Is it time to rethink child support payment processes?

- The FBT prescribed rate of interest to increase.

- Flood affected homeowners find out about the perils of putting your home in a trust.

- New survey shows widespread support for taxes on capital gains and windfall profits

With effect from 1st July this year, there was a change in the Child Support system so that from that date whenever a liable parent makes a child support payment, it will be passed on to receiving carers on a sole parent rate of benefit.

Previously, any such payment was used to pay the cost of providing the benefit. This change is designed to put more money in the pockets of carers.

The change begins with child support payments due for the month of July 2023 onwards. Child support payments are paid by Inland Revenue in the month following deduction. The first payment that receiving carers receive under the new system would have been made by Inland Revenue on 22nd August “as long as the liable payment parent makes their payment on time.”

And that is a very big ‘but’. As an article at the start of the week in Stuff by Susan Edmunds notes, as of the end of August over $1 billion of child support was due. slightly down from the amount owed in August 2022. But of that amount owing $488 million represents penalties charged.

Inland Revenue acts as the intermediary in the system. It calculates the amount due and then payments by liable parents to receiving carers are made through Inland Revenue. This is done when parties after a relationship breakdown can’t agree how financial support is to be provided. Under the Child Support Act 1991 Inland Revenue manage this whole process by collecting payments from liable parents and passing them on to the receiving carers.

To encourage prompt payment, late payment penalties are payable. Those penalties have been adjusted recently, but the basic charge is an initial 2% penalty of the amount not paid, and then another 8% is added to that 28 days later, if it still hasn’t been paid. These penalties arise for each payment. So, if you keep missing payments, debt piles up, which is what we’ve seen.

I’ve been a long standing critic of this penalty regime. It leads to large amounts of debt building up, a very high proportion of which represents penalties. As Susan Edmunds pointed out, for the June 2021 year, Inland Revenue wrote off nearly a billion dollars of debt and then wrote off another $181 million in the June 2022 year. The system has been like this for years, basically it’s never worked as well as people thought it would.

Somehow, we have ended up with a system where the penalties for not paying your child support on time are greater than those for not paying your tax on time. Remember Inland Revenue is just acting as an intermediary. As I told Susan, the current penalty system is outrageous. Really, we need to have a harder think about it.

Can pay, won’t pay?

This is always going to be a difficult matter because relationship breakdowns can get very toxic. Resentment builds up and without some form of compulsion/penalty, the system would probably be even more dysfunctional. Still, we’ve got to find a middle way.

Incidentally Inland Revenue also has a right to issue deduction notices which I’ve discussed before. It can issue these to an employer on the grounds that this person owes X and you are to take an extra 10% of their salary when you are applying PAYE. I understand quite a substantial number of the deduction notices are that are issued each year relate to arrears of child support.

But even so, it’s a question, I think, for all of us to think about – why is the system like this and what can we do to make it better? There’s been some tinkering around the edges but really, whoever forms the Government after the Election, this is something I’d like to see them think longer and harder about improving.

FBT interest rates to rise

The prescribed rate of interest applies when someone has taken a loan from a company or is a shareholder/director with an overdrawn current account balance. In such situations interest is calculated using the prescribed rate of interest on that overdrawn balance or loan to determine the FBT payable by the company. This interest rate is to increase on 1st October from 7.89% to 8.41%. As recently as 30th June last year the rate was 4.50% so you can see there’s been a very rapid increase in the rate payable.

The downsides of holding property in trust

A few weeks back Tammy McLeod of Davenports Law was a guest and we discussed the new landscape for trusts in the wake of the Trusts Act 2019. One of the areas we discussed was whether in fact so much property should be held in trust. Are there in fact too many trusts? The reason people set up trusts are manyfold, some tying back to the story at the start of this week’s podcast about relationship breakdowns.

But trusts come with downsides. And one has been illustrated in a story that emerged this week regarding people applying for government assistance following the floods in January and February. It turns out that the assistance package provides up to $160 a week to help with the cost of renting a house because your home has been red or yellow stickered.

However, according to this story from 1News the package only covers displaced homeowners. Those people who have property held in trusts are not covered. And this has come as a quite understandably unpleasant shock for a number of affected people.

The story is also interesting in that you can see a number of common misconceptions about trusts pop up, such as one affected homeowner saying, “I own the trust I have that owns my house. I’ve had it for 20, 30 years”. That’s not the case. You may be a trustee, but you don’t own the trust. And then a representative from Ministry of Social Development who’s handling these claims saying “a trust is a separate legal entity.” No, that’s not the case either, the property is registered in the name of the trustees of the trust but a trust does not have any separate legal status, whatsoever.

This misrepresentation might actually be hopefully a window of opportunity for the affected homeowners. Someone looked at this and think, well, if there are trust beneficiaries who are also trustees living in that house, then technically they are homeowners and they then may qualify for support.

I’ll keep an eye on this story and see how it pans out. But it’s another example of what Tammy and I discussed, at the time a trust was set up, it served a very specific purpose. But over time, life changes and maybe those original purposes are no longer valid. It may therefore be time to rethink and perhaps wind up the trust.

Just on the other hand, like I said at the top of the podcast, you may have gone through a relationship breakdown. You’re going into a new relationship and you may wish to protect your assets from the impact of another relationship breakdown through settling a trust. There are other mechanisms that might apply there, but the use of trusts by parties to second or third marriages is not uncommon.

A public mood for change?

The Election campaign is still rumbling on with just two weeks to go. This week a survey run for Tova O’Brien’s podcast Tova indicates widespread support for taxes on excess profits and capital gains.

Both suggestions have been ruled out by National and Labour but what’s interesting is the apparent cross-party support amongst voters for the proposals.

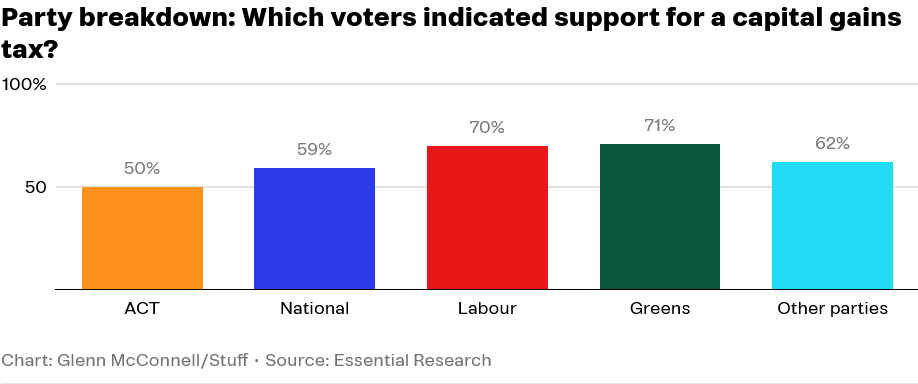

What makes this poll a bit more interesting is the fact that when it was broken down across the various parties, there was still fairly widespread support for a capital gains tax even amongst National and ACT supporters.

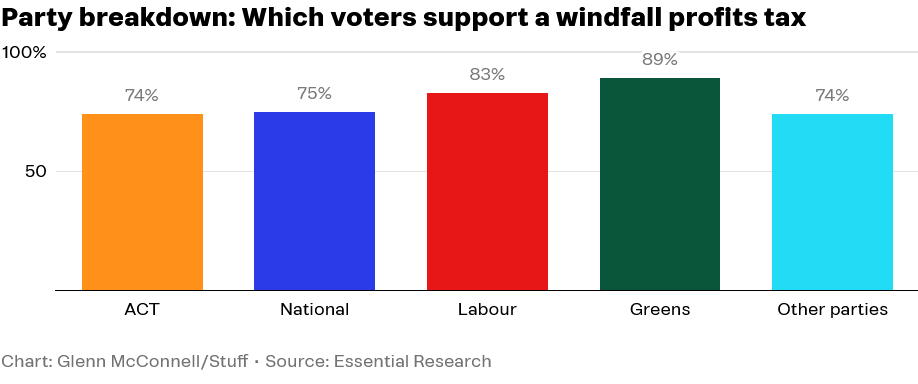

Cross-party support for a windfall profits tax was also surprisingly strong with 74% of ACT supporters and 75% of National supporters in favour.

This is interesting to see and whether any party follows through on any of this is of course a matter which we will only find out after the Election. But even so, the survey perhaps indicates the electorate in some ways thinks there may need to be changes. But on the other hand, as some people rightly pointed out, the Labour Party ran on introducing a capital gains tax in both 2011 and 2014 and got nowhere. Subsequently both Jacinda Ardern and Chris Hipkins ruled out capital gains tax on their watch. The question remains where exactly does the political will amongst the electorate really lie on this issue?

Haere ra Geof Nightingale

Finally this week, haere ra to Geof Nightingale who retired yesterday as a partner from PWC after what can only be described as an distinguished career. Amongst his many accomplishments Geof was a member of the last two tax working groups and has been one of the leading tax professionals in the country for many years. As the many comments on his LinkedIn post announcing his retirement attests, I am one of many he has given sage advice and guidance and it was a delight to have him as an early guest of this podcast. I’m sure this won’t be the last we hear from Geof on tax but for now thank you Geof and go well in your new direction.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.