The Government is considering a review of the charitable exemption for religious organisations this term.

- Canada loses patience and imposes a Digital Services Tax effective 1 January 2024

- Inland Revenue appears to be gearing up for a fringe benefit tax initiative.

Late last week, in response to some questions about a review the charitable exemption that religious organisations enjoy, the Prime Minister responded he was “quite open” to the idea, adding “I’ve actually been thinking through the broader dimension of our charitable taxation regimes…We will certainly be looking at things like that this term.”

The hint that a review of the exemption religious organisations and churches enjoy provoked a testy response from Brian Tamaki, among others which was in turn rebuffed by the Finance Minister, Nicola Willis.

But this is a topic which keeps popping up and obviously people have some concerns about how the exemption operates. It was also reviewed in some depth by the last Tax Working Group.

So what’s the exemption worth?

Putting some numbers around the value of the charitable exemption is a little difficult. Every Budget Treasury prepares a paper on the value what are called “Tax Expenditures” that is specific tax exemptions granted under the Income Tax Act. According to the Tax Expenditure statement prepared by Treasury for Budget 2023,

the forecast value for the year ended 31 March 2023 of charitable and other public benefit gifts given by companies was $32 million. In relation to the donations tax credit for charitable or other public benefits (including to religious organisations), value for the same period was estimated to be $315 million. (Which grossed up at 33% is ~$945 million.)

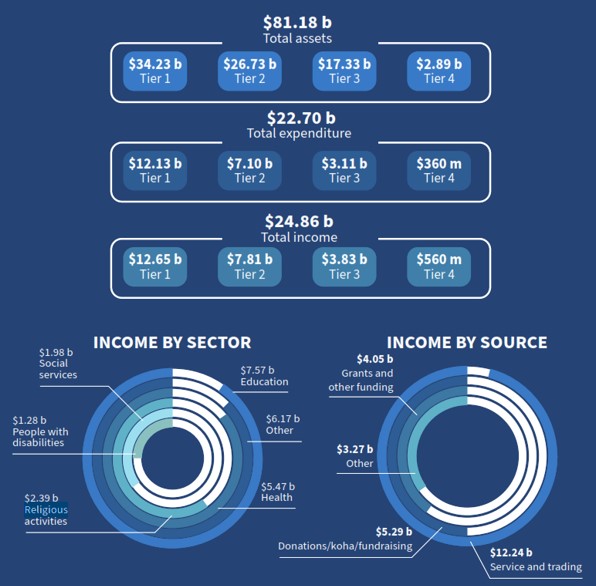

The annual report of Charities Services include a snapshot of the finances for 27,000 charities registered with it. According to the report for the year ended 30th June 2023 the income of the religious activities sector was $2.39 or just under 10% of the total income across all charities.

It’s interesting to consider charities income by source for the same period. $5.29 billion represented donations, koha and fundraising activities. Based on Treasury’s Tax Expenditures statement it appears donations tax credit or charitable donations by companies has been claimed for maybe only a billion dollars of this sum. Interestingly, about half of the total income charitable sector earns during the year comes from services and trading.

Overall Charities Services estimated that the total expenditure by charities was about $22.7 billion. In other words about $2.1 billion of the funds raised were not spent or distributed for whatever reason.

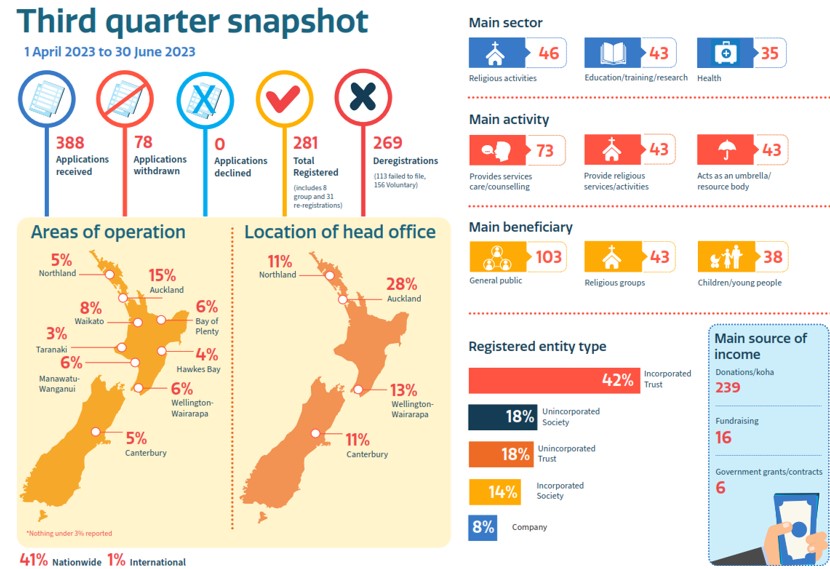

Charities Services also provides a quarterly snapshot of new registrations. The latest available is for the period to 30 June 2023 when it received 388 applications (of which 78 were subsequently withdrawn). Religious activities seem to represent a fairly substantial portion of the new registrations.

What did the Tax Working Group recommend?

The last Tax Working Group took a look at this issue and the best place to consider its views is in Chapter 16 of its interim report which sets out the issues involved.

In its final report the Tax Working Group noted it had “received many submissions regarding the treatment of business income for charities and whether the tax exemption for charitable business income confers an unfair advantage on the trading operations of charities.”

The Tax Working Group responded as follows:

“[39] It considers that the underlying issue is more about the extent to which charities are distributing or applying the surpluses from their activities for the benefit of the charitable purpose. If a charitable business regularly distributes its funds to its head charity or provides services connected with its charitable purposes, it will not accumulate capital faster than a tax paying business.

[40] The question then, is whether the broader policy tax settings for charities are encouraging appropriate levels of distribution. The Group recommends the Government periodically review the charitable sector’s use of what would otherwise be tax revenue to verify that the intended social outcomes are actually being achieved.

I think if the Government is going to review the charitable sector, and religious organisations in particular, the Tax Working Group’s recommendations will be starting point. In April 2019 when the last Government responded to the Tax Working Group’s eight recommendations on charities it noted that Inland Revenue’s Policy Division was already working on five of the recommendations. Two of the remaining three were under consideration for inclusion in Inland Revenue’s policy work programme. The other, in relation to whether New Zealand should apply a distinction between privately controlled foundations and other charitable organisations, would be undertaken by the Department of Internal Affairs, which oversees Charities Services. It’s likely the COVID pandemic disrupted this proposed work programme.

We may get a clue as to the Government’s thinking in next month’s budget, but I think the Government’s focus will be on getting its tax relief package out of the way first so Inland Revenue’s resources will be applied there. The Government and Inland Revenue may then look at this exemption, but I imagine given the fuss and general controversy around such a move, it’s probably relatively low priority. Maybe we’ll see something in the Budget.

Canada loses patience and introduces a digital services tax

There was an interesting development in the Canadian budget, which was released earlier this week. The Canadian Government has decided to push ahead with the introduction of a digital services tax (DST) on large tech companies. Over a five-year period, this was expected to raise ~C$5.9 billion (about NZ$7.3 billion).

Canada had held off for two years to allow for the conclusion of the international negotiations on Pillar 1 and Pillar 2 to conclude, but they’ve dragged on with no clear conclusion in sight. The Canadians have therefore decided to push the button on a DST commenting:

“In view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot afford to wait before taking action….The government is moving ahead with its longstanding plan to enact a Digital Services Tax.”

The tax would begin to apply for the 2024 calendar year, with the first year covering taxable revenues earned since January 1st, 2022. Understandably, this has provoked a pretty vigorous reaction from the United States, where the headquarters of all these tech companies are situated.

What does that mean for us down here? Well, again, we may find out more in the Budget. The Taxation (Annual Rates for 2023-24, Multinational Tax, and Remedial Matters) Bill which was enacted just before 31st March included legislation for our digital services tax. The Government is therefore in a position that it can watch to see if other countries follow Canada’s lead and then decide whether it should follow suit.

The whole purpose of the digital services tax legislation is to act as a backstop in the event the Two-Pillar solution does not reach a satisfactory conclusion. At the moment negotiations are stalled thanks to vigorous push back by the the companies most affected, such as Alphabet, the owner of Google, Amazon and Meta, owner of Facebook. It’s interesting to see this Canadian move and I wonder if other countries will push ahead with their own DSTs. There are quite a number lot of digital services taxes around the world, with many on hold pending the outcome on the Two-Pillar negotiations.

Taxing Google to help New Zealand media?

Just as an aside, as is well known the media in New Zealand is in desperate financial straits and a question that keeps coming popping up is taxing the digital giants more effectively. That’s because a substantial portion of the advertising revenue that in the past went to New Zealand media companies is now going overseas in the form of (little taxed) various licence payments and fees for services to the the likes of Alphabet and Meta. Watch this space I think things are about to get very interesting.

Inland Revenue gearing up for fringe benefit tax initiatives?

This week, Inland Revenue consolidated the various advice and commentary on fringe benefit tax advice it’s published over the years under a single link. This seems to me to be further signs that Inland Revenue is gearing up to launch a fringe benefit tax initiative. It follows comments by the Minister of Revenue Simon Watts, in several speeches in which he referred to Inland Revenue’s regulatory stewardship review of FBT released in 2022. I got the clear impression that he, and therefore Inland Revenue were keen to look further at this matter and investigate what revenue raising opportunities may arise through a more through stricter enforcement of the FBT rules.

As a very good article by Robyn Walker of Deloitte noted FBT is nearly 40 years old. It’s a very strong behavioural tax. It exists to stop people converting taxable salaries into non-taxable benefits. So, it never really should be an extensive tax raise revenue raiser.

That said, I think there have been issues particularly in relation to the status of twin cab utes and the work-related vehicle exemption as to whether there is sufficient enforcement going on. My expectation therefore is Inland Revenue is gearing up to launch a number of fringe benefit tax reviews and this small step consolidating its previous commentary and advice into a single space is another sign.

Got an idea to improve our tax system? Enter the Tax Policy Charitable Trust scholarship competition

Finally, this week, the Tax Policy Charitable Trust has announced its 2024 scholarship competition. This is designed to support the continuation of leading tax policy research and thinking and to inspire future tax policy leaders. Regular listeners to the podcast will know we’ve had past winners Nigel Jemson and Vivien Lei as guests, and I’m looking forward to meeting the next batch of scholarship recipients.

Entrants may submit proposals for propose significant reform of the New Zealand tax system, analyse the potential unintended consequences from existing laws and changes, and suggest changes to address them. It’s open to young tax professionals aged 35 and under on 1st January 2024 working in New Zealand with an interest in tax policy. The winning entry this year will receive a $10,000 cash prize. The runner up will receive $4000 and two other finalists will each receive $1000 each.

I look forward to seeing what comes out of this and hopefully we will have the winners on our podcast sometime in the future. In the meantime good luck to all those who enter.

On that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.