6 Sep, 2021 | The Week in Tax

- Latest lockdown developments

- More on allowances from Inland Revenue

- Could a tax forgiveness programme help SMEs hit by Covid-19?

Transcript

As of today, businesses can now apply for the second round of wage subsidies if they meet the criteria for doing so. Unlike last year, the wage subsidy is being paid in two weekly instalments, and one twist to this is that if you have not applied for the previous two-week period, you now miss out permanently. The qualification is if you have suffered a 40% loss compared to a similar period in the six weeks immediately prior to the move to Alert Level Four on 17th August 2021.

As of August 31st, $922 million has been paid to businesses that had met the criteria, and 225,335 applications had been approved, covering over 822,000 jobs. Another 14,708 applications were declined with 73,000 still being processed as of the first of August.

The support continues to be there, and you can apply for wage subsidies in Levels Three and Four, even if you’re outside Auckland so long as you meet the eligibility criteria. There’s also the Resurgence Support Payment, which is available at levels Two, Three and Four. And there’s various other schemes such as the Leave Support Scheme, Short Term Absence Payments and the Small Business Cashflow Loan Scheme which are also available.

There will always be a few businesses that somehow don’t meet the criteria and other businesses that are slipping through. Whether these are enough to keep the business alive, is another matter, because as I’ve said previously, one of the issues Covid-19 has highlighted is how many small businesses are, in fact, relatively undercapitalised.

And just be aware that the applications are being scrutinised. There are now reports that four applicants who received a wage subsidy are now being investigated as to whether, in fact, those were valid applications.

Clarifying the home office rules

Moving on, I’ve spoken previously about allowances and Inland Revenue Determinations issued in relation to payments provided to employees to work from home. Inland Revenue has now issued a third determination, Determination EE003, which will start from 1st October and will run for 18 months through to 31st March 2023.

What this does is amalgamate and replace all the previous determinations that have been published on the topic which we covered recently. However, although this consolidates the previous determinations that have been made, there are actually no changes to the actual operating principles set out in those determinations and the amounts of payments that can be made by employers to employees as a reimbursement for home office use and use of personal telecommunication tools.

Those rates are $15 per week if they are treated as exempt income for an employee of working from home and then a further $5 a week if that employee is using their own telecommunications tool. So that’s a maximum of $20 dollars per week. As I’ve said previously, these allowances are not terribly generous, but they are at least a de minimis work around. Inland Revenue has by extending the application of the determination through till 31st March 2023, given itself time to have a further consideration of what it wants to do with the law around this practise.

At the same time, Inland Revenue’s latest Agents Answers for September sent to tax agents has caused some confusion. It had a note explaining that if a company uses a home office that is the home of one of its shareholders, it will not be able to claim a deduction for the office unless it has incurred the actual cost. This means that if a shareholder or director, runs the company’s business through a home office and pays all expenses relating to the home office, the company has not incurred any expense and cannot claim a deduction.

This came as a surprise loss to many fellow tax agents and left us scratching our heads a little bit on this. What Inland Revenue has done is set out the law, which is quite clear that the company can only claim the expense if it can prove a nexus between its business income and the home office expense and no private portion can be claimed. The company must incur the expenditure within the income year, that is, it has a liability to pay the expense either direct to the provider or to the homeowner.

And that last phrase there is where perhaps practise will probably align with the theory. What one often sees is that small businesses run out of family homes, will claim a home office expense. And in reality, what it should be is a reimbursing allowance of the type we’ve just been discussing. The director or shareholder-employee or other person should file an expense claim for the home office expenditure they’ve incurred.

Tax policy aimed at the big overwhelms the small

Now this highlights an issue that I’ve talked about previously is that our tax system doesn’t always work well for small businesses. There’s a mismatch that goes on. A lot of policy is driven by larger taxpayers who have the resources to manage their affairs properly and also make submissions when legislation is being considered. However small businesses just tend to muddle along as best they can and sometimes have matters, to put it bluntly, just dumped on them unexpectedly with an increase in compliance costs.

Managing compliance costs for SMEs is always a bit of a hard one for tax authorities. There’s a trade-off between minimising compliance costs and the potential for abuse. If I was to say where I think Inland Revenue lies on that line, I think they have always been more cautious about the opportunities for concessions to be abused.

So that’s that means that sometimes obstacles like this Agents Article note appear, which have everyone head scratching and don’t actually reflect the actual practise. Sometimes, I think policymakers at Inland Revenue would be a little surprised at how “imprecise” would probably be a polite way of putting it, some accounting records kept by small businesses are. This is, as I said earlier a reflection of how small businesses are undercapitalised or under resourced and sometimes the I’s aren’t dotted and T’s aren’t crossed.

Anyway, this note on home office expenses, as I said, caused some confusion. It probably could have been phrased better, it certainly caused a stir when it landed, even though ultimately when you drill down it isn’t a question of Inland Revenue changing the policy. Instead, it’s just saying there are procedures to be followed and you should do so. How helpful you might think that is in the midst of a general lockdown is another judgement you can make.

Tax forgiveness?

And finally, a very interesting article just popped up the other day from Ranjana Gupta, a senior lecturer in taxation with Auckland University of Technology. Ranjana has suggested that a tax forgiveness policy could help many small businesses get through the financial woes that they’re dealing with a result of Covid-19.

She’s been carrying out some research and based on this suggests a voluntary disclosure programme for overseas income could protect these businesses affected by the pandemic and also promote honesty in tax matters. Essentially, what she’s pointed out is that the system, as it currently operates, tends to be quite punitive rather than encouraging compliance. Just to give an example, if you’re late with filing a return and paying tax, a late filing penalty will be imposed for the tax returns involved and there will also be late payment penalties and interest on top of that.

All the research I’ve seen shows that there is no better compliance here in New Zealand over prompt payment of tax than in other jurisdictions that may only impose an interest charge. And as a tax agent unwinding the position where late payment penalties have been imposed is very, very frustrating at times. As I said, it doesn’t seem to encourage any prompter payments. Instead, what happens is the late payment penalties accelerate so rapidly that the debt balloons to the point where taxpayers just give up.

So, Ranjana’s point is a fair one. And she goes on to say that if a taxpayer is operating outside the tax system, the consequences of entering may be harsh because of this penalty regime. And so, this encourages even inadvertent tax offenders to remain outside the system.

And that is something I have encountered, that taxpayers who have realised they’ve made error are often quite worried about coming forward and how hard they will get hit for non-compliance. And so, the position that Ranjana is proposing, and I agree with it, if it’s made clear that there’s an amnesty going on, that may encourage people to come forward who may have stayed under cover hoping Inland Revenue wouldn’t find them.

And interestingly, she then goes on to discuss the point that currently 31% of the population are immigrants and one in 10 of those are self-employed without employees, with about 5% small businesses with employees. And her argument is that they may not be fluent in English and may be unaware of their tax obligations and are therefore unintentionally non-compliant. This was something we actually came across during my time on the Small Business Council. The migrant community is of a size that some may only deal in their own native language rather than, as you might think, in the wider community.

So anyway, as Rajana notes, they now face the ramifications of making a voluntary disclosure. And her suggestion is maybe Inland Revenue should think about some form of amnesty, or message to the public as to how it would take a more sympathetic approach to people who come forward. So, I think this is an interesting proposal.

I have found, to be fair, where people have come to me and made voluntary disclosures to Inland Revenue they’ve been treated reasonably well. There haven’t been many instances of any very heavy penalties being imposed. Tax is collected and the interest is paid and then the system carries on as normal. So, Ranjana’s proposal is something worth considering.

Well, that’s it for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening. And please send me your feedback and tell your friends and colleagues. Until next time Kia Kaha! Stay strong.

30 Aug, 2021 | The Week in Tax

- The latest lockdown developments

- What to do if you can’t pay provisional tax or GST

- The perils of making payments to overseas beneficiaries

- Reflections on the late Sir Michael Cullen

Transcript

We’re now into our second week of lockdown and the full range of government support packages such as the Wage Subsidy and Resurgence Support schemes are now open for applications. As of Wednesday night, 128,000 wage subsidy applications had been made and almost $500 million paid out. Other tax agents are reporting turnarounds as quick as four hours between an application being filed and payment being received.

Lockdown has had a knock-on effect for Inland Revenue staffing because it is responsible for managing the Resurgence Support payments, and since they opened on Tuesday morning Inland Revenue says it’s already received more than 95,000 requests and has already approved 70,000, with distributions totalling $130 million already made to over 40,000 applicants. In addition, Inland Revenue is also working alongside the Ministry of Social Development in checking and signing off on Wage Subsidy applications.

Consequently, Inland Revenue’s call centres are pretty overloaded at the moment because staff have been directed to help in those areas. The dedicated tax agent hotline has been closed down and we’ve been encouraged to use the messaging through the myIR function, and a colleague has reported that he’s had excellent service using that.

Just as an aside, I deal with other tax agencies around the world. And although it’s easy to take a lot of pot shots at Inland Revenue, to borrow a phrase, “We don’t know how lucky we are”. I recently finally received a reply from the United States Internal Revenue Service to a letter that I had sent 19 months previously. HM Revenue and Customs in the UK is an exercise in great patience in trying to deal with them online. In fact, their systems make it impossible to set up an online account from New Zealand. So you may be experiencing frustrations in getting through to Inland Revenue, but rest assured, you could be a lot worse off.

To quickly recap, there are a range of support packages now available at Levels Three and Four including the Wage Subsidy Scheme, the Resurgence Support Payment, which is also available at Level Two, the Leave Support Scheme, Short-Term Absence Payments, the Small Business Cashflow Loan Scheme and Business Debt Hibernation. All those are available now as we discussed in last week’s podcast.

Now, it so happens that the first instalment of Provisional tax for the year ended 31 March 2022 for those on a March balance state is due on Monday, and GST for the period ended 31 July is also due on the same date.

Inland Revenue have advised they are of course, open to assisting with payment plans if you are unable to make payments in full for either Provisional tax or GST. We’ve said this many times before the key is to get in contact with Inland Revenue as quickly as possible. Now as I said, you may be experiencing some difficulties getting through on the phones, but the myIR function works extremely well and actually Inland Revenue are encouraging its use. The key point is to get in touch with them straight away. Let them know that you are experiencing cashflow issues and you want to set up an instalment arrangement.

Now in those circumstances you also need to set out whether or not your business has been adversely affected by Covid-19. Get in front of Inland Revenue as quickly as possible is always the best approach now for businesses that have been hit by Covid-19 (That would be the hospitality sector and large parts of the retail sector as well).

Inland Revenue will be prepared to remit use of money interest on late payments. It’s got specific provisions in the Tax Administration Act to enable that. According to information it sent to tax agents overnight, Inland Revenue has remitted more than $17 million of use of money interest for over 96,000 taxpayers and suppressed another $71 million for another 21,000 taxpayers who have set up a current payment arrangement. So Inland Revenue is prepared to be accommodating for businesses in difficulties. But as always, it’s a question of communication.

Quite apart from trying to allow special arrangements will be made for those affected by the lockdowns, Inland Revenue message is still to continue to file tax returns on time and make tax payments on the due date. But as I repeated earlier, if you are experiencing issues on this, get in touch with it.

Now, there’s been plenty of debate about when and how we will open up to the world after our vaccination programme has been completed. And it’s worth noting that there are about one million Kiwis living overseas at the moment. It is the second largest diaspora in the OECD after Ireland as a percentage of population.

And one of the things I regularly advise on is the implications of making payments to and from members of this diaspora. This week alone, I had three such enquiries and they often involve trust distributions. The plan is that the trustees here want to help a family member overseas, for example a student at university, and they naturally look to see, well what can we do by way of distribution from a trust to help.

The key tax issue here to watch out for though, is that the overseas tax treatment of distributions from trusts is often radically different from what happens here. And although that sounds an obvious thing to say, you would be surprised at the number of times that I’ve been asked to assist or deal with issues involving distributions that have been made without properly considering the tax consequences for the recipient in their particular jurisdiction.

The UK tax treatment is particularly complex because the UK has a habit of adding patches upon patches to legislation to deal with issues rather than do a fundamental rethink. And there is a very real risk that a distribution of what is apparently a tax-free capital gain here will actually represent a fully taxable capital gain for UK tax purposes.

So, if there are any trustees considering distributions to overseas beneficiaries, you must seek advice before doing so. If not, you either run the risk of the distribution being taxed as income, which can be up to 45% in the UK or as a capital gain, which is 28%. So get advice before making any payments.

And finally, this week, a few reflections on the former Finance Minister and chair of the last Tax Working Group, Sir Michael Cullen, who died last Friday.

Alongside Sir Roger Douglas. Sir Michael ranks as one of the most influential finance ministers of the past 40 years. His legacy includes KiwiSaver, the New Zealand Superannuation Fund and Working for Families. There was also the establishment of Kiwibank during his time as finance minister. Equally importantly, he ran a very stable set of books during his time, and he attracted a lot of criticism for it. But the result was the Government’s books were so solid that it has enabled us to manage the triple crises of the Global Financial Crisis, the Canterbury earthquakes and now Covid-19 in much better shape than most other jurisdictions in the world. And that is probably one reason why politicians of all sides have praised him on his passing.

I did get to engage with Sir Michael professionally in 2018 when I prepared and presented a paper on the possibility of a tax advocate to the Tax Working Group. He chaired the discussion briskly and with humour. Something that has come out from discussions with several former Treasury and Inland Revenue officials, they’ve all spoken warmly of their time working with him and his dry wit was a factor

When he presented the final Tax Working Group report in February 2019, much of the noise and discussion was around its recommendation for a capital gains tax. But he spent quite some time during his presentation talking about the need for environmental taxation to help address climate change. And in doing so, he clearly remembered the bitter experience of the abrupt changes made during the Fourth Labour Government because he repeatedly stressed the need if changes to environmental taxation were to be made, then the impact on those most affected by those changes would need to be managed very carefully. He was clearly talking about farmers and to a lesser extent the transport sector.

Right to the very end he was always engaged in public policy, and he continued to have a big interest in tax policy. His reflections on what needs to happen around environmental taxation were wise words and should be heeded by the Government and future governments of whatever hue. He will be sorely missed.

That’s it for today, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next week ka kite āno!

24 Aug, 2021 | The Week in Tax

- What Government support is available for businesses and self-employed affected by the lockdown?

- What is the tax treatment of allowances for employees required to work from home?

Transcript.

With the return to Level Four lockdown, the Government has reactivated its various support mechanisms for businesses and the self-employed. First up is the latest iteration of the Wage Subsidy Scheme. Employers and self-employed can apply for this. Initially, applications are going to be open for two weeks. And as in previous times, this will be run by the Ministry of Social Development, and you apply through their website.

One thing is that the payments are going to be increased. They’re going to be $600 per week per full time employee and $359 per week per part time employee. The criteria will be detailed in full as part of the declaration that’s to be filed when you make your application.

Businesses, organisations and self-employed will be eligible if they experience a 40%[i] drop in revenue over a seven-day period, compared with a typical seven-day period in the six weeks before the increase in alert level. Seasonal businesses need to show a 40% revenue drop compared with a similar week in the previous year.

You need to have been in business for at least six months. Charities, not for profit organisations, the self-employed, as I mentioned, and pre-revenue businesses such as startups may be eligible to apply. Applications for the wage subsidy are available at levels three and four

Starting Tuesday next week applications can be made for a resurgence Support Payment.

The criteria is that they’ve got to show a 30% drop in revenue over a seven-day period after an alert level increase and meet other criteria, including the business must have been in business for at least six months and it must be considered viable and ongoing. When determining income for this payment income such as interest and dividends and all form of residential commercial rent is excluded.

Now, the Resurgence Support Payment is not a loan, it is a subsidy, so it does not have to be repaid. Eligible businesses and organisations can receive the lesser of $1,500 plus $400 per full time equivalent employees, up to a maximum of 50 full time equivalent employees, or four times the actual revenue decline experienced by the business.

Now, the Resurgence Support Payment is actually available at Levels Two and above. So you’ve got a little bit more flexibility around being able to apply for it, depending on what may happen with alert levels around the country.

Then there is the Leave Support Scheme, which enables businesses to pay their workers if they, and this is probably quite relevant right now, particularly in Auckland, have been told by a health official to self-isolate and they cannot work from home, then the business can apply for the Leave Support Scheme. Currently, payments are $585.50 per week per full time workers and $350 per week for part time workers. But from next Tuesday, 24th August, the payment will increase to $600 per week for full time workers and $359 per week for part time workers.

There is also a Short Time Absence Payment. It’s a one-off payment which is eligible for the self-employed. And again, workers need to be unable to work from home and need to miss work because they are being told to isolate and are waiting for Covid-19 tests. Employees or self-employed can apply once in any 30-day period. And the Short Time Absent Absence Payment is available at Levels One and above.

Now, also available, and something which was highly successful last year is the Small Business Cashflow (Loan) Scheme. If you’ve previously applied for this and fully repaid it, you can apply again.

You must show the 30% drop in revenue due to Covid-19 measured over a 14-day period in the past six months, compared with the same 14-day period a year ago. And by the way, if your revenue from the same period a year ago was also affected by Covid-19, you then look at the same 14-day period two years ago, that is in 2019,

The amount which each business can borrow is up to a maximum of $100,000. But basically, it’s $10,000 per business, plus $1,800 per full time equivalent employee. It’s interest free if it’s paid back within two years. Otherwise, an interest rate of 3% will apply for a maximum term of five years and repayments are not required for the first two years. Eligible businesses who may not have applied previously for this can do so now.

Now, there’s also Business Debt Hibernation, which is a government initiative enabling businesses affected by Covid-19 to manage their debt. It’s basically a debt arrangement scheme arranged through the Government and applications will be open until 31st October 2021.

As you can see, there’s a fair bit of support available. The Resurgence Support Payment will be managed by Inland Revenue, but the Wage Subsidy Scheme is being managed by Work and Income.

We’ve heard they will be monitoring and checking the applications for the Wage Subsidy and the Resurgence Support Payments more assiduously than may have been the case last time around. So you have been warned. But the key point is, the Government has turned on the taps and support will be available there. So those that are affected and eligible should take the opportunity to apply for support.

Moving on what about allowances for employees required to work from home? Well, this was a matter of some great discussion last year and in response Inland Revenue issued Determinations EE001 and EE002.

The first Determination, EE001, is in relation to reimbursing payments for employees using phones and other telecommunication tools when working from home. This Determination provides at the moment under a de minimis option, $5 per week can be paid as a reimbursing allowance. The payment will be treated as exempt income for the employee and deductible for the employer.

Under Determination, EE002 employers may make payments of up to $15 per week to an employee who is working from home as a result of the lockdowns. Again, that will be treated as exempt income of the employee and is also deductible for the employer. If it’s paid fortnightly, it’ll be $30 per fortnight or $65 if paid monthly. This payment is in recognition of general expenditure such as additional heating costs that an employee required to work from home may incur.

In addition, there’s the ability to make a payment for the cost of furniture and other equipment for use at home. And an employer may either use the safe harbour option where up to $400 may be paid to an employee for furniture and equipment costs and treated as exempt income.

Alternatively, an employer may choose a reimbursement option in which case the amount which may be reimbursed is equal to or less than the deduction that the employee could have had for depreciation on the asset, but for the fact that under the Income Tax Act employees get no deduction for expenditure incurred as an employee.

Now, these allowances were put in place very quickly last year during the first major lockdown. They were due to last until 30th September 2020. Then another Determination extended their operation through to 17th March 2021. Subsequently a further variation to was issued to extend the application of these Determinations from the period 18th March right through to 30th September 2021.

Inland Revenue, as part of that variation said it was working on a comprehensive review of the treatment of tax payments made to employees working from home and the Determinations EE001 and EE002 were temporary responses to the Covid-19 pandemic. We’re still waiting for that more detailed analysis and perhaps more generous thresholds.

I suspect we might see a further temporary extension given what’s happening now and also the fact Inland Revenue is very busy on other matters going on in relation to the Government’s interest limitation rules and related bright-line tests legislation.

But anyway, those are the allowances are in place so there’s some relief even if it may not be generous. Employers can pay more if they wish but anything in excess of the de minimis allowances set out by Inland Revenue should be taxed through Pay As You Earn. A genuine reimbursement of expenses will be fine.

Well, that’s it for this week. I’m Terry Baucher and you can find this podcast on my website, website www.baucher.tax or wherever you find your podcasts. Thank you for listening. Please send me your feedback and tell your friends and clients. Until next week stay safe, mask up and scan if you are out and about and good luck everyone. Ka kite āno.

16 Aug, 2021 | The Week in Tax

- Inland Revenue guidance on the tax implications of the Clean Car Discount

- Latest on Inland Revenue’s audit activity

- Insights from the OECD’s latest report on Corporate Tax Statistics

Transcript

In the week that the Intergovernmental Panel on Climate Change report declared that climate change is “unequivocally caused by human activities” it is rather opportune of Inland Revenue to release its guidance on the tax implications of the Government’s Clean Car Discount Scheme.

To recap, the Clean Car Discount Scheme has been introduced to make it more affordable to buy low emission vehicles. Between 1st July 2021 and 31st December 2021, a rebate will be paid to the first registered person of an eligible vehicle or to a lessor where that person is a lessee.

Starting 1st January 2022, it’s proposed that the Clean Car Discount will be based on vehicle’s CO2 emissions and vehicles with low or zero or low emissions will qualify for a rebate and those with high emissions will incur a fee (subject to enactment of the relevant legislation).

Now obviously, if you’re in business, you need to be aware of the tax consequences if you receive a rebate or pay a fee under the Clean Car Discount Scheme, or lease a vehicle that comes under the Clean Car Discount Scheme. And obviously the outcome varies depending on what you use a vehicle for.

If you get a rebate under the scheme, you will not have to pay income tax on the rebate. It’ll either be treated as excluded income under the rules for government grants if you’re claiming depreciation on the vehicle or a capital receipt. Conversely, if a fee is paid under the Clean Car Discount Scheme, it will be treated as a capital expense and so no deduction will be available. And that’s obviously going to be something which should be watched carefully.

Now, if you’re using the vehicle in your business, and seeking to claim depreciation, then the base cost for these purposes will be either reduced by any rebate received or increased by the amount of any fee. That’s again something to watch out for.

When it comes on to FBT, and this is going to be quite critical, I would say given that we suspect there’s a fair bit of under compliance in this area, FBT will be payable if the car is made available for private use. FBT will be calculated on the cost of the car when purchased or its value if being leased. The cost will either be reduced by the amount of any rebate or increased by the amount of any fee.

For GST purposes, if you get a rebate under the Clean Car Discount Scheme for a vehicle that you use in your taxable activity, the rebate will be treated as consideration for a deemed supply under the rules relating to government grants. So that means you must the return the GST in your next GST return. Conversely, if a fee is payable, then the GST component of that may be claimed as input tax if you’re carrying on a taxable activity.

Overall, this guidance is useful. Inland Revenue have included some examples as well. As I said, it is quite opportune that it arrived at this time when there’s going to be increasing focus on the question of environmental taxation and the role it may have in enabling us to meet our targets under the Paris Accords.

Tracking Inland Revenue audit activity

Moving on, as I mentioned just now there is a suspicion that there’s perhaps non-compliance with FBT going on at the moment. And so it’s quite interesting to see the latest statistics on Inland Revenue audit activity from Accountancy Insurance.

This is the company that provides insurance against Inland Revenue audits and reviews.

For the period to 31 March 2021, they saw the total number of claims increased by 31% compared with the year ended 31 March 2020. So even though it was in the middle of a pandemic, Inland Revenue is still active in reviewing taxpayers. What is interesting to note here is that GST verification claim activity increased by 48% and that for income tax return related activity increased by 67% over the 12 months to 31 March 2021.

Now, this apparently includes two projects Inland Revenue began last year, the bright-line property rules and also the automatic exchange of financial account information programme relating to the Common Reporting Standards.

GST verification activity actually accounted for 90% or more of all claim values in New Zealand, even though actually only 55% of all claims related to GST verification. So that’s a timely reminder that Inland Revenue is still keeping a watchful eye on matters.

It’s actually a little encouraging to hear that Inland Revenue is still actively reviewing GST returns. I’ve seen one or two instances where I’ve wondered how claims got through including one warranty case going on right now where I am really surprised why Inland Revenue was not onto what was happening much, much sooner.

But the fact is, despite the pandemic and the impact it had on general operations for Inland Revenue last year, GST activity has still been maintained. You have been warned

Interntional benchmarking

The OECD recently released its third edition of its corporate tax statistics. It’s a treasure trove of information relating to corporate tax around the world and with the topics covered and statistics reported being steadily expanded. And there’s some very interesting insights in the report which is based on 2018 numbers.

For that year, the average corporate tax revenue as a share of total tax revenues, was 15.3%. New Zealand was just above that at about 15.5%.

Interestingly, that the percentage of corporate tax revenues has risen since 2000 from an average of 12.3% then to 15.3% in 2018. Similarly, you see a rise in the average corporate tax revenues as a percentage of GDP from 2.7% in the year 2000 to an average of 3.2% in 2018. New Zealand by the by at 5.2%. is well above that average for 2018.

This is an interesting statistic because over that same time period since 2000, the average statutory tax rate has fallen by 8.3 percentage points from 28.3% in year 2000 to 20% in the year 2021. Over that time the rate has fallen in 94 jurisdictions, stayed the same in another 13, but increased in only four jurisdictions. And that supports the argument that was made that lowering the statutory tax rate and broadening the base would lead to higher revenues.

I do think that we probably now plateaued out with tax cuts. I don’t see corporate tax rates continuing to fall. Over in the United States, they’ve signaled that they will rise.

The report drills down into the statistics by considering effective marginal tax rates as well. And that’s where it gets interesting from New Zealand’s perspective, again, because we adopted more thoroughly than most and the broad-based low-rate approach to corporate taxation by stripping away a lot of preferential regimes, our effective marginal tax rate is at just over 20% is amongst the highest in the OECD. Apparently, that is because we have less general fiscal depreciation rules than other most other jurisdictions, although the report notes that we are now more generous after increasing rates in 2020 in the wake of the arrival of the pandemic.

The report also has details of the impact of the implementation of BEPS and statistics relating to anonymised and aggregated country by country reporting although New Zealand doesn’t feature in this part of the report.

But it also has something that I think policymakers here would want to perhaps think hard on, and that is the question of tax incentives for research and development.

What the report notes is that R&D tax incentives are increasingly used to promote business, with 33 of the 37 OECD jurisdictions offering tax relief and R&D expenditure in 2020, compared with just 20 in 2000. New Zealand is one of those countries now doing that.

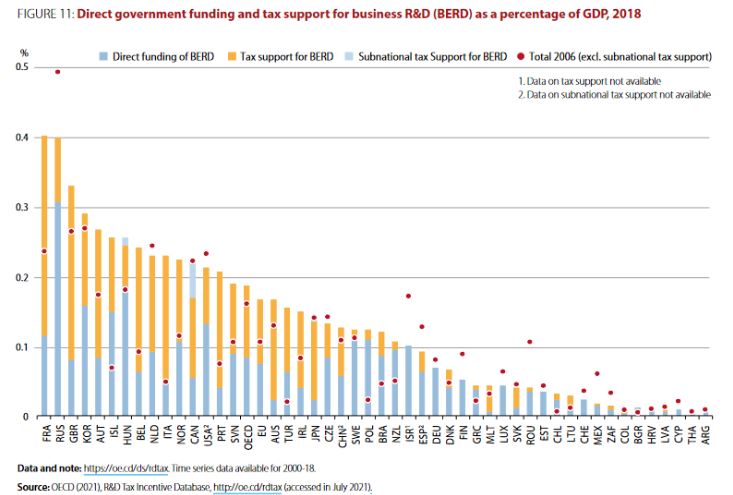

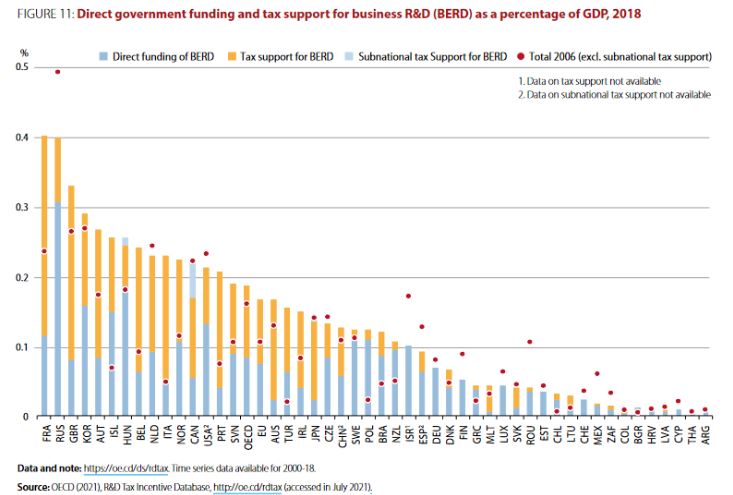

And perhaps we need to think very hard about that because in the statistics showing what the direct government funding and tax support for business R&D as a percentage of GDP in 2018, New Zealand is way down the list at just over 0.1% of GDP. You see countries like France and Russia at 0.4% and the United Kingdom, Korea and Israel close to 0.3%.

So we are way off the pace here. And it has been noted for some time that we do not invest enough in R&D. It was one of the reasons the R&D tax incentive scheme was introduced. So, as I said, there’s plenty to consider in this report with heaps of detailed appendices that you can trawl through.

Robin Oliver tax policy scholarships

And talking about tax policy, this week the Tax Policy Charitable Trust announced its annual Robin Oliver tax policy scholarships worth $5,000 for students majoring in tax at either Victoria University of Wellington or at the University of Auckland.

And later this year the Tax policy Charitable Trust will be launching its 2021 competition scholarship competition for tax policies. You may recall that we had the 2019 winner, Nigel Jemson, as well as one of the runner ups John Lohrentz on the podcast. I’m looking forward to seeing what comes out of these policy submissions in due course.

Well, that’s about it for this week. But before I go, it so happens that it is now 17 years since Baucher Consulting started. And as some of you may know, we recently undertook a slight reorganisation carving out some of our compliance functions to Agentro Limited. Big step that, it’s been a great journey for the last 17 years. And I’m looking forward to the future.

I’d just like to take this opportunity to thank my colleagues Eric, Darryn and Judith for helping me get here together with all our clients and many well-wishers who responded to our latest newsletter covering this news. Thank you very much. We really couldn’t have done it without you.

Well, that’s it for this week. I’m Terry Baucher and you can find this podcast on my www.baucher.tax or wherever you get your podcasts. Thank you for listening. And please send me your feedback and tell your friends and clients. Until next week, ka kite āno.

2 Aug, 2021 | The Week in Tax

- Time for a more generous approach to working from home allowances

- Tax agencies stepping up scrutiny of crypto-assets

- Former Treasury Chief Economist takes a swing at the Government’s tax policy.

Transcript

A couple of weeks ago, I reported that the Inland Revenue main office in Wellington had been closed and the staff were working from home as a result of a potential earthquake risk which had been identified.

There’s still no timeline as to when Inland Revenue staff, almost over a thousand of them, will be able to return to the office. In the meantime, they’re working from home. And the question has now popped up “Well, how about a bit of reimbursement for extra costs like heating and broadband?”

Now, apparently, Inland Revenue response has been “You’re saving money by working from home. You don’t have to pay for commuting, lunches and all the rest”. But the Public Sector Association is saying, “They have to work from home through no fault of their own.” And maybe it’s time that Inland Revenue recognised that and reimbursed them for it.

One Inland Revenue staff member has noted the argument that he was saving money on commuting costs doesn’t wash, because as he put it, “the five dollars a day I spend travelling in and out of work has never been deemed by Inland Revenue as a work-related expense. It’s a personal expense and it’s not claimable.”

Now, what this points to is a grey area which requires a mix of better tax policy which lays out some better guidelines and perhaps employers as well coming to the party. The position is, as I set out last year, when this whole thing became very, very relevant when we were all working from home during the first lockdown, is that employees cannot claim a deduction for home office expenses. They are meant to be reimbursed reasonable costs by their employer. This apparently seems not to be happening generally and it seems Inland Revenue is also reluctant to do this.

There was a determination issued during last year which covered the pandemic, which said that an employer could pay an allowance to an employee working from home that covers general expenditure and up to $15 per week would represent as exempt income. But $15 a week is pretty low with broadband costs and heating costs.

So the question was raised back then and it’s now back on the agenda again in a slightly more ironical context that we perhaps need to be setting out better guidelines. It occurs to me, for example, in the film industry, I understand per diems have been agreed of around $50 per day for contractors working in the film industry. And that’s taken to be a reasonable estimate of the costs they would have incurred.

The position I’m coming to here is Inland Revenue perhaps needs to grasp the nettle and issue more determinations which are more generous in scope and make it clear that for employers who pay these allowances, the extra allowances will be deductible, and the expenses will be non-assessable for employees.

Working from home does shift some of the costs to the employee. And I think it’s only fair that they get reasonably reimbursed. The legislation is in place, but I think it seems clear that the correct practise isn’t always understood and followed by employers. So maybe setting out new actual monetary limits would be a better approach going forward, even if Inland Revenue seems rather reluctant to do that.

Everyone is looking at cryptoasset taxes

Moving on there is increasing scrutiny of the cryptoasset world, and it’s tied into tax authorities wanting to get a better understanding of people’s assets, plus suspicion that people are using virtual assets to evade tax and also that cryptoassets are part of illegal activities and money laundering.

So as part of that, earlier this week, the United Kingdom Treasury announced a proposal that will require any virtual asset transfer of above £1,000 to be accompanied by detailed personal information of both the originator and the beneficiary.

This is tied into proposed amendments to money laundering legislation required to keep the UK’s regime in compliance with the recommendations of the Global Financial Action Task Force. The Financial Action Task Force said in July 2019 anti-money laundering legislation should cover cryptoassets. Putting the legislation in place has always taken a little bit of time.

Anyway, this is another sign of the increasing attention that tax authorities and authorities generally are paying to virtual cryptoassets.

Over in the United States the Internal Revenue Service, in conjunction with the New York State U.S. attorney’s office, has been briefing experts on the latest U.S. government enforcement efforts related to virtual currencies and cryptoassets.

As of April 2021, the IRS has joined its civil and criminal cryptocurrency units through Operation Hidden Treasure. Its Fraud Enforcement Office and Criminal Investigation Units are working with international law enforcement and crypto industry experts to root out tax evasion. And apparently, these include something called John Doe summonses, which sounds pretty sinister, and no doubt will pop up on some American TV show in due course and be explained to us.

The US Federal tax returns, Form 1040, now includes a question on virtual currency income, and it’s actually at the top of the form. That’s deliberately designed in order to make it easier to prove the knowledge and willfulness element for criminal cases in this matter.

So what we’re seeing is a trend all around the world of really amping up the scrutiny of cryptoassets. It’s a fast-moving field and the tax treatment isn’t always as clear as it could be. But Inland Revenue here is continually issuing guidance on the matter. And people need to pay attention to this. You should expect that the tax authorities will have some idea of your cryptoassets holdings and therefore you should follow the law and file returns as appropriate.

Facing up to unintended consequences

And finally this week, a couple of things in relation to the ongoing arguments over the Government’s interest limitation rules. Firstly, Inland Revenue has issued a very useful precis of all the questions and answers relating to the interest limitation rules and bright-line tests.

At 22 pages it’s a much more digestible document than the main discussion document. And of course, Inland Revenue is still working through all the submissions. So it’s a useful one stop shop to go through and get an idea of what’s been said so far. However, you should not take what’s in this Q&A as actual policy. They’re still working through it and the final version still has to be signed off by the Minister of Revenue and Cabinet.

But meantime, Norman Gemmell, who is the chair in public finance at Wellington School of Business and Government, Victoria University of Wellington, and former chief economist at New Zealand Treasury has come out with a working paper entitled What is Happening to Tax Policy in New Zealand and is it Sensible?

It’s a very quick read about 14 pages which looks at the increase in the top income tax rate and the housing package, that is the interest limitation rules, increased bright-line period and other related matters. Basically, it takes the view that both represent ad hoc responses without a coherent strategy. It notes that these were pushed through very quickly based on limited analysis and against most official advice on the matter as to how to deliver on the Government’s objectives.

And in Gemmell’s view, there are potentially serious unintended consequences. In particular, the coherence of the tax system is at risk, and it’s not an unreasonable argument. In fact, someone quipped that’s a statement of fact not an argument,

But this comes back to what I said last week, that when you look at where there is incoherence in the tax system, it keeps coming back to the question of the taxation of capital and of property in particular. We keep fencing around this issue and the unintended consequences of doing so, force further unintended consequences of the actions taken to try and remedy that.

There won’t be an easy answer to this solution until that nettle is very firmly grasped and the politicians put the politics aside and look at how exactly are we going to achieve a coherent tax system and address the issues of diversion of resources away from productive assets, inequality, and housing affordability.

All of those require a comprehensive approach and taking a different approach to what we’ve been doing up to now. The latest patches may work, perhaps, but they come with unintended consequences as Mr Gemmell points out.

That’s it for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next week ka kite āno!