11 Jul, 2022 | The Week in Tax

- IRD targets overdue tax debt

- GST on directors’ fees

- RBNZ analyses housing

Transcript

Inland Revenue has begun taking more action on outstanding tax debt. It dialed back how hard it was pushing on overdue tax debt during last year in the wake of Covid-19. But in recent weeks, its activity has stepped up, and those involved with corporate reconstructions are seeing much more activity with Inland Revenue pursuing tax debt.

There are some reports that it’s particularly targeting the housing and construction sector, but that’s not necessarily the case, as I understand it. But the housing and construction industry has a record of nonpayment. Inland Revenue is particularly concerned about those companies or individuals not keeping up to date in relation to their GST and PAYE obligations. Inland Revenue’s longstanding view is that such receipts are held on trust (because they’re being withheld from the payees) and therefore the companies have no right to the payments and need to pass them straight through to Inland Revenue.

An Inland Revenue spokesperson confirmed they were taking more action adding “We give high priority to any business that has failed to pay employee deductions when due.” In the past Inland Revenue sometimes seemed quite extraordinarily slow in taking action with overdue PAYE. But if it’s boosted its efforts in this space that’s all well and good because following Gresham’s law, bad money drives out the good. And those conscientious employees and businesses that follow the rules and make the payments as required are being undercut by more unscrupulous operators.

In that context, what I’ve been told is that Inland Revenue is also upping its efforts in relation to developers who are claiming GST on land purchases, but then failing to declare the GST when they make the subsequent sales of the properties. In some cases, you also have what they call “Phoenix companies” where there’s a pattern of developers establishing companies which then fall over leaving unpaid tax debts. Inland Revenue got itself extra powers to try and deal with those matters. And I would expect that with its enhanced capabilities following completion of the Business Transformation programme, Inland Revenue should be on top of that situation.

As always with tax debt the key thing to do if you run into trouble, is talk to Inland Revenue. It is actually surprising how little tax debt can soon become unmanageable for people. Inland Revenue’s own research suggests that break point is as little as $10,000. This ties in anecdotally what I’ve seen.

The key thing is, if you get in front of Inland Revenue early, tell them that you have hit difficulties and want to arrange an instalment plan, they will be cooperative. Where they won’t be cooperative, and in fact they may look to take action and prosecute, is where someone persistently fails to meet their obligations in relation to paying over PAYE and GST and then tries to evade any responsibility by attempting to liquidate the company. Such scenarios increasingly will lead to prosecutions by Inland Revenue.

People will be surprised at how reasonable Inland Revenue can be. But to do so you have to be front up early, put all your cards on the table and you can then hope to get a reasonable hearing. Sometimes it doesn’t work out, but you would be surprised at how often these issues can be resolved.

And this also takes the stress away from people, employers and business owners who get into tax trouble quite naturally stress about the matter and often put their heads in the sand. It’s remarkable how much of a difference to stress levels it makes once you’ve spoken to Inland Revenue, and you find is this they are prepared to come to some form of arrangement. That’s dependent on a number of factors, the key factor being willing very early on to deal with the issue.

GST for directors’ fees

Moving on and still talking about GST, Inland Revenue has released some draft guidance for consultation on the treatment of GST for directors’ fees and board members’ fees. This covers a number of draft public rulings and is accompanied as well by a very useful fact sheet. I’m liking how Inland Revenue is sending out a lot of these fact sheets alongside the longer papers with detailed consultation, because the fact sheets of what you can put in front of clients as they are a good summary of the issues.

The rulings will cover directors of companies, board members not appointed by the Governor-General and board members appointed by the Governor-General or the Governor-General in Council. Basically, what the rulings say is board members or directors must charge GST on the supply of services where the director or board member is registered or liable to be registered for a taxable activity that they undertake, and the director or board member accepts a directorship or membership of a board in carrying on that tax taxable activity. Remember, liable to be registered means they are carrying out taxable supplies which over a 12-month period would exceed $60,000.

And the director or board member cannot charge GST on the supply of services where they are engaged as the director or board member in their capacity as an employee of their employer or they’re engaged in in that capacity as a partner in a partnership, or they do not accept the office as part of carrying on a taxable activity.

As I said, these draft rulings are accompanied by a fact sheet, which includes a very handy flowchart, these flow charts and fact sheets makes life a lot easier and more understandable for those affected. The proposed rulings are reissues of previous rulings on the matter. They’re fairly uncontroversial as they generally are simply restating the law, updating the statutory references and setting it out in a clearer and more understandable format for the general public.

Tax take up strongly

Now, this week, the Treasury released the government’s financial statements for the 11-month period ended 31st May 2022. And it all looks a lot better than what was being forecast in May’s Budget. Core tax revenue is $2.9 billion ahead of forecast just at just under at $98.9 billion. Now, the main reason it’s ahead of forecast is a higher than expected corporate income tax take which is $1.6 billion ahead of forecast. There’s also more tax from individuals which is $700 million ahead of forecast and PAYE collections are another $600 million ahead of the Budget forecasts.

The corporate income tax take for the 11 months of the year to date is just under $17.9 billion compared with a forecast $16.2 billion. Just for comparison, in the year ended 30th June 2021, the total corporate income tax take was $15.7 billion. So corporate profits look strong, and I think one or two economists might be pointing to whether that might be feeding inflation. But whatever its role is, I’m sure the Government will be grateful for the continued strong growth in the corporate income tax take. By the way, that increased corporate income tax take will also reflect the fact that the New Zealand Superannuation Fund will be paying substantially less tax this year than in 2021 because of the volatility in the financial markets.

Favourable winds for windfall taxes

Elsewhere in the world President Macron in France is under pressure to consider a windfall tax on some parts of the corporate sector where high energy prices have resulted in higher profits. Britain, you may recall, imposed a windfall tax on some oil companies, although it’s come with a potential subsidy which may dilute the impact of that. Windfall taxes have no real history in New Zealand, so are unlikely to happen here. But it is to see how other jurisdictions are reacting to questions of what they perceive as excessive profiteering.

Housing’s tax-free advantage

And finally, this week the Reserve Bank of New Zealand issued an Analytical Note on how the New Zealand housing market looks in the international context. What it does is compares facets of the housing market in New Zealand with those in 12 other developed countries[1] over the 30-year period from 1991 to 2021.

And it notes that several other economies, Australia is one, have experienced increasing house prices in recent years, but the rate of increase has been the highest here. Interestingly we have also seen the steepest decline in mortgage rates since the Global Financial Crisis and then almost the strongest increase in population. Apparently, although we’ve been ramping up construction quite dramatically in the past few years, the number of dwellings per inhabitant remains low and below the average for the OECD.

There was some mostly passing commentary in the note about the impact of tax. The paper does touch on the absence of a general capital gains tax commenting:

“Another feature of the New Zealand economy that may support higher housing demand is the absence of a comprehensive capital gains tax. New Zealand is unique in that aspect in the sample of countries we consider, fiscal authorities in other countries tax capital gains from asset sales at or close to the personal income tax rate.”

Being an analytical note, it doesn’t make any recommendations as to whether there should be increased taxes on housing, although the OECD has been for a long time pushing that point. It’s always interesting to consider the role of tax in our housing market and also whether the absence of the fact that housing is treated so generously for tax purposes means that investment is driven into that rather than into more productive sectors.

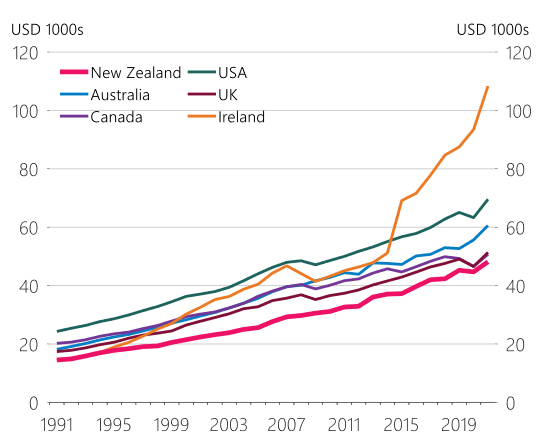

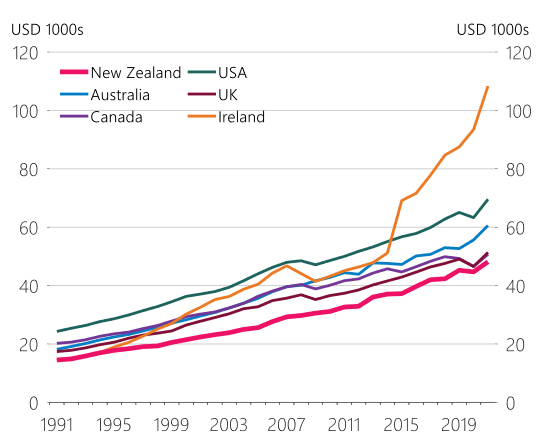

On that point, there’s a very interesting graph illustrating the surge in Irish GDP per capita over the last ten years or so, it’s really quite marked. The note comments that this surge

“was supported by high-performing multinational companies that relocated their intellectual property assets to Ireland attracted by lower corporate tax rates [12.5%] as well as Brexit-related uncertainty in the United Kingdom.”

Figure 4: per capita GDP in US dollars at current PPP

This Reserve Bank note reinforces my long held view that our favourable tax treatment of housing does divert funds away from productive investment and we need to change that treatment. As previously stated, my preference is for the Fair Economic Return approach Susan St John and I have proposed. .

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week.

2 Jun, 2020 | The Week in Tax

- A controversial extra relief for the newly unemployed

- Are redundancy payments overtaxed; and

- Record numbers apply for instalment arrangements with Inland Revenue.

Transcript

According to a Statistics New Zealand report this week, job numbers dropped by a record 37,500 in April. This is the worst fall in employment on record. So naturally, the Government is still under pressure to ameliorate the impact of these job losses.

And its latest measure is a special relief payment beginning on 8th of June. From that date, anyone who has lost their job since March 1st because of the Covid-19 pandemic will be paid $490 a week for anyone who lost full time work and $250 per week for losing part time work. These payments will last for up to 12 weeks and will not be taxed.

Now, the scheme announced is similar to the Job Loss Cover payment introduced by the National Government in the wake of the Canterbury earthquakes in 2010 and 2011. It also has a number of similarities to the ReStart package for workers who lost their jobs in the Global Financial Crisis in 2008. So these are undoubtedly welcome measures for those affected.

The controversy has arisen because beneficiary advocates have pointed out it appears to discriminate against the existing unemployed people. Furthermore, the fact that the payment that is being received of $490 dollars per week is almost double the $250 a week (after tax) that someone on the current Job Seeker payment would receive, implicitly acknowledges that the current level of benefits being paid is too low. This is a point that was made by the Welfare Expert Advisory Group report last year, which actually recommended benefits be increased at a cost of over $5 billion.

One of the other features, which beneficiary advocates might question, is that people who qualify for this payment but have partners who are still working may still be eligible for the payment so long as their partner is earning under $2,000 per week. Anyone who’s been involved with the existing treatment of beneficiaries will know that there are often very harsh cases coming into play where a couple’s income is aggregated, and that benefits are often struck down because a person has formed a relationship or is deemed to have formed a relationship during the period.

So the gap between the generosity of this new measure and the existing rules is quite marked and has drawn criticism. How that will play out is largely a political matter. But it points to something that I’ve talked about previously – we do need to look at our welfare settings and particularly the interaction with the tax system.

Unusually, these payments are not being taxed, whereas benefits are actually taxed. Now, the net effect is intended to be the same, but still it’s an interesting distinction. So whether it points to – as has been hinted at – there’s going to be some further changes and significant changes at that, in the benefits and welfare system remains to be seen.

For the moment, the important thing is for those who are directly affected now, this new payment will come as a relief for them as it’s intended to do so. And leaving aside the politics of it all, we shouldn’t be scapegoating those who’ve been unfortunate enough to be affected by the scale of the pandemic. Let’s look to try and improve the system for everyone, but don’t blame those who are caught up in it right now.

Speaking of redundancy, this week, I spoke to Madison Reidy of Newshub about the tax treatment of redundancy. Currently, redundancy is treated as a extra pay for tax purposes, subject to pay as you earn and taxed at normal rates. That is, it’s fully taxable to the recipient. The PAYE that’s applied is based on the combined total of the redundancy and the annualised value of the PAYE paid to an employee in the previous four weeks.

Now, as Madison and I discussed, the tax treatment of redundancy is pretty harsh. Actually it’s harsh in two ways. Firstly because it’s taxed at a time when you may have to be reliant on it for an unknown period of time. The second point is that for some people the lump sum may be taxed at a higher average tax rate than would normally apply to them. This would be particularly true of lower income earners, say, earning around the $48-50,000 mark, where most of their income is being taxed at 17.5%. They may receive a redundancy payment which would be taxed at 33 percent. And the current system makes no concession for that.

It hasn’t always been the case. But our tax rules have been pretty hard on redundancy since 1992 when the rules were changed and redundancy became fully taxable. There was a period between 2006 and 2011 when a credit was given up to a maximum $3,600. But that was withdrawn in April 2013. Ironically, it was going to be withdrawn from April 2011, but then got extended for a further period to 1st of October 2011 following the Canterbury earthquakes.

But the treatment of redundancy seems harsh compared with what happens across the ditch in Australia, where the first A$10,638 dollars is tax free. And then A$5,320 dollars per year of service is also treated as tax free. So substantial payments can be received and, depending on the length of service, may not be taxed in Australia at all. It does have to be redundancy. Accumulated leave and sick leave would be subject to tax in Australia. Over in Britain, the first £30,000 of redundancy is tax free.

It seems to me that we ought to be looking at this question of redundancy and whether, in fact, the rules are appropriate. There’s going to be a lot of redundancy paid out over the next few months. We haven’t seen the full impact of the pandemic on employment yet. And therefore more people, sadly, will be losing their jobs. And at the moment, they’re going to get hit very hard with the tax on their redundancy and that’s going to cause some grievances.

Yes, that new temporary relief payment that has just been announced will help. But I can’t help but wonder whether it would probably be easier for people if we weren’t so aggressively taxing redundancy in the first place. Unfortunately, rather cynically as I told Newshub, Governments have always said they’d look at this, but nothing ever changes.

As an aside, the treatment of lump sum payments under PAYE is a problem not just for redundancy. Retiring allowances are treated the same way. And most egregiously in my mind, are ACC payments. Sometimes people get in a dispute with ACC over the amount that’s due to them. When those disputes are resolved in their favour, then ACC may make several years of payments all at one go. These are just simply treated as an extra pay and taxed as if it is the recipient’s normal income income.

What that might mean is say, for example, four years arrears at $20,000 a year or $80,000 might be taxed all at once,. The average tax rate which would apply on this payment is therefore much higher than would have applied if the person had received the payments when they should have done. This is a running sore in ACC, which again, governments have talked about changing but not followed through.

And finally, Inland Revenue is reporting a massive jump in the number of people applying to pay their tax off in instalments.

According to Inland Revenue, in March 2020, there are 104,443 payment instalment arrangements in place, compared with 41,014 in March 2019. The amount of tax that’s under instalment has gone from $659 million to $1.167 billion. I suspect this number will rise again in April.

Now Inland Revenue has been very proactive in accepting instalment arrangements, but it is a sign of the scale of what’s going on at the moment that so many more taxpayers are now under an instalment plan. It has doubled in one year. And possibly we may see it may have tripled once we see the April figures.

I’ve talked about instalment arrangements previously and what you need to do is get in front of Inland Revenue as quickly as possible. Explain what’s happening and give them a plan as to how you’re going to deal with it. Don’t put your head in the sand.

Just bear in mind that although at the moment Inland Revenue is being fairly generous about what is COVID-19 related or not, it may well take a second look at this. And that may mean that some people who were trying to set up instalment arrangements prior to the arrival of the virus may still be stuck with having to pay use of interest at 7% on the unpaid debt because it was a pre COVID-19 debt.

Whatever the case, the key thing in dealing with Inland Revenue is communication. Don’t put your head in the sand. Deal with the matter. You’ll find that at this stage, they’re responsive to requests.

Well, that’s it for this week. I’m Terry Baucher, and you can find this podcast on my www.baucher.tax or wherever you get your podcasts. Please send me your feedback and tell your friends and clients. Until next time, Kia Kaha, stay safe.

10 Feb, 2020 | The Week in Tax

- Inland Revenue’s extensive powers of collection and its use of deduction notices

- Triggering a dividend through misunderstanding tax implications of transaction

- Terminal tax payment options

Transcript

As the recent story about the arrest of a student loan debtor at the border revealed, Inland Revenue has quite extensive powers to chase debt.

One of the powers it uses very frequently but which is not particularly well known, is the power to request require a person to deduct money from a payment due to another person and pass it through to Inland Revenue.

These ‘Deduction notices’ are issued under Section 157 of the Tax Administration Act 1994 and Inland Revenue makes quite extensive use of them. In the year to 30 June 2019, for example, nearly 57,000 taxpayers had deduction notices issued against them. Now these notices are usually issued to banks and employers, but the object of today’s discussion is that they can be issued to other persons such as customers and suppliers.

I recently came across one such case. A client approached me and advised they had fallen behind payments on their PAYE. This is a not untypical story. Cash flow suddenly dries up, but you still have to pay PAYE and GST. The amount owed was under $50,000 and was not what I would regard as terribly significant, certainly compared with other cases I’ve handled.

So, it was still at the stage where a discussion with Inland Revenue could have produced an acceptable payment plan for all concerned. But as I often see in cases like this, taxpayers put their head in the sand. And in this particular case there were some tragic personal circumstances developing which meant that the owner was understandably not quite as tuned into what was going on as he perhaps should have been.

What Inland Revenue did was it issued a deduction notice to one of his customers which said was ABC owes us $X and we require you to deduct $Y from any payment that you are to make to him. Now, can you imagine if you are a business and you receive a notice that one of your customers is behind on their tax? What are you likely to do? You’re likely to be concerned about your own payment schedule.

What happened for my client was that his customer took the decision to restrict the amount of work it was going to give in the future, effectively wiping out my client’s margin. And that will probably be the death knell for my client’s business.

Issuing a deduction notice is quite a big step. As I said, it involves going to a third-party supplier and saying basically this customer is in trouble. So, naturally the recipient of such a notice will take steps to protect themselves. It’s also, you could say, a massive breach of privacy, but you could probably also make a counterargument that businesses don’t want to be acting as unpaid bankers for other businesses that are struggling.

Now, the issue that has emerged in this instance is that Inland Revenue did not follow its own procedures. When we asked for a copy of the deduction notice in question Inland Revenue did not have it on file. This was a “manual notice” and Inland Revenue don’t issue many of these. For the year to June 2019, there were some seventeen hundred such notices issued, according to an Official Information Act request I made to Inland Revenue on the matter.

Generally speaking, Inland Revenue’s processes around the use of deduction notices require that the debt must have existed for 12 months before they take what is a fairly extreme step. That wasn’t the case either for my client. These cash flow issues had emerged quite recently.

So, we have an issue here where Inland Revenue haven’t followed the procedures at all. Furthermore, no attempt appears to be made to try and organise an arrangement plan, and after the notice was issued no copy was actually sent to a client. Copies of such notices are by law meant to be sent to a defaulting taxpayer.

Now Inland Revenue needs to have powers to enforce debt collection, and it does have extensive powers. But those powers must be applied properly and in accordance with the law and Inland Revenue’s own procedures. And that didn’t happen in this case. And the consequences are that the business has been hit hard, basically losing one of its major customers. And that will probably be sufficient to put the company out of business. And as a consequence of that, Inland Revenue is possibly not likely to recover the full amount that it was owed. So, it will probably turn out to be a rather counterproductive action on its part.

Now there’s a fine line to be drawn between Inland Revenue making proper use of its extensive powers and abusing those powers. And in my view, Inland Revenue crossed that line in this case. Of equal concern is the likelihood that it will bear no consequences for those actions. And that is simply wrong.

Tax assumptions

Now, moving on, you may have seen in last Saturday’s Herald a story about the unfortunate taxpayer who invested in a overseas exchange traded fund, and then had 33%, or over two thousand dollars deducted in tax when the fund was wound up.

Now, this is one of those situations involving unintended consequences which I see quite frequently. It so happened this week I encountered three similar cases where taxpayers had made assumptions about how a particular transaction would be taxed and then found out that wasn’t the case.

This brought to mind a quote I came across by someone called

Artemus Ward who said

“It ain’t so much the things you don’t know that get you in trouble. It’s the things you know that just ain’t so.”

(Artemus Ward is the nom de plume of Charles Farrar Browne sometimes regarded as America’s first stand up comic.)

And that quote probably should be written into the Tax Act, because that’s exactly what I see regularly.

All the problematic transactions I encountered this week involved companies. In each case, the New Zealand tax implications of the structure were either ignored or widely misunderstood. And as a result, the effect was to trigger a dividend and a substantial tax liability. Fortunately, we’re probably going to be able to manage the fallout from each of these cases.

Two of the cases involved companies with an overseas element. Now, the provisions in the Income Tax Act around dividends are extremely broad and taxpayers frequently misunderstand how broad those provisions are.

The golden rule for any payment made by a company to a shareholder or an associate of a shareholder is that it is probably a taxable dividend and therefore withholding taxes may apply. Keeping that in mind would have saved my clients a considerable amount of bother. The warning is if you’ve got any transactions involving distributing money or changing shareholdings by using, say, the company to buy back shares as was attempted in one of these cases, you are likely to trigger adverse tax consequence. I know it sounds like a plug for my services but get advice before you do so. And incidentally, watch out for any Companies Act implications because these were also overlooked.

And finally, Friday was the due date for payment of terminal tax for the year ended 31st March 2019. That’s for anyone who is not linked to a tax agent or who has had the extension of time arrangements available to taxpayers linked to tax agencies withdrawn.

Following up from my first story this week if you are having difficulties with making your payments today, get in touch with Inland Revenue and explain the circumstances and see if you can enter into an arrangement. Inland Revenue, believe it or not, is actually quite flexible around these issues and can be quite reasonable if approached quickly enough.

Secondly, another alternative is to use tax pooling to manage the payment. Check out the podcast episode I had with Chris Cunniffe of Tax Management New Zealand about tax pooling.

For example, right now cash flow is tight for a lot of people in the wake of Christmas. But through Tax Management New Zealand, and other tax pooling entities, the opportunity exists to make use of their services and mitigate the impact of paying the tax late and reduce the interest payable.

Just finally, a quick note that people should be aware that as of 1st March, Inland Revenue will no longer accept cheques for payment of taxes.

Now the last time I looked cheques were still legal tender under the Bills of Exchange Act. And yes, cheques might be greatly inconvenient for Inland Revenue, but it is a government agency and a substantial proportion of its ‘customers’ (as it likes to call them), are elderly or either don’t actually make extensive use of, or are uncomfortable, using online payments.

So, I think the arbitrary withdrawal of cheques is something that should never have been allowed to happen. It’s discriminatory. Although I can see Inland Revenue’s point of view, if we are all now customers and as we all know the customer is always right, then if customers want to pay by cheque that should be good enough.

Well, that’s it for The Week in Tax. I’m Terry Baucher and you can find this podcast on my website, www.baucher.tax, or wherever you get your podcasts. Please send me your feedback and tell your friends and clients. Until next time, have a great week. Ka kite āno.