- Inland Revenue consults on the OECD Pillar Two GloBE rules for New Zealand and has a new CEO

- Working for families consultation

- A look ahead to next week’s Budget

Transcript

Last year, the G20 and OECD agreed on a two pillar solution to the issue of international taxation and in October 2021, this two pillar solution was endorsed by over 130 countries in what is deemed the OECD sponsored Inclusive Framework. New Zealand was one of the signatories to that endorsement.

Inland Revenue has now released an issues paper looking at how these so-called GloBE rules (Global anti Base Erosion) would operate. Now as this is an issues paper it does not represent government policy. Instead, Inland Revenue is putting the matter out for consultation because the government has not yet decided whether in fact it will adopt Pillar one or Pillar two, and in fact is also not ruled out adopting a digital services tax. So, this issues paper is a basis for formulating policy to be taken to the government. It therefore partly represents a background paper, but also explains how the rules would operate.

To recap, the purpose of the GloBE rules is to ensure that affected multinational groups (MNEs) pay at least a 15% tax on their income in each country where that income is reported for financial reporting purposes. It’s initially intended to apply to MNEs if their annual turnover exceeds €750 million per annum in two of the last four years. It’s estimated to initially apply to approximately 1500 multinational groups worldwide, of which approximately 20 to 25 are based in New Zealand. The OECD estimates that the global revenue gains under Pillar two will be in the order of US$130 to $185 billion annually, which represents about 6 to 7.5% of global corporate income tax revenues.

The paper is split into three parts. Part one is a general overview with Chapter one giving the background on the initiative and on its intended purpose. Chapter two has a summary of the rules in general, and chapter three raises the question which may seem odd ‘Should New Zealand adopt the GloBE rules?’ Part two then explains the proposed rules in more detail, and part three then covers all specific issues form a New Zealand perspective,

The paper is quite comprehensive running to 84 pages so there’s quite a bit of detail to go through here. Fortunately, we’ve got quite a good period of consultation because consultations open until 1st July. Normally we only have a 4-to-6-week period for consultation.

Now, as I said, what may seem a rather strange question is whether New Zealand adopts the rules is a key part of the consultation. The official view is that if a critical mass of countries do adopt or are likely to adopt the global rules, then officials would recommend New Zealand take steps to join them. Officials take the view that they see no benefit, or not much benefit, in New Zealand going it alone and adopting global rules without a critical mass.

Three questions are put to submitters on this issue.

- Do you think New Zealand should adopt the GLoBE rules if a critical mass of other countries does or is likely to do so?

- Do you have any comments about what a critical mass of countries would be?

- Do you have any comments on the timing of adoption?

Now my response would be ‘yes’, New Zealand should, because it’s part of being a good corporate global citizen. Obviously, there’s a likelihood of additional revenue gains, although according to the paper the potential gains are said to be modest.

What would represent a critical mass of countries? Well, that’s a difficult one. I guess the key country to being involved would be the United States. But as you know, they’ve always ploughed their own furrow on this matter. And politics are such that the Midterm Congressional elections may mean that the Republicans are able to block change on this. Like we’ve said in the last couple of weeks when discussing possible wealth taxes, it all comes down to politics. But certainly, if the majority of the 130 countries that have endorsed it do sign up, you’d think that we would want to go ahead even if the United States didn’t. But it would be disappointing, obviously, if America did not.

And then about the timing of these rules this is actually quite tight. Under the Pillar 2 proposals, there is an income inclusion rule which will impose the top up tax on the parent entity in a multinational group. Now under the OECD timeline that should be enacted during 2022 in order to be effective in 2023. And then there’s another part, the under-taxed profits rules, which should come into effect in 2024. I think that timeline is pretty optimistic. I would be expecting to see it slide out a bit, but who knows what the international mood is on this? Maybe progress happens much more quickly than we expect

Anyway, this is an important paper and there’s a lot to consider here. Maybe the gains might be modest, but it is part of the change in international taxation, which will have ripple effects all the way through the tax world

Issues for the recycled ‘new’ IRD CEO

Moving on, Inland Revenue has a new CEO, Mr. Peter Mersi, who has been appointed for five years with effect from 1st July. He takes over from Naomi Ferguson, who has been the CEO of Inland Revenue for the past 10 years and has seen the department through the Business Transformation project.

As it transpires, Mr. Mersi, who is currently the CEO at the Ministry of Transport was a Deputy Commissioner at Inland Revenue at the start of the Business Transformation Project back in 2012. And prior to that he also spent some time at Treasury where he was the Deputy Secretary, Regulatory and Tax Policy branch.

So, although he’s coming from a Ministry of Transport background, Inland Revenue is not unfamiliar territory for him. It will be interesting to see how the organisation develops under his direction and governance of whichever hue will want to cash in on the benefits of the Business Transformation project.

And of course, one of the areas that he and the department will be involved in will be the implementation of law changes such as the proposed GloBE rules we’ve been talking about. And one thing he will need to ensure alongside the Minister of Revenue is that the Department continues to remain adequately funded. And I point to the troubles of the United States Internal Revenue Service, which has had its problems with enforcing the controversial FATCA rules which I mentioned a couple of weeks back.

It seems from another report from the United States Treasury Inspector General for Tax Administration, that the IRS is struggling with funding and its enforcement is falling off as a result. This led the Inspector General to comment. “The trending decline in enforcement activity is likely causing growth in the overall Tax Gap as taxpayers are less likely to be subject to an examination.”

The numbers of what the IRS call examinations, what Inland Revenue terms risk reviews, have fallen by between 55% and nearly 60% in the past five fiscal years. It bears to keep in mind that our IRD is actually a very efficient organisation, which, to borrow a phrase, you mis-underestimate at your peril. But as the example of the IRS shows, if funding falls away the opportunity opens up for the unscrupulous to evade tax.

‘Consulting’ on WfF

There’s a lot going on at the moment, partly because we are in the run up to the Budget next week. Something that’s been underway is for a few weeks now is a public consultation on Working for Families tax credits. This is being handled by the Ministry of Social Development and Inland Revenue. It’s part of a government review of working for families.

It’s interesting to look at what we’re being asked here compared with a typical Inland Revenue consultation, which has a lot more detail and is quite focussed.

The basic question that’s been posted is what do you like about Working for Families? Is there anything you want, don’t want changed? How do you think it can better support low income working families, families changing hours shift, working part time hours and those with care arrangements? What concerns do you have? And if you could change one thing about working families, what would it be? Now those are a set of questions are really not directed at professionals, but I hope that it gets a lot of good buy-in from the public.

In relation to concerns which I would raise one would be about how accessible it is. As my colleague, Professor Susan St Jones has pointed out, the in-work tax credits are a problem because they’re not available to everyone. And then there is the abatement rates and the resulting very high effective marginal tax rates which people on Working for Families suffer. They actually have the highest effective marginal tax rate of any taxpayer in the country. So those are areas where I think should be the focus for improvement.

Tinkering with WfF

Speaking of Working for Families, the Budget is next week, and I expect that there will be some tinkering going on with Working for Families based around the background papers to the consultation. They seem to be pointing towards an increase in payments being announced or being implemented in the Budget. Of course, with the cost-of-living issue, the Government probably will be keen to do something on that matter.

New Zealand budgets are actually really quite boring from a tax perspective. They’re not like budgets I used to see in Britain, for example, where tax measures came out from left field and were not always very coherent in what they’re trying to do. They certainly contained a lot of tinkering which kept us on our toes.

We’re not likely to see much like that next week. Bill English was one for sneaking in quiet tax increases or changes such as imposing employee contribution superannuation tax on KiwiSaver employer contributions, or withdrawing smaller allowances that were meant for children, the so-called “Paper-boy tax”.

One tax issue which has been hammered away at in recent weeks is fact that the tax thresholds have not been increased or adjusted since 2010. Eric Crampton of the New Zealand Initiative had a look at this. He considered what had gone on with the thresholds and where as a result the average tax burden had shifted. He made some educated guesses as to where those thresholds should be now.

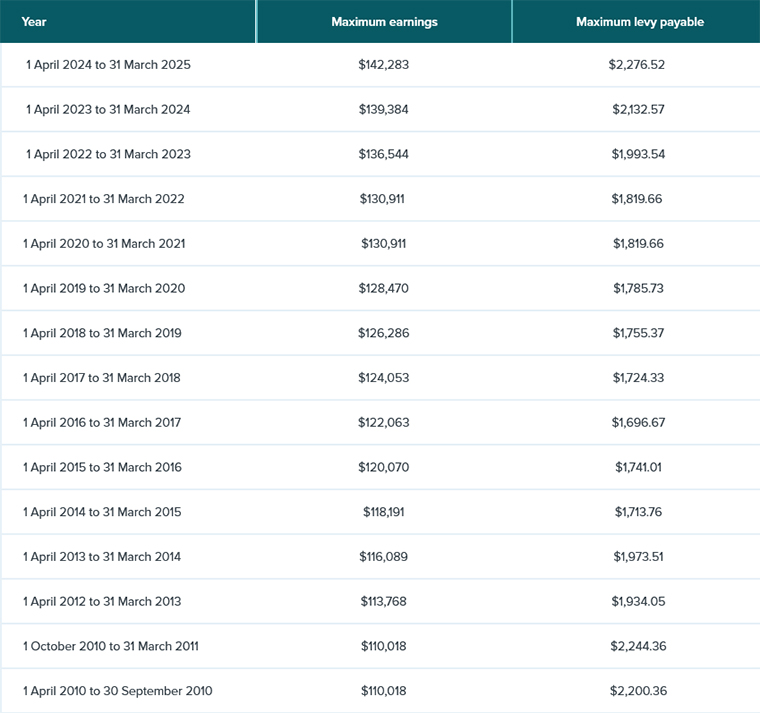

But there is actually some information floating around which would give us a more reasonable direction of what the thresholds should be if they had tracked along with inflation. These are the ACC thresholds for the upper limit of earnings on which the maximum 80% of income that may be paid out under a claim is based.

Back in 2010, when income tax rates were last adjusted, the ACC threshold was $110,018. As of 1st of April this year, it’s now $136,544. And so that increase over time over the period represents just over 24.1%.

So if you applied that 24% increase to the tax thresholds, this would be the position

| Tax rate | Current thresholds | Adjusted thresholds |

| 10.5% | $0-$14,000 | $0-$17,375 |

| 17.5% | $14,001-$48,000 | $17,376-$59,573 |

| 30% | $48,001-$70,000 | $59,574-$86,870 |

| 33% | $70,000-$180,000 | $86,871-$180,000 |

| 39% | >$180,000 | $180,000 |

(Note I’ve not adjusted the $180,000 threshold as it has only been in effect since 1 April 2021).

So that gives you some indication of what’s been going on. I think Governments of both sides have been, quite frankly, underhand in not adjusting for inflation. It isn’t just the tax thresholds, they’ve also done it in their other areas, such as Working for Families, where the threshold for abatement kicking in at $42,700, which is well below the $59,500 odd I suggested would be the upper limit to the 17.5% threshold. It will be interesting to see if anything is said or done about tax thresholds next week, but it’s a point that will certainly be addressed one way or another before next year’s election.

Talking of inflation, Inland Revenue has released a CPI adjustment to the square metre rate for dual use premises. This is where you can base a deduction for home office on a square metre rate. This has been set for the year ended 31st March 2022 at $47.85, which has been adjusted for 6.9% inflation in the 12 months to March 2022. So that’s a little useful thing to keep in mind when you’re preparing tax returns for clients who work from home or have a home office.

Rich entertainers avoiding tax

And finally, what have the Rolling Stones got to do with tax? Well, apparently this week is the 50th anniversary of the release of their magnum opus, Exile on Main Street. And the title is a deliberate reference to the fact that the Rolling Stones in 1971 decamped to the south of France because they were in trouble with UK tax authorities and facing very significant tax bills. At that stage, tax rates in the UK in some cases topped out at 98%.

So they went to France to record this album which is regarded by many as their creative peak. There’s a great story in The Guardian about what happened, including this fantastic quote ‘People took so many drugs, they forgot they played on it’.

Tax troubles and musicians go hand in hand. There are plenty of stories about various musicians and actors who’ve got themselves into terrible trouble with tax authorities and either finished up in jail, such as Wesley Snipes, or decamped elsewhere, like the Rolling Stones.

Well, that’s all for this week I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!