Special edition looks at the tax measures in today’s $12.1 billion stimulus package

- Depreciation on buildings restored

- Low value asset write-off limit increased to $5,000

- Residual income tax threshold raised to $5,000

- Inland Revenue to have discretion to write off use of money interest

Transcript

The Government has released details of its COVID-19 support package and I’m here to discuss the four specific tax measures which form part of that response.

These measures are a mixture of giving immediate relief to taxpayers, who are going to be feeling the pain right now. They are also hoping to encourage investment activity going forward as the eventual recovery takes place.

There were a few surprises in this with the big surprise being the reintroduction of depreciation on commercial and industrial buildings. And this includes hotels and motels. So clearly this is of interest to a sector, the tourism sector, which is going to take a very significant hit as this COVID-19 pandemic continues.

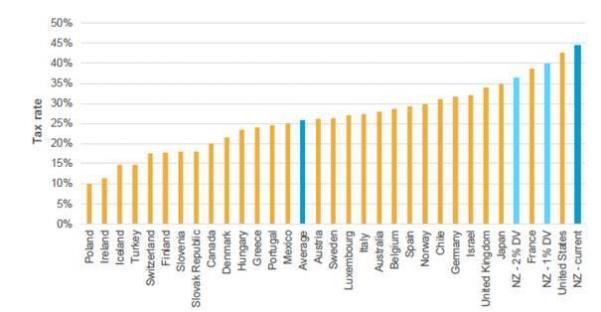

The proposal is that depreciation will be reinstated for those buildings, and a diminishing value rate of 2% is proposed. (They’re working on the straight-line rate and hadn’t yet finished the actuarial calculations on this).

And quite apart from this welcome measure for industrial buildings it also means the capital cost of seismic strengthening will now be depreciable. This has been a sore point for many building owners for quite some time. And in my view, it is a matter that it should have been addressed some time ago.

But leaving that aside, it is an incredibly welcome move to see the depreciation restored in general for commercial industrial buildings and acknowledging that this would include the capital cost of seismic strengthening. It’s worth noting as well that this was one of the recommendations of the Tax Working Group. They suggested that they couldn’t really see any valid reason to continue the policy adopted in 2011 of stopping depreciation on industrial and commercial buildings.

Looking back on the papers from that 2011 Budget, the impression I gained was that that measure was one which was designed to actually balance the books and wasn’t really driven by anything around the fact that there was no economic depreciation going on. Quite clearly buildings depreciate and need replacing. That was true then and it’s true now so it’s simply great to see such a measure.

It’s an expensive measure, estimated to cost $2.1 billion over the forecast period to the 2023/24 fiscal year. I know from business owners and those with property investments in this sector that this will be very, very welcome. The legislation will obviously be rushed through shortly and it is intended to take effect from the start of the 2020/21 tax year, which for most people is April 1.

Also extremely welcome for taxpayers is the proposal to increase the low value asset 100% write off. This is something the small business sector has frequently requested.

This measure contained a surprise in that the level will be increased from $500 to $5,000 for the 2020/21 tax year before falling back to a new increased level of $1,000 with effect from the start of the 2021/22 income year and going forward.

The current $500 threshold has been in place since 2005 if memory serves right. So it was long overdue for an increase. The one-off increase to $5,000 follows a measure the Australians did a couple of years back. This is again extremely welcome. It will encourage investment, but it also greatly simplifies small businesses’ compliance costs.

The measure is estimated over a four-year period to cost $667 million. That’s not as much as I had thought, given that Inland Revenue and Treasury had been previously reluctant to increase the threshold. Again, a very welcome measure. The $5,000 is a bit of a surprise, but again, it’s a good opportunity for businesses once they come through what is going to be frankly, a pretty rough few months. No one’s sugarcoating that but looking ahead they may take the opportunity to upgrade their equipment and invest in new plant and machinery.

Small businesses and individual contractors and the like will welcome the decision to increase the provisional residual income tax threshold from $2,500 to $5,000. And that means with effect from the 2020/21 tax year that basically enables those taxpayers who meet that threshold will be able to defer paying their tax for the coming tax year to basically February 7, 2022.

The final specific tax related measure gives the Commissioner of Inland Revenue discretion to write off and waive interest on late tax payments for taxpayers who’ve had the ability to pay tax “adversely affected” by the COVID-19 outbreak.

Now the use of money interest rate is currently 8.35% and surprisingly, no announcement was made about reducing that rate. I think officials were of the view that that can wait till the regular review, which must happen now in the wake of the OCR cut we had on Monday. So, we probably will see very shortly the use of money interest rate on unpaid tax come down and that will be of help to taxpayers as well.

This is actually applicable from February 14 and it covers all tax payments, which includes provisional tax, PAYE and GST due on or after that date. Taxpayers who are struggling to meet those payments will be able to apply to Inland Revenue and say, ‘we are struggling here as a result of the COVID-19 outbreak’. The requirement is for a “significant” fall which is defined as approximately 30%.

This initiative is going to last for two years from the date of enactment of the announcement unless it’s extended by an Order in Council. So that’s good news. I’ve already had a few inquiries from clients about what do we do when we’re struggling to meet payments. And this is a very welcome relief.

Incidentally, although not specifically mentioned in the announcements, by implication, the late payment penalties and late filing penalties are already going to be suspended as part of this measure to help businesses. Again, a good measure. My longstanding view is that the late payments system does not work and should just simply be scrapped. Hopefully we’ll see something major on this later this year. For the immediate time, suspending use of money interest is a very welcome step.

Just briefly on the other announcements, obviously the leave and self-isolation support and the wage subsidy schemes for small businesses, are going to be very welcome. These schemes apply to independent contractors, so that’s going to be a great deal of relief and take off some of the pressure for them. And for all small businesses, we’ll be looking at the question of what do we do about self-isolation if key staff were taken out of work. This will help considerably.

Interesting point which has also happened and has gone a bit under the radar, is that for working for families, there is an in-work tax credit, which is a means tested cash payment of $72.50 per week. This was only available to families that who are normally working at least 20 hours a week if they were sole parents, or 30 hours a week if couples. The hours test has now been removed, so about 19,000 low income families are going to benefit from that change. And I know the advocates of Child Poverty Action Group, they’re very pleased at what’s in this package with the help for low income families and beneficiaries.

I’ll have more on this week’s tax events with my regular podcast on Friday. But in the meantime, that’s it for this special edition of the Week in Tax.

I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Please send me your feedback and tell your friends and clients. Until next Friday have a great week. Ka kite āno.

The Cullen TWG final report therefore recommended the Government consider restoring depreciation deductions for buildings “if there is an extension of the taxation of capital gains”. Alternatively, the reinstatement could be on a partial basis either for seismic strengthening, multi-unit residential buildings or maybe industrial, commercial and multi-unit residential buildings.

The Cullen TWG final report therefore recommended the Government consider restoring depreciation deductions for buildings “if there is an extension of the taxation of capital gains”. Alternatively, the reinstatement could be on a partial basis either for seismic strengthening, multi-unit residential buildings or maybe industrial, commercial and multi-unit residential buildings.