Inland Revenue launches its tax toolbox for tradies to improve compliance in the construction industry

- The Government introduces a surprise fringe benefit tax exemption

- The potential implications for New Zealanders from the UK’s Spring Budget

Inland Revenue has now formally launched its campaign to improve tax compliance in the construction industry, which I first mentioned a couple of weeks back. Under the heading, “Take the stress out of tax” it is promoting a tax toolbox for tradies.

This is intended to provide the rules, resources and tools to enable people to get their tax position correct. Proclaiming “We’re here to help”, there’s a series of pre-recorded online seminars covering the most common topics, such as an introduction to business, a GST workshop and employers’ responsibilities. There’s also offers for more direct contact, such as a business advisory or social policy visit. And then there’s a reminder that people can also talk to tax agents or use accounting software to, “take the pressure off.”

The background notes released comment that 42% of construction industry taxpayers who are behind either in tax payments or in filings have a tax agent. So, the role of tax agents is seen as important and obviously Inland Revenue is hoping that the role of agents will expand.

There’s also a reminder that Inland Revenue has access to data, which, as it puts it, means “We have a good handle on what happens in the construction industry”, adding it’s never too late to do the right thing. And it goes on to suggest people should come forward if they’ve forgotten some income of past tax returns or maybe have overinflated their expenses.

This is a welcome initiative by Inland Revenue. The phrasing of the campaign “Take the stress out of tax” is a classic example of speaking softly but carrying a very big stick. My view is that too many people either underestimate or are unaware of just how much data is available to Inland Revenue. This campaign phrasing also touches on something of a paradox I’ve experienced when dealing with clients with tax arrears. They’re often relieved to discover after discussing the matter the position is nowhere near as bad as they had feared, and they can now sleep easier. And I expect I’m not the only tax agent to have observed that.

It will be interesting to see the outcomes from the campaign. And as always, we’ll keep you updated with developments.

Exemption from FBT for bicycles, e-bikes, e-scooters … and mobility scooters

Now, two weeks back, I discussed the so-called apps tax. This is part of the Finance and Expenditure Committee report back on the Taxation Annual Rates for 2022-2023 (Platform Economy and Remedial Matters) Bill (No.2). The updated bill included some provisions around the proposals to charge GST on services supplied by the likes of Uber and Airbnb. The bill also included clarifications to a proposed fringe benefit tax exemption for the use of public transport.

As part of the bill, over 400 submitters, including myself, made submissions proposing some form of FBT exemption for e-bikes and e-scooters. The officials report declined the submissions commenting,

“Our overall conclusion is that a specific FBT exemption for bicycles would increase the distortion between the taxation of transport benefits and other fringe benefits, reducing the overall fairness and coherence of the tax system and giving rise to integrity risks, impacting on the fiscal cost.

If Parliament wanted to increase the uptake of cycling to help achieve improved health outcomes and assist New Zealand to achieve emissions reductions, it would instead recommend a more transparent and potentially targeted subsidy specifically designed to achieve considered policy outcomes.”

This is Inland Revenue’s boilerplate for “Nah, go away. We don’t like subsidies and special tax exemptions.”

That was then. But in what has become something of a pattern following Chris Hipkins’ elevation to Prime Minister, this week the Government has released a Supplementary Order Paper for the bill, which now introduces an exemption from FBT for bicycles, e-bikes, e-scooters and mobility scooters.

According to Revenue Minister David Parker the Government “considers that there is a public good to be gained from encouraging low emission transport” and “This measure will support New Zealand’s shift to more sustainable transport options and encourage employers to provide further sustainable and climate-friendly transport options for their staff.”

The bill includes a regulation making power which would specify the maximum cost of the exemption and the specifications to qualify. When I made my submission, I suggested a cap of about $4,000 should apply. It will be interesting to see what will be the maximum available under the exemption and how many employers make use of it, which will come into force on 1st April.

An English Budget and why it’s interesting here

On Wednesday night, the British Government unveiled its Spring Budget. This is a far less dramatic affair than the Autumn Statement last September, just after the Queen died, which led to the downfall of Liz Truss. This time the Chancellor of the Exchequer (Finance Minister) Jeremy Hunt has gone for something rather more cautious in its approach with one or two twists.

I was actually surprised there weren’t any moves around restricting the availability of non-residents to make use of the Personal Allowances exemption, or just generally increase the taxation of non-residents. That’s something I’ve seen other countries do. Australia is a very good example of where that happens. A cynic might say that’s because some of those non-residents are Conservative Party donors. But cynicism aside, given the financial pressures that the British government faces, not kicking over the stone and looking, is a bit surprising,

For example, there weren’t any changes to the controversial non domiciled or “Non-dom” scheme which gives a tax advantage on foreign income for people who are not tax-domiciled in the UK (including Prime Minister Rishi Sunak’s wife). (Most New Zealanders would qualify for this exemption).

But what has perhaps attracted a fair bit of interest here was an excellent proposal, to provide and support up to 30 hours each week of free childcare support for working parents with children now aged between nine months and three years. Basically, free childcare will be available from between the ages of nine months and when children go to school. The National Party has recently announced proposals boosting childcare access.

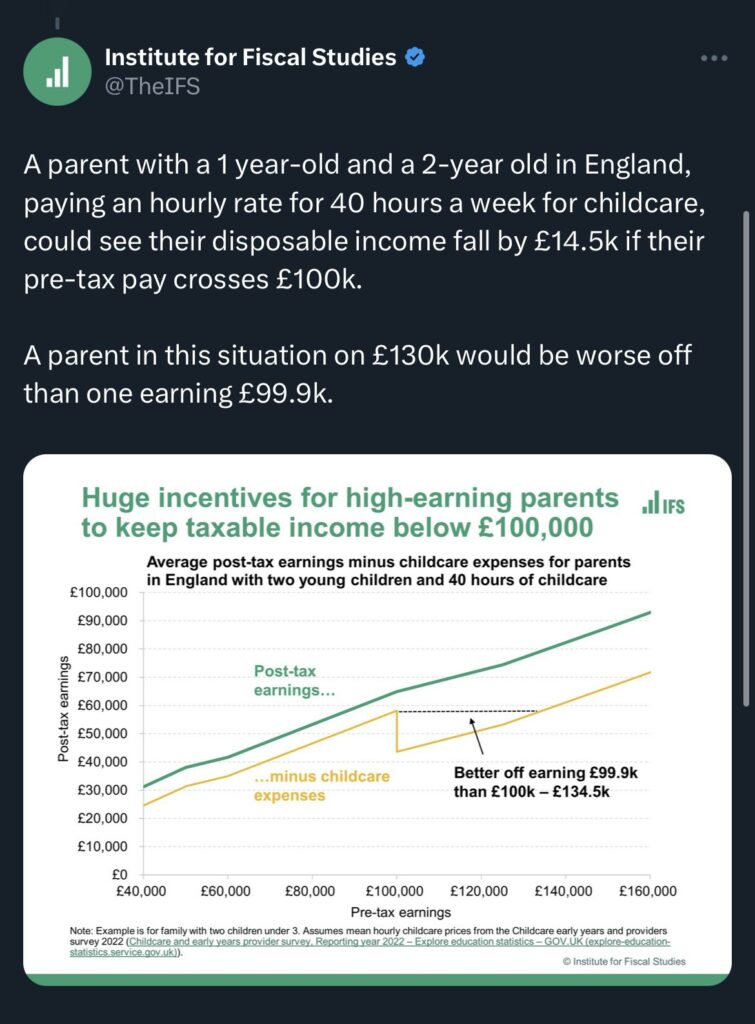

There is a kicker to this in that it’s not available to anyone whose adjusted income is above £100,000. Basically, if someone earns more than £100,000, then all of those childcare costs they might have received are clawed back. Essentially, they don’t get back into the same net position until their income rises to £191,000. A 100% effective marginal tax rate will apply.

Now, you might well say, and I have to agree with you, that income of over £100,000 is a nice problem to have. However, it highlights a similar issue we have in our tax system in relation to clawback of Working for Families tax credits that effectively people on what modest incomes face higher than expected marginal tax rates. The clawback kicks in at a rate of 27 cents per dollar of income above $42,700.

I would hope whoever’s in Government will look seriously at this question of the clawback, the amount applicable and the threshold.

Of more direct interest to some New Zealanders is a change to what is known as the Lifetime Allowance Charge. Now, this is a controversial move that was brought in some years back because Britain has generous tax exemptions for pensions contributions. Consequently, some had accumulated very substantial pension pots tax free. To counter this, the Lifetime Allowance Charge was introduced, which imposed a charge which could be as high as 55% where the accumulated funds were above a threshold (£1,073,100).

The Lifetime Allowance Charge will be removed from 6th April and will be abolished in a future finance bill. Apparently up to 1.4 million people were caught by this. I know of several clients within this group. So they were considering their options about when and how to withdraw funds from their UK pensions. The removal of the charge means they may wish to reconsider their options.

But the other thing that was particularly interesting to me is, and I think for our economy at wide was the decision to allow full expensing for capital assets acquired up to £1 million per year. Under this “Investment Allowance”, a first year allowance of 100% will be available up to the £1 million threshold. The idea is to encourage investment.

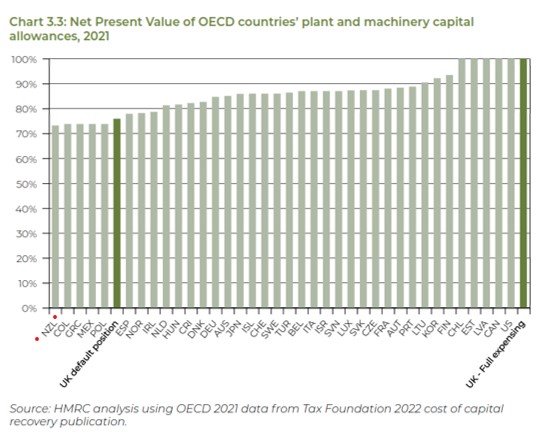

This is a topic that comes up in discussions down here. But what caught my eye was a graph produced as part of the background papers showing the net present value of all OECD countries plant and machinery capital allowances as of 2021.

As you can see under the present previous tax treatment, the UK would have been 33rd in the OECD. By going to full expensing, it moves up to be jointly top of the OECD. However, what caught my eye is that New Zealand is bottom of the OECD.

The question therefore arises whether we ought to be looking at our capital allowances regime. A similar type of initiative would be expensive, there’s no doubt about that. That’s one of the main reasons cited against such initiatives. But on the other hand, Britain has made this move because it wants to boost productivity and we know we’ve got problems with productivity.

So, here’s another challenge for the Finance Minister, Grant Robertson, to be considering right now. How do you boost our productivity? Is something similar to the UK investment allowance worth considering? We will see how that plays out in the UK. I see speculation about what might be in our budget in May is already emerging. Increasing capital allowance deductions is something I’m sure is under consideration. However, I’m also, to be honest, sceptical that we’ll see anything in the Budget.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!