29 Aug, 2022 | The Week in Tax

- Provisional tax is due so watch out for changes to the use of money interest rates and rules

- Is it time for a residential land value tax?

- More on the looming shortfall in the National Land Transport Fund

Transcript

The first instalment of Provisional tax for the March 2023 income year is due on Monday. Now, as most people know, if provisional tax is not paid on time, late payment penalties and use of money interest will apply. The interest rate on underpaid tax will increase from Tuesday 30th August from 7.28% to 7.96%. On the face of it, there’s a lot of incentive to make sure your payment is made on time. The rate, incidentally, for overpaid tax which has been zero for quite some time now, will rise to 1.22%.

There’s been consistent tweaking of the use of money interest rules to try and make it easier for businesses, particularly smaller businesses. The rules are different where the provisional tax exceeds $60,000 for the year.

And the last changes in 2017 were designed so that if taxpayers made the payments they were required to make, then use of money interest would not apply until terminal tax date, which for most taxpayers is 7th February following the end of the tax year in question, or the following 7th April if they are on a tax agent’s listing.

The requirement was that they had to make the payment in full and on time, and this actually led to a few problems because taxpayers sometimes missed their payments by one or two days or even might be out by $10 or so. What has emerged since 2017 is that the number of taxpayers who unintentionally paid short or late was underestimated by Inland Revenue at the time the changes were brought in. Consequently, a large number of taxpayers had to pay use of money interest and late payment penalties.

What Inland Revenue have determined is “in these circumstances, the application of use of money, interest and late payment penalties is not proportionate to the offence committed.” It considers it is “appropriate” to allow taxpayers to retain the safe harbour concession for use of money interest even if they miss a payment. So, the interest rules have been changed rules again with effect from the start of the current tax year.

What the change means is you won’t suffer use of any interest if you miss a payment or there’s a short fall on your tax payment. You won’t be charged 7.96% on the underpaid tax until your terminal tax payment date. However, late payment penalties will still apply. These are 1% of the underpayment immediately and a further 4% if the tax has still not been seven days later for a maximum 5% penalty. (Inland Revenue has now done away with the monthly 1% late payment penalty on top of the initial penalties).

It’s been pointed out to me that there’s probably an opportunity for someone to play a few games and arbitrage their funds by accepting the late payment penalty charge but avoiding the high use of money interest charge. No doubt some taxpayers will do that.

We don’t actually know how much use of money interest the Inland Revenue charges, but pretty substantial amounts are involved. We know, for example, that Covid-19 related interest write offs over a two-year period amounted to $104 million. At a rough guess taxpayers could be paying $100 million or more in use of money interest annually. Measures that help them relieve that charge ought to be to be welcomed.

The case for a residential land value tax

Moving on, last week I discussed the report on housing from the Housing Technical Working Group, a combination of the Treasury, Ministry of Housing and Urban Development and the Reserve Bank of New Zealand. The report raised the question of the role our tax settings may have played in house price inflation. This generated quite a bit of interest and commentary and thank you to everyone who contributed.

But as I said last week, the issue around how our tax settings work in relation to property isn’t going to go away. It’s an issue that sooner or later has to be grasped. And this week, Bernard Hickey who has an excellent Substack, The Kaka, did a very detailed post on the whole question of our lack of training and productivity, our need for substantial numbers of. migrant workers and how that intersected with the under taxation of residential land.

Bernard’s post pulled together a lot of conclusions I’d reached during my time in the Government’s Small Business Council between 2018 and 2019. I grew quite concerned at the lack of training, particularly among small businesses and the extensive need for migrant workers coming in. What is well established is that Aotearoa-New Zealand has the highest use of temporary migrant labour in the OECD and simultaneously it also has one of the highest diasporas in the OECD. In other words, our skilled people are moving overseas and we’re bringing in relatively low skilled people and this is causing a whole number of tensions.

As Bernard notes we really need to rethink the matter of how we deal with this approach because this long term, it is not economically prosperous for us all. As he concluded:

“All roads were always going to lead back to changing those investment incentives through a new tax that gives the Government the resources to invest in productivity-enhancing physical and social infrastructure. That tax would also radically change the incentives for businesses and individual investors….

In my view, a Capital Gains Tax would be too politically toxic, complicated and slow to break the log jam. The case for a residential land value tax, a much simpler, faster and more politically possible option is a simple and very-low-rate infrastructure levy or tax on residentially-zoned land values that is calculated annually from land value measures in council-maintained databases.”

This, by the way, is very similar to what Susan St John and I have been promoting for some time, the Fair Economic Return, and we and Bernard are coming at it from pretty much the same place.

Bernard then puts some detailed numbers around this. He estimates a 0.5% tax on residential land values would raise an extra $6 billion and effectively increase the Government’s tax take from 30% of GDP to 32% of GDP. Bernard also considers the revenue raised from such a tax should be

“hypothecated into a housing and climate infrastructure fund jointly administered on a region-by-region basis by central Government and councils, with the aim of using those funds to achieve affordable housing and net zero transport and housing emissions by 2050. affordable housing in net zero transport and housing emissions by 2050.”

I support this approach. We’ve just seen the flood damage in Nelson which is after about $80 to $85 million of damage from last year’s flooding. This year’s event is even bigger, and the damage is estimated to be well over $100 million. We could also be looking at similar events on a regular basis. Those sums are way too big for homeowners and local councils to manage by themselves. Central government is going to have to get involved.

Climate change is happening right now. It is no longer something in the distance and we need to start addressing those changes. Local councils cannot afford to be incurring $100 million in repairs each year. That is simply not sustainable. Bear in mind the chief executive of the country’s largest insurer has recently said premiums in higher risk areas will become incredibly expensive to the fact they become unaffordable.

A whole number of issues are starting to coalesce around climate change and around the taxation of capital. These will force a change on how we approach our current taxation system. What Bernard is proposing ties in with the Fair Economic Return Susan St John and I are promoting. In our view it is a fairer approach as it widens our tax base and as Bernard points out, starts to remove distortions to how we currently approach investment.

A $1 bln shortfall

Also related to the question of climate change, there was a report in the Herald this week about the Ministry of Transport’s forecast that the National Land Transport Fund is likely to have a shortfall of $926 million over the next three years. The shortfall is mainly as a result of the Government’s decision to cut fuel taxes and road user charges. However, there’s also a decline in driving going on as well, which may be related to the pandemic. Those figures were prepared in April and didn’t take into account the extension of the cuts to January. This shortfall will be made up out of general taxation.

The Government has taken a short-term decision to help the cost of living, but inadvertently it points to something that’s fundamentally flawed about how the National Land Transport Fund is presently funded. The reliance on fuel taxes encourages more driving which until we get to a fully electric vehicle fleet, that is not helpful, as transport emissions are one of the biggest chunks of our carbon emissions.

Transport is also one of the areas where we probably can do something quite quickly with the right incentives to encourage switching away from using internal combustion engines to hybrids and electric vehicles obviously, public transport, walking, cycling, scooters. All those alternatives are available now in the urban environment and could make a huge difference.

This is another area where governments have kicked the can down the road, but now they need to address the issue of how we fund the National Land Transport Fund because it’s how the maintenance of our roads is funded. We have to devise a new means of funding it, probably as readers have suggested higher road user charges on all vehicles including electric vehicles. Here’s another example of change in our tax system being driven by a number of factors, including the climate.

Refugee evacuation

Finally, I mentioned earlier my time on the Government’s Small Business Council in 2018-19. Our chair was Tenby Powell who is a Colonel in the New Zealand Army. He is currently in Ukraine delivering humanitarian aid and helping to evacuate people from the most dangerous areas in the Russian occupied South and East of the country. Tenby has established Kiwi K.A.R.E. (Kiwi Aid & Refugee Evacuation) to fund this aid. Here’s a link to the funding page for Kiwi K.A.R.E.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

9 May, 2022 | The Week in Tax

- Inland Revenue gets ready for tax filing season and puts recipients of COVID-19 support payments under the microscope

- Insights into the composition of the Top 0.1%

Transcript

Inland Revenue is currently gearing up to begin processing 31st March 2022 year-end tax returns and personal tax summaries. Starting later this month it will be issuing automatic income tax assessments for most New Zealanders. But in preparation for that it has been giving updates to tax intermediaries on particular matters of interest. And a couple of notifications in the latest release caught my eye.

Firstly, there is form IR833 bright-line residential property sale information return which is required to be completed whenever a transaction which is subject to the bright-line test has taken place during the tax year. What Inland Revenue is saying is the form will pop up in a client’s return if it thinks the client has made a bright-line sale. And it will also pre-populate the information on the form, including the title number, address, date of purchase and date of sale.

This illustrates something we’ve spoken about many times, the level of information that’s available to Inland Revenue. It’s actually very good, in my view, that Inland Revenue is proactively putting in this information and saying, “Well, we know this.” I am aware that a few tax agent colleagues have had some very interesting discussions with clients where this notification has popped up and it’s the first the accountant or tax agent has heard about the matter.

As of last income year, all portfolio investment entity (PIE) income must be included in individual income tax return. Inland Revenue will pre-populate returns with the relevant data but not all returns will contain all the PIE information until after the PIE reconciliation returns and filed on or before 16th May.

In the meantime, Inland Revenue has reminded tax agents about this and advised not to file March 2022 tax returns either through Inland Revenue’s myIR or other tax return software until after that date unless you know for certain that the client is not a KiwiSaver member and does not have any other PIE income. That’s something to keep in mind because I’m sure some tax agents will be under pressure from clients who think that they are due a refund but haven’t factored PIE income into the equation.

What’s also going into tax returns is details of payments received under the Wage Subsidy Scheme, Leave Support Scheme and Short-Term Absence Payments. All these are what are termed reportable income. Consequently, tax returns will be required to be filed by recipients and there is going to be an information request in relation to these as part of the tax returns. Yet again, this is another example of how MSD and Inland Revenue shared the relevant information.

Inland Revenue administers the highly successful Small Business Cashflow Scheme which gave out loans to small businesses at the start of the pandemic. The initial two-year interest free period is now expiring for some businesses so repayments will be required to start shortly.

Talking about COVID-19 support, the numbers involved were quite extraordinary: apparently MSD has so far paid out $19.28 billion in the various subsidies and leave support payments. And Inland Revenue has paid out another $3.95 billion including Resurgence Support Payments and COVID-19 Support Payments.

The Resurgence Support and COVID Support payments were paid to businesses to help them pay business costs and therefore GST output tax is required to be returned on those receipts. Where the funds are used on relevant expenditure GST input tax credits may be claimed.

Inland Revenue has started checking that those who claimed the support payments were entitled to do so and assuming they passed that hurdle, they then applied the expenditure as was intended, i.e. business expenses. And I’m hearing stories from tax agents of very thorough investigations combing through the bank accounts of the businesses and individuals who received these payments. Some have resulted in “Please explain” enquiries coming back where apparently personal expenditure has been identified such as in one case where an EFTPOS payment for McDonald’s was identified.

This is yet another warning for those who applied for COVID support payments they either weren’t entitled to or misapplied the payments that they may find themselves under the gun from Inland Revenue. So far Inland Revenue have decided to proceed with 15 criminal charges and court proceedings are already underway for seven. In addition, as a result of investigations and some self-reviews the repayments made to date to MSD are over $794 million. ,

All of this is a timely reminder that with things calming down a little bit and so coming back to a stability, Inland Revenue is now applying itself back to its core business activities of investigations and reviews. Expect to see more news of these reviews and I think we may see one or two interesting cases emerge.

What Parker means

Moving on, last week’s speech by the Minster of Revenue David Parker quite predictably caused a stir and there was plenty of politicking over whether or not the proposal would lead to the introduction of wealth tax at some point and whether the Prime Minister would stand by her comments it wasn’t going to happen, the usual politicking etc. etc.

Subsequently, last Sunday I appeared together with Jenée Tibshraeny of www.interest.co.nz on TVNZ Q&A to discuss the implications of Mr. Parker’s speech. Off-air Jenée made a point echoed by several colleagues commenting on a LinkedIn post that the Tax Principles Act, if enacted, would work both ways. It wasn’t just a tool for saying, “Well, we need to introduce a particular type of tax.” It could equally stop a government introducing changes because it contradicted the agreed principles.

It’s a very valid point and it’s actually one of the sources of disagreement with the introduction of the 39% tax rate, because it affects the integrity of the tax system and the idea of administrative efficiency. Furthermore, it could apply to the measures relating to personal services, income attribution, which also I discussed last week. The argument here is that these rules would breach potential principles of horizontal equity, in that people earning similar amounts, may pay different rates of tax because of variations in the tax treatment.

Under the microscope

Other interesting insights have emerged in the wake of the speech. The Revenue Minister pointed to the lack of information about the high wealth individuals which prompted the research project into high wealth individuals would have caused some controversy. And earlier this week journalist Thomas Coughlan in the New Zealand Herald commented on an interesting briefing note about the project he’d obtained under the Official Information Act.

The briefing note looked into the representativeness of the wealth project population, and whether the high wealth research project population effectively represented the 0.1% of the wealth distribution of the population and the economic sectors they operated.

The note explains that the group that was selected for the project was based on

…environmental scanning undertaken by Inland Revenue over the past 20 plus years. This environmental scanning involved monitoring large transactions or other indications that individuals had significant wealth holdings using both public information and the department’s tax data. …

The briefing notes the selection is non-random and it is not expected to be representative of the population of all high wealth individuals. It is therefore quite possible that there may be high wealth individuals missing from the group “and there is no way to definitively state that the selected group is representative of the top 0.1% of the wealth distribution.”

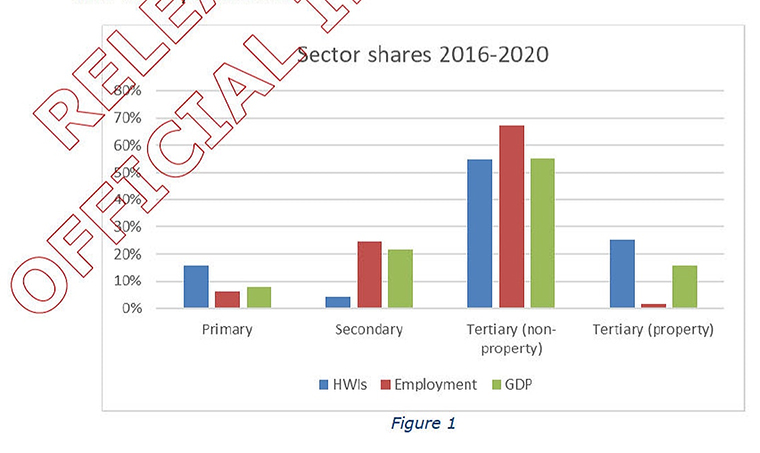

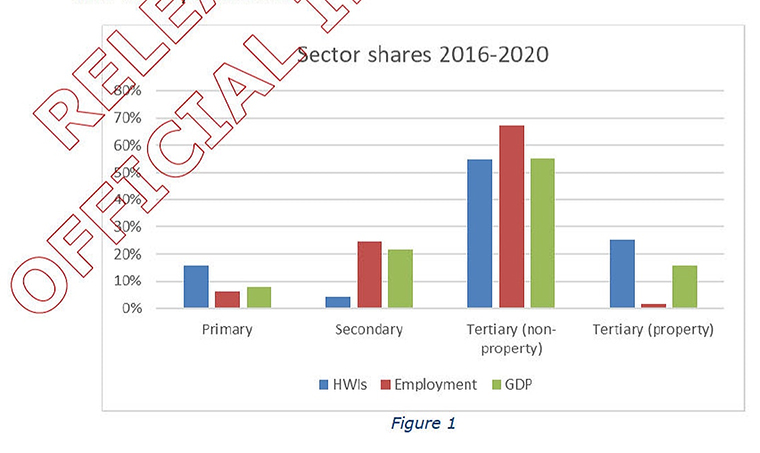

Having included that caveat, the note had some interesting analysis of what they had found so far. And it had a diagram comparing the share of GDP and employment to the main activities of high wealth individuals on the basis that you could reasonably expect the share of the industries represented by the individuals to be broadly similar to the spread of industries and activities in the New Zealand economy.

But it turns out that wasn’t the case. And in particular, relative to employment and GDP shares, the property and primary sectors are disproportionately represented in this project. The number of high wealth individuals in the primary sector is approximately 15%, even though the sector represents less than 10% of GDP. In relation to the property sector the proportion of high wealth individuals is 25%, compared with approximately 15% of GDP.

However, as the briefing note commented, there are clear reasons why there is this discrepancy “…there are certain activities (investment, property ownership) that would be expected to have greater involvement by those accumulate significant wealth….”

Incidentally, the primary sector and particularly the property sector, are sectors where existing tax rules such as the Bright-line test and the associated person rules work already to tax capital transactions. So that’s another reason why Inland Revenue may have better data on this particular group of wealthy individuals than others that work in the service economy.

Anyway, it will be interesting to see what further insights emerge from this high wealth research project. Meantime, no doubt the debate over how that data may be applied and the question of the taxation of capital and wealth will continue to rage, particularly in the run up to next year’s election.

Getting ready for tax filing season

And lastly this week, the final instalment of Provisional tax for those with a 31st March year-end is due on Monday. The key point here is taxpayers whose residual income tax liability for the year is expected to exceed $60,000, should ensure that they pay sufficient provisional tax to cover that total liability for the year. Otherwise, use of money interest, which is increasing to 7.28%, will start accruing together with potential late payment penalties.

As always, if taxpayers are struggling to meet payments in full, then either contact Inland Revenue to let them know and start to arrange an instalment plan. You will find that they are generally cooperative on this. Alternatively, consider making use of tax pooling to mitigate the potential use of money, interest and late payment penalties.

Well, that’s all for this week I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

5 Oct, 2020 | The Week in Tax

- Highlights from the ATAINZ spring workshop including provisional tax payments holding up, home office expenditure allowances.

- Inland Revenue is chasing cryptoasset investors.

- How to design and implement a wealth tax.

Transcript

Late last week, I was one of the presenters at the Accountants and Tax Agents Institute of New Zealand’s Spring Mini Conference. As you’d expect, the programme was dominated by the impact of Covid-19 and its implications for accountants and tax agents. It was an excellent mini conference and there were plenty of very useful insights from the presenters and also from the audience and participants. Here are a few of the highlights which stood out for me

From what Chris Cuniffe of Tax Management New Zealand is seeing, outside of the very obviously hard hit sectors such as tourism and hospitality, business seems to be holding up well, judging by the tax take. During the first lockdown, the final tax payments for the year ended 31 March 2020 year were due on the 7th of May. Now, by that stage, Inland Revenue had made it clear that it was using new provisions to enable it to waive the application of use of money interest if tax was paid late. So Chris Cunniffe thought there would be a huge take-up of that opportunity.

But in fact, what they saw was about $2.8 billion of provisional tax paid on the due date through the tax pools. According to Inland Revenue statistics, it has about $163 million of tax that would have been payable on the 7th of May under instalment. That is, the person contacted Inland Revenue saying “Hey, we’re not going to make this payment, can we arrange to pay it in instalments?”

That $163 million represents about five per cent of the total tax payable on the due date. And that’s actually really encouraging because it means businesses had the money, their profitability was relatively unaffected, and they were prepared to meet their liabilities. Given that the tax year end was 31st March, is what you would expect to see because the full impact of Covid-19 had not been felt by that date.

For most businesses the first instalment of provisional tax for the current year to March 2021 was due on 28th August. And there was only about a five per cent fall in the tax paid comparing what was paid on in August 2020 with what was paid in the previous year.

Remarkably, 55% of all depositors with TMNZ paid more tax this year, with only 42% paying less tax than the previous year. So that was actually really encouraging when you consider that the June quarter was when GDP fell 12.2%, the tax take holding up as well as it did seems to be an encouraging factor.

Generally speaking though, most people thought the real acid test for how businesses are tracking along will be the second instalment of provisional tax, which is due on the 15th of January. Which of course is terrible timing in the middle of a holiday period. So that will be interesting to see how well businesses have held up then.

Insolvency issues

Derek Ah Sam of insolvency practitioners Rogers Reidy thought the real wave of insolvencies hasn’t really got underway yet. But what was intriguing to hear was that despite Inland Revenue’s Business Transformation programme, it seems that a fair number of companies going into liquidation still owe several years of PAYE and GST. And this is surprising to me because Inland Revenue systems really ought to be picking this up much, much sooner. We used to see this quite a bit several years ago, but with Business Transformation, they’re supposed to be across this much sooner and taking action earlier. If that is not happening, then there’s something else going on at Inland Revenue that we don’t know which the Minister of Revenue should be perhaps asking a few questions about.

The other thing Derek noted is in relation to the question of commercial landlords who have not been required, as in Australia, to provide some form relief for their tenants. Actually, in Australia, I think there’s some provisions preventing eviction notices being issued. What Derek is seeing is that commercial landlords are taking much harder line on tenants in arrears. And they seem to be particularly targeting food outlets that have already been hit hard by Covid-19 and probably long term are not sustainable. So it appears some landlords are going to apply pressure now and get rid of them. That seems to be something that’s happening there. Again, we’ll see more as the year goes on.

Wage subsidy ethics

Tristan Dean of Hayes Knight, then ran us through the professional ethics issues to be addressed when a client takes up a wage subsidy which they’re either not entitled to or don’t apply it as prescribed. That was highly relevant given the issue popped up in the second leaders debate on Wednesday night. And it provoked an interesting discussion around that, which no doubt won’t be the last time we hear about that.

Home office safe haven

And finally, from the floor when we were discussing the question of home office allowances, the overwhelming reaction was that Inland Revenue safe haven of $15 per week was well short of the mark, with most people suggesting somewhere between $40 and $50 per week being much more realistic representation of the costs involved using the formulas available to people under the Income Tax Act.

That’s something that I’ve seen pop up in commentary or from some of the comments to articles when I’ve discussed this question. The present determination Inland Revenue issued was a temporary one. Maybe when a permanent one comes out we can get an increase of the available amount to say something closer to that $40 mark.

New pressure on crypto tax

Moving on, a couple of weeks back, I mentioned that Inland Revenue has issued up updated guidance on the taxation of cryptoassets. It now seems that it’s decided to apply much more pressure on this industry and investors, because this week it emerged that it has been asking companies that deal with cryptoassets to hand over customer details.

Now, as people are probably quite aware, the cryptocurrency and cryptoassets world is quite libertarian in its philosophy. So this probably came as a huge shock to investors and the companies themselves – that Inland Revenue could not only demand the information, but there was nothing they could do to stop Inland Revenue’s action.

A couple of years back the information gathering powers of Inland Revenue contained in the Tax Administration Act 1994 were increased and new sections giving them wider powers of search and entry were given to them.

Inland Revenue’s extensive powers are well known within tax and professional community. And pretty much our response is when a client asks, “Can they really do this?” is “Yes, you’re just going to take your lumps on this”. And so, the cryptoassets community is not the first to find out just how extensive Inland Revenue powers are, and they won’t be the last. And if they’re feeling very unhappy about it, they’re not alone in that.

I would think that this could work out quite profitably for Inland Revenue. If taxpayers have been thinking “Well, the web servers are offshore, we don’t really need to comply with this as all takes place in the darker reaches of the Internet and outside the reach of Inland Revenue”. You’re not. And other tax jurisdictions are also taking a close look at a cryptoassets. So you’ve been warned. It will be interesting to see what comes of this and how much revenue Inland Revenue raise as a result of their actions.

A wealth tax template

And finally, the Green Party’s wealth tax has been in the news again as we get closer to the election date. There’s been a reigniting of the whole question of the taxation of capital.

Without getting into too much detail, one of the arguments advanced against a wealth tax is that it would be complicated to implement. And undoubtedly, there are quite a lot of complexities to be addressed, most notably around valuations, but it’s not impossible. In fact, we already have a de facto wealth tax in operation. And we’ve had it since April 2007 when the revamped Foreign Investor Fund regime with the fair dividend rate was introduced.

For those who are not familiar with the Foreign Investor Fund regime it applies to overseas stocks and shares (but not bonds because they are subject to a different regime). Basically, taxpayers are assessed on the lesser of the notional gain over the tax year, together with the actual receipts from sales and dividends in that year, or the 5% fair dividend rate applied to the value of the investments at the start of the income year. For KiwiSaver funds and companies, the 5% fair dividend rate is automatically applied. They don’t have the alternative of the actual gains and losses during the year.

Now, as you might expect, I have to explain the foreign investment fund rules to overseas clients. And they’ve conceptually struggled with it, because it’s not a capital gains tax. But once it’s reframed in the idea of a flat wealth tax, they get it very quickly. And that’s basically how I explain it to overseas investors. Effectively the 5% fair dividend rate is a wealth tax. And if your tax rate is 33%, you’re talking about a 1.67% effective wealth tax.

Now, the foreign investment fund regime is easy to apply where you have publicly listed securities, but the regime has a whole set of rules that people normally don’t see, which relate to unlisted securities. So much of the work that you’d expect to see when you’re addressing a wealth tax has actually already been done and is part of the Income Tax Act.

So if you were introducing a wealth tax your starting point would be to expand the Foreign Investment Fund rules across more asset classes and tweak the fair dividend rate to whatever rate of tax you wish to levy on the assets.

In short, it’s complicated, but not quite as insurmountable as people make out. And of course, when you hear people saying, “Oh, it’s too complicated”, a cynic like myself is always wondering just how much they’re arguing that out of self-interest.

And on that bombshell, that’s it for this week. I’m Terry Baucher. And you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening. And please send me your feedback and tell your friends and clients. Hei konei ra!

31 Aug, 2020 | The Week in Tax

- COVID-19 related measures for tax losses and AirBnBs

- National releases its small business policy

- Is a capital gains tax back on the agenda?

Transcript

Friday was the due date for the first instalment of Provisional ax for the year ending 31st March 2021, Provisional tax is going to be payable by anyone whose net tax for this year will exceed $5,000.

Now in the past, we’ve covered the ability to use tax pooling to give more flexibility about payments of tax, and that’s going to be particularly important for the current tax year, given our ongoing uncertainties arising from the COVID-19 pandemic. My recommendation to clients at this moment is to adopt a conservative approach. Look at paying the first instalment of tax due today but keep watching your progress and how your turnover is going. And if matters move into a tax loss position as a downturn comes through soon, then we will take steps to mitigate or deal with the next two instalments of Provisional tax.

But what if you already know you’ve got losses this year and it’s not likely to get much better for the current year? Say you’re a restauranteur or you’re in the tourism business. These are two sectors which are very clearly hit hard by the pandemic and the various lockdown measures.

Well, one of the measures introduced as part of the government’s response to the pandemic was the ability to carry tax losses back. Under this measure, if you have a tax loss for the 2020 or 2021 income years, you can carry those losses back one year. And the idea is that if you carried back to a profitable year this will mean you have overpaid tax in the prior year, and that tax can be released to help smooth your time through this ongoing pandemic.

And for most larger companies the tax loss carry-back regime is pretty straightforward. Carry back the loss one year, get a tax refund at 28% percent, and then you’ve got funds, which you can either use to meet other bills you may be behind on, or bring it forward and apply it against your current tax year liabilities such as GST or PAYE, depending on how dire the situation might be.

But one of the problems that’s emerged with the tax loss carry back rules affects a lot of smaller companies where their shareholder is also an employee. And under the rules that apply to these companies, these companies can pay out their profits to a shareholder-employee who is then responsible for the tax.

For example, say a company makes a profit of $100,000. Instead of paying tax at 28% it instead distributes it as a salary to a shareholder-employee and he or she is taxed on it at their relevant marginal rates. For someone on $100,000 with no other income, that roughly works out to about $24,000. So, there’s a tax benefit to shareholder-employees because of the gradual increase in tax rates for individuals.

But the problem that’s emerged wasn’t really addressed in the current legislation. What do you do if you carry a loss back for a company with a shareholder employee? The carried back loss is not much used to that particular company because they’ve already reduced their profit to nil by distributing it to the shareholder-employee.

And by the way, I note there was a Radio New Zealand report noting that about $2 billion dollars in wage subsidies has been paid to companies that do not appear to have paid any company income tax. It’s highly likely many of those companies have shareholder employees and it is the shareholder employee who has paid the tax using the mechanism I just explained where the whole or substantial amount of the company’s profit is paid out to the shareholder-employee.

So the tax loss carry back rules don’t work too well for small micro businesses that use a shareholder-employee mechanism. And it’s something we’ll need to be looked at if there is a permanent iteration of these rules, which I believe should happen.

But it’s also why the small business sector and accountants have not looked on this particular measure with a great deal of enthusiasm yet. Because of those complexities how do we deal with these tax losses that are brought back? Do you rewrite the whole position in the prior year? And then what does that do for other matters that are related to that person’s income, such as social assistance, ACC earner levies? The amount of ACC you may claim if you have an accident is dependent on your salary as a shareholder-employee.

So, there’s a lot of complicated issues to work through. But the tax loss mechanism is there. It works very well for companies which don’t have shareholder-employees and individuals trading for themselves or trusts can use the loss carryback rules in either the 2020 or 2021 income years.

Converting from short-term to long-term rental accommodation.

Moving on, Airbnbs in the tourism sector will also have been hit very hard by the pandemic and the collapse in overseas tourism and the substantial decline in domestic tourism. So what has happened is some of these Airbnbs have reversed a trend that was developing, and have moved back into providing longer term residential accommodation.

As always, there’s a tax consequence to that and for GST purposes it means that if the GST activity is stopped, then the person is required to de-register for GST. Part of the de-registration process will mean a deemed supply of the goods that were brought into the business. You’re deemed to have sold them and pay GST output tax on the way out. And if you’ve claimed a big input tax credit for, say, a whole property, moving it over to Airbnb, that means that you could have a substantial output tax payable on de-registration, as it’s done at a market value.

Now, under the GST Act, there is a provision that where someone is no longer carrying on a taxable activity they are obliged to let the Commissioner of Inland Revenue know within 21 days of their taxable activity ceasing, and then that registration must be cancelled unless there are reasonable grounds to think the taxable activity will be carried on within 12 months. So, this could apply if you think that within 12 months-time, we could be back up and running again.

What Inland Revenue has done is extended this twelve-month period to 18 months through a special COVID-19 determination which has just been issued and this will apply until 30th September 2021. So you now have 18 months, a lot more flexibility about whether you’re going to resume your Airbnb activities or drop out of the picture completely.

Just a caveat though – if you are currently using a property for residential accommodation, but you anticipate going back to making taxable supplies in Airbnb, you have to do what’s called a change in use calculation. This is basically an apportionment of the value of the property brought into the GST net over the expected time it’s being used for taxable activities. A little bit complicated, but you produce one of those calculations as part of your GST returns.

Political tax policy

Yesterday National released its small business tax policy. In terms of tax rates it has come straight out and said it does not plan on increasing taxes or introducing any new taxes.

Other than tax rates, National’s tax policy has a number of other measures. Firstly, they’re going to lift the threshold for the purchase of new capital investment from $5,000 to $150,000 per asset. That is you can take a complete deduction for an asset costing up to $150,000. Now apparently this only applies to “productive assets” so there’s a question as to what that might mean. It’s a temporary two-year change. Something similar has been done overseas.

And it’s a good idea although it is a question, of course, of what will and won’t meet the definition of ‘productive’. But you could see some fairly substantial plant and machinery being purchased and as a means of getting investment into productivity in the economy it’s a measure to be to be welcomed.

National proposes increasing the Provisional Tax threshold from its current $5,000 to $25,000. I’m not so sure about this one, because one of the reasons the threshold stayed at $2,500 for a long time was concern that if it was increased substantially taxpayers might forget they’ve got terminal tax to pay and find themselves short of funds. And obviously that risk increases the greater the threshold, so $25,000 is extremely generous.

It would also have an impact on the Government’s cash flow, by the way, because it would drop quite a lot of people out of the provisional tax requirements. So the Government’s income, so to speak, was will be reduced temporarily before these payments will then come in at terminal tax time. I think $25,000 is too generous, $10,000 is probably manageable. Still it’s a measure in the right direction.

Next, they want to raise the GST threshold from $60,000 to $75,000. Big tick for that, the GST threshold hasn’t been increased since 1 April 2009. So it’s well overdue and on an inflation basis $75,000 is about right.

Businesses will be allowed to write off an asset once its depreciated value falls below $3,000 as opposed to continuing to depreciate it until its tax value reaches zero. Really good measure here. Should be done straightaway regardless of who’s in power. Keeping a track of all these assets when they’ve fallen below that threshold is hard and causes needless complexity. So I like that a lot.

I also like this next one – change the timing of the second Provisional Tax payment for those with a 31 March balance date from 15th January to 28th February. That’s really quite sensible. It’s bizarre it’s in the middle of January when we’re all supposedly on holiday and it’s not a great time for cash flow. February makes a bit more sense.

Ensure the use of money interest rates charged by Inland Revenue more properly reflect appropriate credit rates. So right now, if you overpay your tax Inland Revenue will pay nothing. National are saying, well, we want something that’s a little bit more realistic than that. It’s not a bad move and it certainly would be popular with small businesses, but it’s rather based on an assumption that taxpayers would be using Inland Revenue as a bit of a bank. They won’t. A better option in this case would be tax pooling which takes care of a lot of those issues.

Increase the threshold to obtain a GST tax invoice from $50 to $500. A very generous upper limit there. I’m not sure I’d go as high as that, but that $50 threshold below which you don’t need to have a full GST invoice with all the required details on it has not been changed since 28th September 1993. So an increase in the threshold is welcome. I’d say $150 might be a better option.

Implement a business continuity test rather than an ownership test for carry-forward of tax losses. Moves in this space are already happening but the measure is to be welcomed.

Next and also welcome, review depreciation rates for investments in energy efficiency and safety equipment. That’s not a bad idea. And then consolidate the number of depreciation rates to reduce administration costs. That’s another big tick from me on that, because there are so many different rates and there’s options to probably get it wrong more often than right. And the level of micro detail required probably isn’t really appropriate for small businesses.

So those measures I think are mostly all welcome. And frankly, they’re sort of pretty much apolitical. Whoever is in power should be adopting almost all of those proposals.

Just a matter of time?

And finally, talking of parties’ tax policies, the Greens released as part of their tax policy, a proposal for a wealth tax to apply on net wealth over $1 million. Earlier this week, former legal practitioner, Human Rights Commissioner and retired Family Court Judge Graeme MacCormick picked up on the Green Party’s proposal when he wrote about the question of a wealth tax. He suggested a one percent levy on net assets of more than $10 million per person.

He also argued that it was time for the wealthy to step up and help out in this the crisis. He was sceptical of the idea of the trickle-down effect, that wealth trickles down and dissipates out through the country. He was of the view that basically we’ve got 30 years to show that hasn’t happened.

One of the interesting points he raised was that New Zealand not only doesn’t have a comprehensive capital gains tax, it also doesn’t have an estate tax or a gift tax nor a wealth tax. It’s highly unusual in the OECD for one jurisdiction to be not have at least one of those taxes applying on a comprehensive level. Some have capital gains tax and no wealth tax or estate tax. Others have a wealth tax, but no capital gains tax and some like the UK and the US, have capital gains taxes and estate and gift taxes.

The position varies across the OECD, but New Zealand is pretty unique in not having either a comprehensive capital gains tax, estate tax, gift duty or wealth tax.

Wealth taxes have fallen out of favour in the past few years, but they’re back on the agenda because, as I discussed with Radio New Zealand panel and Patrick Smellie of Business Desk, the pandemic and Thomas Piketty has opened the door on that.

And I was very interested to see this week that former Reserve Bank governor Dr Alan Bollard said in his presentation to the New Zealand CFO summit that, like it or not, given the scale of the borrowing the Government has had to engage in, capital gains tax may be an unpalatable option for governments to consider as they want to pay down the debt.

So this matter of capital taxation hasn’t gone away. We’ll hear more from other politicians no doubt, Labour and New Zealand First have still to release their tax policies. But we’ve still got another seven weeks to go to the election so there’s plenty of time for discussion on that.

Well, that’s it for this week. Thank you for listening. I’m Terry Baucher and this has been The Week in Tax. Please send me your feedback and tell your friends and clients until next week. Ka kite āno.

24 Aug, 2020 | The Week in Tax

News on the latest COVID-19 initiatives including:

- Updated Inland Revenue determination on working from home costs;

- Resurgence wage subsidy eligibility

- Updated Business Finance Guarantee Scheme conditions

- Provisional tax due on 28th August

Transcript

In last week’s podcast I did a refresher on the payments to employees who were working from home and a reminder about Inland Revenue Determination EE002, which covered the payments from employers to employees. Now, I noted that that determination only covered the period up until 17th of September 2020, and I suggested that Inland Revenue probably needs to issue an extension to it.

Lo and behold, later that day, that’s what happened. Determination EE002A has now been issued. This is a variation to the previous determination and now applies to payments made by employers for the period 18th September 2020 through to 17th March 2021. So that’s great to see that come through from Inland Revenue.

The Determination includes a couple of interesting comments from Inland Revenue. Firstly,

The Commissioner is currently considering issuing a public statement dealing with the tax implications of having employees working from home as a “new way of working” rather than being limited to the enforced way of working occurs during the lockdown period of the COVID-19 pandemic.

Now, this public statement won’t be ready for publication before 17th September so Inland Revenue has decided to continue to allow employers and employees to use the approach set out in the previous determination.

Secondly, what Inland Revenue has also done is remove the requirement that the payment must relate to an expenditure or loss incurred by the employee as a result of the employee being required to work from home because of the COVID-19 pandemic. So I guess you could say it’s a relaxation of the rules, but it’s also about Inland Revenue recognising that work habits are changing. And the previous position with a flat out prohibition on employee deductions and the complications that this led to will need to be addressed. So there’s obviously something new in the pipeline, and I’ll bring it to you when that turns up.

Moving on, in other COVID-19 related news this week, we’ve got a two week Resurgence Wage Subsidy payment to be available nationally for employees and self-employed who are financially impacted because of the resurgence of COVID-19. To be eligible, your business must have experienced a minimum 40% decline in actual predicted revenue for a 14 day period between 12th August and 10th September compared to the previous similar period last year.

You can’t receive this Resurgent Wage Subsidy at the same time as other COVID-19 payments for the same employee. But once that those existing payments end you can apply for the Resurgent Wage Subsidy. Applications are open from 1p.m. today, 21st August through to 3rd September 2020. So that’s very helpful.

The return of the virus in Auckland has had ripple effects as everyone is now well aware.

Tourism from around New Zealand is driven to some extent by Aucklanders travelling around the country. And therefore, it’s not unreasonable that not only those businesses affected in Auckland by the move to Level 3 should be supported, but also those outside Auckland.

In a related move, the Business Finance Guarantee Scheme has been reshaped.

Now, this was the first attempt by the government to give financial support during the pandemic but the take up of this has been very low. At the moment, I understand $150 million have been lent although the banks apparently had put aside something close to $6 billion.

Now, what has been done is to make the scheme a little easier to access. Credit is now available for general purpose borrowing and capital purchases or projects that might be related to COVID-19. The revenue limits of whom can apply have been extended from $80 million per annum to $200 million per annum. The loan limit has gone up from $500,000 to $5 million and the loan term has also been increased from three to five years. So you have up to five years to repay the loan.

The scheme continues to have the government underwriting the default risk up to 80% of the loan. Now, no personal guarantee is required for loans under the scheme which is obviously helpful. All lending decisions, are made by the banks and are obviously subject to commercial rates of interest. In other words, loans under the scheme are pretty typical bank loans.

One of the drawbacks for small businesses that the Business Finance Guarantee Scheme had and probably still does to a large extent, is the amount of information that’s required to support the application for small businesses. That means pulling together a lot of information quickly and using accountants and other advisers to help them do so. That’s not always the most practical approach for smaller businesses. That’s why the Small Business Cashflow Scheme had a huge take up because it was more easily accessible with fewer lending conditions. Yes, the lending limits were much lower. But the point was that it was very readily and quickly available.

And for those who are eligible to apply for the Small Business Cashflow Scheme applications are still available open right up until 31st December 2020. So just a quick recap on eligibility for the Small Business Cashflow Scheme. You must have been eligible to apply for the original wage subsidy. That is you have to show at least a 30% percent drop in income or predicted income compared with the same period 12 months ago. The maximum size of the company organisation that can apply is 50 employees.

Under the scheme the maximum amount of the loan is $10,000, plus up to $1,800 per full time equivalent employee. And if you repay the loan within 12 months, it’s interest free, otherwise, a 3% interest rate applies. I’m hearing from other colleagues and tax agents that smaller and micro businesses made extensive use of the scheme, which is hardly surprising. It is a fairly flexible regime designed to reach smaller businesses.

And finally, just like the seasons, Provisional Tax has rolled around. The first instalment of Provisional Tax for the year ended 31 March 2021 is due next Friday, 28th August. A quick reminder that Provisional Tax is due if your residual income tax now exceeds $5,000. Otherwise, you can drop out of the regime.

But there’s a caveat to this. If it turns out that your residual income tax does exceed $5,000 in this year and you would have been liable to pay Provisional Tax under the previous $2,500 limit, then use of money interest at 7% will apply from 29th August.

The main thing here is to check how cash flows are going and probably err on the side of caution here. And a good thing to do in these very uncertain times if you’re paying substantial amounts of provisional tax – I think that’s anyone paying more than $60,000 – you should really be making use of tax pooling. It gives you a lot more flexibility. You’ve also got to consider any tax losses which may be available. And, of course, the impact on your business of these moves to various Alert Levels.

The key thing, as always with Provisional Tax is if you think you’re going to struggle with this, get in front of Inland Revenue straight away and set up an arrangement plan. At the moment, Inland Revenue is still being flexible and willing to cooperate in helping companies and businesses manage their cash flows and their tax payments. But sooner or later, their patience will wear thin. And at that point, you don’t want to be on the wrong side of the border with Inland Revenue, so to speak.

Well, that’s it for this week. I’m Terry Baucher. And you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening. Please send me your feedback and tell your friends and clients. Until next week. Ka kite āno.