30 May, 2022 | The Week in Tax, Uncategorized

- Will the IRD be able to deliver the cost-of-living payment?

- Potentially unwelcome GST surprise for farmers selling up.

- The latest developments from the OECD

Transcript

In the wake of the Budget, a Cost of Living Payments bill was introduced and has now been enacted. As part of the enactment a supplementary analysis report was released giving background to the proposed $350 payment. And this supplementary analysis has some very interesting commentary.

It appears the Cost of Living Payment was put together very much at the last minute as a response to the adverse effects of inflation on low to middle income households. According to these documents, this report was finalised on May 4th, barely two weeks before the Budget was delivered, which is very late in budget terms.

According to the document, Inland Revenue recommended against being the delivery agency for this Cost of Living Payment. The reason it gave was that it was concerned, that being asked to administer the payment would significantly impact its services to customers – taxpayers in plain English.

“The addition of this payment to their portfolio of services Inland Revenue already delivers will compromise Inland Revenue’s already stretched workforce and affect the taxpayer population, including the families and individuals that the payment would be intended to support them.”

Inland Revenue correctly identified that as soon as the announcement was made, they would get contacted about it which would put strains on their systems. It calculated a maximum of approximately 750 full time equivalent staff would be required to handle the payments to be made in the weeks of 1st August, 1st September and 1st October. Now, to put that in context, Inland Revenue staff as of 30th June 2021 was 4,200 full time equivalents. It would therefore need to use the equivalent of 18% of its staff to handle the delivery of this Cost of Living Payment. Quite clearly this would put strains on its system. The $816 million appropriation for the Cost of Living Payments includes $16 million to Inland Revenue for delivery of the services.

It’s therefore likely that Inland Revenue will need to hire additional staff, presumably contractors, on a short-term basis. And as we’ve discussed previously, the issue of contractors hit the courts with the Employment Court ruling that the contractors were not employed by Inland Revenue although I understand that decision is being appealed.

It also seems the Inland Revenue poured a bit of cold water on how the payments would be structured. According to the report, 55% of the total payments to be made will be to the middle 40% of households, 20% would be made to the bottom 30%, and 25% would go to the top 30%. There would be an estimated 478,000 households with children and 610,000 households without children who would receive a Cost of Living Payment. Although around 60% of all potentially eligible recipients will have annual income below $70,000, 10% would have family income of between $70 and $100,000 and 30% will have family incomes over $100,000.

And this led Inland Revenue to point out that potential equity concerns could arise because using individual income to calculate the eligibility for the payment rather than household income may result in different outcomes for households with the same income level. For example, a single person earning $100,000 won’t receive a payment, but a household with two people working who each have income of $50,000 would both receive the payments.

There’s also some analysis regarding how the eligibility is dependent on a person’s prior year’s income, which means the tax returns for the March 2022 must be filed. The paper notes that by the time Inland Revenue begins making payments on 1st August, it expects to have already raised individual tax assessments for approximately 3.2 million individuals, about 75% of individual taxpayers. But that leaves about 500,000 individuals, who may not initially receive the payment between the August to October payment run period because they haven’t filed their tax return. And this includes people who file through tax agents and have in theory until 31st March 2023 to file last year’s tax return.

This underlines a point I made in last week’s Budget commentary that you can probably expect tax agents to come under more pressure to get tax returns done on time so that those people who think they’re eligible may get a Cost of Living Payment. Overall, it’s some interesting insights into the administration of these systems and the Budget process.

GST pitfalls for the unwary

Now moving on, GST is probably the best example you can find of the broad-base low-rate approach to taxation policy. But even though it’s a highly comprehensive tax, that does not make it a simple tax. In fact, it’s full of pitfalls for the unwary. And I’ve been alerted to one which may affect farmers who are selling up.

Back in 2020, Inland Revenue caused some consternation when it issued Interpretation Statement IS20/05 on the supplies of residences and other real property. The Interpretation Statement reversed a long-established policy since 1996 on the sale of the farmhouse where the farmer might have used part of the property for their taxable activity, for example a home office in the homestead. Previously Inland Revenue’s position was that the sale of a farmhouse would generally be a supply of a private or exempt asset and not subject to GST.

However, in IS 20/05, Inland Revenue reversed that position and now said that the sale of the dwelling would have been useful for families who would now be subject to GST. The example the Interpretation Statement gave was if a GST registered farmer was claiming an automatic 20% deduction for farmhouse expenses, an Inland Revenue would expect that the property was therefore being used 20% of the time in the taxable activity and consequently sale of the farmhouse would be a supply in the course or furtherance of a taxable activity and therefore subject to GST.

This change has caused some consternation although some relief was given in the recently enacted Taxation Annual Rates for 2021-2022, GST, and Remedial Matters Act. This included a provision which allowed a deduction for the private use portion of a sale. Coming back to that 20% example I mentioned a moment ago, if 20% of the homestead was used for farming business and 80% for private purposes, there would be an adjustment for the output tax of 80% of the private portion. But that would still mean that 20% of the current value of the farmhouse at the time of sale would be subject to GST, which would be an increased tax burden for many farmers and undoubtedly a surprise for some.

Apparently Inland Revenue is now indicating that it may reconsider its position in its Interpretation Statement, which is a classic example of the military maxim “Order, counter-order, disorder”. But until that point is clarified, farmers who are selling their farm should be aware of this potential liability and seek advice on that transaction.

How the OECD influences our tax policy

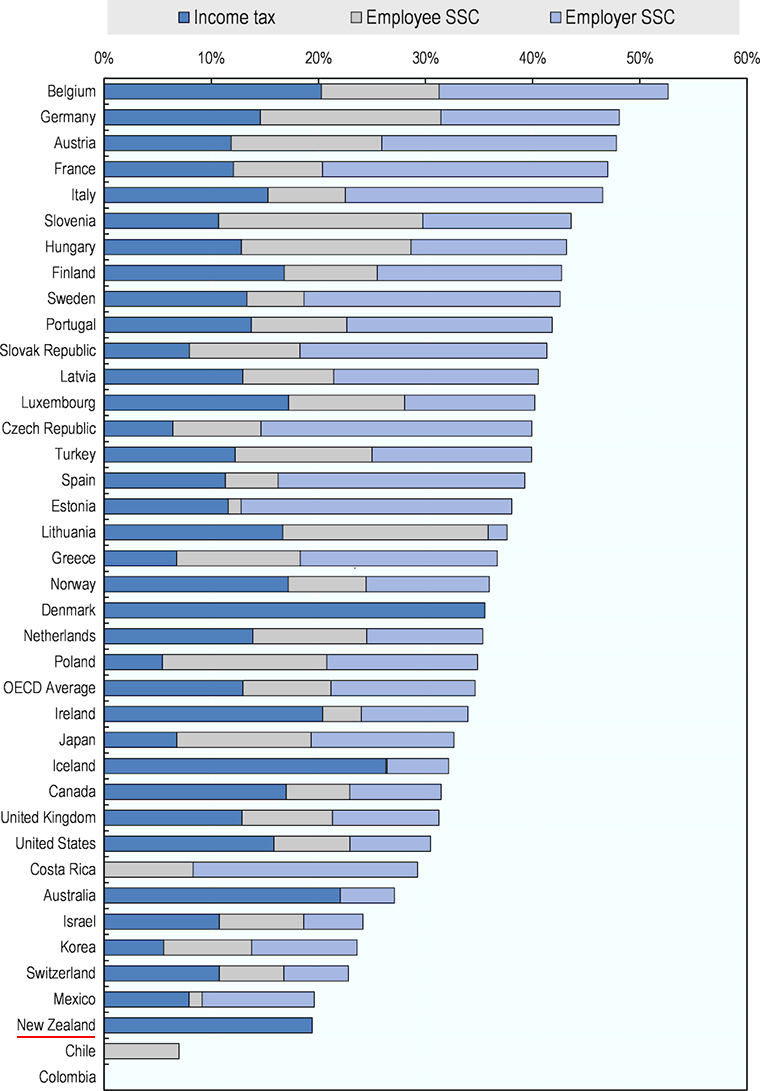

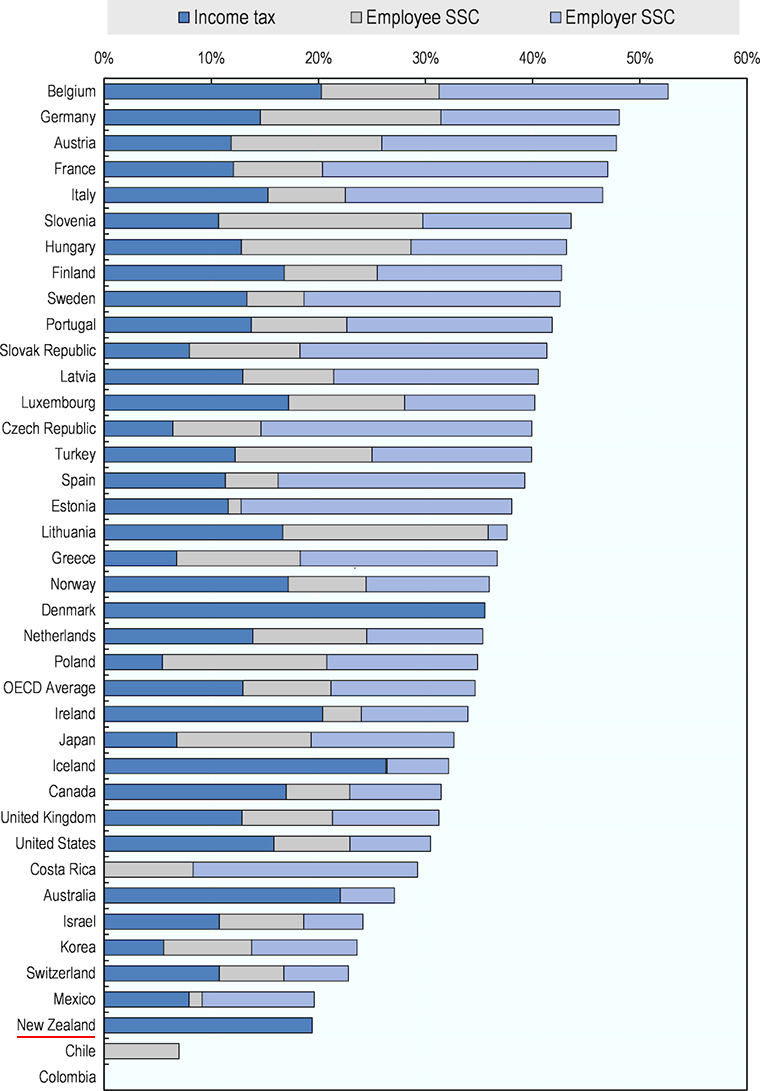

And finally this week, a couple of updates from the OECD. Firstly, it released its annual report on the taxation of wages. This includes its tax wedge analysis, which looks at the difference between labour costs to the employer and the corresponding net take home pay for the employee. Basically, the tax wedge is the sum of the personal tax income tax payable by the employee plus any employee and employer social security contributions plus any payroll taxes less any benefits received by an employee. (I think ACC is included for these purposes).

As can be seen New Zealand, scores very highly with a tax wedge of 19.4%, which is the third lowest in the OECD. The average in the OECD is 34.6%.

What this tax wedge measure also points to is the significance of Social Security and payroll taxes in other jurisdictions. One of the criticisms of the Government’s proposed social insurance scheme is it would be the first real Social Security tax that New Zealand has. It seems from early feedback this is one reason employers are pretty reluctant about the scheme. But even if the scheme was introduced, we’d still be down the lower end of the tax wedge.

Now the second OECD report was titled Tax Cooperation for the 21st Century. This was prepared by the OECD for the G7 finance ministers and central bank governors when they met recently in Germany. It’s particularly interesting because it picks up on what’s been happening with the adoption of the Two Pillar solution for international taxation we’ve talked about recently.

The OECD was asked to prepare was a report that would focus on the further strengthening of international tax co-operation and what recommendations it has in this field. This is looking beyond the implementation of the Two Pillar solution which makes it very significant, in my view, about the future administration of international tax.

For example, a key recommendation is tax administration should be seen as a common mission by tax authorities rather than a potentially adversarial exercise. The development of international cooperation is one of the biggest themes in international taxation in the 21st Century and is also probably one of the least understood. And I will repeat what I’ve said beforehand, most people are oblivious to the amount of information that is being shared by tax authorities at all levels. China, incidentally, has just signed up to the mutual agreement and protocols on that. So every major jurisdiction in the world is cooperating or looking to cooperate on international tax at some level. This is why this paper is important because it starts to map out and where that international co-operation might be going.

The report focuses initially on corporate tax saying there needs to be a reliable framework for cross-border investment. As just noted, tax administration should be seen as a common mission. There should be a collaborative approach with early and binding resolution.

The impact of going digital is emphasised and that it needs to speed up to improve engagement with taxpayers. There are also recommendations beyond corporate tax about moving to real time data availability for taxpayers and tax administrations to make efficient use of evolving technologies while maintaining data privacy and confidentiality.

The issue of data privacy and confidentiality is a developing area where taxpayers are starting to push back against tax authorities because they are concerned, rightly, whether everything is secure as it should be. Furthermore, some are, understandably, not too happy about information sharing.

Finally there’s a recommendation that advanced economies should commit to supporting developing economies so that they can fully benefit from the policy changes. This means building capacity which is going to be needed, especially for the implementation of the Two Pillar solution. Overall, this is a relatively brief but fascinating paper with potentially significant implications.

And just incidentally, on the international Two Pillar solution, the Secretary General of the OECD has now indicated that he expects that implementation will be delayed by a year until 2024. That doesn’t surprise me, given the scale of the project, because there’s a lot of legislation that needs to be put in place by the middle of next year at the latest. Inland Revenue have only just started consultation on the matter.

Still, the Two Pillar project has moved on quicker than some cynics might have expected. But as I’ve said previously, politics is likely to get in the way, particularly the upcoming US Congressional midterm elections. Anyway, as always, we shall bring you the news as it develops.

Well, that’s all for this week I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

16 May, 2022 | The Week in Tax

- Inland Revenue consults on the OECD Pillar Two GloBE rules for New Zealand and has a new CEO

- Working for families consultation

- A look ahead to next week’s Budget

Transcript

Last year, the G20 and OECD agreed on a two pillar solution to the issue of international taxation and in October 2021, this two pillar solution was endorsed by over 130 countries in what is deemed the OECD sponsored Inclusive Framework. New Zealand was one of the signatories to that endorsement.

Inland Revenue has now released an issues paper looking at how these so-called GloBE rules (Global anti Base Erosion) would operate. Now as this is an issues paper it does not represent government policy. Instead, Inland Revenue is putting the matter out for consultation because the government has not yet decided whether in fact it will adopt Pillar one or Pillar two, and in fact is also not ruled out adopting a digital services tax. So, this issues paper is a basis for formulating policy to be taken to the government. It therefore partly represents a background paper, but also explains how the rules would operate.

To recap, the purpose of the GloBE rules is to ensure that affected multinational groups (MNEs) pay at least a 15% tax on their income in each country where that income is reported for financial reporting purposes. It’s initially intended to apply to MNEs if their annual turnover exceeds €750 million per annum in two of the last four years. It’s estimated to initially apply to approximately 1500 multinational groups worldwide, of which approximately 20 to 25 are based in New Zealand. The OECD estimates that the global revenue gains under Pillar two will be in the order of US$130 to $185 billion annually, which represents about 6 to 7.5% of global corporate income tax revenues.

The paper is split into three parts. Part one is a general overview with Chapter one giving the background on the initiative and on its intended purpose. Chapter two has a summary of the rules in general, and chapter three raises the question which may seem odd ‘Should New Zealand adopt the GloBE rules?’ Part two then explains the proposed rules in more detail, and part three then covers all specific issues form a New Zealand perspective,

The paper is quite comprehensive running to 84 pages so there’s quite a bit of detail to go through here. Fortunately, we’ve got quite a good period of consultation because consultations open until 1st July. Normally we only have a 4-to-6-week period for consultation.

Now, as I said, what may seem a rather strange question is whether New Zealand adopts the rules is a key part of the consultation. The official view is that if a critical mass of countries do adopt or are likely to adopt the global rules, then officials would recommend New Zealand take steps to join them. Officials take the view that they see no benefit, or not much benefit, in New Zealand going it alone and adopting global rules without a critical mass.

Three questions are put to submitters on this issue.

- Do you think New Zealand should adopt the GLoBE rules if a critical mass of other countries does or is likely to do so?

- Do you have any comments about what a critical mass of countries would be?

- Do you have any comments on the timing of adoption?

Now my response would be ‘yes’, New Zealand should, because it’s part of being a good corporate global citizen. Obviously, there’s a likelihood of additional revenue gains, although according to the paper the potential gains are said to be modest.

What would represent a critical mass of countries? Well, that’s a difficult one. I guess the key country to being involved would be the United States. But as you know, they’ve always ploughed their own furrow on this matter. And politics are such that the Midterm Congressional elections may mean that the Republicans are able to block change on this. Like we’ve said in the last couple of weeks when discussing possible wealth taxes, it all comes down to politics. But certainly, if the majority of the 130 countries that have endorsed it do sign up, you’d think that we would want to go ahead even if the United States didn’t. But it would be disappointing, obviously, if America did not.

And then about the timing of these rules this is actually quite tight. Under the Pillar 2 proposals, there is an income inclusion rule which will impose the top up tax on the parent entity in a multinational group. Now under the OECD timeline that should be enacted during 2022 in order to be effective in 2023. And then there’s another part, the under-taxed profits rules, which should come into effect in 2024. I think that timeline is pretty optimistic. I would be expecting to see it slide out a bit, but who knows what the international mood is on this? Maybe progress happens much more quickly than we expect

Anyway, this is an important paper and there’s a lot to consider here. Maybe the gains might be modest, but it is part of the change in international taxation, which will have ripple effects all the way through the tax world

Issues for the recycled ‘new’ IRD CEO

Moving on, Inland Revenue has a new CEO, Mr. Peter Mersi, who has been appointed for five years with effect from 1st July. He takes over from Naomi Ferguson, who has been the CEO of Inland Revenue for the past 10 years and has seen the department through the Business Transformation project.

As it transpires, Mr. Mersi, who is currently the CEO at the Ministry of Transport was a Deputy Commissioner at Inland Revenue at the start of the Business Transformation Project back in 2012. And prior to that he also spent some time at Treasury where he was the Deputy Secretary, Regulatory and Tax Policy branch.

So, although he’s coming from a Ministry of Transport background, Inland Revenue is not unfamiliar territory for him. It will be interesting to see how the organisation develops under his direction and governance of whichever hue will want to cash in on the benefits of the Business Transformation project.

And of course, one of the areas that he and the department will be involved in will be the implementation of law changes such as the proposed GloBE rules we’ve been talking about. And one thing he will need to ensure alongside the Minister of Revenue is that the Department continues to remain adequately funded. And I point to the troubles of the United States Internal Revenue Service, which has had its problems with enforcing the controversial FATCA rules which I mentioned a couple of weeks back.

It seems from another report from the United States Treasury Inspector General for Tax Administration, that the IRS is struggling with funding and its enforcement is falling off as a result. This led the Inspector General to comment. “The trending decline in enforcement activity is likely causing growth in the overall Tax Gap as taxpayers are less likely to be subject to an examination.”

The numbers of what the IRS call examinations, what Inland Revenue terms risk reviews, have fallen by between 55% and nearly 60% in the past five fiscal years. It bears to keep in mind that our IRD is actually a very efficient organisation, which, to borrow a phrase, you mis-underestimate at your peril. But as the example of the IRS shows, if funding falls away the opportunity opens up for the unscrupulous to evade tax.

‘Consulting’ on WfF

There’s a lot going on at the moment, partly because we are in the run up to the Budget next week. Something that’s been underway is for a few weeks now is a public consultation on Working for Families tax credits. This is being handled by the Ministry of Social Development and Inland Revenue. It’s part of a government review of working for families.

It’s interesting to look at what we’re being asked here compared with a typical Inland Revenue consultation, which has a lot more detail and is quite focussed.

The basic question that’s been posted is what do you like about Working for Families? Is there anything you want, don’t want changed? How do you think it can better support low income working families, families changing hours shift, working part time hours and those with care arrangements? What concerns do you have? And if you could change one thing about working families, what would it be? Now those are a set of questions are really not directed at professionals, but I hope that it gets a lot of good buy-in from the public.

In relation to concerns which I would raise one would be about how accessible it is. As my colleague, Professor Susan St Jones has pointed out, the in-work tax credits are a problem because they’re not available to everyone. And then there is the abatement rates and the resulting very high effective marginal tax rates which people on Working for Families suffer. They actually have the highest effective marginal tax rate of any taxpayer in the country. So those are areas where I think should be the focus for improvement.

Tinkering with WfF

Speaking of Working for Families, the Budget is next week, and I expect that there will be some tinkering going on with Working for Families based around the background papers to the consultation. They seem to be pointing towards an increase in payments being announced or being implemented in the Budget. Of course, with the cost-of-living issue, the Government probably will be keen to do something on that matter.

New Zealand budgets are actually really quite boring from a tax perspective. They’re not like budgets I used to see in Britain, for example, where tax measures came out from left field and were not always very coherent in what they’re trying to do. They certainly contained a lot of tinkering which kept us on our toes.

We’re not likely to see much like that next week. Bill English was one for sneaking in quiet tax increases or changes such as imposing employee contribution superannuation tax on KiwiSaver employer contributions, or withdrawing smaller allowances that were meant for children, the so-called “Paper-boy tax”.

One tax issue which has been hammered away at in recent weeks is fact that the tax thresholds have not been increased or adjusted since 2010. Eric Crampton of the New Zealand Initiative had a look at this. He considered what had gone on with the thresholds and where as a result the average tax burden had shifted. He made some educated guesses as to where those thresholds should be now.

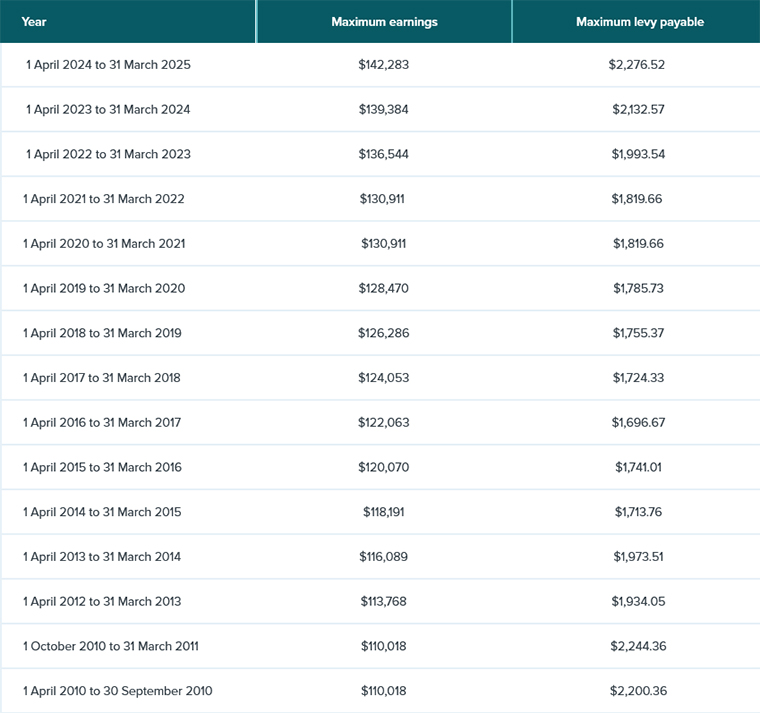

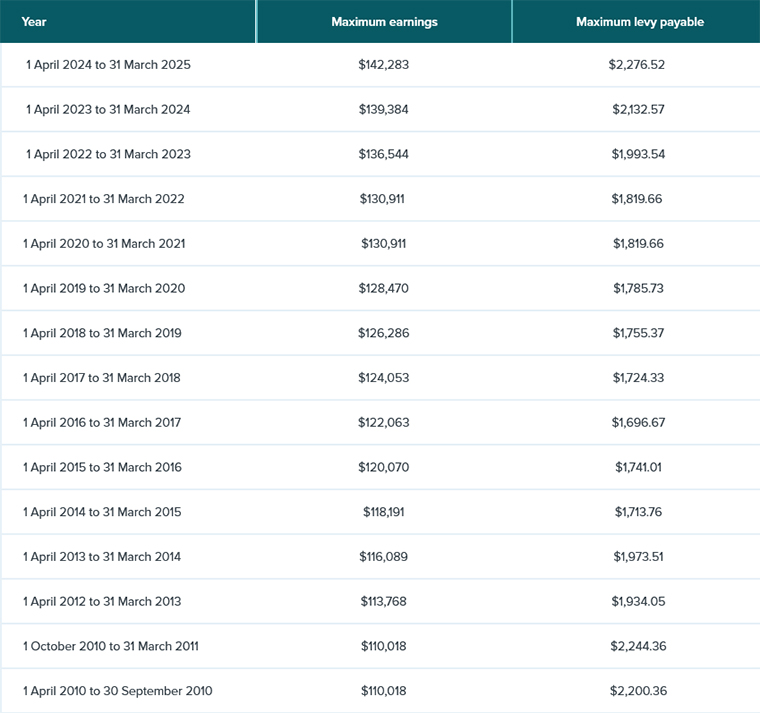

But there is actually some information floating around which would give us a more reasonable direction of what the thresholds should be if they had tracked along with inflation. These are the ACC thresholds for the upper limit of earnings on which the maximum 80% of income that may be paid out under a claim is based.

Back in 2010, when income tax rates were last adjusted, the ACC threshold was $110,018. As of 1st of April this year, it’s now $136,544. And so that increase over time over the period represents just over 24.1%.

So if you applied that 24% increase to the tax thresholds, this would be the position

| Tax rate |

Current thresholds |

Adjusted thresholds |

| 10.5% |

$0-$14,000 |

$0-$17,375 |

| 17.5% |

$14,001-$48,000 |

$17,376-$59,573 |

| 30% |

$48,001-$70,000 |

$59,574-$86,870 |

| 33% |

$70,000-$180,000 |

$86,871-$180,000 |

| 39% |

>$180,000 |

$180,000 |

(Note I’ve not adjusted the $180,000 threshold as it has only been in effect since 1 April 2021).

So that gives you some indication of what’s been going on. I think Governments of both sides have been, quite frankly, underhand in not adjusting for inflation. It isn’t just the tax thresholds, they’ve also done it in their other areas, such as Working for Families, where the threshold for abatement kicking in at $42,700, which is well below the $59,500 odd I suggested would be the upper limit to the 17.5% threshold. It will be interesting to see if anything is said or done about tax thresholds next week, but it’s a point that will certainly be addressed one way or another before next year’s election.

Talking of inflation, Inland Revenue has released a CPI adjustment to the square metre rate for dual use premises. This is where you can base a deduction for home office on a square metre rate. This has been set for the year ended 31st March 2022 at $47.85, which has been adjusted for 6.9% inflation in the 12 months to March 2022. So that’s a little useful thing to keep in mind when you’re preparing tax returns for clients who work from home or have a home office.

Rich entertainers avoiding tax

And finally, what have the Rolling Stones got to do with tax? Well, apparently this week is the 50th anniversary of the release of their magnum opus, Exile on Main Street. And the title is a deliberate reference to the fact that the Rolling Stones in 1971 decamped to the south of France because they were in trouble with UK tax authorities and facing very significant tax bills. At that stage, tax rates in the UK in some cases topped out at 98%.

So they went to France to record this album which is regarded by many as their creative peak. There’s a great story in The Guardian about what happened, including this fantastic quote ‘People took so many drugs, they forgot they played on it’.

Tax troubles and musicians go hand in hand. There are plenty of stories about various musicians and actors who’ve got themselves into terrible trouble with tax authorities and either finished up in jail, such as Wesley Snipes, or decamped elsewhere, like the Rolling Stones.

Well, that’s all for this week I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!