1 Aug, 2022 | The Week in Tax

- Inland Revenue draft interpretation statement on tax loss carry-forward and continuity of business activities

- Inland Revenue applies little-known provisions to find director personally liable for company’s tax debts

- What role for windfall taxes?

Transcript

Inland Revenue have released an extremely important draft interpretation statement covering the loss carry forward continuity of business activities provisions. These relatively new provisions enable a company to carry forward tax losses, even though there has been a breach of what we call shareholder continuity, so long as the company is continuing the same business activity.

The general rule is in order for companies to carry-forward tax losses for future use, at least 49% of the shareholders must remain the same throughout the period between when the losses arose and when they are used. Tax accountants and advisers pay particular attention to these shareholder continuity provisions because they are all or nothing. If there’s been a breach, you lose all the losses, and they may no longer be carried forward.

We therefore watch this very carefully, but they are not terribly popular and are seen as somewhat cumbersome because they are so hard and fast and they are regarded as impediments to enabling corporate reorganisations, allowing companies to access new sources of share capital or adapt their business activities in order to either grow or become more resilient.

When the Covid-19 pandemic hit in March 2020, one of the Government’s first responses was to introduce these business continuity provisions which took effect from the start of the 2020-21 income year. That’s generally 1st April 2020. But as one of the many good examples in the paper illustrates, sometimes the rules can actually take earlier effect.

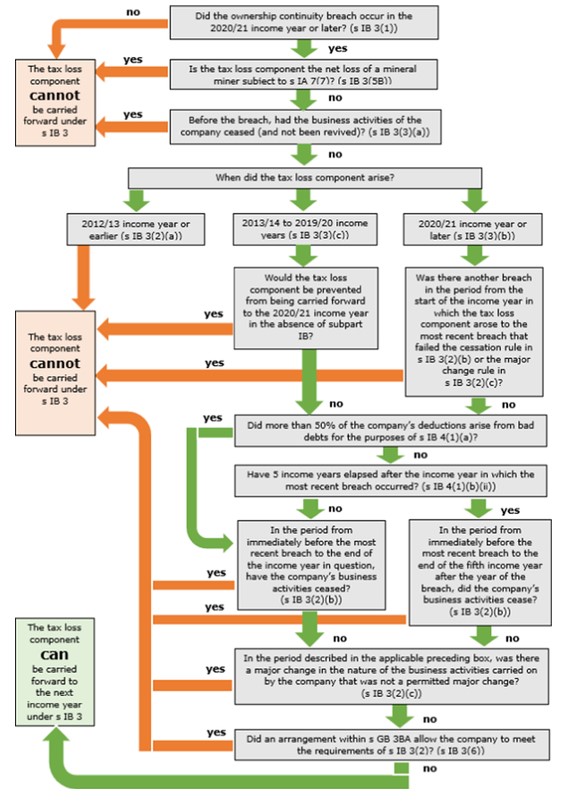

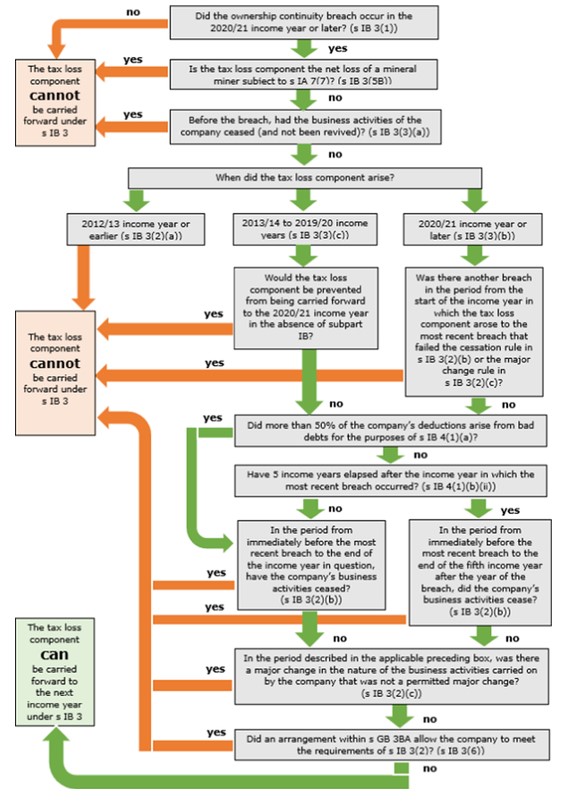

Under the business continuity rules even if there has been a breach of shareholder continuity, a company’s tax losses may continue to be carried forward despite the breach if no major change in the nature of the business activity carried on by the company occurs throughout what is termed the business continuity period. This is subject to an exemption for some permitted major changes. This draft interpretation statement is therefore very useful in giving us guidance as to how these rules are meant to work.

Tax losses can continue to be carried forward for what is termed the ‘business continuity period’. Typically that is the period starting immediately before the shareholding continuity breach and it ends on the earlier of the last day of the income year in which the tax losses have been used, or the last day of the income year in which the fifth anniversary of the shareholding breach occurs. In other words, there’s a five-year cap on the ability to use these provisions. However, that five-year cap doesn’t apply where 50% or more of the losses are eligible for carry forward arose from bad debt deductions.

These new rules will apply where there’s a shareholder continuity breach starting in the 2020-21 income year and tax losses that arose in the 2013-14 income years or later can be carried forward using these provisions.

The key thing is determining what is the nature of business activities and have they continued? When you’re considering this, you look at matters such as its core business processes, for example, farming, manufacturing, construction, distribution, retailing, etc., the type of products or services produced or provided, what significant assets have been utilized, for example premises, plant machinery, livestock, etc. and if there are any other significant supplies or other inputs, such as key staff and the scale of the activity.

But even if there has been a major change in the nature of the business activities carried on, the business continuity test may still be satisfied if that change is one of four permitted changes. Broadly speaking, these changes can be those made to increase the efficiency of the business activity, to improve or keep up to date with advances in technology, are as a result of an increase in the scale of the business activity or a change of type of products to be provided.

Overall, this is a fairly significant and obviously very detailed interpretation statement. It runs to 54 pages, and includes 15 very helpful examples, together with a useful, if somewhat crowded, flowchart. It’s very welcome to see this guidance as we’ve already handled a number of enquiries regarding the application of these rules. Consultation on the draft is now open until 1st September.

Directors liability for company tax

In previous podcasts I’ve mentioned some Inland Revenue technical decision summaries. Inland Revenue has started releasing these summaries of decisions from its adjudication unit relating to disputes with taxpayers. These are released for information purposes only and are not meant to be formal guidance, such as the interpretation statement we just discussed. They do not represent the Commissioner’s official opinion. That said, they are often very useful indicators of how Inland Revenue might approach certain matters.

We therefore pay attention to what these summaries show and one released this week TDS 22/14 is particularly interesting because it involves a couple of provisions which we’ve not seen used extensively by Inland Revenue.

The facts are a little complicated, and initially the matter at dispute was whether a contractor providing services to a New Zealand company through another company (ABC Co) was an employee of the first New Zealand company. Ultimately, it was determined he was not.

Inland Revenue had a look at what was going on and discovered agreements between ABC Co and another company DEF Co. When these were examined, Inland Revenue concluded that ABC Co was providing services to DEF Co which had been returned. It therefore assessed ABC Co for income tax and GST on these services. These assessments were not disputed by the taxpayer so were deemed to be accepted.

So far there’s nothing particularly unusual about this, it’s what happened next that’s interesting, because when ABC Co didn’t pay its tax, Inland Revenue then deployed two provisions, section HD 15 of the Income Tax Act and section 61 of the GST Act. These provisions enable tax owed by a company to be recovered from the shareholders or directors of the company where there has been an arrangement entered into which has the effect that the company is unable to meet a tax liability.

As I said, these provisions have been around for a while, but I’ve not previously seen them used. In order for them to apply there has to be an arrangement, the effect of which is the company has a tax liability whether an existing one or one which arises later which it cannot meet. It must also be reasonable to conclude that a purpose of this arrangement was that the company could not meet that tax liability. And finally, would a director who made reasonable enquiries at that time have anticipated that a tax liability would or would likely, be required to be met? So, there’s a few hurdles to get through before the provisions apply which is why we probably haven’t seen much use of it previously.

In this particular case, the arrangement appeared to be that the taxpayer’s private expenditure was met at all times, but the company never had any funds available to meet any tax liability. So that’s why Inland Revenue ultimately decided to apply these agency provisions.

Understandably, the taxpayer disputed the matter, but the Adjudication Unit ruled on Inland Revenue favour. As I’ve said, these provisions have been around for a while but have not seen much use of them, which also makes it uncertain when advising clients as to what could happen. Until now we’ve advised these rules could apply, but we haven’t seen much evidence of them being used. Now that has changed. This seems very much like a warning shot from Inland Revenue that feels it can deploy these provisions and obviously is doing so as part of a harder line on debt and attempts to avoid payments of tax debt.

It will be interesting to see whether this case progresses any further, for example if it’s taken to the Taxation Review Authority or High Court on appeal. More importantly, will we see more use of these provisions by Inland Revenue. As always, we’ll keep you up to date on developments.

How likely is a windfall profits tax?

And finally, this week, the rising cost of living has been in the news, as has obviously the Government’s response. As people should be aware part of that response involves a cost-of-living payment of $350, which Inland Revenue is now about to start paying, even though there’s about 160,000 people for whom it doesn’t have any bank details and who may therefore miss out on these payments.

There’s also been plenty of debate about what’s causing the spike of inflation and what can be done about that. And an issue that popped up this week was the question of windfall taxes which have re-emerged as tools in perhaps in fighting inflation. Italy, for example, introduced one last year on extra profits realised by Italian energy industry companies. The Spanish have a similar one, also targeting energy production companies. And in May the UK government announced a 25% energy profits levy charged on profits from UK oil and gas extraction activities.

I was asked by Geraden Cann of Stuff whether such a tool could be used here, and my response was not immediately, because we have no history of such taxes, although I understand that there were excess profit taxes levied in both world wars with varying degrees of success. I think most countries struggled with how they could define excess profits in that case.

But then following through on this issue, I did suggest that there might be room for developing such a windfall tax on the principle that it’s always good to speak softly and carry a big stick. However, that would involve determining what would be the trigger points as to when the tax would apply. When would they apply? What constitutes excess profits subject to the tax? What rate would apply? And for how long would such a windfall tax supply? There’s a lot to consider and they would be very complex to design.

Furthermore, although the Government might think, “Well, gee, that’s a nice stick we’d like to have”, businesses quite rightly would be saying “We’re not happy about that because who could be the subject of a windfall tax”.

Currently, windfall taxes are being applied to energy companies in Europe. However, in the past Britain has applied them to banks and privatised utility companies. Businesses might therefore be a little cautious about how they might invest if they felt there was a reasonable prospect of a windfall tax applying. Now our tax policy settings are very much about providing certainty for businesses and business investment. So, on that basis, I can’t see a windfall tax appearing any time soon, even though quietly a finance minister might like to have such a weapon in his or her toolbox.

Well, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

15 Mar, 2021 | The Week in Tax

- Business loss continuity test and tax loss carry back

- A review of working for families is underway and how abatement levels impact beneficiaries

- Pre 31st March tax planning tips

Transcript

Last week, I discussed the Government’s new proposed business continuity test for losses. Subsequently, a reader from Inland Revenue kindly got in touch to confirm that the new test would indeed be retrospectively applicable from the start of the current tax year, 1st April for most taxpayers.

He also pointed out that the new regime will allow losses from the 2013-2014 year to be carried forward. So that means the losses that were occurred in those years, they can continued to be used if there’s a change of shareholding, resulting in a breach of continuity and you wish to use the business continuity test to preserve those losses. So, thank you very much for that, Barry.

But in the spirit of the Lord giveth and the Lord taketh, we’ve also heard that the Government has decided not to proceed with a permanent iteration of the temporary loss carry back scheme introduced last year as part of its initial response to Covid-19. That’s disappointing news as it would have been a useful addition to the loss regime.

These regimes exist in other jurisdictions. And ironically, the British Budget, which I also discussed last week, included a measure relating to its carryback regime, temporarily extending the loss carryback period from one to three years.

Now, the official reason for the decision to not proceed with the permanent iteration of the scheme is the potential fiscal cost. That’s perhaps understandable, but it would be good to see the decision revisited sometime in the future, because I think this is an important measure to have as part of the loss regime.

A poverty benefit trap

Moving on, it emerged this week that the Government is undertaking a review of the Working for Families regime. This is a quite significant undertaking because Working for Families pays out approximately $3 billion a year. And this came out as part of a decision to increase main benefit abatement thresholds from 1st April.

Now, something which is not generally well known and appreciated is the real problem with the interaction between tax and the social welfare system and the impact of abatement thresholds. Basically, and understandably, as a person’s income increases, then the need for social assistance is reduced. And what we have is an abatement threshold above which benefits are abated.

These formulas vary quite significantly and can be actually quite savage. The decision that the Cabinet made related to the Minimum Family Tax Credit. Now, the abatement here is once you cross the threshold, you lose a dollar of credit for every dollar above the threshold. This means that the effective marginal tax rate for people who cross the threshold is effectively greater than 100%. (The dollar of income is taxed AND a dollar of benefit is lost).

And this is an area that’s always problematic because Governments must choose the threshold at which it kicks in and what abatement rate applies. The Working for Families abatement rate is currently 25% for family income above $42,700. And one of the other problems that this paper indicated is that the amount beneficiaries can earn before their benefit reduces has declined substantially over time because benefit abatement thresholds have not been increased in line with wage growth.

And so a poverty benefit trap has emerged because the financial incentives to enter the labour market and work part time are substantially reduced. To give you an idea how bad that has become, a person currently receiving the Jobseeker Support for being unemployed could work about 11.8 hours on minimum wage in 1997 before their benefit was abated. By 2019, that had reduced to around 4.5 hours on the minimum wage.

These problems exist across all of the social welfare network and one of the Welfare Expert Advisory Group’s recommendations was it needed serious overhaul. There’s always been talk about perhaps integrating a tax and welfare systems with a universal basic income seen as a solution to this particular issue. So anyway, there’s going to be a lot of work going on in that space and it will be very interesting to see what comes out of it.

Ideas to prepare for March 31

And finally, this week, the tax year end is fast approaching. So here’s a few ideas which may require action before 31st of March.

A big one, obviously, for businesses is to write off any bad debts before 31st of March. Take a good look at your debtor ledger and be realistic. And if those debts are written off before the 31st of March, you can claim a deduction for those bad debts.

Similarly, look to see what stock is obsolete, write it down to market value. Fixed assets which are no longer in use should be scrapped or otherwise disposed of to ensure you can have any available deductions. At the same time, you might want to accelerate certain types of expenditure, such as repairs and maintenance.

And one thing important to take note of is that the temporary increase in the low value assets to $5,000 ends tomorrow (Tuesday, 16th March). From Wednesday, 17th March, it will be $1,000. So now is the time to take a quick look at your fixed assets and think, do I need a new laptop, new computers, any any matters like that? And if so, try and take advantage of this $5,000 concession now.

There’s a lot of matters to think through at year-end, and I’ll come back to a few of these next week as well. One important one, which is tied into the increase to the 39% tax rate, which will take effect from 1st of April, is to look at imputation credit account balances. Make sure that all imputation credits are correctly recorded and perhaps consider paying a year-end dividend before March 31st particularly if you are likely to be affected by that 39% threshold change.

If you’re considering entering or leaving the look-through company regime, you need to have made the election before the start of the new tax year. So again, review your position there and make sure the relevant election is filed by March 31st.

By the way, I wouldn’t say Inland Revenue is a huge fan of the look through company regime, but it seems to want to direct individuals into that regime. There’s been one or two things I’ve seen going on, which has made me wonder that there may be a change of policy towards the use of look-through companies coming.

A very important thing to consider is to review whether the shareholders in a company have overdrawn current accounts. If so, look to take steps to either bring the current accounts into credit or charge interest on those overdrawn current accounts. And similarly, if companies have made loan advances to other related companies, then consider charging interest on those loans.

And finally, the last GST return for the tax year is also called the adjustment period for GST, such as change of use adjustments. And that’s when you need to calculate the impact of the change of use for GST purposes and account for this to Inland Revenue. So, for example, this would affect people that may have changed their Airbnb properties, to long term residential accommodation because there’s no tourists now.

They may have claimed an input tax credit and now they have to do a change of use adjustment and that obviously can cause some cashflow issues. So this is the period you need to think carefully about whether you want to do that and then look to make sure the calculation is filed in time. This is an area where I’m seeing quite a bit more work coming through as it is not well known and trips up a lot of people.

Well that’s it for today, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next week Ka kite āno and go Team New Zealand!

20 Apr, 2020 | The Week in Tax

- New temporary loss carry-back regime – will it help small businesses?

- The inherent flaw in the foreign investment fund regime; and

- The rules around claiming deductions for working at home

Transcript

In today’s podcast, will the latest government tax measures help small businesses? The inherent flaw in the foreign investment fund regime. And we look at claiming deductions for working at home.

The temporary loss carry-back scheme announced by the Government last Wednesday was one of the most significant tax measures yet.

It enables businesses that were expecting to make a loss in either the 19/20 income year or the 20/21 income year to estimate the loss and use it to offset profits in the previous tax year. In other words, they could carry the loss back one year.

Now, this is a measure I’ve seen before and used when I was working in the United Kingdom. That measure was introduced in the wake of a fairly severe recession in the late 80s, early 90s. It’s a promising measure which is expected to cost up to about $3.1 billion over a two-year period.

However, my tax agent colleagues are concerned that we’ve only just ended the year end 31 March 2020. And right up until 1st March, everything was running reasonably smoothly before the effects of Covid-19 landed with a big thump. Companies with a standard balance date of 31st March 2020 won’t actually have been significantly affected by the Covid-19 pandemic, but it’s quite likely that in the year to 31 March 2021 they will be.

The issue we have is that that’s a long way out to be predicting losses. And what if we get those estimates wrong? The position is that use of money interest would still apply. Although the temptation would be to make a guess at an estimated loss for the coming financial year and then carry that back to the 2020 tax year, it comes with the caveat that use of money interest – currently 8.35% – will apply on any underpaid tax. It’s a very much a dual-edged sword.

So, the main concern that my colleagues have about the loss carry-back proposal is that it’s really not terribly helpful for small businesses that have a standard 31 March balance date because they’re being asked to predict too far ahead and with too many variables.

The better option is, as I’ve said previously, would be to postpone or cancel the 7 May provisional tax payment coming up, let things settle down a bit and then work forward from that.

The loss carry-back measure is going to be introduced as a permanent feature with effect from the start of the 2021/2022 income year and the Government will take consultation later this year on the proposal. It is a measure that I’ve thought for some time would be useful.

The problem is its timing is not terribly convenient for many small businesses right now. And this points to a dichotomy in our tax legislation and tax policy.

The majority of taxpayers and small businesses prepare their financial statements, their tax returns to 31 March. But the majority of provisional tax, however, is paid by bigger companies, and many of those have different balance dates. The Government SOEs have a 30 June balance date and then overseas companies might have a 31 December or 30 September balance date.

Now, if you’ve got a 31 December balance date, you’ve got to wait a bit of time ahead, but you’ll probably get a better handle on what’s going to be happening. That’s even truer of those with a 30 September balance date because this has happened halfway through their tax year.

So larger businesses are probably going to be the primary beneficiaries of this measure. It’s not to say it’s of little use to small businesses. It’s just that they’re going to need to proceed with caution because the use of money interest provisions will apply.

I think that this measure will need to be fine-tuned. As I said earlier, I do wonder whether it might just be easier to simply say forget about paying provisional tax on 7 May.

Alternatively, maybe do as the Canadians have done. They’ve introduced a measure where a business can borrow up to 40,000 Canadian dollars from the Government, and if they repay it by 31 December 2022, 25% of the amount borrowed will be written off. Such a measure will help companies with their cash flow, which is the critical matter for small business at the moment.

But still this loss carry-back measure is going to be of use. It’s something that will become part of the tax landscape and we should never look a gift horse in the mouth.

There’s a couple of other things the Government measures announced as well, which are also important for small businesses. One is the changes to tax loss continuity rules.

Currently, if you have a tax loss and you want to continue to carry forward that loss, you must maintain 49% of the same shareholders, what we call the shareholder continuity rule. What has been an issue for some time for growing businesses is that a significant investor wants to come onboard and they want to have more than 51% of the company, maybe a 60- 70% stake. If they do that, then under the current rules, the losses accumulated to that point are forfeited.

This is something we in the Small Business Council recommended be reviewed. It’s therefore good to see this proposal. With effect from this income year – 1 April for most people – if you can show that you’re continuing to carry on a same or similar business as that prior to the change of shareholding, you can continue to carry forward losses. This is a test modelled on what happens in Australia. It’s a welcome move for fast growing companies who want to attract capital but don’t want to lose the value of the tax losses.

The other tax measure announced gives Inland Revenue discretion to temporarily change due dates and other procedural requirements outlined in the various Inland Revenue acts. This is for businesses and individuals affected by Covid-19. This will enable Inland Revenue to extend the filing date for elections and filing tax returns or defer the due date for payment of tax.

This is a good move. It gives Inland Revenue flexibility, which it probably should’ve always had, but it never really managed to see a need for such a measure beforehand. That said, I still think there’s one or two other things that legislative changes will be needed around. For example, accidental overstayers becoming tax resident. But on the whole, this proposal is a good move, and we’ll look forward to seeing that in operation very quickly.

KiwiSaver and the Foreign Investment Fund regime rules

Moving on, the foreign investment fund regime was introduced with effect from 1 April 2007. Those who know this rule should also know it applies to KiwiSaver account holders if their KiwiSaver fund is invested overseas.

Basically, the rules say that for KiwiSaver funds, the income to be determined is calculated using what is called a fair dividend rate, that is 5% of the portfolio’s opening market value at the start of the tax year.

Now for individuals, they have the option to take the actual accrued gains/losses over the tax year. And that means that when there was a significant fall in the markets, individuals are protected against that and don’t have to pay tax on a portfolio which has just suddenly depreciated in value.

But unfortunately for KiwiSaver accounts, they don’t have an alternative. And this is also a big problem for the New Zealand Superannuation Fund, the country’s largest taxpayer, because it has a huge portfolio of overseas investments.

Now, the FIF regime has been in place, as I said, for 13 years now. And Covid-19 is the second such financial crisis to have hit financial markets since the regime was introduced. The flaw in the regime is it’s predicated on markets continually going up or being stable.

Events such as we are seeing right now and in the Global Financial Crisis are anomalies which the FIF regime really doesn’t manage well. Particularly if portfolios are significantly devalued for a period of time to come, and if you look at the overall economic return, sometimes too much tax will be paid.

The Tax Working Group recommended reviewing the 5% fair dividend rate and possibly reducing it perhaps to maybe 3 or 4%. And I think that’s something the Government really need to look at. But – there’s always a but – it’s going to need the revenue going forward. So, whether in fact that measure, which I believe is needed and the Tax Working Group recommended, will actually come to pass, we’ll have to wait and see.

Home office deductions

And finally, many listeners and readers will be working from home and will continue to do so when we go to alert Level 3. So what are the rules around claiming expenses for working from home? Well, I did an article on this. The basic rules are as an employee, you can’t claim a deduction.

Instead you are able to be reimbursed by your employer who can make a reasonable estimate of the amount that you should be claiming based on a number of factors such as area of the place you’re working in – your home office – rates, power, Internet usage, etc. A reimbursement based on this is tax free to the employee and deductible to the employer.

If the employer decides to simply pay a flat rate, it might in fact be more than what is actually a reasonable calculation of expenses. Instead, PAYE will apply.

What was interesting to see about that article was the reaction to it – several employers are applying the rules clearly. Others are completely oblivious to it, and others are simply ignoring the fact that their employees have an expense and are just simply expecting them to bear the costs. It will be interesting to see how this shakes down. All employers will need to be looking at this matter and determining some form of allowance to help their employees.

Well, that’s it for this week. Thank you for listening. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you find your podcasts. Please send me your feedback and tell your friends and clients. Until next time Kia Kaha. Stay strong and be kind.