- Treasury Analytical Note examines the effects of taxes and benefits for the 2018-19 tax year

- The Australian Tax Office gets heavy with the Exclusive Brethren – will Inland Revenue follow suit?

Understandably the start of the new tax year on 1st April and the increase in interest deductibility for residential investment property to 80% was generally greeted by residential property investors with enthusiasm. Users of apps such as Airbnb and Uber, on the other hand, were less enthusiastic because the provisions relating to GST on listed services also took effect on 1st April. It has become clear that this change has caused some confusion and led indirectly to price rises.

Now GST on listed services refers to online marketplace operators who “facilitate the sale of listed service”. This is the so-called “Apps Tax”, which National promised to repeal when it was campaigning in last year’s election but then decided to keep it because it needed the money to make up for the loss of its overseas buyers tax.

These rules apply to the likes of Airbnb, Uber, Ola, and Bookabach which facilitate the sale of related the services. They now have to collect and return GST when the relevant service is performed, provided or received in New Zealand. It doesn’t matter whether or not the seller, the actual person doing the providing of the Uber or Airbnb, is GST registered. (For those already GST registered the change will have little effect).

Confusion and an unnecessary price increase?

However, a significant number of those providing the Uber or Airbnb, are not GST registered because the total services they provide annually are below the GST registration threshold of $60,000. But the introduction of the apps tax has prompted some of these non-registered persons to effectively increase their prices 15% to take account of the GST charge. However, this overlooks that though as part of the changes those non-GST registered persons can expect a 8.5% rebate under the flat-rate credit regime scheme.

What happens here is the offshore marketplace (Uber or Airbnb) will collect 15% GST on the booking but then pass 8.5% of that to the persons actually providing the Uber or Airbnb. But as an article in The Press notes, it appears many people now think they are GST registered and have effectively increased their prices by 15%. As Robyn Walker of Deloitte said, there definitely appears to be some confusion around hosts about this law change, and probably many don’t fully appreciate that they’re getting this 8.5% rebate.

As GST specialist Allan Bullot of Deloitte, noted there is a lot of confusion with Airbnb. It’s a complicated area, and something Airbnb providers are very careful about is registering for GST because of the fear they might have to pay GST if they sell the property to someone who’s not GST registered. In which case they effectively had to pay GST on the capital gain.

It appears what we’re seeing here is that those who have been brought into the new flat rate credit scheme haven’t yet quite worked out how the new rules will work for them. I would expect things to settle down in time and maybe Inland Revenue might put out more guidance. But it would appear that some providers are getting an accidental windfall at this point, although the increase is taxable for income tax purposes. Anyway, watch this space to see how this plays out and whether there’s some tweaking to the rules as this scheme beds in.

Treasury analyses the effects of tax and income

Moving on, just before the end of the tax year, Treasury produced an interesting Analytical Note on the effects of taxes and benefits on household incomes in tax year 2018 – 2019. This is interesting in a number of ways because frequently when people are talking about the effective tax burden, they look at the impact of direct taxation on a person’s pre-tax income.

Some have pointed out this is not really a true measure of a person’s net tax burden. They’re referring to the effect of transfers that people might receive from government in the form of Working for Families or New Zealand Super, but also the indirect transfers such as education and healthcare.

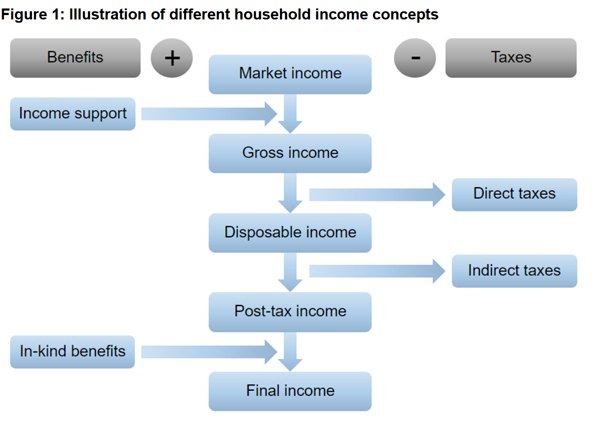

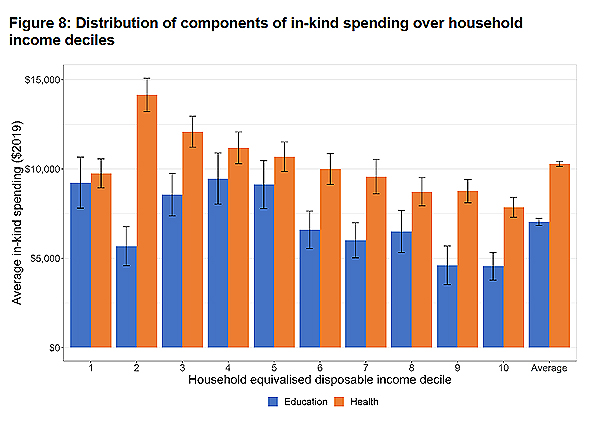

This paper tries to examine that for the 2018-19 tax year and what it does is calculate a household’s “final income” which represents net income after direct and indirect taxes and then adds an estimate of the government spending on health and education services received in kind.

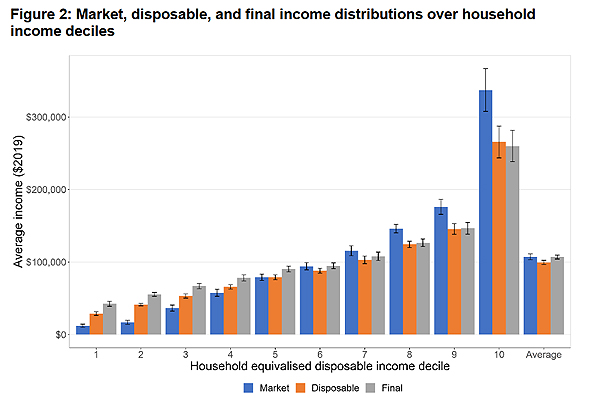

As the paper notes basically when you just look at disposable income, that is market income plus transfers, such as Working for Families credits or New Zealand Super, these are incomes are generally lower than market incomes on average over the population of New Zealand, and fairly unequally distributed. However, once you bring in indirect taxes and in kind benefit payments to get final incomes as defined, these are significantly more equally distributed than disposable incomes and close to market incomes when averaged over all households.

Yes, but what about Gini?

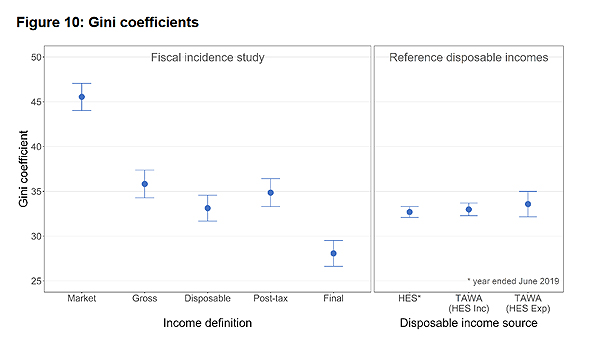

The Note also considers the Gini coefficient. This is the measure of inequality, where the higher the number, the more inequality society is. The Gini coefficient starts at 45.6 ± 1.5, and that drops to 35.8 once you bring in income support payments. Once you include consumption taxes and the benefits in kind such as health and education you end up with a Gini coefficient of 28.1 which is considerably lower and indicative of a much more equal society.

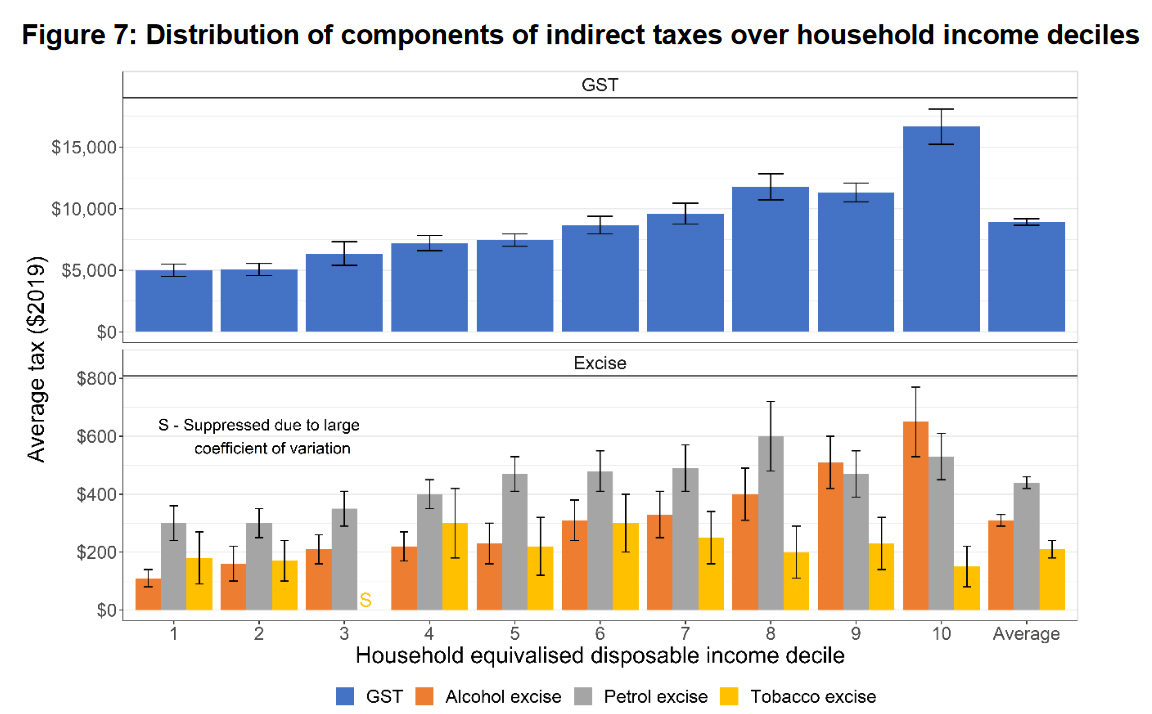

What the Treasury analysis did was to take 66% of all core Crown tax revenue and 68% of core Crown expenditure and allocated that to New Zealand households. Although the effect is approximately neutral as the note describes the effect is unevenly distributed. Households in the bottom five “equivalised disposable income deciles” received on average more in government services than they paid in taxes, whereas the opposite is true for houses in the top four deciles.

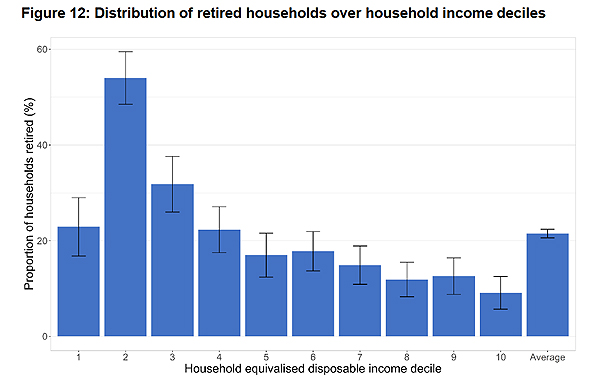

The second decile is the one where there’s a large amount of support happening. This is because there’s a fairly high concentration of New Zealand super recipients in that second docile.

The Note also considers “retired households”, where one of the people in the household is receiving New Zealand super.

“Drink yourself more bliss”

I was amused to see in the analysis of indirect taxes a comment about the average alcohol excise amounts increasing reasonably steady with each decile household equivalent. In other words, the richer the decile, the more they drink. That is a crude summary but it did amuse me.

As I noted, the Treasury analysis covers GST and the effect of economic benefits in kind. There was some commentary at the time of last year’s High Wealth Individual report that it wasn’t really quite fair because it didn’t take into account what the impact of GST and government benefits in kind. This is interesting to see, and I definitely recommend having a read of the note which is a reasonably easy read.

The Australian Tax Office raids the Exclusive Brethren’s business operations

And finally this week, a story coming out of Australia caught my eye about the Australian Tax Office (“the ATO”) raiding multiple premises associated with the global headquarters of Universal Business Team (UBT) on March 19th. UBT is a Sydney registered company that provides services and advicee to about 3000 exclusive Brethren owned businesses in 19 countries.

ATO investigators also apparently raided the head offices of a number of Brethren run companies, including OneSchool Global. In what would also be the standard procedure here, they confiscated phones, computers, documents and other materials. This was done as part of what the ATO call a “no notice raid”. Inland Revenue can do such raids as well, but the point is, it’s not done very often, and the fact that this has happened is extremely intriguing to see.

One of the things that I see frequently pop up in the comments of these transcripts, are questions/ pushback about charities having an exemption from tax on their business profits. It’s more complicated than that, but it’s there’s an obvious tension there. (Again thank you to all those who contribute, your comments are read even if I don’t always respond).

On this point I recall a discussion I had with the late Michael Cullen when he was chairing the last tax working group. During a roadshow event I asked him if there was anything which had surprised him during his role. He replied that he had been surprised by the scale of the charitable sector. He and the group had some concerns about whether in fact, all the charitable donations were being used for charity. In particular whether donations made under an exemption to an exempt business were in fact being used for a charitable purpose. The Tax Working Group’s final report noted:

“80. …the income tax exemption for charitable entities’ trading operations was perceived by some submitters to provide an unfair advantage over commercial entities’ trading operations.

81. notes, however, that the underlying issue is the extent to which charitable entities are accumulating surpluses rather than distributing or applying those surpluses for the benefit of their charitable activities.”

The Sunday Star Times asked Inland Revenue to comment on the ATO’s action but Inland Revenue just dropped a dead bat on it. But I would think, as the Sunday Star Times said, any information relating to New Zealand businesses that came into the ATO’s hands would proactively be passed on under the Convention on Mutual Administration Assistance and Tax Matters, part of the double tax agreement between Australia and New Zealand.

The scale of information exchange which goes on between tax authorities is very largely unknown, but it’s probably one of the most revolutionary changes to the tax landscape which has happened in the last five to 10 years. I don’t think we’ve yet seen anything like the impact that it will have.

Will Inland Revenue follow suit?

In summary the ATO clearly feels that it’s justified in launching a “No notice raid”. The question is whether Inland Revenue is considering something similar or is it just going to sit back and watch carefully? We don’t know, it won’t say, but you can be sure that it will be watching very closely to see what findings that come out of the ATO raid. If it does get anything interesting from the ATO, expect to see something similar happen here.

On that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.