17 Dec, 2019 | The Week in Tax

- The Tax Working Group report and capital gains tax

- Inland Revenue’s business transformation

- OECD’s international tax proposals

Transcript

This week, our final episode of the year takes a look back at the big tax stories of 2019 and also casts an eye over the tax events of the past decade.

The Tax Working Group report

The release of the Tax Working Group report and the Government’s decision not to follow through on the group’s recommendation for a general capital gains tax is by far and away the biggest tax story of the year. Although the Prime Minister stated that as long as she remains leader of the Labour Party, she will not be proposing a capital gains tax, the issue still excites and generates quite a degree of controversy. The reaction, for example, to a recent podcast in which I talked about Robin Oliver and Geof Nightingale’s session about why a capital gains tax didn’t happen at the recent Chartered Accountants Australia New Zealand Tax Conference is a good illustration of that.

As I’ve said many times beforehand, the frustrating thing for me about the aftermath of the Tax Working Group is that the debate around a capital gains tax completely drowned out all the other good work the group undertook. Some very interesting matters were raised and discussed. The tax system was found to be in generally good health, but there were issues. Pressures are building around the demographics and the funding of New Zealand Superannuation and rising health care costs for our ageing population.

On the other hand, the Government’s books are pretty solid and there is no immediate requirement to be raising revenue and expanding the tax base to pay for those additional costs. So, a capital gains tax is not something that’s going to be immediately necessary. But what the group did point out was those pressures are not that far off and we need at some stage to consider how the tax base will respond to that.

The other thing I thought was very interesting and I’ve talked about it before, is we started to see some movement on the question of environmental taxation. The TWG said we could do a lot more in this space. But also, and certainly this was Sir Michael Cullen’s recommendation initially, much of any changes that happened in this environmental taxation space should be in terms of recycling the funds through to enable the transition to a lower carbon emission economy. And that is something which is much more immediate and doesn’t require a capital gains tax. We should really be spending more time debating how we will implement these taxes and in which way we will allocate the funds that are raised.

Inland Revenue

The second large story for the year was Inland Revenue’s Business Transformation and in particular its Release Three, which happened in April. This is when it said, right, we are going to do auto-calculations for all taxpayers. And instead of them having to use a tax intermediary, Inland Revenue will automatically calculate the unders and overs for the year and issue appropriate refunds or demands as required.

This is a hugely ambitious project. About 2.9 million automatic assessments were processed resulting in approximately $572 million dollars of refunds being paid to taxpayers. But it threw up quite a lot of controversy. Probably in hindsight Inland Revenue was too ambitious in what they tried to do. They were bedding in the new tax system which for example involved transferring something like nineteen point seven million records into the new START (Simplified Tax and Revenue Technology) system.

Two key points emerged from the switch. Firstly, somehow over a period of time, 1.5 million people had managed to get their prescribed investor rate wrong. So those who had underpaid were expected to pay up. But those who had overpaid on average about 40 dollars each weren’t going to get a refund.

Now, as it transpires, political pressure and the howls of outrage from the public means that work is in progress to correct this issue. Currently the Finance and Expenditure Committee is looking at a measure which will deal with the question of the overpayments not presently being able to be refunded. That’s a good outcome coming from that pressure.

We don’t need no education?

What that issue shows to me though, is something that’s been taken for granted across the system. Not just this year, but for the past decade and probably even longer. And that is a dangerous assumption – that taxpayers know how the system operates and will always act in their own best interests because they are always across what’s happening their prescribed investor rate, their PAYE codes. That’s clearly not true. And it’s something Inland Revenue and tax professionals will have to deal with going forward.

Looking ahead to what’s going to be happening over the next three or four years, I think it’s probably one of Inland Revenue’s greatest priorities to introduce an educational process to ensure people are kept up to date about what happens with their KiwiSaver and PAYE.

The other part of the fallout from Release 3 as it was called, was that Inland Revenue basically did enormous damage to its relationship with tax agents. We as a group were pretty much left out in the cold about how to manage the transition to the new tax system. As a result, our experience in using the phones when interacting with Inland Revenue was uniformly very poor. And the survey I talked about last week with Chris Cunniffe of Tax Management New Zealand shows how dissatisfied tax agents have become with Inland Revenue’s performance.

Now credit to the Commissioner of Inland Revenue Naomi Ferguson, she’s acknowledged this. And we now know that going forward, Inland Revenue will not be making auto calculations for any taxpayer who is linked to a tax agent, and is overhauling its procedures around contacting clients of tax agents directly.

This is very much a sore point. 72% of tax agents had clients approached directly by Inland Revenue. And one of the interesting points about that was a significant proportion of them were approached by Inland Revenue in relation to the Accounting Income Method AIM, which Inland Revenue has been promoting as a simpler means of paying provisional tax.

At present only two thousand or so people have taken up AIM. And the reason is they’ve done that – despite Inland Revenue’s huge push – is that we as tax agents feel that it isn’t right for many of our smaller clients’ businesses – that it requires too much information and is rather inflexible in its approach. So that’s something which is probably going to change. I know Inland Revenue is working on that.

Overall, I think this huge transformation can be regarded as a qualified success. There are issues, as I’ve just said, around how Inland Revenue’s relationship with tax agents deteriorated. At the same time this is a reflection of how open our tax policy process is. We were able to get to Inland Revenue and say, “Hey, this is not working, and you need to do something about it”. And through various sources – including also the Revenue Minister, Stuart Nash, getting his ears bent by many tax agents and accounting bodies – change is happening. And that’s actually how the system should operate. So that’s a sort of reflection of the good and the bad of how our tax system works.

Meanwhile over at the OECD…

The third story, and again, this is another one that’s been running for quite some time with huge implications, are the ongoing international developments that we’re seeing in tax now. There are two parts to this. The first is what we’re seeing right now, the impact of the Automatic Exchange of Information under The Common Reporting Standard. This is where the tax authorities around the world swap information about taxpayers’ offshore financial holdings. There’s a colossal amount of data being swapped, and it really is surprising how unaware people are about just how much data is being swapped by tax agencies. Inland Revenue has now received over the two releases made to date under CRS, one point five million account records of New Zealanders who have overseas financial accounts. It’s presently working its way through that data and starting to ask questions.

Separate from that are the developments by the OECD in international tax and how we actually calculate a multinational’s income and allocate it to various jurisdictions. The previous permanent establishment regime built around a bricks and mortar approach no longer operates in the digital economy and through initiatives such as BEPS – Base Erosion and Profit Shifting -the OECD has been working on a replacement.

And this

latest development is called the Global Anti-Base Erosion Proposal or “GloBE”. And this is proposing nothing less than a minimum tax rate for multinationals. This is a huge initiative and the OECD is hoping agreement can be reached among the 135 jurisdictions involved by the end of 2020.

How the GFC changed international tax

And that leads on to what has been happening over the past decade. Back in 2010, the OECD was starting to look at the implications for tax jurisdictions of international tax planning in the wake of the global financial crisis, which in 2008 had pretty much smashed to bits the budget balances of most jurisdictions around the world.

All around the world, countries tax take took a huge hit in the wake of the GFC. And countries then started looking very closely at where all the money was going and the scale of tax avoidance, and in some cases outright tax evasion, became ever more apparent. And so, this is the most important tax story over the past decade because it is transforming the way international tax operates.

You can run but you can’t hide…

And the implications for our tax base have been twofold. One, as a result of the global financial crisis and the initiatives that the OECD started, we now have Automatic Exchange of Information and the Common Reporting Standard and as I mentioned a minute ago, vast amounts of information sharing. We are also seeing moves to determine how multinationals will be taxed and that will not only affect how we tax multinationals, but also how our multinationals are taxed. Fonterra is the one that’s most often mentioned in this regard.

But it was the Americans that kicked this all off in 2010 with the Foreign Account Tax Compliance Act. What FATCA did was it required other jurisdictions to report to the US Internal Revenue Service – the IRS – details of American citizens who held bank accounts in their jurisdictions.

FATCA was the blueprint for what we have now CRS and Automatic Exchange of Information.

American exceptionalism

But there was one other thing that the Americans also did which is still playing out. The Americans are not part of the CRS initiative. In effect they said, “Well, we’ve got FATCA. we don’t need to be part of this.”

And American unilateralism is a continuing issue for the global tax base, because in the wake of the OECD proposal for the Global Anti-Base Erosion Proposal, the American Treasury Secretary just last week said, “Well, actually, we might not join that. Instead, we’ll just rather keep going with our old international tax rules”. The suspicion is that’s because the digital giants are putting pressure on the Treasury Secretary and the American government. So, a decade ago, America took unilateral action to introduce FATCA, which then led to the CRS. And now a decade on, it is throwing a large amount of grit into attempts to reform the taxation of multinationals.

A tax groundhog day

Here in New Zealand, back in 2010, Peter Dunne was the Revenue Minister, the Canadian Robert Russell was Commissioner Inland Revenue. The top income tax rate was 38% and the threshold at which it kicked in had just been increased to $70,000. GST was then 12.5% and the registration threshold had also just recently increased to $60,000.

Now those thresholds haven’t been increased since then. I think one of our faults in our system is we do not review the tax thresholds regularly enough and it causes distortions. And then suddenly politicians are making grandiose claims about massive tax cuts, which are nothing more than inflation led adjustments.

But in a real case of Groundhog Day, back in January 2010, the Victoria University of Wellington Tax Working Group, issued its report. The group (which included recent podcast guest and member of the latest Tax Working Group Geof Nightingale) shied away from recommending a capital gains tax. But it was in favour of increasing the amount of taxation from property, particularly in the form of a low rate land tax. And it also wanted to see more taxation of residential rental properties, suggesting they could be taxed in a similar manner to the fair dividend rate and foreign investment fund regime. So, there you have it, ten years ago, we were also talking about capital gains and the taxation of investment property.

The other thing that was raised by the Bob Buckle led group in 2010 was a recommendation for “a comprehensive review of welfare policy and how it interacts with the tax system with an objective being to reduce high effective marginal tax rates”. Both the Welfare Expert Advisory Group, which reported earlier this year, and the TWG commented on this situation. And I suspect that in another 10 years we will still be talking about this issue. It doesn’t go away, even if governments are unwilling to deal with some of the political consequences of action.

Well, that’s it for the Week in Tax for this year. I’d like to thank all our listeners and my guests throughout the year. I’d also like to thank David Chaston and Gareth Vaughan at www.interest.co.nz for publishing these transcripts.

We’ll be back next decade on Friday, the 17th of January. Until next time. Meri Kirihimete me te Hape Nū Ia. Merry Christmas and a Happy New Year. Thank you.

9 Dec, 2019 | The Week in Tax

Chris Cunniffe of Tax Management New Zealand talks about tax pooling and the latest TMNZ/CAANZ survey of tax agent satisfaction with Inland Revenue

Transcript

This week, I’m joined by Chris Cunniffe CEO of tax pooling company Tax Management New Zealand. Morena Chris, welcome to the podcast. Nice to have you here. Now tax pooling is something that’s been around now for what, 15 years? For me and many other accountants and tax agents, it’s a vital tool in helping manage clients’ tax payments. But how exactly does it operate?

Chris Cunniffe

It’s a good question, Terry. There’s a lot that happens behind the scenes that people aren’t aware of. So let me take a moment just to paint that picture. The tax pool is one really large account at Inland Revenue. It’s got multiple billions of dollars in it because we have clients ranging from New Zealand’s largest taxpayers right down to small businesses who pay their tax through the pool. When that happens, they deposit their tax in a bank account with our corporate trustee Guardian Trust, and Guardian Trust immediately passes that on to Inland Revenue. So the money is always sitting at Inland Revenue, but instead of being allocated at Inland Revenue against each taxpayer, it’s sitting in this large pool known as the TMNZ tax pool.

We have the ability to trade balances within that pool. So if somebody has paid too much tax, they can sell their excess. If somebody hasn’t paid enough tax, they can come to us and buy what they are short. At the end of the year, when people know their liability, we transfer to their account at Inland Revenue exactly the amount that they need. And their statement at Inland Revenue will show them to be completely compliant taxpayer with the right amount of tax paid on the right dates.

TB

Fantastic. It sounds a bit intricate. But what is the big advantage for clients of using a tax pooling method.

Chris Cunniffe

So the advantages differ I guess across the client base. Ultimately, tax pooling is about managing uncertainty around your tax payments. It’s around giving people an insurance policy that if they have underpaid, somebody is there to help them out. It’s particularly about managing exposure to Inland Revenue use of money interest. I’ll come back to that in a minute. And increasingly, for small and medium businesses, it’s about managing cash flow.

So let me just go back to the use of money interest. Inland Revenue charges taxpayers at the moment, 8.35% if they don’t pay their tax on time. Now, that rate is designed to hurt them. It certainly does. Inland Revenue does not want to be a an involuntary banker where people say, oh, look, there’s a fairly good interest rate there. I’ll just pay later. So they want to have a fairly sharp interest rate that focuses the mind and gets people paying their tax on time and use of money interest largely achieves that.

But there’s many reasons why people don’t pay their tax on time, and we’re not talking bad taxpayers. We’re talking people who have cash flow constraints, who have seasonal businesses, who have unexpected events that caused them to have taxable income that they hadn’t planned on. And for them to be hit with an 8% interest charge is kind of unfair.

So the genesis of tax pooling way back in the early 2000s was big business saying to Inland Revenue you’re charging us at that stage double digit interest when we don’t make our payment on time or we get our tax payments wrong. That’s usury. It’s unfair. So Inland Revenue came up with this idea that said, well what about allowing those who have paid too much to trade with those who have paid too little? And an intermediary can effect the payments.

So that’s what we do. So people will save probably 30% on the Inland Revenue interest. They’re going to charge them 8.35% We’ll be charging them a rate. And it varies depending upon the amount of tax you’re buying, the age of the tax but we’re charging around 5% to 6%, in some cases less.

TB

That’s a very significant advantage. It also means because the tax is deemed to be paid on its proper due date, you trade tax within the pool. And so not only have you reduce your use of money interest, you avoid the late payment penalties.

Chris Cunniffe

Absolutely. And there’s a 5% penalty if you’re a week late. So if you’ve missed a tax payment, tax pooling is an amazing solution. Just an example. Yesterday we had an inquiry, somebody at a largish company. Because it was it was over two million dollars was saying, can we buy a tax payment for 28 November? And right now they’re looking and down the barrel of a 5% penalty on that. They can come to us and buy that tax and we’ll just charge them an interest rate and they eliminate their late payment penalty.

TB

Seriously for those who have not used it before this is a real life saver at times. When’s the biggest demand for your services? Is there any particular time you’d see a lot of payments going through?

Chris Cunniffe

Oh, we run a regular cycle through the year. Most of New Zealand’s largest taxpayers deposit their tax through us and increasingly small and medium businesses are paying their tax. So as you go through the year. If you think about the cycle on P1, 28th August, a lot of money comes into the pool and then again for the P2 payment on 15th January and finally for P3 at the 7th of May after which it sits there until people file their tax return.

Now, like all good tax agents, I’m sure your filing percentages are right up to date, but there are some who seem to do all their tax returns of the last week of March. That is when we get frantic at that stage. Agents are coming to us and saying, here’s the tax liability for my client, please transfer. And that’s where agents are coming to us and saying, my client’s got a problem. They didn’t pay enough tax. Can I please buy tax? So we are frantic from March through till June. That’s our trading window.

The rest of the year it’s regular and routine transactions. Under the new provisional tax rules, interest now only applies from P3 on 7th May if people have used the standard uplift method. So most of the demand is for tax for P3 so seventh of May is the biggest date that we will sell tax for.

TB

So the changes to the provisional tax rules, they were designed to make life a lot easier for taxpayers. That probably made your life worse.

Chris Cunniffe

We were disrupted without doubt, but I don’t think there’s a business in New Zealand that doesn’t get disrupted by competition or by technology or in our case, by regulation. Yes. And what it’s forced us to do is look at “What are the services we provide? What are we good at doing?” And looking at our client base and so. Whereas we originally existed, I guess, as an ambulance at the bottom of the cliff, “my client is short paid can I buy tax?” We have now morphed into being a cash flow and a working capital solution, particularly for small business.

So it will be no news to you – what’s the biggest issue for your clients? Cash flow. Inland Revenue is quite prescriptive. You shall pay tax on these dates depending on your balance date with no care about whether you’re a seasonal taxpayer, whether your business is growing, whether there’s any other things going on. Too often those dates don’t fit with your business needs.

So paying tax on the 15th of January, straight after Christmas and when everyone’s in shutdown mode, how dumb is that?

TB

Indeed, there’s a story behind that which can wait for another day.

Chris Cunniffe

Anyway, we increasingly have people saying, look, will you pay tax on our behalf? We could give you an example of some people who use us for cash flow. Trucking company wins a major contract. Great news. The business is going to grow. What we need is to buy three more trucks. I need to pay my property tax. Now, where’s the best use of their cash right now? It’s obviously putting down deposits and getting new trucks into the fleet. So they came to us and said, can we defer the payment of our provisional tax for six to nine months? And we said, of course you can. So, we have this product we call it tax finance and you essentially tell us I’m due to pay tax on a particular date, let’s say the 15th of January coming up. It would suit me better if I could pay that in six months time. So we will get a funded pay tax on your behalf and you pay us a fee upfront and in six months time when cash flow is strong you come back and you essentially buy that deposit out of the pool. We transfer it to Inland Revenue you’re a compliant taxpayer. You’ve paid your tax on time. So that’s one way to do that. Kind of “I know exactly what I need to pay and I want to defer it in a structured way”.

The other way is just to do it like having a revolving credit or a flexible mortgage. You say, “I know what my liability for this year is and I want to pay it through TMNZ and I’ll pay 200 dollars a week.” We had a lot of clients who do that and they just set up that automatic payment to pay it through us and we transfer it across and we work with the tax agents to make sure the tax is on the right date at the right time. But for that taxpayer and sometimes even for the agent, all that stress about whether the money will be still in the bank account when it’s time to pay the provisional tax will is gone. We often hear agents that tell us about clients who when they get the provisional tax reminder they go “Whoops, I’ve just spent that.”

TB

Yeah, that’s fairly common. There wouldn’t be a tax agent in New Zealand who hasn’t experienced the call on the morning of the 28th August, for example. “So what’s this about paying ten thousand dollars? I haven’t got it”. I mean what are you describing here is something that anyone who works in the SME sector knows, that a lot of the legislation and processes are designed for big companies and assume a level of cash flow and capital and basic skill that just simply doesn’t exist or is not commonplace in this sector.

I mean, we’ve talked about provisional tax, but actually you can also cover GST and other taxes. How does that work?

Chris Cunniffe

We can cover other taxes where there’s been a reassessment. Where you’ve got an uncertain position, and this could either be that Inland Revenue has approached you and questioned a tax position you’ve taken or increasingly it is where the tax agent has done a review and says “I don’t know that we got this quite right” and a voluntary disclosure is going to be made. You can come to us and buy tax at those historic dates. This is incredibly valuable. If you if you think that interest rates over the last four years have fluctuated between 8% and 9%. So take a client who has been getting a position wrong for the last four years. The interest that has built up on that underpaid tax there could be north of 30% of the core tax, so that’s quite an uncomfortable conversation to be having with your clients as you talk them into a voluntary disclosure or when Inland Revenue is putting a proposal for a reassessment on the table and then they went 30% extra with interest. This is before we even get to penalties.

We’ve got tax in the pool going all the way back to 2008. It does not matter what date your client is being reassessed for. We’ve got tax available. Anybody who is being reassessed for any income tax or any other tax type, you should contact the pool and we’ll be able to reduce their interest costs in the region of 30% to 40%.

TB

That’s a significant help. This is a scenario we see quite a bit often around overseas income because the rules are so complex and people assume that it’s just like to be taxed at source. So, yeah, the ability to make a voluntary disclosure and get a reassessment and then use TMNZ to reduce the interest bill is very significant. In one example I can think of we saved a client $10,000 in interest by using tax pooling.

Chris Cunniffe

Yeah. And this is real money for people who in most cases were unaware that they had a problem.

TB

It’s the old saying you don’t know what you don’t know until you find out. And then it gets very expensive. So obviously, a key part of your business would be regular interactions with Inland Revenue. And at several different levels. So how does that work? There is a special unit within Inland Revenue that deals specifically with tax pooling.

Chris Cunniffe

Well, let’s take a step back. Inland Revenue created tax pooling, it was the solution to a problem that arose in the early 2000s. So we exist at the behest of Inland Revenue. So at a policy level, we have engagement with them, which is around what should tax pooling be able to be used for and how has the industry evolved? I talked about how we changed over the years. We have regular discussions with tax policy officials. Just to let them know what’s happening and make sure that, you know, they are comfortable with the settings. So that gets a gets a big tick.

And about four years ago, Inland Revenue did a review of the industry just to check that there was no risk to the system by having this industry called tax pooling.

And it came back with a very solid report, in fact one of the recommendations was this is now relied upon by so many taxpayers, you would not want to take it away.

Operationally, there’s a unit at the processing centre and on a daily basis we’re interacting with them. We’re uploading schedules, we’re saying this is who’s put money into the pool, this is people who are buying tax. Please transfer from the pool to these taxpayers X amount of tax. We do tens of thousands of transactions a year with that unit. So we work very, very closely with them.

And as you can imagine, with all interactions with Inland Revenue just around the fringe, there can be systems, issues or uncertainty about legislation. And we work through that. And that final piece of uncertainty with legislation is in a technical area at Inland Revenue that we liaise with and there’s a regular liaison between Inland Revenue and the industry to ensure that issues are running smoothly. We pay a massive amount of New Zealand’s provisional tax. TMNZ would be the largest taxpayer in New Zealand. If you think about our account at Inland Revenue with multiple billions of dollars in it. So there’s a an investment on both sides to make sure that this runs efficiently.

TB

Yes, the tax pool has at any one time six or seven billion dollars?

Chris Cunniffe

It can get well north of that when is all the money comes in. And then as it gets transferred out, the pool drains again and then we fill it up for the for the next year. But it’s in the multiple billions of dollars.

TB

I understand included amongst your clients is the New Zealand Super Fund, the country’s single largest provisional taxpayer, with a billion dollars plus regularly. So it’s dropping 300 million at a time every provisional tax payment.

Now we’ve got a provisional tax payment coming up on the 15th of January. So now tax agents like you will be looking out to our clients and telling them what’s going on. But as you know the rules, 105% or 110% of RIT [residual income tax] are confusing. I think you’ve got a specific tool to help tax agents like myself and clients calculate your RIT and your payment.

Yeah. A couple of years ago, Inland Revenue looked to simplify the provisional tax rules to take the heat out of the use of money interest by saying if you pay your first and second installments based on an uplift to prior year returns, then there’s no interest. That’s good for business, but they’ve created a level of flexibility and an optionality in the system that has actually now started to confuse people. As you say, should it be 110% of two years ago or 105% of last year? Have I filed my last year’s return or not? It starts becoming quite a complex calculation. So we’ve created a calculator on our website which allows agents to enter the details of their client’s prior tax positions. And it will come up and say this is how much tax should be paid on on each installment date. And so that’s become very popular with agents. And they tell us it is now a core part of their provisional tax process in terms of advising clients.

TB

Excellent. Yes, even for someone who’s been like myself working for 25 years or more, provisional tax every now and again, I just go back and say “Wait a minute. What applies here? Do we file a return or not file a return?” It’s all sort of needless complexities and confusion. So it’s always invaluable the assistance we get from yourself.

Chris Cunniffe

And again, that’s the advantage of the pool is that you can kind of pay what you think you owe. But if there’s overs or unders at the end of the year, you can work with us to smooth that out. We shouldn’t be stressing before Christmas about provisional tax.

General satisfaction with Inland Revenue engagements well down

TB

Yes, but we have to. Now a big part of your daily routine is interaction with Inland Revenue. And in recent years, you actually started conducting an annual survey of tax agents views about satisfaction with Inland Revenue. And the latest iteration was released at the Chartered Accountants Australia New Zealand tax conference that I was at two weeks ago. Now, this is a fully professional poll carried out by Colmar Brunton. And how did, what was the survey’s results?

Chris Cunniffe

That’s right Terry. We have run the survey for the last nine years in conjunction with Chartered Accountants Australia New Zealand. It’s designed to elicit feedback from agents or tax professionals generally about how their engagements with Inland Revenue have gone. I guess the key out-takes from this year [is] it has been a tough year and the general satisfaction on Inland Revenue engagements is well down.

Let’s take a step back and think why that is though, and acknowledge that Inland Revenue have just implemented probably the single biggest technical or system transformation in New Zealand history with millions and millions of accounts for taxpayers being moved from the old FIRST system to the new START system and the movement of that data went without a hitch. Unfortunately, as happens with all major transformations around the edges, there’s a few challenges and these played out and all agents will be aware of these if they think back to what life was like between April and July this year.

TB

We’d rather not.

Chris Cunniffe

Yes, the auto refund, they thought this was a good idea, but in many cases the money was sitting with Inland Revenue for a damn good reason and the agents knew why it was there. And if you take it back to first principles, agents know their clients’ tax affairs and should be trusted to manage them. The getting hold of Inland Revenue on the phone became a nightmare. Correspondence slowed down – mixed views on this – but they stopped doing audits. So if your business consisted of advising taxpayers through audits, that was a bad thing as all the auditors were pulled in to answer correspondence.

The survey showed that the overall satisfaction with Inland Revenue has been declining since 2015, which corresponds with this massive transformation change they’ve been going through. It’s now at 66%. It had been right up into the into the 80s.

People in public practice are the ones who are expressing the greatest dissatisfaction with the engagement. That probably makes sense because they deal with Inland Revenue on a much more regular basis than those in business. And to be fair, I think if you are in business, the new system is much more intuitive and much more immediate. And so, yeah, there’s a winner in that area. If you’re in practice, the frustrations we’ve talked about have come to the fore.

The dissatisfaction with phones is very, very strong. This is nothing Inland Revenue doesn’t know. They get feedback all the time. The advantage of the survey is it’s kind of like a mark in the sand and we’ll be able to track over time how they perform. We would expect that next year we should see an upturn in satisfaction with contacting Inland Revenue by phone or by for processing purposes.

TB

Inland Revenue seems, however, to be very much driving its business model to take everyone going online. And from their business perspective, that makes sense. It reduces maintaining a large call centre staff. It probably would be comfortably the largest in the country by a long way. I remember one time hearing from a person at Inland Revenue who had handled a call centre for a bank. And the one thing he hadn’t realised just was what was involved – whereas for a bank call centre, the interaction was designed to be kept to two minutes or so. But for Inland Revenue, basically anything goes, and that’s something that he hadn’t realised the issues around that. So the call centre issue is one I think we will want to watch very carefully how that proceeds, because the nature of tax being what it is.

And this is also a reflection of the fact that Inland Revenue is a largely trusted organisation. Understandably, people will want to talk to Inland Revenue and say “Have I got this right?” So it’s a double edged sword for Inland Revenue. It might want to move people online, but its stature and trust within the community means it’s going to get a lot of calls. Tax agents as well want a bit of reassurance because here’s the thing. There are about 5200 tax agents registered and that would include organisations as big as PricewaterhouseCoopers, Ernst and Young, Deloitte, – the huge mega firms who have hundreds of accountants down to your sole practitioners. But the majority are sole practitioners. And it’s lonely out there. And we carry the can if we get it wrong. So every now and again, it’s nice to have a voice at the other end who said, yep, that’s right or no, you need to do it differently.

Chris Cunniffe

It’s a very good point. And there’s a real point about what is the psychology of engaging with your regulator. Clients in particular are worried when Inland Revenue contacts them. They think, have I done something wrong? So there’s a there’s a real fear. And Inland Revenue has invested a lot in trying to show off a friendly face. But they still are a regulator. Tax is a really big issue for people. It’s not something that they feel qualified to do. And the stigma and the consequence of getting it wrong is significant penalties and interest. For an agent you wear that because if you have advised your client and got it wrong, the client is pretty grumpy and would expect you to be responsible for the consequences.

So I agree there is a need to be able to get the right assurance and the right level of engagement where appropriate. On the other hand, a really good system design would say we make it really hard for you to get it wrong. We give you all the easy and all the basic information you need. The most popular question asked of Inland Revenue call centre staff is “What is my IRD number?” There’s an engagement if they can get rid of that, you would free the staff up to answer the high quality calls where there is genuine uncertainty and people do need to be guided. So Inland Revenue has got that challenge. But I think it’s essential for agents in particular that when there is uncertainty, they can talk to somebody and figure out what’s going on. So getting that service available and an effective fit for agents, I think is a top priority for Inland Revenue.

TB

Yes. That’s an amazing thing. And people ring up asking “What’s my IRD number?” That’s going to be a very circular conversation. I think education is going to be very important about people understanding the system, and that’s everybody. I think the classic example this year, it’s emerged, is a one and a half million people got their prescribed investor rate wrong either under or over. So there is something where everyone needs to work out. There was an assumption that people knew more about this, were watching it regularly, and there was an assumption that because of the auto default rate, Inland Revenue and the KiwiSaver funds were all getting it right. So everyone was sort of assuming everyone else was looking after what they should have been looking after and of course, it landed up in a big mess in the middle.

So, yes, Inland Revenue is still going to have an educator role. I think in many ways it probably needs to be putting more resources into that. We run a self-assessment system, which means we’re supposed to know and assess our own position. But even though our tax system is widely regarded as one of the more conceptually straightforward in the world, you get around the fringes of GST or the financial arrangements regime, or even the Brightline test all those little quirks in them, which keeps people like myself in business, but means that you can’t really work on a true yes, you can work out this tax for yourself.

Chris Cunniffe

It’s interesting, over the years Inland Revenue had pushed away the salary wage earner, the man or woman in the street. “You didn’t need to file tax returns”. So a lot of people were totally unaware of how Inland Revenue works, how your tax system works. And that leads to things like when you are asked by your bank or by your fund manager, what is your tax rate? People are kind of oblivious to this. It led to the expansion of the tax refund companies charging for a service that anybody themselves could have done online, but people just weren’t used to being in the tax system that the new platform now brings people in a lot more.

And the interaction with investment income and with PR, they have lifted a rock and found out there’s actually quite a lot under there. That was everyone was oblivious to it – be it by design or by accident. People were on the wrong rates. I suspect that’s an example of something that wasn’t really thought through particularly well. It should take us a period of time to get it right before going forward it will be set and forget. But you’re right, there’s a number of other places where people get drawn into the system. So the bright line test, the other person who has one property, one investment property, you’re now in the system. The increased amount of information that Inland Revenue will be getting from foreign tax authorities, from the banks and from the investment funds means that they will be asking questions if all your settings are not right. So I think there’s a lot more engagement or interaction going to happen between individuals and the department.

TB

Yeah, that’s definitely coming. Definitely. And the survey was fascinating to be part of it because the Commissioner then spoke immediately afterwards, talk about the wrong warm up act. How did you think she responded? She responded to the criticism that clearly could not be ignored, but also was also looking forward. How much confidence you draw from what her summary of where things were at?

Chris Cunniffe

It worked very well that I was able to report the survey. And one of the main issues out of the survey – if we take away the what’s general satisfaction like in a year where there’s a massive transformation – the biggest gripe that’s been coming through had come from tax agents around Inland Revenue approaching their clients directly. And I think this was a philosophical thing in some ways from Inland Revenue, “we want to talk to people that ultimately, they’re the customer. We can get there and share information with them”.

But what that was doing was frustrating agents immensely. And we got really, really strong feedback from agents, around 72% of them said Inland Revenue had gone to their clients directly and we don’t like that.

TB

Can you imagine if you’re in business – any businessman – and one of your rivals approach 72% of your clients? You could see why the tax agent community was seething.

Chris Cunniffe

Indeed, because in the feedback we got was things like ” this worries my clients needlessly” because the agent often would have it all under control – as a GST refund about to be released. It’ll cover that liability, it’ll all be squared out and the client’s got this phone call “you haven’t paid your tax. What’s going on.” That undermines the agent in the eyes of the client. “I thought, Terry, I paid you to look after my affairs. I’ve got Inland Revenue in my ear saying I’m in arrears. What’s going on?” It means that you as an agent have to then spend time talking to the client, calming them down. You probably can’t charge for that.

So there was a lot of needless angst. Inland Revenue has found that there were 72 letters or interaction, real written interactions going out to clients that probably should have gone to tax agents. They have worked through the system and have now re-pointed those so that they will go to the agents in the first place and they will only go to the client where the agent becomes non-compliant. Or they will go to the client directly if there’s thing’s like a change in bank account number. That’s proper, that’s an updated security check.

TB

I hate to say this, but it’s one of the more common frauds I’ve encountered where the tax agent alters a client’s bank account details that refunds go into the agent’s bank account. I encountered that a number of times. So Inland Revenue is absolutely proper to be sending authorities like that to clients as well as tax agents.

Chris Cunniffe

But what they have acknowledged now is their settings were wrong. I think it was a deficiency in the new system that they’ve got that it’s not particularly geared around the New Zealand system and the way that we use agents. It is an off the shelf system. So it has needed some adoption.

But it was getting to the stage, and Terry I know you’ve been vocal on this yourself, about Inland Revenue’s engagement with clients. You and a number of others have been very vocal about this saying “This is wrong”. And I’ve I talked to an awful lot of agents and they’ve been saying to me, is there a strategy at Inland Revenue to displace the agent, to essentially disintermediate, get them out of the system?

So I put that question at the conference and the Commissioner basically got up and her opening comment was, “Let me affirm the place of tax agents in the New Zealand tax system”, which I think was music to the ears of tax agents. She then talked through the changes that have been made and the fact that they’re kind of inverting the pyramid to say our default position is we’ll engage with the agent. As an agent you can control this if you’d rather the client dealt with maybe the payroll or maybe that the GST, you can you can adapt adjust the settings to do that.

So look, that was a major success because the agent community felt like they were banging on the door and not being heard. And I think we finally had pulled all the strings together and I was very grateful to the Commissioner for her immediate response and the fact she stood there and said, “look, this is where we see agents. This is what we’re doing. We’ve got a strategy around it”. I’m hopeful that in a year’s time we’re not talking about this.

TB

So am I. And I think also the other thing was interesting about your survey, and this is something we’ve seen when business transformation first came along. A lot of agents I was speaking to were nervous about it “have we got a role in the future?” But the survey shows very much the feeling is, “yes, we definitely have a role in the future” and they are adjusting their business model to something which is more appropriate to an advisory client, helping clients with cash flow issues and using tools like TMNZ and getting ahead of the tax issue so being proactive rather than reactive. And the survey showed those results, didn’t it?

Chris Cunniffe

It did. And it’s been a theme that we’ve asked for the last couple of years, essentially for the reasons that you ask. I talked about disruption so that the model of doing a basic tax compliance programme where you do everything for your client is largely dead because the software companies have got to the stage where clients can do a certain amount of it themselves. How far the client goes along that that process is a discussion between the agent and the client. But you’re right, agents are looking to move up the value curve and be less about someone who will process a set of accounts and tell you six months or nine months after year end whether you made a profit or not, to somebody who engages with you in real time around how your business is doing.

TB

Well, I look forward to seeing the survey next year. And I think that we’ll leave it there. Going to be an exciting twelve months ahead, another release coming forward. And so the commissioner reassured us about how they were managing. So it’s a wait and see. But thank you very much, Chris, for joining us on the podcast. It’s been absolutely insightful and fascinating. I really appreciate you coming over.

That’s it for The Week In Tax. Next week will be the final podcast of the year and we’ll have a retrospective on the big events of the year. In the meantime, I’m Terry Baucher, and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Please send me your feedback and tell your friends and clients, until next week. Have a great week. Ka kite āno.

2 Dec, 2019 | The Week in Tax

- Inland Revenue’s new approach to tax investigations

- Waste disposal levy good example of an environmental tax

- How being six minutes late could cost the ATO almost $100 million

Transcript

This week, more highlights from the Chartered Accountants of Australia New Zealand Annual Tax Conference, are the proposed waste levy increases a good behavioural tax and how being six minutes late could cost the Australian Tax Office nearly 100 million dollars.

CAANZ Annual Tax Conference

Last week, I was at the Chartered Accountants of Australia New Zealand Annual Tax Conference. We heard a number of papers from Inland Revenue, including from the commissioner herself. But the one I want to focus on is on their investigations and what is the future of investigations going forward now. This was chaired by Scott Mason of Findex and Tony Morris of Inland Revenue.

Scott began by pointing out something we had noticed over the past few months – that Inland Revenue had not appeared to be very active in the investigation field and certainly wasn’t being very visible. And he raised the point that in such an environment, voluntary compliance falls and “industry practices” emerge where advisers respond to non-activity from Inland Revenue by thinking that keeping quiet is actually a valid strategy.

Tony Morris responded by acknowledging that that was an issue, but in fact, Internal Revenue after the business transformation restructure was now moving forward again. It had much more data available and understood that data better. For example, he noted that there was now potential to get the EFTPOS data for a particular industry. And then from there calculate what should be the potential cash sales for a business in that industry. The analytics were now available to determine more quickly if there were issues around non reported cash sales.

That’s something I’ve mentioned in the past. Now Inland Revenue will in some cases physically visit a business to see what’s actually going on behind the counter. So a question was then put to Tony – why not release some of this data to tax agents? This is an approach I favour. Tony replied that this can be a two-edged sword. Obviously, tax agents need to use that information proactively. But clients may not want you to know that they’re not doing that well, or that their positions are now in jeopardy, because they have been quietly salting away piles of cash unnoticed, such as the baker who got put away for nearly five years this week. He was jailed after failing to declare some six and a half million dollars in cash sales.

So Inland Revenue obviously wants to clamp down on such behaviour and identify much more quickly what’s going on. But the converse of releasing data to tax agents is that there is a risk that something might be seen as a benchmark. Therefore rather perversely it might encourage behaviour if people say “Well, if that’s the benchmark, we’ve got a bit of leeway to quietly salt away some cash”.

I think in the end the answer to this question of the cash economy is going to be what I talked about last week – the Swedish example – of fiscal control units, a centralised approach that’s already happening.

Australia and New Zealand are slightly behind the eight ball on that area of progress. But it is a matter where we could see change similar to changes we’re seeing in the rest of the world. And I would expect that Inland Revenue, with its enhanced capabilities, may decide that’s an area where it wants to move forward into.

Nudge letters

What Tony Morris talked about was Inland Revenue has developed a policy of what they call sending out “nudge” letters, which are to encourage behaviour in the right place. And these are sometimes often sent to a wide number of clients. The problem is that while that might be encouraging better behaviour at a macro level, it does cause some confusion at the micro level for individual clients who think they are already compliant. So why are they receiving notes about compliance with the automatic exchange of information, for example?

But he also revealed one or two interesting snippets. Particularly one which I think people who file their own tax returns ought to be aware of. If you’re filing your own tax return online Inland Revenue can see how you progress that filing. They will note if you are amending the expenses – this is one thing they watch very carefully. Tony Morris gave the example of someone who amended the expenses that they were claiming in their tax returns 80 times. He also noted that more often than not, early filings before the normal due dates are more likely in Inland Revenue’s experience to be fraudulent.

But he also talked about how Inland Revenue could perhaps use social media to put a message across in a very specific way. We do know Inland Revenue watches social media closely. For example, Inland Revenue might notice that a client is putting his boat into the water at Whangamata on Sunday. So the question that they might put through myIR is “how is your FBT return going?” Because FBT on twin cab utes is one of the great under-reported and probably undeclared sources of income that it might want to have a look at.

That was all very, very interesting. It gave an insight into where Inland Revenue is at, where it thinks it’s going to go, particular areas of interest to it and how it approaches these issues at a tactical level. The ability to watch what goes on in a tax return I think is fascinating and should serve as a warning for people. And how it also might possibly make more use of watching social media to then make quiet “nudges” to make sure people are compliant. Tony also made a note that the initiatives on the property area have seen the strike rate gone up astronomically since they started really looking into this area in the wake of the introduction of the Brightline test in October 2015. So that was an absolutely fascinating session from Scott and Tony.

Behavioural taxes

Another highlight of the conference was a debate about whether behavioural taxes were a good thing to have. The team arguing against included Barry Hollow of Inland Revenue. As he said, he found himself in a very unusual position for a tax policy person arguing against such taxes. His extremely witty yet insightful and funny speech carried the day and the motion was defeated. The government wasn’t listening, though, because this week it released proposals for increasing the waste disposal levy.

Now, this has caused a bit of controversy. But it is something to think about. And a point raised by the Tax Working Group is whether such a tax is a behavioural tax or just a tax grab, increasing the tax base. But the idea is to recycle funds raised. For example, half the revenue would go to councils to fund resource recovery and other waste related infrastructure. And then the remaining money would go to the Waste Minimisation Fund, which provides grants for waste reduction.

And to repeat a point I made earlier at the time of the launch of the Tax Working Group, Sir Michael Cullen talked about recycling the revenue from environmental taxes to help people transition to a lower carbon economy. Or in this case, a lower waste economy, because the amount of waste per capita New Zealand produces is extraordinary. There’s also the fact this waste disposal levy is a very good example of a behavioural tax which works.

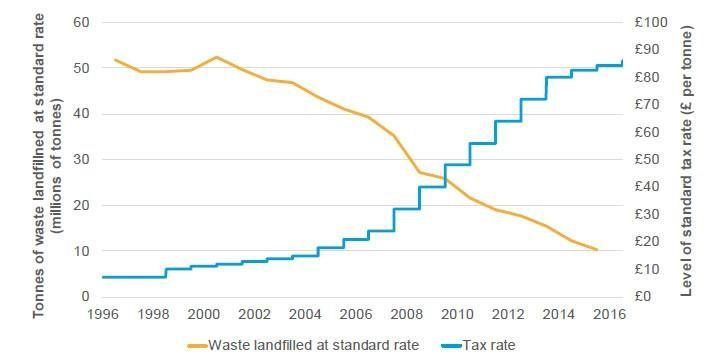

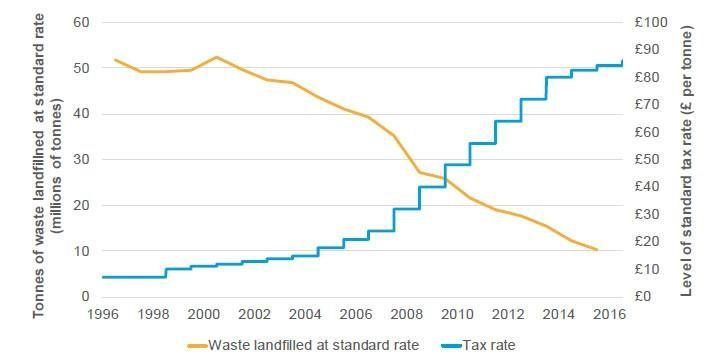

The Tax Working Group cited the example of the U.K. They raised their waste levy tax rate from £10 pounds a tonne in 1996 to £80 a tonne by 2016. But over the same period of time, the annual waste in landfills fell from 50 million tonnes a year to 10 million tonnes a year.

https://www.interest.co.nz/sites/default/files/styles/full_width/public/embedded_images/Baucher%202.jpg?itok=Cr0dx6Vj

So, you saw the tax increases achieving the desired result of lower waste And that’s something I think we really need to think about going forward. The reflex “All taxes bad, no tax is good” approach is understandable in political terms.

But you’ve got to look beyond the politics of this. If this tax is being recycled to reduce waste and we’re moving away from the use and disposal economy to reach “the circular economy” as it is called, then encouraging that is something we all need to be on board with. Because our environment in New Zealand is our key selling point. You know Stephen Colbert on The Late Show. He’s showing off the beauties of New Zealand and we have $46 billion of agricultural exports. They’re all dependent on our natural environment. So protecting them and making sure we make the best use of it and keep it free of pollution so we are green and clean is something we should all be behind.

The ATO stubs its toe

Finally from the “So you think you’re having a bad day” files, the Australian Tax Office has been forced to ask the Federal Court, the highest court in Australia, for special permission to appeal a decision it lost in the High Court, involving a A$92 million tax bill against mining giant Glencore. This is quite a significant transfer pricing case, by the way. And apparently the reason why the ATO had to find a special motion was it was six minutes late in meeting a critical filing deadline last month.

Now, schadenfreude aside, the case is a good, if extreme, reminder of the critical importance of filing tax returns and elections on time. Inland Revenue is reasonably flexible about late filed tax returns and can be persuaded to waive penalties in many cases. However, it is typically inflexible about other deadlines, such as those involving the disputes process, Notices of Proposed Adjustment, Notices of Response and elections to join the look through company regime. Ask any tax agent and I’m pretty sure we’ve all had situations where we’ve encountered delay in filing for the look through company or its predecessor, the qualifying companies.

These are really, really important and the big lesson is be aware of the timing of your elections and don’t leave it to the last minute. Otherwise, you too could be tripping up over a significant tax bill, although maybe not to the tune of 100 million dollars.

Next week, I’ll be joined by Chris Cunniffe of Tax Management New Zealand. We’ll be discussing the role of tax pooling and also the results of TMNZ’s recent survey of tax agents. Inland Revenue might not like that one too much.

Have a great week. Ka kite āno.

1 Dec, 2019 | Tax News

Inland Revenue says it is asking countries with tax treaties to share details about Kiwi hosts renting out their homes on Airbnb. by Ben Leahy

This article first appeared on the Herald.

Take care if you’re one of the thousands of Kiwis using Airbnb or other online websites to rent out a home; you could be in the crosshairs of Inland Revenue.

The Government agency has set its smart, new data robots loose on the sector in the hunt for tax cheats.

It’s also lobbying hard to get its hands on Airbnb’s company records.

It means you could be in line for a nasty letter or a fine should you have failed to report your rental income.

“Some of the records of activities, such as Airbnb, are held offshore. However we’re working to obtain this data via data-sharing agreements we have with many overseas tax authorities,” an IR spokeswoman told the Herald on Sunday.

Mike Rudd, tax director for accountancy firm Baker Tilly Staples Rodway, said the IRD publicly clarified the tax rules around short-term rentals in May, meaning there was no longer any excuse not to declare your income.

He expected a crackdown to begin in earnest at the end of the tax year.

“They will be matching up data automatically and spitting out a lot of nasty letters,” he predicted.

It’s a blitz triggered by the big money at stake.

Tax expert Terry Baucher from Baucher Consulting said people underestimate Inland Revenue at their peril

A Victoria University and IR study estimated in April that undeclared income from the so-called hidden economy was resulting in New Zealand missing out on about $800 million in annual tax. Chartered Accountants Australia and New Zealand put the figure in excess of $1 billion per year.

Builders, plumbers, and hotel and restaurant owners accepting cash payments and not declaring their income were among those initially in the department’s sights.

But bitcoin users, Uber drivers and Airbnb and other short-term rental hosts were now on notice as well.

Short-term rentals owners could get themselves into trouble by failing to declare the income they make from guests.

Those owning two or three short-term rentals on Airbnb or other platforms also ran the risk of racking up big tax debts under the goods and services tax if they didn’t fully understand the rules.

This was due to short-term rentals tending to bring in higher gross returns than normal rentals and so being more likely to earn above the $60,000 threshold at which GST must be paid.

Rudd said he had seen a number of people shocked to discover they were meant to have paid GST on their rental income as well as on the sale of homes used as Airbnb rentals.

Terry Baucher, founder of tax advisers Baucher Consulting, warned those who hadn’t declared their income that they were better off coming forward voluntarily.

If IR found undeclared tax, it would usually search back through five years of income at a minimum. If there had been deliberate tax avoidance, it could do an audit through a person’s entire tax history and may even prosecute for tax evasion.

Baucher said IR was also armed to the teeth with new data-matching capabilities having recently spent $1.9 billion – mostly on computer technology – in a major upgrade.

And the upgrade appeared to be bearing fruit already. IR’s latest annual report said that every $1 dollar spent hunting undeclared tax was now returning $5.65 to the tax coffers.

Tax data was also whizzing between New Zealand and other countries at an unprecedented rate. According to its annual report, IR received information about 700,000 financial accounts held overseas by New Zealand residents in the year to June 2019.

Baucher said he had one client use an overseas credit card to hire a campervan in New Zealand. IR saw the transaction and contacted the man, wanting to know where the cash had come from.

Baucher described IR’s ability to detect that transaction as like finding a needle in the haystack and yet it had been done using the old computer system, not the new one.

“People underestimate Inland Revenue at their peril,” he said.

The IR spokeswoman said the tax department’s first step in securing unpaid tax was to use education to encourage Kiwis to voluntarily declare their income.

This included holding regular free seminars around the country.

However, she acknowledged there was a “temptation” for users of “sharing companies” to under-report their income.

“If that happens and people choose not to report their rental income, Inland Revenue will audit them where we need to,” she said.

Airbnb head of public policy for Australia and New Zealand, Derek Nolan, said the platform partnered with the Government to ensure it could do its job, as well as with rental owners to help them meet their tax obligations.

“We support a light-touch, mandatory data-sharing framework that not only takes data privacy laws into account, but makes it easier and cheaper for New Zealanders to pay their taxes across all sharing economy platforms,” he said.

What about the bed tax?

Inland Revenue might be calling on tax robots and international treaties to ensure Kiwi Airbnb users pay up, but Auckland Council has no such tricks up its sleeve.

Council brought in a new targeted rate, also known as a bed tax, last August for homeowners renting out their whole property or guest-house on websites like Airbnb or Bookabach.

Yet about two-thirds of eligible Airbnb hosts in Auckland have so far avoided paying the bed tax.

Council said the targeted rate would capture about 3800 of the approximately 8000 Airbnb properties in Auckland. But in the latest figures, just 1219 Auckland properties advertised on online platforms had been charged the tax.

The main obstacle has been finding the properties. Airbnb and other websites refused to share information about hosts on privacy grounds, and council officials have been forced to scour the sites manually.

Council also can’t call on its big-brother, Inland Revenue, to help.

“We currently have no plans to request the online provider information from IRD,” a council spokeswoman said.

So far short-term rental owners using Airbnb and other platforms had paid $461,765 through the bed tax.

What are the tax rules?

- When a person’s rental properties earn less than $60,000 they do not have to pay GST tax. Instead they must declare their earnings as part of their income and pay income tax.

- When the properties make more than $60,000 they have to register for GST and then pay GST (15 per cent) on the rent and on any future sale of the home. A tax adviser can help short-term rental owners in this situation claim deductions against the GST and against their income tax.

- Failure to accurately report income can result in tax penalties or, in the most serious instances, prosecution for tax evasion.

26 Nov, 2019 | Tax News

1966 and all that: The chequered history of entertainers, sports stars and tax

What have William Shakespeare, The Beatles, The Rolling Stones, U2, Norman Wisdom, Richard Burton, Boris Becker, Lionel Messi, Christian Ronaldo and Bobby Moore all got in common? They are but a few of the many, very many, actors, entertainers and sports stars who have found themselves in trouble (sometimes bigly) with the taxman.

One reason entertainers and sports stars run into money and tax problems so frequently is that they work in an industry where vast sums of money can be generated practically overnight from all around the world. Consequently, musicians and bands probably have some of the most complex tax affairs outside of multinationals. It’s therefore unsurprising many engage in elaborate tax planning and it’s equally unsurprising this sometimes comes unstuck with expensive consequences.

This Top Five looks at actors, musicians and footballers who left a tax legacy as well as an artistic one. Moreover, these tax legacies remain highly relevant today.

1. “Know you of this taxation?” (Henry VIII).

Despite his colossal cultural legacy, we know very little about the real Shakespeare. We do know that between 1597 and 1600 he appears in several rolls for the “lay subsidies” for the St Helen’s Bishopgate parish in London. Lay subsidies were a form of local wealth tax on local householders. The lay subsidy roll contained an estimate of a person’s wealth and the amount assessed.

It appears that in 1598 Shakespeare defaulted on his lay subsidy for the year of 13 shillings and four pence. It’s not known whether this debt was ever paid but since about this time he bought into the Globe Playhouse for £70, he was surely not short of money. This has led to much conjecture about whether Shakespeare was one of the first known tax avoiders of the entertainment industry.

Like so much else about the man, we’ll never know the truth about Shakespeare’s finances. I can’t help but wonder if the quip in Henry VI“The first thing we do, let’s kill all the lawyers” might reference some dud tax advice he received.

2. From Abbey Road to Exile on Main Street.

It appears The Beatles were pioneers in tax planning for musicians. Very early on in their career they were introduced to accountant Harry Pinsker who specialised in the entertainment area. (Pinsker’s first reaction was that “they were just four scruffy boys”).

One of Pinsker’s recommendations was a songwriting company Lenmac through which their earnings would be channelled. He successfully argued the company’s income should be taxed as trading income rather than investment income which would have incurred higher taxes.

Even so, the very high tax rates of the mid-60s (more than 90%) prompted George Harrison to write Taxman.

“One, two, three, four, one, two

Let me tell you how it will be

There’s one for you, nineteen for me

‘Cause I’m the taxman, yeah, I’m the taxman”

Pinsker ultimately suggested the formation of Apple Records as a tax effective means of managing the band’s revenue. His efforts did not go unnoticed by the Beatles. During rehearsals of their final album Let it Be, the band started singing Harry Pinsker instead of Hare Krishna.

The Rolling Stones weren’t as well managed as The Beatles and in 1971, facing huge tax bills, they moved to the south of France where they recorded one of their greatest albums: Exile on Main Street. The title was a deliberate reference to their tax exile.

Having also fallen out with Decca Records and their manager Allen Klein, the band took control of their affairs at this time by forming their own record company. They also established a Netherlands company to shelter their income. This started a trend which other bands including U2 would follow.

The Rolling Stones move into tax exile didn’t attract much criticism at the time, perhaps because the rates of tax they then faced were so high. Forty years on attitudes have changed.

U2 were in town recently and their tax practices have drawn increasing criticism. Lead singer Bono has been accused of hypocrisy after he was linked to the Panama Papers.

In 2015 Bono and U2 were criticised for making changes to shift royalties through the Netherlands to take advantage of a special concession. Now it appears this concession is ending.

If U2 still haven’t found the perfect tax structure they were looking for, The Rolling Stones should remind them “You can’t always get what you want.”

3. The slapstick clown with a tax lesson for crypto-asset investors.

The British comic

Sir Norman Wisdom rose to fame in the 1950s playing a hapless but good-natured incompetent who somehow through a combination of slapstick humour and good fortune saves the day.

Contrary to his clownish on-screen character, Wisdom was a very shrewd investor, and this ultimately resulted in one of the more notable and still influential tax cases of the 1960s.

In 1961 Wisdom invested in silver ingots as a hedge against a possible devaluation of the British Pound, eventually realising a profit of £48,000 (about £800,000 today). At a time of very high personal tax rates Wisdom claimed the profit was a tax free capital gain (the transaction occurred prior to the introduction of capital gains tax in Britain).

Wisdom won in the High Court but in 1968 the Court of Appeal in Wisdom v Chamberlain (Inspector of Taxes) determined that the transaction was in the nature of trade and therefore taxable. Wisdom paid the tax due and outraged by the high taxes then went into tax exile in the Isle of Man where he lived until his death in 2010.

His case is often cited when considering whether a transaction is of a revenue or capital nature. In 2017 Inland Revenue cited it in a “Question We’ve Been Asked” on whether the proceeds of the sale of gold bullion would be income. (The short answer is almost certainly).

Inland Revenue also consider some crypto-assets to have similar characteristics to bullion. It is therefore probably only a matter of time before some crypto-asset investors will need to acquaint themselves with Wisdom v Chamberlain and Norman Wisdom’s unwilling tax legacy.

4. Gone for a Burton.

Richard Burton was probably too busy being one of the great actor hell-raisers of the 1960s to be paying attention to the price of silver bullion. Yet, he too has left a tax legacy, one of particular relevance to many of the thousands of Britons currently living in New Zealand.

Burton became a tax exile in the late 1950s after taxes had reduced his earnings of £82,000 for 1957 to £6,000. (Allegedly he subsequently remarked “I believe that everyone should pay them [taxes] — except actors.”) Burton moved to Switzerland where he lived until his death in 1984.

Burton was buried in Switzerland, apparently in a red suit together with a copy of Dylan Thomas’ poems. However, many years earlier when he was married to Elizabeth Taylor, Burton had acquired two burial plots for himself and Taylor in the Welsh village where he had been born. And this proved extremely costly for Burton’s estate.

Inland Revenue argued successfully that the presence of the burial plots together with his Welsh themed funeral meant that Burton had never lost his UK tax domicile. Accordingly, his estate worth just over £4 million had to pay a total of £2.4 million in Inheritance Tax.

In my view Inheritance Tax represents the greatest tax risk to anyone either born in the UK or who owns assets situated there. The lesson from Richard Burton’s death is that Inheritance Tax could still apply many years after a person has left the UK.

5. England, One; HM Inspector of Taxes, Nil.

November 22 was the anniversary of when England won the Rugby World Cup in 2003. In the wake of England’s unexpected defeat by South Africa I saw a perhaps rather too gleeful tweet asking if 2003 was destined to become English rugby’s equivalent of England’s sole football World Cup win in 1966.

On the other hand, the RFU’s Treasurer possibly breathed a sigh of relief after the final as apparently the squad stood to win bonuses totalling over £6 million.

Anyway, back in 1966 the English Football Association rewarded its world cup winning squad with £1,000 each. (About £15,000 in current terms or only 30% of the English Premier League’s current AVERAGE weekly wage of £50,000). Enter the Inland Revenue stage right in the form of HM Inspector of Taxes Mr Griffiths. He considered the amounts paid to England’s captain Bobby Moore and cup-final hat-trick hero Geoff Hurst were taxable as they formed part of their remuneration.

The case finally reached the High Court in 1972 where Mr Justice Brightman ruled the £1,000 payments were non-taxable as they had the “quality of a testimonial or accolade rather than the quality of remuneration for services rendered”. A convincing one-nil win then.

Other footballers haven’t fared so well against the taxman: Lionel Messi and Christian Ronaldo are unquestionably two of the greatest players of this generation, but their tax planning has not matched their sublime footballing skills. In 2017 Messi had a 21-month jail sentence for tax fraud commuted to a fine. This was in addition to a voluntary €5m “corrective payment” he and his father had made in August 2013. Earlier this year Ronaldo was fined €18.8 million for tax evasion and given a suspended 23-month jail sentence.

5B. Beware the Ides of…November?

Finally, 22nd November, was also my father’s birthday. It’s actually a pretty momentous, if not infamous, day in history. Most notably in 1963 when President John F Kennedy was assassinated (with both Aldous Huxley and C.S. Lewis also dying on the same day the obituary writers had a very busy day). Charles de Gaulle was born on this day in 1890 and Angela Merkel became German Chancellor in 2005.

There’s a tax connection in convicted tax evader and serial tax exile Boris Becker who was born on this day in 1967 and the obligatory Kiwi connection is the death in 1982 of the pioneering aviator Jean Batten.

Lastly, Margaret Thatcher resigned on this day in 1990 (as a result of, you shouldn’t be surprised to hear, a Conservative Party split over Europe). This was not only a pretty funny 60th birthday present for Dad but also something of a rich irony as he was a staunch Thatcher supporter. Miss you Dad.