Terry Baucher on Google, tractors, tax evasion, cashless society, taxing CO2 emissions, the Swiss cryptocurrency town, really big tax cuts, sugar tax, Nigeria’s census & more

Today’s Top 10 is a guest post from Terry Baucher, an Auckland-based tax specialist and head of Baucher Consulting.

We welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

If you’re interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

1) What’s a tractor in Australia got to do with Google?

“NZ strikes blow for global tax clampdown as Google shifts policy” was the headline in the Financial Times after Google revealed to Parliament’s Finance and Expenditure Select Committee it was going to change how it booked its revenue from New Zealand.

“We intend to shift our business model from this past approach, such that customers will enter into contracts with our New Zealand entity, which will generate revenue from NZ advertising customers, and pay taxes in line with its role in the transaction.”

So, will this mean more tax for New Zealand? Not necessarily because although the advertising revenue will no longer be booked in Singapore, Google New Zealand might still be charged for the right to use Google’s intellectual property.

Intellectual property and the right to use intellectual property is embedded in many more household objects than just smartphones. For example, farmers in Nebraska are demanding the passage of a law to enable them to carry out repairs to tractors which now contain millions of lines of software code.

Australian farmers are increasingly concerned that they may not be able carry out their own repairs on tractors purchased from America.

“If you buy a tractor, you buy a tractor and it’s yours. And the big companies are now trying to say if you buy a tractor, it’s not yours.

How long before Australian and New Zealand farmers may have to follow the lead of farmers in Nebraska and demand the ”right to repair” tractors?

2) Tax evasion.

Two tradies were recently jailed for each evading nearly $1 million in tax.

The tax department said Hamilton plasterer Paul Andrew Mills was sentenced on February 9 to two years and one month prison.

Auckland builder Hamish Paul Aegerter received a sentence of two years and seven months on Friday

The sentences seem in line to similar offences committed in Australia and the United Kingdom:

“WILSON, a 64-year-old male from Chapel Hill Queensland falsified nine BAS to obtain $217,134 in refunds he was not entitled to. Documents provided at audit were determined to be false. He was convicted on two charges and sentenced to 36 months jail with a non-parole period of 12 months.”

“The director of a Gloucester security services company, who stole almost half a million pounds in tax, has been jailed for three years after an investigation by HM Revenue and Customs.”

It’s tempting given New Zealand’s ranking as the least corrupt country in the world to think tax evasion is a relatively minor matter.

In fact, as Treasury admitted in 2013: “There are no reliable estimates of the size of the tax gap in New Zealand.”

The same report then went on:

“A reasonable general order of magnitude for the tax gap across OECD countries would be 5 to 20 percent of total tax collections.18 This implies a tax gap for New Zealand of around $3-11bn. We expect New Zealand to be at the lower end of this general range owing to our general broad-base, low-rate tax settings, significant reliance on indirect taxes, and low levels of corruption – all things that are thought to be correlated with a smaller tax gap”.

This seems a naïve attitude but even at the lower end of the scale $3 billion of additional tax is not chump change.

3) Sweden goes cashless.

The Riksbank, the Swedish central bank, is considering whether it should issue an e-krona.

This is a logical step as Sweden is rapidly becoming a cashless society.

Between 2007 and 2015, cash in circulation decreased by nearly 15%.

And between 2010 and 2015, the number of cash payments in shops almost halved, from 39% to 20%.

At the same time, electronic payments have surged. Ninety-five per cent of Swedes have access to a debit or credit card, and made an average of 290 card payments a year in 2015. That’s well above the EU average, at 104 card payments per year.

In fact, as this OECD report notes:

“In Sweden companies can refuse to accept cash payments. This approach is already being used by some restaurants, public transportation and hotels. In Sweden the use of cash is decreasing, and approximately 80 % of all transactions are made electronically, including through new techniques such as smartphones and contactless payment methods. An app developed by banks in Sweden facilitates money transfers between private persons and make payments to companies, which has increased in use from 76 000 transactions in 2012 to 76 million transactions in 2015” (page 23).

As part of an anti-tax evasion programme, Sweden requires that sales must be registered in a cash register connected to a fiscal control unit. The immediate revenue effect once the requirements were introduced was a 5% increase in the reported revenues. This resulted in increased tax revenues of at least SEK 3 billion (€320 million) per annum as a result of reduced tax evasion. Something for Inland Revenue to consider?

4) Tax year end approaches.

The end of the 2017-18 tax year is fast approaching. The 31st of March is also the due date for tax agents to file clients’ tax returns for the March 2017 year. The pressure will ramp up on tax agents to meet the deadline.

In the UK, the deadline for filing 2016-17 tax returns was 31st January. According to HM Revenue and Customs a record 10.7 million “customers” filed before the due date with 92.5% of these completed online. As HMRC noted, it got a bit frantic towards the end.

There were 758,707 people who completed their return on the last day before the deadline and the most popular hour for customers to hit submit was from 4pm to 5pm on 31 January with 60,596 returns received (1,010 per minute, 17 per second).

Thousands of customers avoided any penalties at the last minute as 30,348 customers completed their returns from 11pm to 11:59pm yesterday.

The penalties for late filing can accumulate quickly so naturally people were quick to offer excuses including the following gems:

- I couldn’t file my return on time as my wife has been seeing aliens and won’t let me enter the house.

- I’ve been far too busy touring the country with my one-man play.

- My ex-wife left my tax return upstairs, but I suffer from vertigo and can’t go upstairs to retrieve it.

- My business doesn’t really do anything.

- I spilt coffee on it.

No doubt Inland Revenue will soon be receiving a few creative excuses. It would be good to know whether aliens are also at work in New Zealand.

5) Taxing CO2 emissions from road transport.

New OECD reports on the taxation of energy use make uncomfortable reading for New Zealanders.

Road transport is taxed relatively highly, but other negative side effects of fuel use in road transport (e.g. local air pollution, congestion), suggest that taxes are still too low in most countries. Fuel taxes dominate price signals, carbon taxes play almost no role.

According to the OECD New Zealand has the lowest rate of taxation on diesel at €1.3 per tonne of CO2. (Road user charges are not taken into consideration). By comparison the UK charges €299.9 per tonne of CO2. When it comes to taxing petrol New Zealand imposes €184.8 per tonne with the UK again the heaviest taxer at €353.4 per tonne. Russia doesn’t tax either diesel or petrol and the US has the third lowest rates of taxation at €21.8 per tonne for diesel and €19.1 per tonne for petrol.

Based on these numbers the taxation of CO2 emissions represents a huge challenge to the New Zealand economy. The greater use of environmental taxes is within the terms of reference of the government’s Tax Working Group. It will be interesting to see what conclusions it reaches.

6) Swiss banking goes crypto.

6) Swiss banking goes crypto.

Investors in cryptocurrency got a rude awakening at the start of the year when what Nouriel Roubini called “The biggest bubble in human history” appeared to burst. The price of bitcoin fell from just under US$20,000 in mid-December to US$6,000 on February 6th. According to CoinMarketCap, the total market capitalisation of cryptocurrencies has fallen by more than half this year, to under $400bn.

However, the volatility of cryptocurrencies doesn’t seem to have deterred the Swiss town of Zug which has been quietly developing into a hub for crypto-services with the encouragement of the Swiss government.

The country should seek to become the “crypto-nation”, said the economy minister, Johann Schneider-Ammann, last month. Zug aims to be the capital of that nation.

To that end, Switzerland is maintaining loose rules for crypto-businesses, even as other countries are tightening theirs. An industry is developing to store tangible crypto-assets, such as the hard drives on which cryptographic keys are stored, offline in cold, dry, secret sites complete with rapid-response teams. Where better than a decommissioned military bunker in the Swiss Alps? In Zug, friendliness to crypto-currencies is in evidence all around. “Bitcoin accepted here” stickers adorn the city hall and several shops, including the wine merchant’s. In 2016 Zug became the first place in the world to accept bitcoin for some public services. Residents can get a blockchain-based digital identity.

It was the arrival of the Ethereum Foundation in 2013 which really kick-started Zug’s development. Regardless of the seemingly speculative nature of cryptocurrencies, it’s the potential application of blockchain technology at the core of Ethereum, which is attracting interest. As this E&Y report suggests blockchain technology could transform indirect tax such as GST “by securely establishing the what, where and when of transactions”.

Regulators around the world are struggling to keep up with the pace of developments in cryptocurrencies. My view is that blockchain technology means cryptocurrencies are here to stay. With that in mind, how about making New Zealand a “crypto-nation”? After all, the advantages of Zug as a hub are equally true of New Zealand, only we have better beaches and wines.

7) The biggest tax cut in (American) history?

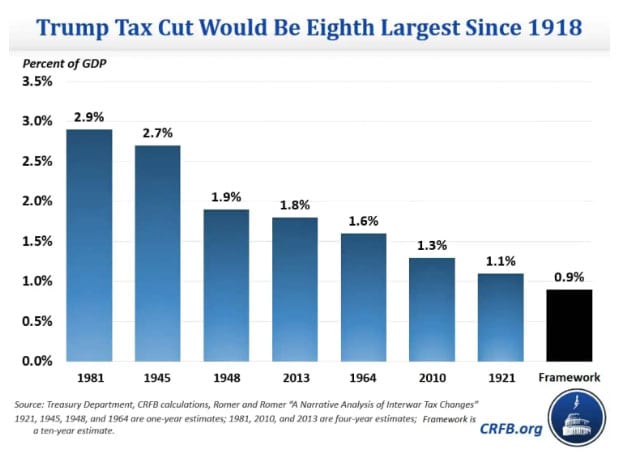

On the passing of The Tax Cuts and Jobs Act 2017, President Trump declared “It will be the biggest tax decrease, or tax cut, in the history of our country.” Is that so? Not according to several sources including the United States Treasury Department.

The largest tax cuts in American history were President Reagan’s Economic Recovery Act 1981, which cut taxes by 2.89% of GDP (the top rate fell from 70% to 50%). By the same measure President Trump’s cuts would the eighth largest since 1918.

It would therefore appear the President’s claim was wrong. Bigly. (Sorry, not sorry).

But what would be the biggest tax cuts in New Zealand history? Tax rates and thresholds have been remarkably stable over the past 30 years and there have been few genuine tax cutting budgets. (The Budget 2010 income tax cuts were offset by an increase in GST). There were some tax reductions in 1996 and 1998, but for radical income tax cuts those in the mid-1980s when the top rate fell from 66% to 33% are the most radical.

8) “Sugar, sugar, oh honey, honey…”

”Sugar, rum and tobacco are commodities which are nowhere necessaries of life…which are…objects of almost universal consumption, and which are therefore extremely proper subjects of taxation.”

Thus spake Adam Smith, yes THAT Adam Smith, in The Wealth of Nations. However, as the recent spat between health advocates and NZIER demonstrated, taxing sugar is a controversial move.

Although Health Minister David Clark said the government had no immediate plans for a sugar tax, the merits, or otherwise, of such a tax are within the remit of the Tax Working Group to consider.

Meantime, the United Kingdom is introducing a Soft Drinks Industry Levy on 6th April. The levy applies at a rate of 18 pence per litre to drinks containing at least 5 grams of sugar per 100 millilitres. It increases to 24 pence per litre if the sugar content is 8 or more grams of sugar per 100 millilitres. The SDIL is expected to raise £520 million per annum to be spent on increasing the funding of sport in primary schools. Both proponents and opponents of sugar taxes will be watching to see if it achieves its health objectives. Watch this space.

9) Census.

Next Tuesday is Census Day, the 34th in New Zealand since 1851. It will be the first digital census, barring a major IT malfunction such as happened in Australia in 2016 it should pass off without note.

As the Census website states, censuses are important for identifying where new schools, hospitals and other infrastructure may be needed. For that reason, they can be politically very sensitive. Nigeria, Africa’s most populous country (184 million and counting), may or may not have a census this year. As the Nigerian National Population Commission explains previous censuses have been very controversial:

The refusal of the government to accept population census of 1962 prompted the 1963 population census which critics claimed were arrived at by negotiation rather than enumeration. The result was contested at the Supreme Court which ruled that it lacked jurisdiction over the administrative functions of the Federal Government.

The 1973 Census conducted between November 25 and December 2 was not published on the ground of deliberate falsification of the census figures for political and /or ethnic advantages.

Tuesday’s Census will be nowhere near as fraught as Nigeria, but it will be interesting to see how central and local government act on the data gathered.

10) A playlist for preparing your tax return.

Right now, if you ring Inland Revenue and find yourself on hold, there’s a good chance you’ll hear Coconut Rough’s 1983 hit Sierra Leone. In fact, you’ll probably hear it a lot. For the past few weeks some fault, or just plain sadism, has meant that Inland Revenue’s hold music has put Sierra Leone on continuous loop.

It could be worse, though, The Beatles Taxman for instance:

“Let me tell you how it will be

There’s one for you, nineteen for me

‘Cause I’m the taxman, yeah, I’m the taxman”

Here are a couple of collections of music to prepare your tax return by:

Unsurprisingly the Beatles’ Taxman, Pink Floyd’s Money and Abba’s Money, Money, Money feature in both soundtracks. There’s no sign of Blondie’s One Way or Another (its opening lyrics are surely Inland Revenue’s mission statement “One way or another, I’m gonna find ya’, I’m gonna get ya’, get ya’, get ya’, get ya”).

Sierra Leone isn’t anywhere to be heard either. Mercifully.