- the CGT debate gets spicier.

In the same week as Public Service Minister Nicola Willis directed department bosses to tighten up on working from home arrangements, it’s a little ironic to see Inland Revenue release a draft consultation on the topics of deductions for expenditure and travel by motor vehicle between home and work and when an employer provided motor vehicle is subject to fringe benefit tax (FBT) for travel between home and work.

These were released alongside some interesting commentary from Inland Revenue that it is currently reviewing FBT, so what is set out in the draft consultations may change, but as Inland Revenue note, it gets a lot of questions on the topic. With regard to this FBT review my understanding is we may see something relatively soon. I think given the outcome of the Inland Revenue’s regulatory stewardship review of FBT and what the Minister of Revenue has said previously, it’s likely this review with look at simplification measures.

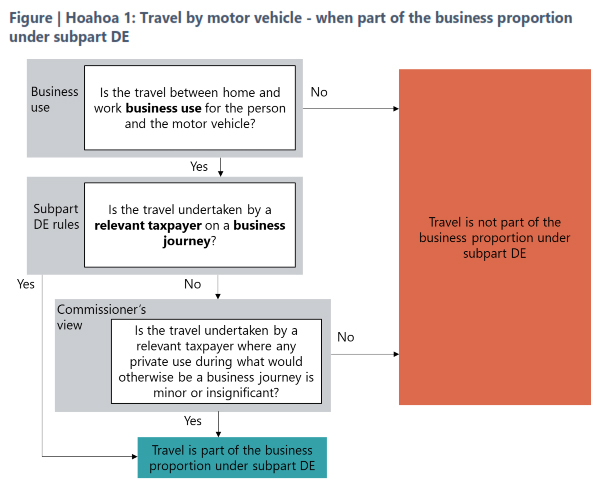

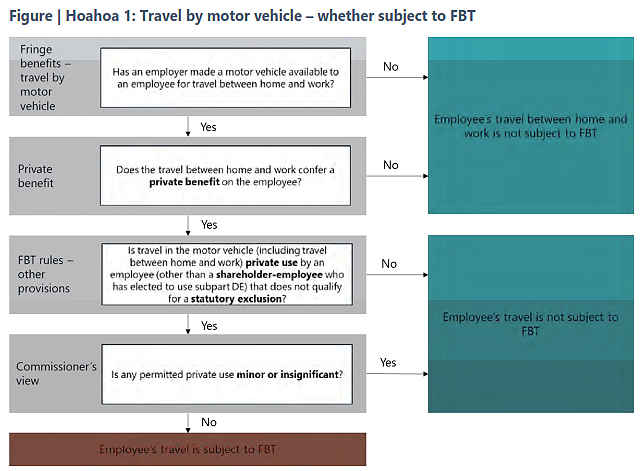

There are actually two consultations which will replace the previous interpretation statement IS3448. The topic is quite involved, because the two draft consultations run to 111 pages of commentary and examples. Fortunately, as is now the common practise, each draft consultation is accompanied by fact sheets, each containing a very useful flow chart to help people work their way through the maze.

The deductibility of motor-vehicle travel between home and work

The first draft interpretation statement deals with the question of deductibility of travel by motor vehicle between home and work which is set out in Subpart DE of the Income Tax Act 2007. What that subpart does is limit deductions for motor vehicle expenditure to the business proportion of the expenditure. It generally applies to self-employed taxpayers and partners in partnerships, but it can also apply in some circumstances to close companies and look through companies.

The basic position is that a journey is deductible if it’s a business journey, but to be a business journey and deductible, the whole journey must be undertaken for the purpose of deriving income. This is actually slightly different from the general deductibility provision for tax, which allow deductions quote to the extent to which they are incurred in deriving gross income. By contrast, this the provisions in Subpart DE are very specific it’s got to be a business journey if it is to be deductible.

Four exceptions

Generally speaking, and it’s probably no surprise here, travel between home and work is viewed as private. But there are four exceptions as a result of case law. Firstly, where the vehicle is necessary for the taxpayer to transport goods and equipment that are essential for their work between their home and workplace and for use both at home and in their workplace.

Now secondly, the taxpayers work is itinerant, which means that the taxpayer works at different locations during the workday and the sequence of where they work and how much time they spend is unpredictable and varies. It’s therefore not practicable for them to carry out their work without the use of a vehicle.

The third case is where a taxpayer is responding to emergency call outs and does so from home. And finally, and this is increasingly relevant, the taxpayer’s home is a workplace or base of operations for the purposes of travel to and from work.

This latter point is where we’ll probably see a lot of discussions and arguments. In order for a home to be treated as a workplace or base of operations the role requires a significant proportion of a person’s work to be spent working at home. I think it’s most likely to apply to owners of businesses who may be working between two places, but senior employees who might be required to make international calls in the evening, they may will be covered.

What’s a business journey?

A business journey is one primarily carried out for business purposes. Case law allows an overall journey to be treated as two journeys if there is a stop in between. It’s possible that one part represents a business journey, and the other part is private.

Furthermore, case law also said that some incidental private use does not mean a journey is prevented from being a business journey. Under the draft Inland Revenue consider that insignificant private use can’t exceed either approximately 5% of the total journey and approximately two kilometres.

The consultation also deals with the issue of what if vehicles are taken home for security purposes or, as is now more common, it’s an electric vehicle taken home to be recharged. Either of those circumstances are not sufficient in themselves to make the relevant journey between home and work a business journey. There have to be other factors at play, such as the exceptions we’ve previously mentioned or that home represents a workplace.

When does a fringe benefit arise?

The second interpretation statement and supporting fact sheet considers the question of when a fringe benefit arises when an employer provided motor vehicle is used for travel between home and work. The position is pretty straightforward: if a vehicle has been provided for private use, FBT will apply. In this context private use would include the use of the vehicle for travel between work and home and work. If a employee has a employer provided vehicle and travels to between home and work in that, then fringe benefit will apply.

There are three statutory exclusions from FBT which would cover travel between home would work. These exclusions apply to work related vehicles (a topic the subject of a whole another interpretation statement;

- Emergency calls affecting health, life or the operation of essential machinery and services; and

- business trips of more than 24 hours.

- If any of these exclusions apply the whole day is excluded from the calculation of FBT.

As noted above Inland Revenue is in the course of reviewing FBT, so maybe some of this might change within the next couple of years or so. In the meantime, it’s good to have this draft guidance. Consultation on this is open until 6th November.

Meanwhile progress on the international tax deal continues

Moving on, we’ve talked regularly about the G20/OECD international tax agreements on base erosion and profit sharing. This week, several jurisdictions signed a multilateral treaty which will to help the Pillar Two subject to tax rule. But the other thing that’s important which was concluded in the last few days, was a Model Competent Authority Agreement on the Application of the Simplified and Streamlined Approach to Amount B of Pillar One. This agreement will provide a framework to enable jurisdictions to comply with what’s expected to be the final format of the rule of the Pillar One and Pillar Two agreements.

However, progress has slowed right down since October 2021 when 135 jurisdictions announced that they were accepting the two-pillar solution. With tax, the devil is in the detail and there is a lot of detail and devil to work through.

I think the other thing that should be kept in mind is that the US Presidential and Congressional elections happening in November will determine how much further progress will happen. As previously noted, the likes of Meta and Alphabet are none too keen on what’s proposed here and their lobbyists have the ears of plenty within Congress. We’ll just have to wait and see. But in the meantime, the deal seems to be inching forward.

“The time has arrived for a capital gains tax”

Last week I covered the report from Victoria University of Wellington about comparing tax rates between New Zealanders and taxpayers in nine other jurisdictions. This week things got spicier than I would expect in this sort of debate after the CEO of ANZ Bank Antonia Watson said in the course of her RNZ interview with Guyon Espiner “the time has arrived for a capital gains tax.” This in turn provoked a strong response from both the Prime Minister and the Minister of Finance. I found this a little surprising. I would have thought they’d just let Ms Watson make her comments and move on, but it certainly adds to the headlines.

CGT the most likely option

Following on from Antonia Watson’s remarks, I spoke to RNZ’s The Panel on Wednesday evening about the question of a capital gains tax. Put on the spot I said I could see it happening. To expand on my answer, it seems to me that a CGT is the most likely option if we do expand the tax base, because CGTs are common in other jurisdictions and the concepts are broadly well understood. And as Antonia Watson also noted, wealth taxes on unrealised gains are deeply unpopular with those that would be affected.

The interview with Antonia Watson is well worth listening to. One of the things I found quite interesting was that a couple of times she mentioned the impact of adverse weather effects. This wasn’t anything to do with tax, but she was explaining that our vulnerability to such events was a factor in why we have higher interest rates than Australia.

This circles back to the point that I made last week and again on The Panel, that the discussion around the question of capital gains tax or expanding the taxation of capital base is really around the question of how do we pay for the forthcoming costs of climate change and an ageing population? Are we raising enough tax revenue right now? If not, what are the options on the table?

What does Inland Revenue think?

Inland Revenue currently have their proposed long-term insights briefing for next year out for consultation. Susan Edmunds of RNZ picked up on this in a story on Thursday. The consultation finishes Friday 4th October, and I really do recommend reading and submitting on it.

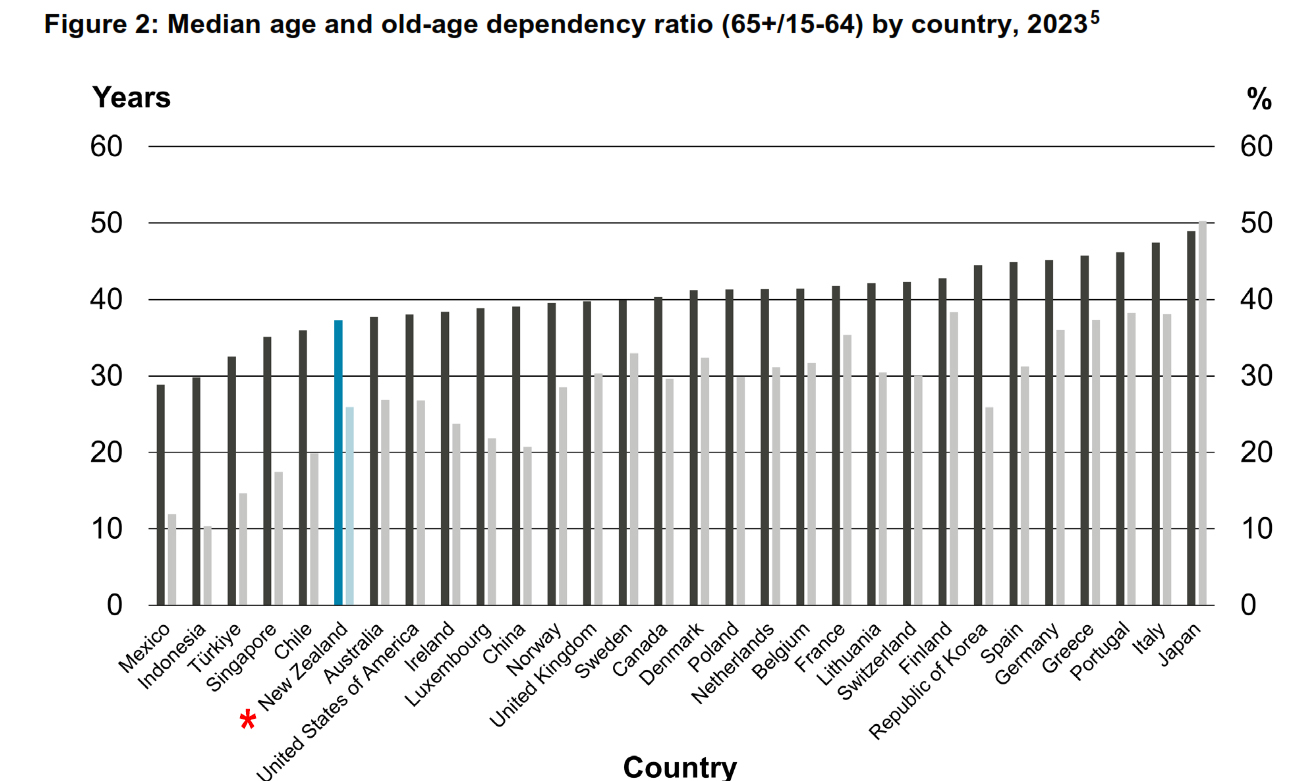

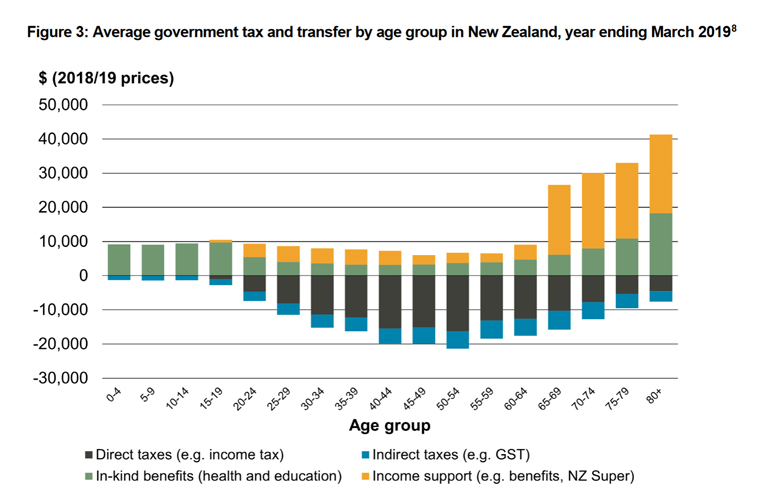

On the question of the forthcoming actual fiscal pressures, Dominick Stephens, the chief economic adviser for the New Zealand Treasury (and former chief economist for Westpac), delivered a speech on Wednesday titled Longevity and the Public Purse, which I’d recommend reading. It includes plenty of graphs illustrating the difficulty that we are facing. Our population is ageing, which is well known and the median old age dependency ratio is rising, although as the speech notes thanks to strong population growth it’s not as bad as other jurisdictions which means we are at the lower end of that range.

There’s a particularly telling graph about the average government tax and transfer by age group in New Zealand, for the year ended 31 March 2019

As can be seen above for the 65 and over age groups the transfers from Government rise significantly. These are the age groups which is where the debate about sustainability arise, as Dominick Stephens comments:

“Since 2006, the Treasury’s Long-term Fiscal Statements have repeated the message that our fiscal settings are not sustainable over the long run given the impact of population ageing.”

Over the period since 2006 some interesting developments have somewhat ameliorated the potential impact. Interest rates, for example, have been lower than were predicted in 2006, while population growth has been higher.

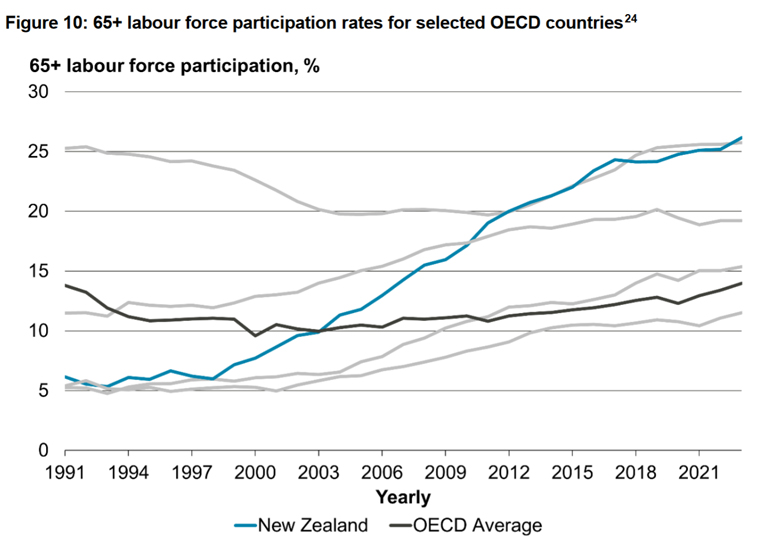

One of the more extraordinary developments since 2006 is labour force participation for 65 plus age groups has dramatically increased. Consequently, we’ve gone from being amongst the lower labour force participation rates to one of the highest.

All things being considered, there are difficult choices to be made and the question of whether more revenue is necessary is a question which isn’t going to go away.

“There is no silver bullet: none of the policy options we modelled in 2021 was large enough to stabilise debt on its own. This means that governments will need to likely draw on multiple expenditure and revenue changes to close the fiscal gap.

Some savings can be made from a greater preventative focus and reducing inefficiencies but making substantive savings is likely to require some tough choices around entitlements. This would have come with trade-offs, particularly for groups of the population who already face challenges accessing health services.”

Governments could also choose to raise additional revenue, in fact as Dominick remarked “successive increases in taxes over time would be required unless actions were also taken to manage demographic expenditure pressures.”

So tough fiscal choices ahead. I note in the comments on last week’s transcript some noted ‘well, wait a minute, why don’t we try and reduce expenditure?’ That’s certainly a driver for the current Government. But I think what Dominick Stephens and Treasury are saying, addressing the fiscal pressures will be a two-part process. We will need to both reduce costs and raise revenue. So, this debate over capital taxation isn’t going to go away soon and will continue. I expect I’ll be asked plenty more times to comment.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.