5 Sep, 2022 | The Week in Tax

- A new tax bill causes a massive storm but what happens next?

- Also a brief run-through of what other tax measures are in the Taxation (Annual Rates for 2022-23, Platform Economy and Remedial Matters) Bill. (TL:DR – a lot!)

Transcript

Tax ultimately is politics. And that was very clearly demonstrated this week when the Government introduced and then withdrew within 24 hours its proposals to apply GST on management services supplied to managed funds as part of the Taxation (Annual Rates for 2022–23, Platform Economy, and Remedial Matters) Bill.

On the face of it this was a provision to address a technical issue which had developed over time where fund managers were applying different treatments to how they determined what proportion of the fees they provided were taxable supplies subject to GST and what portion represented GST exempt financial services.

The proposal determined by Inland Revenue was to standardise the approach and apply GST service and fees. This would have taken effect from the 1st of April 2026. We’re therefore talking about a measure three years in the future, but which would have netted an estimated $225 million a year in GST. That in itself probably wouldn’t have caused many issues except the Regulatory Impact Statement which accompanies the Bill, included modelling by the Financial Markets Authority which on the assumption that the increase in GST would be fully passed on to KiwiSaver fund members, KiwiSaver balances would be reduced by an estimated $103 billion by 2070.

And then the fun kicked off. There clearly was quite a bit of misunderstanding about this measure with some people thinking the Government would be charging GST on KiwiSaver balances. The Government was taken completely by surprise and the furore was such that it decided to abandon the proposal within 24 hours of announcing it, which is some form of record. It certainly made for an entertaining 24 hours in tax. You can hear more about what happened in this week’s edition of the Spinoff’s podcast When the Facts Change where Bernard Hickey and I discuss the background to the proposal and how it fits into the history of tax reform since 1984.

But it should be noted that the particular issue of an inconsistency of approach by fund managers still remains. So, what’s going to happen now? Probably Inland Revenue will have to negotiate with fund managers and come to some form of agreement over what proportion of fees it deems to be acceptable to be treated as taxable supplies. This was what happened back in 2001, but that agreement has long expired. Such an agreement is going to take some time, although maybe negotiations already started. We’ll have to wait and see how that pans out.

Ironically the GST on fund management proposal was a relatively minor part of the Bill, although it would have had the biggest single tax effect. The rest of the Bill, as its name implies, covers a whole range of matters, including the gig economy, more GST issues, cross-border workers, fringe benefit, and the bright-line test to name a few.

Addressing the Platform Economy

A number of reporting and other tax issues have arisen around economic activity facilitated by digital platforms. That is where an app connects buyers and sellers and includes accommodation services such as Airbnb and transportation services, such as the ride sharing apps, Uber and Zoomy and Ola together with other professional services provided through digital platforms.

The Bill intends to ensure Inland Revenue has better access to information about income earned by sellers using digital platforms based in New Zealand or offshore. These provisions build on proposals developed through consultation by the OECD. Inland Revenue will get greater information and it will also share that information with foreign tax authorities where it relates to non-residents.

The Bill also wants to maintain the sustainability of the GST system. Digital platforms will be required to collect GST on services provided through them in New Zealand. This will be done by extending the rules that currently apply to imported digital services and low value imported goods. These will now apply to accommodation, ride sharing and food and beverage delivery services all currently provided through digital platforms.

There is a proposed flat rate credit scheme intended to reduce the compliance costs for those accommodation hosts and drivers who are not required to register for GST because the value of the services they provide over 12 months is less than $60,000. The GST changes will come into effect from 1st April 2024 and the net impact is expected to be around $37 million per annum.

These changes reflect the growing impact of the digital economy and the moves by tax authorities to ensure they know what’s going on and close potential gaps in loss of revenue may be arising because some of this may be happening under the table. It also reinforces something we see a lot of already and which we’ll see more of, and that is information sharing with other jurisdictions as appropriate.

We’re still working through the impact of COVID-19. And one of the areas where I’ve seen quite a bit of interesting work develop is in relation to cross-border workers. In the wake of the pandemic, we’ve seen a lot of people return to New Zealand from overseas. In many cases these returnees continue to carry on working remotely for their previous employer. This pattern of working remotely has expanded greatly as a result of the pandemic, and I don’t think that’s going to change significantly. But it was also another one of the situations where tax legislation and reporting and withholding tax obligations haven’t kept up with developments.

The Bill therefore has measures to deal with cross-border workers. The PAYE, FBT and employer superannuation contribution tax rules are very strictly applied, but they are incredibly inflexible. They really don’t take into account that employees might be working in New Zealand for non-resident employers and have very different compliance circumstances to those employees of New Zealand resident employers.

The Bill’s proposals acknowledge that such people coming in and working remotely for overseas employers justify taking a different approach to help reduce compliance costs for those cross-border workers. The key amendments are to allow more flexible application of the PAYE rules in specific circumstances. For example, it might allow PAYE to be paid annually. There’s also a repeal of a little used PAYE bond provision.

Alongside those rules are changes to the non-resident contractor rules which relate to the performance of services by non-resident contractors in New Zealand. These are essentially a withholding tax which operates to try and manage the tax risk of people coming in for a short period to perform contract work on a project and then return overseas. Without these non-resident contracting rules, no tax would be deducted. These rules have been in place for a very long time. Apparently, they were first introduced in the wake of the ‘Think Big’ projects of the late seventies and early eighties. They also apply quite extensively to the film industry as well which is where I first encountered them.

The non-resident contractor rules are being tweaked to update them and manage the compliance costs for those subject to them. Again, this reflects a trend that had been developing but has accelerated in the wake of the pandemic. The changes for the PAYE and non-resident contracting rules take effect from 1st April next year.

Notwithstanding what went on with the GST on managed funds issue, there’s quite a bit of other GST matters addressed in the Bill. These include provisions to address issues in the GST apportionment and adjustment rules. These are intended to reduce the compliance costs these rules impose and supposedly better align with current taxpayer practises.

There will be a principal purpose test for goods and services acquired for $10,000 or less GST exclusive. This would enable a registered person to claim a full GST input tax deduction. The other key change is to allow GST registered persons to elect to treat certain assets that have mainly private or exempt use, such as dwellings as if they only had a private or exempt use.

That latter change addresses an issue which has popped up from time to time in is that people may have made claimed GST as part of a home office deduction. If so, then potentially when that property is sold, is it therefore not the case that some portion of the sale will be subject to GST? This was a matter which technically existed, but probably wasn’t being addressed by many taxpayers and advisors.

This issue is generally covered by the GST apportionment and adjustment rules which are very complex and have high compliance costs. Under these rules if you have claimed an input tax deduction based on the estimated use business use of an asset, you are meant to track the business use of the asset. Where the actual use is different from the estimated business use, then you calculate and return an adjustment at the end of the tax year.

This is quite an involved process, and this measure is intended to try and simplify the matter. It’s a sensible change, in my view, which reflects the fact that although GST is a very broad-based tax, you can’t actually really describe it as a simple tax in its operation. There are all these issues around its margins regarding what represents business use, what proportions become taxable and therefore subject to GST, etc. And as we saw in relation to the GST and fund management services, the sums involved can be quite large actually. These proposed changes to try and simplify matters and will take effect from 1st April 2023.

I frequently discuss tax and environmental issues and I’m therefore pleased to see a proposal in the Bill for an exemption from fringe benefit tax (FBT) for certain public transport fares which are subsidised by an employer. This will take effect from 1st April 2023.This is a good example of tax being used as a behavioural change and comes about by looking at the bigger picture of how we address greenhouse gas emissions and what role can tax have in that. The Tax Working Group identified that the FBT treatment of parking is inconsistent and in many cases is not subject to FBT. By contrast, FBT is applied to subsidised public transport.

When you step back and take a wider environmental policy perspective about this, what’s happening is the opposite of what you really would want. The policy should be to tax parking to help reduce emissions and encourage the use of public transport. That’s what this measure is intended to do. It’s a very welcome move which is estimated to cost about $9 million a year. This would also appear to be a good example of how environmentally friendly changes can be achieved at relatively low cost.

Outside of the main policy issues we just discussed, the Bill, as is typical, contains a whole heap of provisions relating to many other issues. For example, there’s a number of changes in relation to the Bright-line test and interest limitation rules introduced last year.

Unsurprisingly, given the complexity of those rules, we are seeing a number of tweaks and clarifications about how they operate. One such example relates to when relief is available under the bright line test, when land is transferred on the death of the owner to the executor of or beneficiaries of the estate. Such a transfer is meant to be exempt, and the Bill has provisions making that clear.

There are some other provisions relating to rollover relief, that is when the bright-line test does not apply to transfers between related parties in certain circumstances. Most of those amendments will take effect the day after the Bill receives Royal Assent, which will probably be in late March next year. But some pleasingly have a retrospective effect back to when the changes to the Bright-line test and the interest limitation rule were announced on 27th March 2021. I fully expect we’ll see more such technical changes in the future, possibly even with some Supplementary Order Papers to this particular tax bill.

Another provision deals with a potential issue with the foreign trust regime and the exemption for foreign trusts whereby income from a non-New Zealand source is not taxable in New Zealand so long as it’s not distributed to a New Zealand resident. In some instances, a trust can make use of that provision but not have to comply with the foreign trust, registration and disclosure rules. The Bill therefore has provisions addressing that issue and some other minor technical matters applying to foreign trusts.

The recently announced build to rent exemption from interest limitation is also part of this bill. According to the supporting Regulatory Impact Statement this will cost $2.1 million if applied to existing build to rent assets.

Then inevitably, as in any of these tax bills, there’s a whole heap of other little remedial matters tidying up technical issues that have arisen around student loans, financial arrangements, provisional tax look-through companies, dual resident companies and more.

Ordinarily, this type of tax bill would barely get a mention in the press, so this week’s drama was quite unexpected. Now the dust has settled, it’s worth remembering that the issue around inconsistent treatment of GST on fund management services still remains. Ultimately, the Government backdown is another example of how short-term politics will nearly always trump longer-term policy.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

29 Aug, 2022 | The Week in Tax

- Provisional tax is due so watch out for changes to the use of money interest rates and rules

- Is it time for a residential land value tax?

- More on the looming shortfall in the National Land Transport Fund

Transcript

The first instalment of Provisional tax for the March 2023 income year is due on Monday. Now, as most people know, if provisional tax is not paid on time, late payment penalties and use of money interest will apply. The interest rate on underpaid tax will increase from Tuesday 30th August from 7.28% to 7.96%. On the face of it, there’s a lot of incentive to make sure your payment is made on time. The rate, incidentally, for overpaid tax which has been zero for quite some time now, will rise to 1.22%.

There’s been consistent tweaking of the use of money interest rules to try and make it easier for businesses, particularly smaller businesses. The rules are different where the provisional tax exceeds $60,000 for the year.

And the last changes in 2017 were designed so that if taxpayers made the payments they were required to make, then use of money interest would not apply until terminal tax date, which for most taxpayers is 7th February following the end of the tax year in question, or the following 7th April if they are on a tax agent’s listing.

The requirement was that they had to make the payment in full and on time, and this actually led to a few problems because taxpayers sometimes missed their payments by one or two days or even might be out by $10 or so. What has emerged since 2017 is that the number of taxpayers who unintentionally paid short or late was underestimated by Inland Revenue at the time the changes were brought in. Consequently, a large number of taxpayers had to pay use of money interest and late payment penalties.

What Inland Revenue have determined is “in these circumstances, the application of use of money, interest and late payment penalties is not proportionate to the offence committed.” It considers it is “appropriate” to allow taxpayers to retain the safe harbour concession for use of money interest even if they miss a payment. So, the interest rules have been changed rules again with effect from the start of the current tax year.

What the change means is you won’t suffer use of any interest if you miss a payment or there’s a short fall on your tax payment. You won’t be charged 7.96% on the underpaid tax until your terminal tax payment date. However, late payment penalties will still apply. These are 1% of the underpayment immediately and a further 4% if the tax has still not been seven days later for a maximum 5% penalty. (Inland Revenue has now done away with the monthly 1% late payment penalty on top of the initial penalties).

It’s been pointed out to me that there’s probably an opportunity for someone to play a few games and arbitrage their funds by accepting the late payment penalty charge but avoiding the high use of money interest charge. No doubt some taxpayers will do that.

We don’t actually know how much use of money interest the Inland Revenue charges, but pretty substantial amounts are involved. We know, for example, that Covid-19 related interest write offs over a two-year period amounted to $104 million. At a rough guess taxpayers could be paying $100 million or more in use of money interest annually. Measures that help them relieve that charge ought to be to be welcomed.

The case for a residential land value tax

Moving on, last week I discussed the report on housing from the Housing Technical Working Group, a combination of the Treasury, Ministry of Housing and Urban Development and the Reserve Bank of New Zealand. The report raised the question of the role our tax settings may have played in house price inflation. This generated quite a bit of interest and commentary and thank you to everyone who contributed.

But as I said last week, the issue around how our tax settings work in relation to property isn’t going to go away. It’s an issue that sooner or later has to be grasped. And this week, Bernard Hickey who has an excellent Substack, The Kaka, did a very detailed post on the whole question of our lack of training and productivity, our need for substantial numbers of. migrant workers and how that intersected with the under taxation of residential land.

Bernard’s post pulled together a lot of conclusions I’d reached during my time in the Government’s Small Business Council between 2018 and 2019. I grew quite concerned at the lack of training, particularly among small businesses and the extensive need for migrant workers coming in. What is well established is that Aotearoa-New Zealand has the highest use of temporary migrant labour in the OECD and simultaneously it also has one of the highest diasporas in the OECD. In other words, our skilled people are moving overseas and we’re bringing in relatively low skilled people and this is causing a whole number of tensions.

As Bernard notes we really need to rethink the matter of how we deal with this approach because this long term, it is not economically prosperous for us all. As he concluded:

“All roads were always going to lead back to changing those investment incentives through a new tax that gives the Government the resources to invest in productivity-enhancing physical and social infrastructure. That tax would also radically change the incentives for businesses and individual investors….

In my view, a Capital Gains Tax would be too politically toxic, complicated and slow to break the log jam. The case for a residential land value tax, a much simpler, faster and more politically possible option is a simple and very-low-rate infrastructure levy or tax on residentially-zoned land values that is calculated annually from land value measures in council-maintained databases.”

This, by the way, is very similar to what Susan St John and I have been promoting for some time, the Fair Economic Return, and we and Bernard are coming at it from pretty much the same place.

Bernard then puts some detailed numbers around this. He estimates a 0.5% tax on residential land values would raise an extra $6 billion and effectively increase the Government’s tax take from 30% of GDP to 32% of GDP. Bernard also considers the revenue raised from such a tax should be

“hypothecated into a housing and climate infrastructure fund jointly administered on a region-by-region basis by central Government and councils, with the aim of using those funds to achieve affordable housing and net zero transport and housing emissions by 2050. affordable housing in net zero transport and housing emissions by 2050.”

I support this approach. We’ve just seen the flood damage in Nelson which is after about $80 to $85 million of damage from last year’s flooding. This year’s event is even bigger, and the damage is estimated to be well over $100 million. We could also be looking at similar events on a regular basis. Those sums are way too big for homeowners and local councils to manage by themselves. Central government is going to have to get involved.

Climate change is happening right now. It is no longer something in the distance and we need to start addressing those changes. Local councils cannot afford to be incurring $100 million in repairs each year. That is simply not sustainable. Bear in mind the chief executive of the country’s largest insurer has recently said premiums in higher risk areas will become incredibly expensive to the fact they become unaffordable.

A whole number of issues are starting to coalesce around climate change and around the taxation of capital. These will force a change on how we approach our current taxation system. What Bernard is proposing ties in with the Fair Economic Return Susan St John and I are promoting. In our view it is a fairer approach as it widens our tax base and as Bernard points out, starts to remove distortions to how we currently approach investment.

A $1 bln shortfall

Also related to the question of climate change, there was a report in the Herald this week about the Ministry of Transport’s forecast that the National Land Transport Fund is likely to have a shortfall of $926 million over the next three years. The shortfall is mainly as a result of the Government’s decision to cut fuel taxes and road user charges. However, there’s also a decline in driving going on as well, which may be related to the pandemic. Those figures were prepared in April and didn’t take into account the extension of the cuts to January. This shortfall will be made up out of general taxation.

The Government has taken a short-term decision to help the cost of living, but inadvertently it points to something that’s fundamentally flawed about how the National Land Transport Fund is presently funded. The reliance on fuel taxes encourages more driving which until we get to a fully electric vehicle fleet, that is not helpful, as transport emissions are one of the biggest chunks of our carbon emissions.

Transport is also one of the areas where we probably can do something quite quickly with the right incentives to encourage switching away from using internal combustion engines to hybrids and electric vehicles obviously, public transport, walking, cycling, scooters. All those alternatives are available now in the urban environment and could make a huge difference.

This is another area where governments have kicked the can down the road, but now they need to address the issue of how we fund the National Land Transport Fund because it’s how the maintenance of our roads is funded. We have to devise a new means of funding it, probably as readers have suggested higher road user charges on all vehicles including electric vehicles. Here’s another example of change in our tax system being driven by a number of factors, including the climate.

Refugee evacuation

Finally, I mentioned earlier my time on the Government’s Small Business Council in 2018-19. Our chair was Tenby Powell who is a Colonel in the New Zealand Army. He is currently in Ukraine delivering humanitarian aid and helping to evacuate people from the most dangerous areas in the Russian occupied South and East of the country. Tenby has established Kiwi K.A.R.E. (Kiwi Aid & Refugee Evacuation) to fund this aid. Here’s a link to the funding page for Kiwi K.A.R.E.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

22 Aug, 2022 | The Week in Tax

- A big tax break for build-to-rent developers

- The role tax has played in the housing crisis

- Clarifying the treatment of donations to private schools

Transcript

Housing Minister Megan Woods recently made a surprise announcement that blocks of at least 20 new and existing build to rent flats will be exempt from the interest deductibility limitation rules in perpetuity if they offer 10-year tenancies. Currently, build to rent flats would only qualify for the exemption from interest deductibility rules if they are new builds and then only for 20 years.

This is quite a significant change clearly aimed at the developing build to rent market, which after the announcement of interest deductibility limitation was made last year was quite concerned that the sector would be very hard hit by the proposals. During the group discussions and consultation that went on with Inland Revenue in the run up to the release of the relevant legislation, these concerns came across very strongly from the build to rent sector.

Obviously, they’ve continued lobbying in the background and have won this concession. This is a big win for the sector as it will probably greatly shake up the rental market over the long term. It gives it security of supply and therefore for financing. But it’s also a win for tenancy advocates who have been pushing there should be longer tenancies available to renters similar to what we see in continental Europe.

It’s also worth noting that this new exemption will apply to existing properties. Therefore, if you take an existing property and convert them into 20 apartments or flats, then you qualify for this permanent exemption. Again, last year there was quite a bit of discussion over what constituted a “new build” and conversions were high in the list of matters under consideration.

On the other hand, the move does further sideline the mum and dad type investors who are currently a large part of the rental market. And at the moment they will definitely be left hoping for a change of government next year. Overall, this change seems a smart policy to boost the growing rent to build sector, but also give greater protection to tenants.

The reasons for very high house price inflation

Moving on, exactly why house price inflation in New Zealand has been so high has long been a matter of debate. The Multi-Agency Housing Technical Working Group, which consists of members from the Ministry of Housing and Urban Development, the Reserve Bank of New Zealand and the Treasury has been studying this issue in some detail.

And on Thursday the Housing Technical Working Group released a report on the housing system based on a close look at the housing development system in Hamilton, Waikato area.

Now the group’s key conclusion was:

“…a combination of a global decline in interest rates, the tax system, and restrictions on the supply of land for urban use have led to a large change in the ratio of prices to rents and are the main cause of higher house prices in Hamilton-Waikato, as well as other parts of Aotearoa New Zealand, over the past 20 years.”

The report has some interesting insights on the road tax matter. The report starts from the pretty standard theory that a neutral tax system is one that treats different economic activities equally. However, the report notes that “New Zealand’s tax system is not neutral” and there are a range of tax distortions that affect house prices, land prices, rents and construction costs.

According to the report, the most important distortions in the tax system are firstly imputed rent, that is the rent owner occupiers effectively pay themselves is not taxed, whereas other forms of income from investments are taxed. This is a very controversial point and conceptually counter-intuitive for owner-occupiers. But it is an approach that the Netherlands has adopted to tax housing on an imputed rental basis.

Secondly, capital gains are often not taxed, whereas other forms of income are. Well, this podcast is a broken record about the distortions the lack of a comprehensive capital gains tax produces.

Then thirdly, the GST is charged as a lump sum when a house is built and is charged on maintenance costs and rates but is not charged on rents. This is a very interesting point and not one that I’d actually considered in much depth.

The consequences of these distortions is the first increases the incentive for people to live in bigger or better houses than otherwise. We see that in New Zealand, new builds are the second or third highest in the world in terms of area.

The report expands on the matter of the first and second distortions, that the lack of capital gains and imputed rent also increases the investment value of housing relative to other investments. This is a well understood point which means those resources devoted to owner occupied housing “yield untaxed shelter in perpetuity as well as untaxed capital gain”. If on the other hand, you put money in the bank or in shares you will be taxed on the income. Finally, as is well known and is one of the reasons for the interest deductibility limitation rules, investing in rental housing yields tax free capital gains for those who hold property long enough.

The report concludes these tax distortions have caused a higher price to rent ratio in New Zealand than under a more neutral tax system. The group also reaches the interesting conclusion that New Zealand is “closer to restricted land supply than abundant and therefore we conclude that these income tax distortions are likely to have driven house prices higher rather than increasing supply and reducing rents.”

The commentary on the impact of GST is interesting because as I said, not many of us have actually thought about that and how it might play out. What it says is that the overall role of GST extends well beyond the “…direct impact on construction costs and includes a complex array of interactions stemming from the fact that GST is not charged on rents but is charged in other goods and that GST is charged only on some land transactions. The report notes “Assessing the overall impact of New Zealand’s GST on house prices is a possible area for future research.”

The report includes an interesting table estimating the impacts of tax distortions on house values for each type of buyer. The report notes the tax distortions were relatively small in 2002 when interest rates were much higher but by 2021, the impact of these tax distortions “had grown significantly”. The report further noted that in a low interest rate environment, the tax distortions were significantly amplified.

Table 2 Impacts of tax distortions on house values for each buyer type

Estimates with current tax settings

(Estimates with ‘neutral’ tax settings) |

| Date

Inflation rate

Interest rate* |

Q2 2002

π = 1.8%

i= 5.6% |

Q2 2011

π = 2.5%

i= 5.4% |

Q2 2016

π = 2.1%

i= 4.1% |

Q2 2021

π = 2.0%

i= 3.5% |

| Landlord

Equity financed |

$169,031

($114,495) |

$289,709

($185,365) |

$438,582

($261,808) |

$680,901

($379,377) |

| Landlord

60% debt** |

$164,869

($112,175) |

$276,188

($179,021) |

$435,601

($261,950) |

$431,979

($400,966) |

| Owner-occupier

Equity financed |

$189,161

($89,753) |

$278,309

($141,369) |

$367,980

($185,213) |

$516,949

($255,797) |

This is a very interesting report which feeds into the ongoing debate about housing. I think it underlines a constant theme of this podcast that we need to change our tax settings, settings around the taxation of capital and in particular, housing. Of course, Professor Susan St John and I would be pointing to the fair economic return methodology as one option for starting to take some of these tax distortions out of the market.

GST and private schools

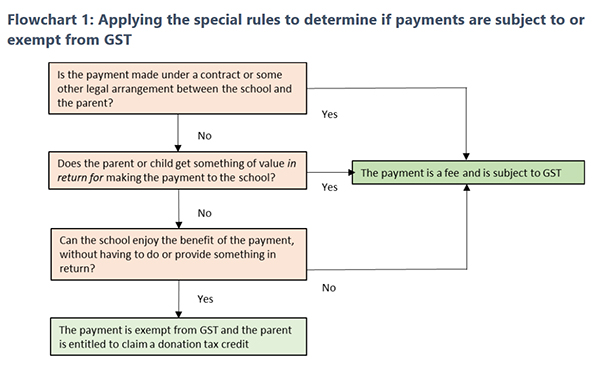

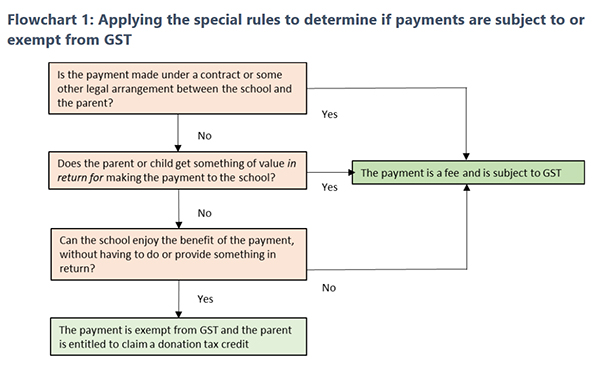

And finally, private schools have been in the news recently, largely because of the revelations about the behaviour of the newly elected MP for Tauranga. Quite by coincidence, this week Inland Revenue has released a draft Question we’ve been asked on the GST and income tax treatment of payments made by parents to private schools. This also comes with a handy flow fact sheet as well which has a useful flowchart which explains how the rules apply.

Something else to keep in mind are the special rules for calculating GST on school boarding fees. Where students have arranged to board at the school for more than four weeks, the school charges GST at a lower rate (9% or 60% of the standard rate) to the extent the boarding fee is for the supply of domestic goods and services.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

17 Aug, 2022 | The Week in Tax

- Insights from the Budget information release

- The IRS is a big winner in Biden’s tax proposals

- Inland Revenue writes off $100 million

Transcript

The Budget information document release on Thursday caused a bit of a stir and some excitable commentary. A few points stood out for me, particularly in relation to the ongoing controversy over the cost-of-living payment and its delivery by Inland Revenue.

We already knew Inland Revenue was less than happy to be involved in it, but some of the further documents released shed further light on it. Treasury’s recommendation was,

“…if you wish to progress with the payment along the lines of the commission[sic], the Treasury recommends that Inland Revenue be the delivery agency, given they are the agency best placed to deliver such a broad payment in the short term.”

Inland Revenue, on the other hand, didn’t want to be involved because,

“…delivering this payment, which is estimated to require around 1,000 staff at its peak for around two months, would have critical operational impacts on Inland Revenue while delivering the current COVID 19 economic supports. The addition of this payment to the portfolio of services that Inland Revenue already delivers would severely compromise Inland Revenue’s already stretched workforce.”

That’s quite an admission from Inland Revenue. I guess some of the controversy about accidental overpayments of the cost-of-living payment to ineligible recipients is an assumption that Inland Revenue is highly efficient. In reality once humans are involved then on the precept of “garbage in, garbage out” there were always going to be a few errors involved.

What concerns me about Inland Revenue’s admission, though, is it does seem to point to perhaps the organisation is a little bit too lean and mean after its staff has been cut quite substantially by over 20%. We know it makes extensive use of contractors which as we discussed last year, led to an Employment Court case, which it won, by the way. On the other hand the admission that basically it needs to increase its staff by about 20% to manage something like this points to perhaps Inland Revenue being more stretched than it ought to be in staffing levels.

And that also indirectly does raise some questions about Inland Revenue’s enhanced capability following completion of its Business Transformation project. It is perhaps too simplistic to think that a couple of pushes of buttons is all that was needed to enable the cost-of-living payments to be made. But it does strike me as surprising that Inland Revenue has to devote a thousand staff and additional resources to deliver the payment.

Now, one of the other criticisms that emerged has been made about the payment is that only 1.3 million people have received it so far of the estimated 2.1 million. But in reality, it was known beforehand that all 2.1 million estimated eligible people would not receive a payment straight away. One of the papers notes,

“around 25% of potentially eligible recipients, around 500,000 individuals, will not receive this payment during the proposed August to October window because their assessment for the 2020 122 tax year is not complete”.

The paper goes on to explain that based on tax filing information for the year ended 31st March 2020,

“…around 38% of people who submitted an IR3 did so by the end of July, and 53% by the end of September 2020. Assuming the same pattern for the 2021/22 tax year, Inland Revenue expects there will be a long tail of IR3 filers who would not receive their cost-of-living payment during the proposed payment window.”

The paper notes this will mean Inland Revenue will have “increased contacts” as people will be asking why they haven’t received a payment. This will then “have an impact on other services for taxpayers” such as Working for Families.

This is quite a reasonable point. But, of course, politics has intervened. And when you’re beating a dog, any old stick will do. So, the Government is copping it for what was obviously something that would have happened in the first place.

The other point that comes across is a wider one around the future sustainability of the tax system. Treasury was pouring a lot of cold water on Ministers’ various spending plans and pointing out the unsustainability of what was being asked for. Treasury warned

“Meeting these new targets consistently will require you to maintain a balance between revenue and expenditure. Over the medium term this would require significantly constraining spending growth, unless your revenue strategy is adjusted to maintain a higher level of tax revenue-to-GDP in later years.”

As the Herald noted, that would mean finding new taxes to leave spending as a share of the economy higher over the long term.

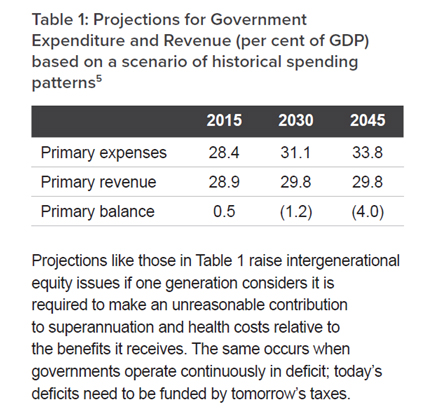

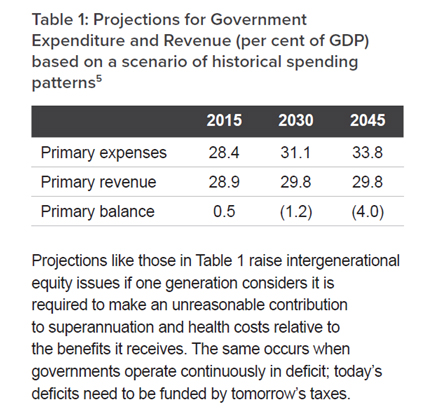

Now, one of the reasons the Tax Working Group recommended a capital gains tax was it had considered the long-term fiscal sustainability of the tax system based on the then current spending trends. Its Submissions Background Paper in March 2018 pointed out that based on then current projections, the Government’s primary expenses would rise steadily to reach 31.1% of GDP by 2030 and would actually mean that there would be a deficit of. 1.2% of GDP by then. The TWG recommended steps were needed to widen the tax base.

Those issues have not gone away and in fact will have been exacerbated because of the increase in borrowings that the Government incurred as a result of the COVID 19 pandemic.

We are not really having a discussion around how are we going to fund an ageing population, the increased demands on health and, as I pointed out last week, adapting to climate change. Every government seems to be stuck around keeping tax limited to 30% of GDP, Bernard Hickey has a long series of very interesting commentary on this.

The Budget documents don’t really address that issue in my mind, and it’s something that, as I’ve said beforehand, we’re going to need a serious discussion around how we expand our tax base and manage these pressures. Superannuation, remember, is now the second single biggest item of Government expenditure. This discussion isn’t going to go away and inevitably it’ll come back to the question of taxation of capital. We probably see the politicians fence around it during next year’s election. But those pressures will remain.

Pressure derails OECD deal?

Now, speaking of politicians under pressure, President Biden had been struggling to get his Inflation Reduction Act through Congress. But this week he managed to do so after a few recalcitrant senators finally came on board.

There’s a couple of interesting implications about this. Firstly, it appears to move forward the possibility of America coming on board with the OECD’s global tax deal. And in particular, the Pillar Two proposal for a minimum corporate tax rate of 15%.

However, it’s emerged that the Biden administration’s changes to the bill in order to get it passed appear to be at odds with how the minimum 15% corporate tax rate % is going to work. The details are a bit complicated, inevitably, but the corporate minimum tax of 15% will apparently only apply to the book income, that is income reported in financial statements of companies with revenue over US $1 billion. It will also only apply on a group level rather than at a country-by-country basis, which is contrary to the intention of the OECD tax deal, of eliminating the practise of setting up subsidiaries in tax havens.

Some international tax experts are saying the Biden deal may not now actually be compliant with the global tax deal. That possibly opens it up for other jurisdictions to say “Hang on, we’re not going to have that”. But ironically, it appears that US multinationals may in fact be keen to get the OECD Pillar Two deal passed through, because otherwise they may be exposed to additional taxes. So, watch this space. The point is, the Inflation Reduction Act is progress even if there are ructions still going on in Europe with Hungary now putting a spanner in the EU’s need for unanimity to agree the deal.

The other quite interesting thing that emerged is that the US Internal Revenue Service, the IRS, got US$80 billion of extra funding. And there’s a story from the Washington Post which explained why it needed that funding.

It includes an absolutely extraordinary photograph of the cafeteria in an IRS office in Austin, Texas. All that is visible is boxes and boxes of paper files, because the IRS had, as of the end of July, a backlog of 10.2 million unprocessed individual returns.

To give you an idea just how archaic the IRS’s system is, paper tax returns aren’t scanned into computers. Instead, IRS employees manually keystroke the numbers from each document into its system, (this is what Inland Revenue previously had to do until its Business Transformation programme).

It is absolutely extraordinary what’s going on with the IRS. I suggest every time you feel that Inland Revenue has dropped the ball and is hopelessly inefficient, thank God you’re not dealing with the IRS. We had a situation where we sent the IRS a letter in January 2020 and we did not get a reply until August 2021, and we were possibly one of the lucky ones.

Giant jump in tax writeoffs

And finally, a little snippet emerged about how much use of money interest the Inland Revenue has written off in relation to the COVID pandemic funding. National MP Andrew Bayly asked the Minister of Revenue how much tax interest and penalties have been written off for the last three financial years. The response was in the year to June 2020, it was $17.8 million, in the year to June 2021, $22.5 million, and in the year to June 2022, $26.8 million. Quite reasonably substantial amounts.

But what was also revealed was how Inland Revenue had applied its increased discretion to write off use of money interest as a result of the COVID 19 pandemic. The total amount remitted between 10th June 2020 and 4th of July 2020 was $104 million, which is way above what I would have ever estimated. This amount probably relates to well over $1 billion of debt, possibly as much as $2 billion. It gives an idea of the fiscal impact COVID 19 has had and will probably continue to have.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

1 Aug, 2022 | The Week in Tax

- Inland Revenue draft interpretation statement on tax loss carry-forward and continuity of business activities

- Inland Revenue applies little-known provisions to find director personally liable for company’s tax debts

- What role for windfall taxes?

Transcript

Inland Revenue have released an extremely important draft interpretation statement covering the loss carry forward continuity of business activities provisions. These relatively new provisions enable a company to carry forward tax losses, even though there has been a breach of what we call shareholder continuity, so long as the company is continuing the same business activity.

The general rule is in order for companies to carry-forward tax losses for future use, at least 49% of the shareholders must remain the same throughout the period between when the losses arose and when they are used. Tax accountants and advisers pay particular attention to these shareholder continuity provisions because they are all or nothing. If there’s been a breach, you lose all the losses, and they may no longer be carried forward.

We therefore watch this very carefully, but they are not terribly popular and are seen as somewhat cumbersome because they are so hard and fast and they are regarded as impediments to enabling corporate reorganisations, allowing companies to access new sources of share capital or adapt their business activities in order to either grow or become more resilient.

When the Covid-19 pandemic hit in March 2020, one of the Government’s first responses was to introduce these business continuity provisions which took effect from the start of the 2020-21 income year. That’s generally 1st April 2020. But as one of the many good examples in the paper illustrates, sometimes the rules can actually take earlier effect.

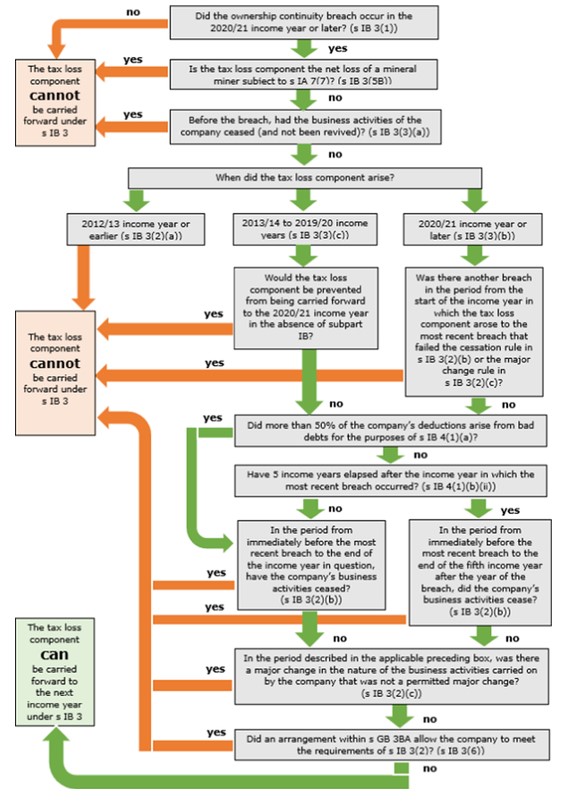

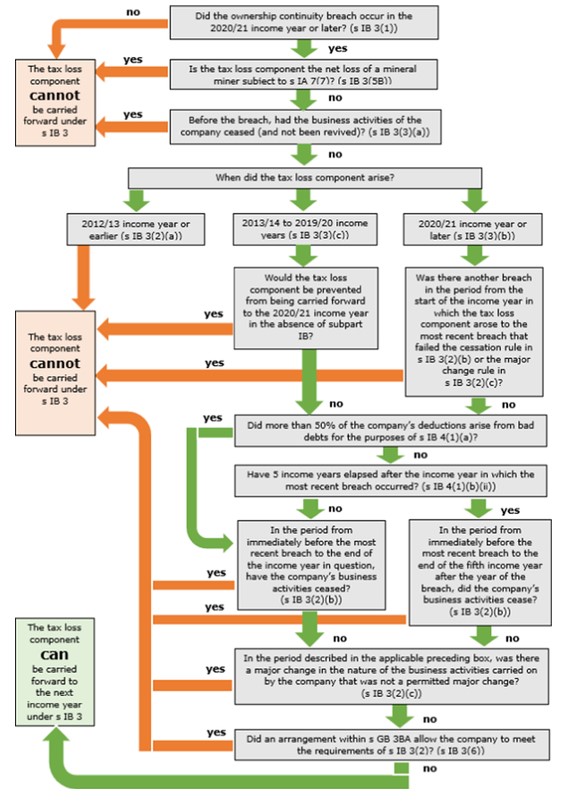

Under the business continuity rules even if there has been a breach of shareholder continuity, a company’s tax losses may continue to be carried forward despite the breach if no major change in the nature of the business activity carried on by the company occurs throughout what is termed the business continuity period. This is subject to an exemption for some permitted major changes. This draft interpretation statement is therefore very useful in giving us guidance as to how these rules are meant to work.

Tax losses can continue to be carried forward for what is termed the ‘business continuity period’. Typically that is the period starting immediately before the shareholding continuity breach and it ends on the earlier of the last day of the income year in which the tax losses have been used, or the last day of the income year in which the fifth anniversary of the shareholding breach occurs. In other words, there’s a five-year cap on the ability to use these provisions. However, that five-year cap doesn’t apply where 50% or more of the losses are eligible for carry forward arose from bad debt deductions.

These new rules will apply where there’s a shareholder continuity breach starting in the 2020-21 income year and tax losses that arose in the 2013-14 income years or later can be carried forward using these provisions.

The key thing is determining what is the nature of business activities and have they continued? When you’re considering this, you look at matters such as its core business processes, for example, farming, manufacturing, construction, distribution, retailing, etc., the type of products or services produced or provided, what significant assets have been utilized, for example premises, plant machinery, livestock, etc. and if there are any other significant supplies or other inputs, such as key staff and the scale of the activity.

But even if there has been a major change in the nature of the business activities carried on, the business continuity test may still be satisfied if that change is one of four permitted changes. Broadly speaking, these changes can be those made to increase the efficiency of the business activity, to improve or keep up to date with advances in technology, are as a result of an increase in the scale of the business activity or a change of type of products to be provided.

Overall, this is a fairly significant and obviously very detailed interpretation statement. It runs to 54 pages, and includes 15 very helpful examples, together with a useful, if somewhat crowded, flowchart. It’s very welcome to see this guidance as we’ve already handled a number of enquiries regarding the application of these rules. Consultation on the draft is now open until 1st September.

Directors liability for company tax

In previous podcasts I’ve mentioned some Inland Revenue technical decision summaries. Inland Revenue has started releasing these summaries of decisions from its adjudication unit relating to disputes with taxpayers. These are released for information purposes only and are not meant to be formal guidance, such as the interpretation statement we just discussed. They do not represent the Commissioner’s official opinion. That said, they are often very useful indicators of how Inland Revenue might approach certain matters.

We therefore pay attention to what these summaries show and one released this week TDS 22/14 is particularly interesting because it involves a couple of provisions which we’ve not seen used extensively by Inland Revenue.

The facts are a little complicated, and initially the matter at dispute was whether a contractor providing services to a New Zealand company through another company (ABC Co) was an employee of the first New Zealand company. Ultimately, it was determined he was not.

Inland Revenue had a look at what was going on and discovered agreements between ABC Co and another company DEF Co. When these were examined, Inland Revenue concluded that ABC Co was providing services to DEF Co which had been returned. It therefore assessed ABC Co for income tax and GST on these services. These assessments were not disputed by the taxpayer so were deemed to be accepted.

So far there’s nothing particularly unusual about this, it’s what happened next that’s interesting, because when ABC Co didn’t pay its tax, Inland Revenue then deployed two provisions, section HD 15 of the Income Tax Act and section 61 of the GST Act. These provisions enable tax owed by a company to be recovered from the shareholders or directors of the company where there has been an arrangement entered into which has the effect that the company is unable to meet a tax liability.

As I said, these provisions have been around for a while, but I’ve not previously seen them used. In order for them to apply there has to be an arrangement, the effect of which is the company has a tax liability whether an existing one or one which arises later which it cannot meet. It must also be reasonable to conclude that a purpose of this arrangement was that the company could not meet that tax liability. And finally, would a director who made reasonable enquiries at that time have anticipated that a tax liability would or would likely, be required to be met? So, there’s a few hurdles to get through before the provisions apply which is why we probably haven’t seen much use of it previously.

In this particular case, the arrangement appeared to be that the taxpayer’s private expenditure was met at all times, but the company never had any funds available to meet any tax liability. So that’s why Inland Revenue ultimately decided to apply these agency provisions.

Understandably, the taxpayer disputed the matter, but the Adjudication Unit ruled on Inland Revenue favour. As I’ve said, these provisions have been around for a while but have not seen much use of them, which also makes it uncertain when advising clients as to what could happen. Until now we’ve advised these rules could apply, but we haven’t seen much evidence of them being used. Now that has changed. This seems very much like a warning shot from Inland Revenue that feels it can deploy these provisions and obviously is doing so as part of a harder line on debt and attempts to avoid payments of tax debt.

It will be interesting to see whether this case progresses any further, for example if it’s taken to the Taxation Review Authority or High Court on appeal. More importantly, will we see more use of these provisions by Inland Revenue. As always, we’ll keep you up to date on developments.

How likely is a windfall profits tax?

And finally, this week, the rising cost of living has been in the news, as has obviously the Government’s response. As people should be aware part of that response involves a cost-of-living payment of $350, which Inland Revenue is now about to start paying, even though there’s about 160,000 people for whom it doesn’t have any bank details and who may therefore miss out on these payments.

There’s also been plenty of debate about what’s causing the spike of inflation and what can be done about that. And an issue that popped up this week was the question of windfall taxes which have re-emerged as tools in perhaps in fighting inflation. Italy, for example, introduced one last year on extra profits realised by Italian energy industry companies. The Spanish have a similar one, also targeting energy production companies. And in May the UK government announced a 25% energy profits levy charged on profits from UK oil and gas extraction activities.

I was asked by Geraden Cann of Stuff whether such a tool could be used here, and my response was not immediately, because we have no history of such taxes, although I understand that there were excess profit taxes levied in both world wars with varying degrees of success. I think most countries struggled with how they could define excess profits in that case.

But then following through on this issue, I did suggest that there might be room for developing such a windfall tax on the principle that it’s always good to speak softly and carry a big stick. However, that would involve determining what would be the trigger points as to when the tax would apply. When would they apply? What constitutes excess profits subject to the tax? What rate would apply? And for how long would such a windfall tax supply? There’s a lot to consider and they would be very complex to design.

Furthermore, although the Government might think, “Well, gee, that’s a nice stick we’d like to have”, businesses quite rightly would be saying “We’re not happy about that because who could be the subject of a windfall tax”.

Currently, windfall taxes are being applied to energy companies in Europe. However, in the past Britain has applied them to banks and privatised utility companies. Businesses might therefore be a little cautious about how they might invest if they felt there was a reasonable prospect of a windfall tax applying. Now our tax policy settings are very much about providing certainty for businesses and business investment. So, on that basis, I can’t see a windfall tax appearing any time soon, even though quietly a finance minister might like to have such a weapon in his or her toolbox.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!