- the good

- the not so good

- the concerning

This week we take a close look at Inland Revenue’s Annual Report for the year ended 30th June 2022. It begins with an overview of how Inland Revenue “has contributed to the well-being of New Zealanders”. There’s a summary of the highlights and key results for the year including a summary graphic illustrating the composition of the $100 billion of tax revenue raised during the year and the areas in which it was spent. The highlights note that Inland Revenue exchanged financial account information with more than 70 countries and has information sharing arrangements with more than 17 agencies. This is something that people always need to keep in mind just how much information Inland Revenue has access to and how much it shares.

The overview declares “we interact with a range of customers on tax and provide payments that are critical to people’s wellbeing.” You’ll note the use of the word “customers”. In fact, “customer” or “customers” is used over 660 times in the report, compared with a mere 30 mentions of “taxpayers”.

I have great reservations about describing taxpayers as customers. I can appreciate there are some benefits from this approach in terms of helping Inland Revenue staff understand the need to provide better service to taxpayers. But the repeated use of the term customers implies a voluntary transactional relationship and ignores the power dynamic. Actually, tax is compulsion. We are compelled to pay tax and we can’t exactly say to the Inland Revenue, ‘Your service is terrible. I’m switching providers to the Australian Tax Office’.

Whatever the description, Inland Revenue considers it’s dealing with three groups of customers; individuals, families and businesses. This, however, overlooks the important role of tax agents who interact with Inland Revenue on behalf of these groups daily. However, tax agents are only mentioned nine times throughout the whole report. It’s a long-standing complaint of myself and other tax agents that the Business Transformation process underestimated the important role of tax agents in enabling the smooth running of the tax system. Accidentally or not this summary of who Inland Revenue sees as its customers rather reinforces our point.

Anyway, moving on, the next section within the report expands on Inland Revenue’s story for 2021-2022 outlining the benefits of its transformation of the tax and social policy system. After a brief look at the year ahead, we then get into the detailed analysis of how Inland Revenue performed against key measures and indicators, its organisational capability, and finally the departmental financial statements. Lots of juicy stuff here, in fact too much for one podcast.

Inland Revenue’s major achievement for the year is the completion of its Business Transformation programme, which was officially closed on 30th June this year. The project was completed on time and under budget and as a result, Inland Revenue is on track to save $100 million in administration costs annually. Furthermore, at the end of the Transformation Project, Inland Revenue handed back $458 million to the Crown. The programme was initially budgeted at $1.5 billion and came in at just over $1 billion. Given the notorious history of some I.T. projects such as Novapay, this is a significant achievement. So well done, Inland Revenue.

Business Transformation, of course, has enabled Inland Revenue to proceed with its auto-assessment process. As the report notes, previously, approximately 1.4 million people who were potentially eligible for a tax refund never applied. This year tax refunds were sent to 1.65 million taxpayers and as of 30th June, $602 million had been refunded. Apparently, it now costs on average $1.35 to process a tax return, compared with $2.33 back in 2015-2016. So that’s a significant improvement.

Business Transformation has also meant that many taxpayers now use Inland Revenue myIR portal to communicate with Inland Revenue and handle their tax affairs. There were over 60 million user sessions in the June 2022 year, and that’s a growth of 140% since 2019. Overall, 80% of taxpayers say they find it easy to deal with Inland Revenue, which is about the same as last year.

Although Inland Revenue encourages the use of its digital platform, it is aware that not everyone has ready access to computers. It’s good to see that this year it has been working with the likes of the Citizens Advice Bureau to ensure that those who are at risk of being digitally excluded always have a chance to engage with Inland Revenue. That’s something to be applauded and we hope that will continue.

There’s some interesting commentary on the impact of Business Transformation for small businesses. The report notes that approximately 90% of businesses in Aotearoa New Zealand have five or fewer employees. Inland Revenue’s hope was that this group would especially benefit from Business Transformation. However, the compliance effort for this group has not reduced as much as Inland Revenue had hoped.

According to an Inland Revenue survey in 2021, SMEs said they spend an average of 31 hours a year on meeting their tax obligations. Now, this is five hours fewer than in the survey’s baseline year of 2013. But the introduction of mandatory pay day finding from 1st April 2019 means that businesses spend as much time complying with PAYE obligations now as they did in 2013. Overall, though, 60% of small business owners felt that the time their business spends on tax matters was acceptable and that’s up from 55% in the previous survey.

The core role of Inland Revenue is the collection of tax. And this is the first year the total tax take has exceeded $100 Billion, up 7.3% on 2021. However, the overall amount of tax debt increased by 10.5% to $4.8 billion at 30th June 2022. And there are some concerning numbers in here. As of June 2022, 55,888 people who received Working for Families were in debt, which is a 27% increase on the June 2021 year.

Overdue student loan debt has also increased by 17.6% to $2 billion. This is apparently mostly due to only 24.5% of the overseas based student loan borrowers making their required repayments this year.

Inland Revenue wrote off $688 million of debt during the year. That’s down from the $812 million written off in 2021. Write offs of GST and individual income tax debt made up 58.8% of that total value.

Now the report admits that “The total amount written off is lower this year, due in part to Inland Revenue prioritising COVID-19 support work over proactive debt collection work.” The report then notes that “overdue tax debt grew at a comparable rate to tax revenue. It was 4.6% of tax revenue, compared to 4.5% in 2020–21 and 4.5% in 2018–19. This is a good result, considering how difficult the environment has been.” That’s probably fair comment. Inland Revenue has had to deal with an enormous amount of other projects such as the COVID 19 Resurgence Support Programme as well as getting ready for the cost of living payments, which happened after the end of the year.

But what action is it taking about trying to collect all this debt? Well, during the year $2.38 billion of debt was put under instalment arrangements involving approximately 120,000 taxpayers. As of 30th June, $491 million has already been repaid in full. And it’s then also started a programme in November 2021 targeting those with bigger debts. This involves around 1,350 businesses with debts totalling $356 million. And that’s apparently generated about $90 million of repayments so far.

It also pulled out the big stick and commenced the liquidation process against 759 companies, resulting in 163 companies being liquidated through the High Court. Another 592 companies went into liquidation, owing tax debt after the Inland Revenue initialised the process. Now some of these liquidations are inevitable, to be frank. Although Inland Revenue is trying to work hard in this area I definitely think there’s room for further improvement.

One of the key metrics I’m always interested in is Inland Revenue investigations activity. There’s an admission that it …

0 of 15 secondsVolume 0%

“…didn’t undertake as many interventions as usual as we didn’t want to put more pressure on customers during a difficult year. We paused some investigation activity and focused on ensuring the integrity of our COVID-19 support products.”

Consequently, Inland Revenue only met one of its four measures for investigations category. Whereas last year it achieved three out of four.

One measure is the ‘Percentage of customers whose compliance behaviour improves after receiving an audit intervention.’ The target is 85% but the actual measurement achieved this year was 69.6%. I don’t quite know how they’ve measured that, but it’s a little bit concerning because pretty much my experience is if someone from Inland Revenue turns up and there’s an audit, behaviour generally improves afterwards. I think this measurement may be a by-product of overdue debt existing.

On the other hand, it did meet the measure for ‘Discrepancy identified for every output dollar spent.’ Now the target is $7 per dollar but Inland Revenue achieved a return of $9.88. “We have assessed additional tax or protected the integrity of the tax system to the value of $1.12 billion. This has exceeded expectations.” Although I find the phrasing of that a little opaque.

Intriguingly, that measure has been retired and is not being used in the current year. I’m not sure why, but we will watch with interest as we won’t know what the new measure is until next year’s report is released.

As part of its usual compliance activity Inland Revenue ran a number of compliance campaigns for specific sectors and compliance issues. For example, it ran campaigns about tax residency, disclosing offshore income and basically ensuring people meet their international tax obligations. According to the report, these campaigns targeted some 7,000 taxpayers and their tax agents and resulted in voluntary disclosures totalling $100 million in omitted income in the past two years. That’s not $100 million of tax, the best-case scenario would be maybe $40 million of tax. But anyway, still a good return for Inland Revenue.

I think we can see more of this campaign. Inland Revenue, as I mentioned earlier, shares information with 70 countries. This is an area it was starting to pay attention to before the Pandemic and is now returning to this area with the launch of a new offshore tax programme in June 2022. So, watch this space.

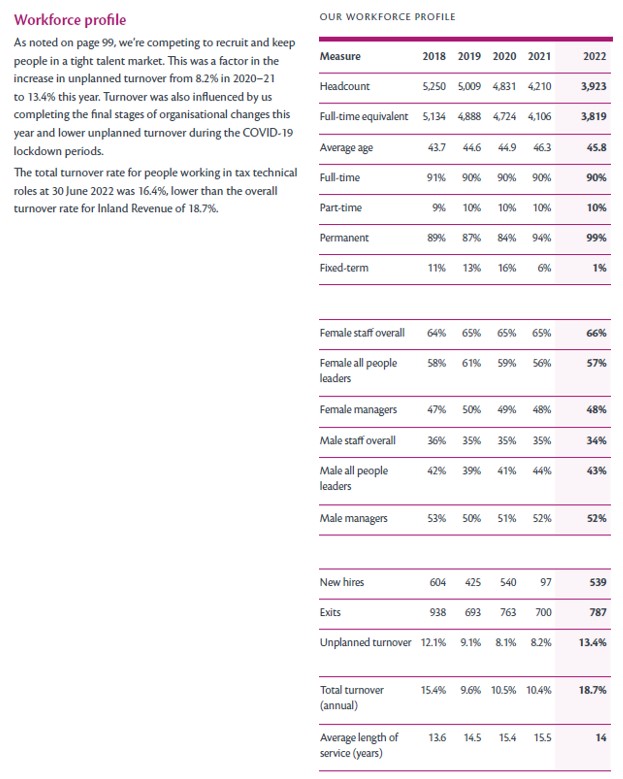

Now the key to any organisation is its people. And Inland Revenue has been through a massive amount of change in the past five years. As of 30th June, its workforce is now 3,923, which is down 1,327 or 25% since June 2018.

During the year, 787 people left Inland Revenue and it hired 539. Over the past five years, some 3,881 people have left Inland Revenue, which is 74% of the workforce as of July 2017. That is a massive churn and I have concerns about that.

The average length of service in years has dropped this year to 14, compared with last year’s 15.5 years. A lot of people have left and Inland Revenue’s staff turnover this year was 18.7%. Rather worryingly, the total turnover rate for people working in tax technical roles at 30th June 2022 was 16.4%. Although that’s lower than the 18.7% for the whole organization, it is well up on last year’s 1.3%.

Inland Revenue staff are actually very highly valued outside the public sector. My understanding is Inland Revenue is pretty competitive on wages. Seeing so many gamekeepers turning into poachers is not something we really should see. hence my concerns about what’s going on.

Page 100 onwards in the report looks at the state of morale and health in the report in Internal Revenue, and it’s very mixed. Some of the metrics are better than the public service generally. For example, 96% of staff can work remotely, which is well above what the rest of the public sector.

The report has a breakdown of employee ethnicity and the proportion of roles held by people with different ethnicities. Now, actually, Inland Revenue pretty much reflects the diversity of modern-day Aotearoa. 66% of its staff are European, compared with 70% of the population generally, 12% are Māori, which is below the 16.5% of the general population.

A bit more concerning though is looking at the proportion of leadership roles. When you get up to senior management, 96.4% are held by Europeans. Even the team leader and general management roles are all over 80%. So, there’s work to be done there.

But something which really caught my eye and is a matter that needs to be discussed more widely is a disclosure under Schedule 6 of the Public Service Act 2020. This requires Inland Revenue to report on situations where the Commissioner has delegated any of the Commissioner powers outside the public service. In other words, it said to people, ‘You can act in our capacity’.

In previous years the disclosure has involved Westpac and Callahan Innovation. But this year, for the first time, it includes Madison Recruitment Ltd. The disclosure reads

“Inland Revenue engaged Madison Recruitment Ltd to provide contingent labour to help with the introduction of the Cost of Living Payment and to provide additional support with other specific tasks due to the ongoing impact of COVID-19. The first Madison personnel began undertaking their engagement in June 2022. To enable the Madison personnel to fully undertake the engagement, the Commissioner delegated some powers to those Madison personnel. This delegation has been operating as intended in line with the contractual arrangements with Madison Recruitment.”

I have major reservations about this because it shows that Inland Revenue is perhaps under-resourced if it is taking on temporary labour. I don’t believe an organisation such as Inland Revenue with the powers available to it, should be taking on temporary contract labour. I can see there might be a business case for doing so, but as I said earlier there’s an issue with mounting overdue debt and the drop off in investigations activity.

We also have this staff churn that’s going on at Inland Revenue. Losing 75% of your workforce over five years, is not something I think is healthy for an organisation. Staff changes are inevitable and healthy. But 75%, I’m not so sure about that. So, this one of the major concerns I have coming out of this report.

Summing up the report is a mixture of the good, the not quite so good and the concerning. One of the not quite so good is a rather bumpy relationship with the tax agents, as I mentioned previously. But I understand the new commissioner Peter Mersi has been meeting with representatives of the professional bodies and no doubt this point has been discussed. In fairness, the ongoing huge challenge of dealing with a pandemic and its aftermath have not helped.

My great concern is the level of staffing and the state of morale at Inland Revenue. As I mentioned, there’s been considerable turnover of staff in the past five years, and I don’t believe the delegation of powers to Madison Recruitment is acceptable. I think it threatens Inland Revenue very well-deserved for reputation, for privacy and security of taxpayer information. It may be a temporary measure in order to help handle the Cost of Living payments, but judging by the report overall, I think Inland Revenue should be consider whether its current staffing levels are sufficient.

Overall, I would give Inland Revenue a pass mark for what has been another difficult year. The impression I have is an organisation right now in transition and under understandable stress. It could not have handled the many COVID-19 related issues it’s faced in the past two years without the benefit of Business Transformation. So, getting that project finished on time and under budget is a massive achievement. At the same time, the Pandemic and the continuing cost of living crisis has pointed to some ongoing weaknesses, which I think the new Commissioner will need to address urgently. We will be watching with interest.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.