- This week a preview of what tax measures might be in Thursday’s Budget. What could Finance Minister Nicola Willis do to cover the cost of the tax threshold adjustments and where might Inland Revenue get additional funding for investigations and enforcement?

- Also the UK election and the latest fallout from the ATO’s raid on Exclusive Brethren related businesses.

Before we preview next Thursday’s Budget a quick note on a couple of other interesting developments this week. The announcement of the UK General Election on 4th July will further delay details around the replacement of the current remittance basis of taxation. You may recall this was originally announced in the UK’s Spring Budget on 6th March. The proposal was for the remittance basis to be replaced by something similar to our Transitional Resident’s Exemption.

We were meant to have seen draft legislation by now, together with consultation on the related inheritance tax implications of the proposed change. But neither of those had materialised by the time the Election was called. We therefore remain in limbo as to what will be happening, although we do understand that the Labour Party, currently odds-on favourite to win the election, is broadly in favour of the new rules. As always, we’ll keep you up to date on when further developments arise, but in the meantime, anyone potentially affected should continue to plan on the basis that the existing remittance basis rules will remain in force.

Fallout from the ATO’s investigation into the Exclusive Brethren

In early April, I covered the Australian Tax Office’s (ATO) no notice raid on the offices of businesses related to the Exclusive Brethren. This week, the accounting firm Universal Business Team Australia or UBTA which is controlled by the exclusive Brethren, advised its clients that its accounting division would close with immediate effect. The same announcement said that UBT’s UK and New Zealand operations will continue unaffected for the moment.

As I said at the time of the initial ATO raids it would be interesting to see whether Inland Revenue will initiate a similar investigation of the Exclusive Brethren’s New Zealand related operations. It has to be said that closing down the accounting operation indicates that something fairly serious has been identified by the ATO. But no doubt we’ll find out more in the coming months.

A much anticipated Budget

Thursday is Budget Day. This will be my 14th Budget lockup and I’m looking forward to it as I always do. But this year is probably one of the most anticipated budgets in in a long time. There are two reasons for that. On the one hand, many people are very keen to finally discover the size of the proposed tax cuts and how they will personally benefit. On the other hand it’s a pretty anxious time for civil servants and a myriad of agencies and organisations waiting to see how the accompanying budget cuts will affect them.

Lessons from Bill English

Former Prime Minister Bill English, who’s been advising the current government, delivered eight budgets during his time as finance minister and it would be surprising if Nicola Willis had not absorbed a few lessons from his experiences. Clearly what she would love to do is match what English did in 2010, when he masterminded a so-called tax switch. This cut the top personal income tax rate from 38% to 33%, together with a reduction in the corporation income tax rate to 28%. But at the same time, he increased GST from 12.5% to 15%. As former Labour Minister of Revenue David Parker ruefully admitted it was a masterpiece of political campaigning and delivery.

But Bill English was also a master of slipping in some quiet and relatively unnoticed tax increases. There was a controversy in 2012 about the removal of an old measure which primarily affected paper boys. But one which was turned out to be very significant was the reintroduction of employer superannuation contribution withholding tax on employer KiwiSaver contributions in 2011. That’s now worth almost $2 billion a year according to Inland Revenue’s annual report to June 2023

Bill English, and to be fair, Grant Robertson, were both happy to allow fiscal drag to increase the tax take, hence the fact that tax thresholds have not been adjusted since 2010. Tax cuts were a key promise of the National Party and the ACT Party and the key delivery in this budget will be increasing income tax thresholds. These are certainly one of the tax measures we know will happen. We also know that there will be increased funding for Inland Revenue for investigations as that was included in the coalition agreement with New Zealand First.

What did National promise?

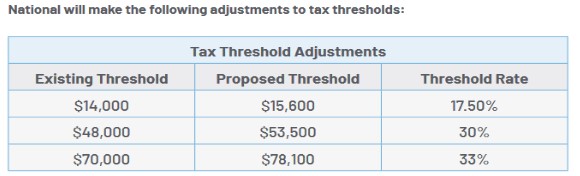

On the tax threshold adjustments, National’s promises in its election manifesto were fairly modest.

As long-standing listeners to the podcast will know, I think the $48,000 threshold is highly problematic.

Steven Joyce and the Independent Earner Tax Credit

Now it’s worth noting and remembering back in 2017, then Finance Minister Stephen Joyce proposed quite a significant family incomes package, including threshold adjustments, for the 17.5% and 30% rates. As part of the measures to pay for those increases, he proposed cancelling the Independent Earner Tax Credit (IETC). This is a tax credit worth up to $520 a year for people earning between $24,000 and $48,000. One of the rationales given by Joyce for cancelling the IETC was that only 30% of those people who could claim it actually did so.

Here’s where it gets quite interesting. According to the Tax Expenditure Statement (tax expenditure statements estimate the cost of a specific tax relief) released at the time of the 2017 Budget, the estimated cost of the IETC for the year ended 31 March 2017 was about $223 million. The Tax Expenditure Statements released in last year’s budget estimates the value of the IETC for the year ended 31 March 2023 to be $174 million. According to Treasury the amount of IETC claimed “has fallen by 9.5% over the past two years.

The Independent Earner Tax Credit to be abolished?

My first big prediction is therefore that the tax threshold adjustments, the IETC, will be abolished, which would free up $174 million. As I said, it would be interesting to see where the emphasis of those threshold adjustments will fall. I’d like to see them focus around that $48,000 mark.

By the way, Steven Joyce would have increased the threshold where the 17.5% rate kicks in from $14,000 to $22,000 and the threshold at which the rate increases to 30% would have been increased to $52,000. Inflation has really devalued those thresholds, so it will be interesting to see what comes out on Thursday relative to what was proposed in 2017.

What Inland Revenue investigation activities will get funded?

Now the other thing that definitely is going to happen is increased investigations and enforcement funding for Inland Revenue. I expect there to be a reasonably substantial increase. At present in the Appropriations to June 2024, there’s $133.8 million of funding for investigations. Just to put some things in context, in Steven Joyce’s 2017 Budget, the Appropriates for investigations for the year to June 2018 was $173.7 million. Inflation adjusted that would now be close to about $200 million. However, I doubt whether Inland Revenue presently has the capacity to use what would effectively be in a 50% boost in funding. (As an aside, the reduction of investigation staff funding since 2018, has been a matter of some controversy – were too many skilled people let go just to make the numbers balance?)

A fringe benefit tax review?

Whatever additional funding is provided I expect to see tied to specific initiatives. One of those will be in relation to fringe benefit tax (FBT) which has just been in the news. Inland Revenue’s Stewardship Review of FBT in 2022 has clearly caught the Minister of Revenue, Simon Watts’ attention, because he’s mentioned it in a couple of speeches. We also know through an Official Information Act release that he has received advice on his options for review. These are either a once over lightly approach or a more fundamental review. Inland Revenue prefers the latter approach. As previously mentioned, FBT has been around for a long time and it’s long overdue for serious review. Expect the Budget to contain funding for that review.

Dealing with the hidden economy and organised crime

There will also be substantial funding given for an initiative into the hidden economy. Minister Watts has received advice on Inland Revenue’s role in defeating organised crime which includes money laundering and tax evasion. Increasing funding here would not only tick the box for the Coalition agreement with New Zealand First, but also with the Coalition Government’s wish to get tough on crime and the gangs.

Cracking down on Student Loan debt

I also expect to see a fairly substantial amount of funding given to addressing the question of student loan debt which currently stands at over $9 billion. There’s a particular problem with overseas based borrowers, many of whom are in default either because Inland Revenue doesn’t know where they are, or they’re simply ignoring any requests for payment.

At the moment, Inland Revenue’s record with overseas defaulters is not terribly impressive. According to Inland Revenue’s annual report for the June 2023 year, it received just 108 payments totalling $16,421 from 18 overseas based student loan defaulters.

You can therefore expect a crackdown. Not only will there be increased funding to track down defaulters (including greater use of the existing agreement with Australia), I expect the Government will make it very clear that the already existing powers to detain student loan defaulters at the border will be enforced. Expect to hear more stories about that.

More Student Loan changes?

I also wonder whether the student loan repayment rate may be increased. One of Bill English’s sneaky tax measures was back in April 2013 when he increased the repayment rate from 10% to 12%. Another increase would mean student loan borrowers would have one of the highest effective marginal tax rates because this 12% or whatever it might be, is on top of their PAYE deductions.

Alternatively, the Government might introduce a nominal interest charge on student loan debt, or they could increase the minimum amounts of repayments required by overseas borrowers. Re-introducing interest on student loans would be a controversial measure. But my view is, if you’re going to have controversy around tax, you do it in your first budget.

What about GST on fund management fees?

If Nicola Willis is considering measures which could help claw back the cost of threshold adjustments GST on management services to managed funds is one which I think might come back onto the table. You may recall when the Labour Government introduced this proposal in August 2022 it withdrew the bill within 24 hours in the face of some ferocious pushback, which also included the fairly creative use of some long term fiscal impacts as to the potential impact on KiwiSaver funds.

That measure would have done two things. It would have clarified the treatment, which is currently very ad-hoc, but it would also, and this is where Finance Minister Nicola Willis, will be paying attention, have been worth about $225 million a year from 1st April 2026. So don’t be surprised if it’s reintroduced again to help pay for the tax threshold adjustments and as part of a “rebalancing.”

Could Cash PIEs be in the firing line?

Potentially the most controversial measure, though, would be to tackle the question of the prescribed investor rate (PIR) on portfolio investment entities (PIEs). Currently the highest PIR for a PIE is 28%, which means there’s an 11-percentage point difference between the top maximum prescribed investor rate and the top personal tax rate, (and also now since 1st April, the trustee tax rate). This has helped the development of what are called Cash PIEs, which are largely invested in term deposits/money markets. If the funds had been directly invested in term deposits held with banks, the interest would be taxed normally up to 39%. But because they’re in PIEs, that’s capped at 28%.

Inland Revenue has increasing concerns about this mismatch between the corporate income tax rate of 28% and the top marginal rate of 39% and it tried unsuccessfully back in 2022 to introduce some measures around this issue. If it was going to make a start on addressing these issues, I think you could see a proposal to income of Cash PIEs taxed at 39%. The Government might even try to make all PIEs except KiwiSaver funds subject to ordinary tax rates. Such a move would be hugely controversial, but it would probably also raise a fair bit of cash as well.

Anyway, we’ll find out on Thursday. As usual, I’ll be in the lock up and you’ll be able to hear our view on this year’s Budget just after 2PM.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.