantial variations between industries. 21 industries had effective unweighted company tax rates of less than 25%. In particular, the unweighted average effective company tax rate for the insurance and superannuation fund, residential care services, and motion picture and sound recording activities industries was 16%. Remarkably, 38% of the enterprises within these three industries were making a tax loss even though only 11% reported an accounting loss.

To help explain the variation in effective tax rates, the paper then reviewed the major tax adjustments in the 2015/16 tax year. Based on a sample of large enterprises which had approximately $13 billion in net taxable income for the year, the three most significant adjustments which decreased taxable income relative to accounting profit were untaxed realised capital gains amounting to $2.2 billion, unrealised valuation gains ($1.3 billion) and untaxed overseas dividends of $1 billion.

Conversely, those adjustments which increased taxable income included non-deductible accounting write-downs ($1.1 billion), non-deductible capital losses from sales of fixed assets ($600 million) and other non-deductible expenditure such as goodwill write-offs ($280 million).

The paper also looked at the untaxed capital gains for small and medium companies over the same four tax years. It found the average yearly value of untaxed capital gains was $2.2 billion with companies within the rental, hiring and real estate services averaging gains of $763 million each year. The research also noted that the following four industries had particularly high proportions of untaxed realised gains when compared with the accounting profits of the industry:

- Accommodation and food services (64%)

- Agriculture (53%)

- Rental, hiring and real estate services (40%)

- Financial and insurance services (27%)

In something of a throwaway comment the paper remarked that “the majority of small and medium enterprise are in a loss position”. Given the number of small businesses in New Zealand it’s not reassuring to hear that many are in loss.

What does all this mean? Quite apart from reducing the likelihood of a company tax rate cut, the analysis shows the relative importance of untaxed capital gains to several industries. After noting “the primary cause of under-taxation is untaxed capital gains, both realised and unrealised” officials then asked the TWG “Does this information affect the Group’s views on business and company tax”. We’ll know the answer next month when the TWG’s interim report is relased but defenders of the status quo on the taxation of capital gains are likely to have their work cut out.