28 Jun, 2022 | The Week in Tax

- Shining some light on the impenetrable maze of the financial arrangements regime

- Inland Revenue brings estate agents into line

- Google NZ’s latest results show the need for international tax reform

Transcript

The financial arrangements regime is one of the most complicated parts of the income tax. It has huge scope but is not particularly well known. And until very recently there has been little practical guidance on the regime from Inland Revenue. Fortunately, all that is changing now. In the past couple of years, Inland Revenue has issued a series of Interpretation Statements which have clarified how the regime operates.

This week it’s released a revised draft Interpretation Statement on the critical issue of cash basis persons and how the regime applies to these people. Now, this is particularly important guidance because a person who is a cash basis person accounts for income and expenditure from a financial arrangements regime on a cash or realised basis rather than the at accrual or unrealised basis. The draft statement also sets out the adjustment that must be made when a person ceases to be a cash basis person and then has to switch to accounting for their financial arrangements income and expenditure on the accrual or unrealised basis.

There’s an accompanying fact sheet, so you don’t have to go through the whole full 33 pages of the Interpretation Statement. Page four of this fact sheet has a very useful flowchart, setting out process for determining if a person is a cash basis person. In summary, a cash basis person is someone who does not hold financial arrangements which exceed either of the following thresholds $100,000 of income and expenditure in the income year or the total value of these financial arrangements is under $1 million.

In relation to the $1 million threshold, the taxpayer must be below that threshold throughout the entire income year. So, if you cross it for just one day, that’s it, and you may be in the regime. If both those thresholds are exceeded the person cannot be a cash basis person.

Then there’s the second test you apply, if neither, or only one of the thresholds is exceeded. In this case you still have to check whether the difference between income and expenditure calculated on the cash basis, realised basis and under the accrual or unrealised basis does not exceed $40,000. This is what they call the deferral threshold. If it does, then the cash basis cannot apply. Now this $40,000 deferral threshold is often overlooked when people are considering whether or not they’re within the cash basis person. The Interpretation Statement has some good, worked examples how this applies.

If someone falls into or out of the cash basis status, they have to carry out a cash basis adjustment. And again, the Interpretation Statement has a good, detailed example. One of the issues that many people encounter is exchange rate fluctuations, which can put people unexpectedly into the regime and therefore have unintended consequences.

The classic examples I’ve seen are with people holding overseas mortgages against an overseas investment property and the fluctuation of the thresholds. Brexit in particular was one of those events that caught quite a number of people. Incidentally, this is perhaps why one of the examples here refers to the 2016-17 tax income year when Brexit happened.

The Interpretation Statement has a useful tip about financial statements subject to exchange rate fluctuations. It suggests identifying when the New Zealand dollar was at its lowest point compared to the foreign currency in the year and calculate the value of the New Zealand financial arrangements at that time. That’s a quick way of determining the highest possible value of the arrangement during the income year, assuming the principal hasn’t changed materially.

Paragraph 69 of the Interpretation Statement also includes some nice examples of why people might adopt the accrual basis from the outset. Doing so might resolve the problems around cash basis adjustments or they might want to actually bring the income or expenditure such as an unrealised exchange loss into account immediately.

The financial arrangements regime is actually another example where thresholds have not been frequently adjusted. These particular thresholds were last set at the start of the 1997-98 income year. They now catch far more people than were probably ever intended. Using the Reserve Bank calculator based on CPI, those absolute thresholds now would be $170,000 instead of $100,000, $1.7 million instead of $1,000,000 and the deferral threshold would be $70,000. If you use the Reserve Bank’s housing inflation calculator, then the income expenditure threshold would be $560,000, the absolute threshold for all financial arrangements would be $5.6 million and the deferral threshold $225,000. So whichever inflation indicator you’re using an adjustment is therefore well overdue.

The point here that frustrates me is that there’s a persistent theme across the tax system, where thresholds are not adjusted for inflation frequently enough. It’s a sneaky way for governments of both hues to collect additional revenue without too much notice. Quite apart from these financial arrangements regime thresholds, the income tax thresholds were last adjusted in 2010 as is well known.

The abatement threshold for working for families, that is the threshold above which abatement clawback applies hasn’t kept up inflation. By my calculation, I believe it’s now lower than what someone on minimum wage would earn. And the threshold for student loan repayments above which 12% is deducted from your income, that hasn’t been adjusted for some period. Governments really ought to be much more proactive about changing these thresholds. There’s actually a good political point here, in that doing so would de-politicize the issue. However, as I said, governments appear to quite like this sneaky increase in revenue.

Rant aside, it’s good to see guidance like this from Inland Revenue, the fact sheet is particularly useful. No doubt we’ll see more guidance on this area, but in the meantime, you should definitely have read this because this is a complicated regime and it catches far more people than you would expect.

Targeting real estate agents

Moving on, there was an interesting little piece in Stuff this week regarding the success of Inland Revenue’s campaign about real estate agents claiming personal expenditure when they shouldn’t as an attempt to reduce their tax bills. Inland Revenue advertised it was looking at estate agents’ expenditure which it thought was excessive.

We haven’t heard too many stories about who has been caught by this, but Inland Revenue took the view that focussing some attention on the issue would encourage others to behave. Basically, what was happening that some agents were understating income and overstating expenses. And it appears now over 90% of the tax returns for the March 2021 income year have been filed, Inland Revenue compared the results from that sector relative to earlier tax years and it has seen these trends reverse, particularly in relation to what it called private expenditure.

One of the one of the issues is claims for gifts, personal clothing and grooming and entertainment expenditure. And there was also under-reporting for GST purposes. Some people apparently used a net amount in their bank account for GST purposes. This is actually a really good example of Inland Revenue applying the blowtorch by saying “We have got the data we can match this and don’t think we’re not noticing what’s going on here”. So good to see on that.

There’s an interesting point here which I think Inland Revenue should issue some guidance on. And that is where someone who is working with clients and has to look professional, and therefore purchases smarter clothes for that role, what proportion may be claimable?

I remember a very famous case on this issue from my time in the UK: Mallalieu versus Drummond. A female barrister claimed a deduction for some very sombre, dark clothing that she wore only in court. She didn’t win her case, but the point still stands if you are purchasing clothes which are only use work to what extend is that deductible. And I think Inland Revenue should come out and clarify what it thinks about that.

Incidentally, Mallalieu didn’t involve the astonishing Section 189 of the Income and Corporations Taxes Act 1970. This allowed an individual to claim an expense for “keeping and maintaining a horse to enable him to perform the same or otherwise expend money wholly, exclusively unnecessarily the performance of said duties”. Yes, the UK tax legislation in 1970 (and actually again in the 1988 consolidation), had a reference for a specific deduction for a horse. That provision actually wasn’t updated until 2003. So, if you think our tax legislation is a bit arcane to spare a thought for the UK.

How much of Google’s NZ revenue escapes the NZ tax net

International tax has been in the news lately because concerns are starting to grow as to whether the tax deal signed last year by 130 countries, including New Zealand, is actually going to be implemented. Inland Revenue currently has a major issues paper out on the topic, submissions on which close next week.

The Revenue Minister David Parker was speaking to the Finance and Expenditure Committee this week. From his reported comments he expressed some concern about whether the so-called Pillar One and Pillar Two proposals would come into effect.

But the need for those rules to come into place was underlined, in my view, by Google New Zealand’s December 2021 results, which were published on the Companies Office website yesterday.

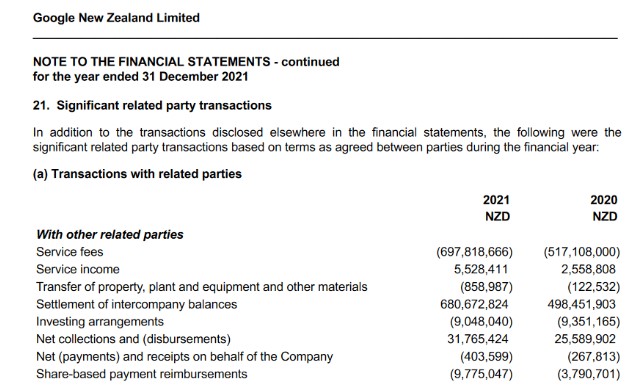

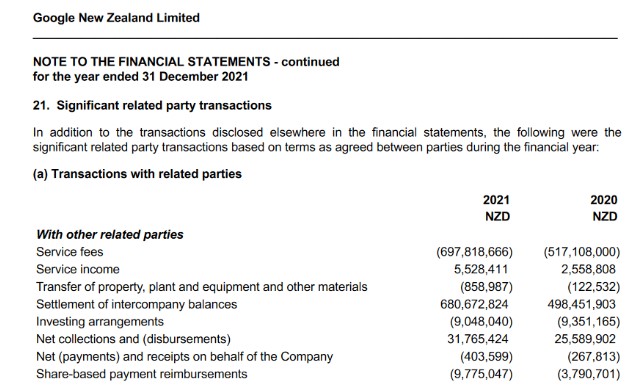

Google’s revenue, as reported for income tax purposes, rose from $43.8 million in 2020 to $57.8 million in 2021. Its pre-tax profit went from $10.2 million to just under $18 million, and Google ended up with $3 million corporate income tax for the year ended 31st December 2021 once you take into account timing adjustments.

But what’s really interesting when you drill into the financial statements is what’s going on with related parties. The notes to the financial statements disclose the transactions with the related parties. We can see that the service fees Google New Zealand paid to other overseas companies in the Alphabet Group (the owner of Google) in the year amounted to $697.8 million. Now that’s up from $517.1 million in 2020.

This gives you an indication of the level of advertising revenue activity actually going through Google New Zealand. These service fees are perfectly valid although Inland Revenue will no doubt have its transfer pricing specialists run their eye over these fees. There may be some queries going on, we don’t know as the accounts are silent on that. But the level of activity here indicates how much advertising revenue is going through Google New Zealand and how much is being paid offshore as a legitimate deduction for income tax purposes.

But it shows the arrangements that are in place that enable substantial amounts of advertising revenue pass through Google New Zealand, but it finishes up paying only $3 million in income tax. It does pay a substantial amount of GST, according to the financial statements the GST payable has on 31st of December 2021 was just over $21 million. This would indicate a very significant level of taxable supplies deemed to be made in New Zealand. But it’s likely that the GST Google New Zealand is charging is probably also being claimed by New Zealand businesses. In other words, it’s largely a net zero-sum game.

Anyway, my hope is that the international tax deal will go through. There is politics being played in America, no surprises there, but also in Europe where the EU is trying to get unanimity amongst its 27 member states. It’s a question of “Watch this space” for developments. But Google gives you an example of why we would want to know more about what’s going on here and hope the deal goes through.

International Tax was a topic at the International Fiscal Association Conference held last week. As this was held under Chatham House rules, I can’t really say too much about it, but there were a lot of interesting topics from excellent presenters and a fairly lively debate on a number of topics including international tax.

Another featured topic was the controversial dividend integrity and personal services attribution rules, and that had probably the liveliest debate. The key takeaway for me from that particular session was a comment that these proposals show the limits of what can be done in the current tax system without a capital gains tax system. Because when you sit back, the cause of controversy there was that there were potentially capital transactions happening, which would be tax free under our present regime. However, Inland Revenue was looking at this and saying, “These transactions mean tax is not being paid”.

Now, the other take away I had, is that this tension is just getting worse and isn’t going to be resolved until the matter of taxing capital gains is resolved as well. I’m on record as supporting a capital gains tax. It probably is needed not so much as a revenue raiser but to preserve the integrity of the tax system. Because when you have such a hole in your base, it will be exploited. Incidentally, this means you can’t really argue, you’ve got your tax system is broad based. There are measures in place to deal with this, but we are talking about patches upon patches.

And so, this debate, which is going on for all the time I’ve been here in New Zealand but has intensified in recent years, is going to continue. At some point the issue will have to be grasped and resolved. No, it won’t be terribly popular. But if you want to maintain the integrity of the tax system, it seems to me that some form of capital gains tax is pretty near inevitable.

Well, that’s it for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time Mānawatia a Matariki, enjoy Matariki!

7 Jun, 2022 | The Week in Tax

- New details around the Cost of Living Payment, wealth taxes and windfall profits taxes

- Car travel reimbursement rates

- Longer-term perils of cheating on GST transactions

Transcript

Inland Revenue has now released more details about the requirements for receiving the Cost of Living Payment and how it will be administered.

Firstly, there is no need to apply for the payment. It will be made automated automatically if a person is eligible. The key thing is to make sure that Inland Revenue does have your correct bank account into which the payments can be made. Apparently, Inland Revenue only has records for just over 79% of potentially eligible people

As previously advised, they were going to be three payments, which will be made on the 1st of August, 1st of September, on the 3rd of October, the first working day of that month. Each payment will be made after a check of a person’s eligibility.

To summarise, a person is going to be eligible to receive this payment if:

- they earned $70,000 or less for the year ended 31 March 2022;

- are not eligible to receive the winter energy payment which means they are either receiving New Zealand super or a qualifying benefit;

- they’re aged 18 or over;

- are both a New Zealand tax resident and present here and are not in prison or deceased.

People receiving student allowances will get the payment if they meet the other eligibility requirements.

So the key thing, as previously advised, is to have had your income tax assessment made for the year to March 2022. So that means either Inland Revenue has auto-assessed it or you have filed an individual tax return which has been processed.

Eligibility is measured before each payment, so it’s quite possible that a person may not be eligible for one payment, but becomes eligible for a subsequent payment. For example, the person turns 18 after 1st of August, so will be eligible to receive the second and third payments. Alternatively, the person receives one payment but then starts receiving New Zealand Super, in which case they’re no longer eligible to receive the second and third payments.

The payment is not taxed and does not count as income for:

- child support

- Working for Families

- student loans

- benefits and payments from Work and Income.

Inland Revenue has also said it will not use the payment to pay off any debt a person may have with it, which is a welcome step.

Inland Revenue will keep checking eligibility until 31st of March 2023, although you will have until 31st March 2024 to provide bank account details to Inland Revenue. The Inland Revenue website has some useful examples of when persons are eligible and how they will administer it.

Travel claims by car

Briefly, Inland Revenue have also published the kilometer reimbursement rates for the 2021-2022 income year for business motor vehicle expenditure claims.

These rates may be used by businesses and self-employed to calculate the available tax deductions for the business use of a vehicle. They’re also often used by employers to reimburse employees for use of their own car for work purposes.

As you might expect rates have been increased but not significantly from previous years the tier one rate is now $0.83 per kilometer for the business portion of the first 14,000 kilometres traveled by the car including private use travel (an often-overlooked point).

Incidentally, the difference between the Tier 1 and Tier 2 rates is because the Tier 1 rate is a combination of the vehicle’s fixed and running costs and the Tier 2 rate is for running costs only.

Windfall profits taxes? Wealth taxes?

Talking about cost of living payments, over in the UK the government there has also announced some cost of living support measures. The interesting thing is that to pay for the £15 billion package it’s announced a 25% energy profits levy on the profits of oil and gas companies operating in the UK and on the UK continental shelf.

This windfall tax will apply to profits arising on or after 26th May this year. It’s a temporary levy which will be phased out when oil and gas prices return to “historically more normal levels” with the expectation that the tax will lapse after 31st December 2025.

The UK actually has a history of windfall taxes: that well-known tax cutter Margaret Thatcher imposed one on banks back in 1981 (I dare say a similar tax here would be popular) and in 1997 Tony Blair’s newly elected Labour government raised £5.2 billion on the increased values of previously privatised companies to fund a welfare-to-work scheme.

The idea of a windfall tax here in New Zealand has never been seriously discussed in recent years but it crossed my mind when the issue of the taxation of billionaires came up following the release of the NBR rich list earlier this week. There are now 14 billionaires in New Zealand with an estimated aggregate wealth of around $38 billion. Inevitably the question of how much tax they pay was raised. I repeated my longstanding view that some change to our tax mix to include greater taxation of capital is both necessary and inevitable.

Talking about it with The Panel on RNZ, Max Harris asked about a wealth tax. My favoured response is the Fair Economic Return Professor Susan St John and I have suggested. But there’s possibly an argument for a one-off wealth tax to capture the huge largely untaxed growth in property values over the past two years as a result of the Government’s initiatives around COVID.

If something like that happened, my belief is that any funds raised there should be used to speed up the transition to a low emissions economy, for example, by providing greater subsidies for lower emission vehicles and assisting communities to relocate from areas threatened by climate change. This is something I think we were going to see a lot more of, and particularly once (not if) insurers start withdrawing cover.

In the UK, a Wealth Tax Commission suggested in December 2020 that a one-off wealth tax was feasible. That proposal was for a one-off wealth tax payable on all individual wealth above £500,000, which at 1% a year for five years would raise £260 billion. The tax by the way, was to help restore the UK government’s finances in the wake of the COVID 19 pandemic. The proposal hasn’t gone anywhere at the moment, but it is an example of some of the current thinking we’re seeing around the topic of taxing wealth.

As I’ve said before the debate around taxing wealth will continue to run. In my view when you examine Treasury’s 2021 He Tirohanga Mokopuna statement on the long term fiscal position, tax increases of some sort seem inevitable.

The perils of tax short cuts

And finally, this week, another reminder about the perils of taking short cuts around tax. I got a call from a somewhat alarmed tax agent trying to unwind a GST scenario. This appears to have arisen because someone tried to avoid being GST registered in relation to a lease of land to a related party. At the same time that related party claimed GST in respect of a school building from which it runs a school. The issue has now boiled over because the school business is up for sale and it’s not clear who owns the building the school will operate out of, whether a proper lease is in place for those buildings and if so, what is the annual value of that lease? The result is that the potential sale of the business may not proceed.

I’ve seen similar impacts where a business hasn’t booked cash sales to evade GST & income tax, only to find that either when the business is up for sale, purchasers don’t have a true picture and the sale price disappoints. Alternatively, the owner applies for lending but because they have been suppressing their income, they haven’t got the necessary level of income. The lesson in all these cases is the same. Short term decisions to avoid tax consequences can often have longer term and much more adverse implications.

And on that note, that’s all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

23 May, 2022 | The Week in Tax

So, much as expected, no headline tax surprises again. We will have to wait until next year for any changes to tax thresholds Interestingly, the matter of increasing thresholds was not raised with the Finance Minister during the Budget Lockup, although he addressed that in part by arguing the cost of living payment was better targeted than a general across the board threshold adjustment.

Transcript

The ongoing (but not quantified) effect of fiscal drag means tax revenue for the year ending 30th June 2022 is expected to cross the $100 billion mark for the first time to a total of $103.8 billion. The main growth is from PAYE, forecast to rise by $3.7 billion to just under $42 billion and corporate income tax projected at $16.7 billion up nearly $2 billion. (That includes an estimated $322 million from the New Zealand Superannuation Fund, down an eye-watering $1.8 billion from 2021 – illustrating the impact of the recent turbulence in financial markets, thanks Vladimir). GST receipts are also up over $1.2 billion from June 2021 to an expected $25.7 billion.

The big announcement was the cost of living payment of $350 in three monthly instalments starting 1 August (about $27 per week). The payment will be available to individuals who earned less than $70,000 per annum in the past tax year, and not eligible to receive the Winter Energy Payment – approximately 2.1 million New Zealanders. It will cost an estimated $814 million.

Eligibility for this payment will be determined by a person’s income for the March 2022 year. Most of those eligible will have their income determined by Inland Revenue’s auto-assessment process which is now underway. The payment is therefore an incentive for eligible taxpayers who have to file a tax return to do so as soon as possible. Not entirely sure my tax agent colleagues will welcome that development.

The temporary reductions in Fuel Excise Duty and Road User Charges will be extended for a further two months at an estimated cost of $235 million. Half-price public transport is also extended for a further two months and will be make permanent for 1 million Community Services Cardholders which seems a good initative. Extending half-price public transport should be a measure which helps in reducing emissions.

Small businesses are an important part of the economy, so the proposed Business Growth Fund is an interesting move. The Crown will initially invest $100 million alongside private banks. Through the Fund the Crown will take a minority interest in SMEs where equity finance would be more appropriate than debt finance.

The intention is for the BGF to be an active investor providing growth capital, but it would not take a majority position although it would have a seat on the board. It’s an interesting development based on similar initiatives in the UK, Ireland, Canada and Australia so we will watch with interest. Personally, I think a permanent iteration of the Small Business Cashflow Scheme would be a good long term initiative.

There’s a small but welcome change to Child Support rules with the scrapping of the rule under which the Crown retains the Child Support payments of beneficiary sole parents. From 1 July 2023 those Child Support payments will be treated as income.

Although there were no specific funding initiatives for Inland Revenue it’s interesting to dig into the formal Vote Revenue Appropriation. The total 2022/23 appropriation for “Services for Customers” is $721.8 million, an increase of $120 million or near 20% from the 2021/22 appropriation of $600 million. This increase is mainly due to re-categorisations and transfers including a transfer of $55.8 million for ongoing operating costs arising from the Business Transformation programme.

Breaking it down there’s an extra $9.4 million for investigations and over $37 million for tax return processing, both of which reverse falls in funding in the 2021/22 appropriations. The biggest increase though is for Services to Ministers and to inform the public about entitlements and meeting obligations which is up $56 million or 21,7% from 2021/22. I expect some of this will be to remind people of their eligibility for the cost of living payment, but there may also be initiatives about tax obligations and the cash economy.

In summary, a very boring Budget from a tax perspective although leaving income tax thresholds unchanged for another year is now something of a political hot potato for the Government. The intention appears to be to address this in next year’s Budget which is of course an election year. We shall wait and see.

16 May, 2022 | The Week in Tax

- Inland Revenue consults on the OECD Pillar Two GloBE rules for New Zealand and has a new CEO

- Working for families consultation

- A look ahead to next week’s Budget

Transcript

Last year, the G20 and OECD agreed on a two pillar solution to the issue of international taxation and in October 2021, this two pillar solution was endorsed by over 130 countries in what is deemed the OECD sponsored Inclusive Framework. New Zealand was one of the signatories to that endorsement.

Inland Revenue has now released an issues paper looking at how these so-called GloBE rules (Global anti Base Erosion) would operate. Now as this is an issues paper it does not represent government policy. Instead, Inland Revenue is putting the matter out for consultation because the government has not yet decided whether in fact it will adopt Pillar one or Pillar two, and in fact is also not ruled out adopting a digital services tax. So, this issues paper is a basis for formulating policy to be taken to the government. It therefore partly represents a background paper, but also explains how the rules would operate.

To recap, the purpose of the GloBE rules is to ensure that affected multinational groups (MNEs) pay at least a 15% tax on their income in each country where that income is reported for financial reporting purposes. It’s initially intended to apply to MNEs if their annual turnover exceeds €750 million per annum in two of the last four years. It’s estimated to initially apply to approximately 1500 multinational groups worldwide, of which approximately 20 to 25 are based in New Zealand. The OECD estimates that the global revenue gains under Pillar two will be in the order of US$130 to $185 billion annually, which represents about 6 to 7.5% of global corporate income tax revenues.

The paper is split into three parts. Part one is a general overview with Chapter one giving the background on the initiative and on its intended purpose. Chapter two has a summary of the rules in general, and chapter three raises the question which may seem odd ‘Should New Zealand adopt the GloBE rules?’ Part two then explains the proposed rules in more detail, and part three then covers all specific issues form a New Zealand perspective,

The paper is quite comprehensive running to 84 pages so there’s quite a bit of detail to go through here. Fortunately, we’ve got quite a good period of consultation because consultations open until 1st July. Normally we only have a 4-to-6-week period for consultation.

Now, as I said, what may seem a rather strange question is whether New Zealand adopts the rules is a key part of the consultation. The official view is that if a critical mass of countries do adopt or are likely to adopt the global rules, then officials would recommend New Zealand take steps to join them. Officials take the view that they see no benefit, or not much benefit, in New Zealand going it alone and adopting global rules without a critical mass.

Three questions are put to submitters on this issue.

- Do you think New Zealand should adopt the GLoBE rules if a critical mass of other countries does or is likely to do so?

- Do you have any comments about what a critical mass of countries would be?

- Do you have any comments on the timing of adoption?

Now my response would be ‘yes’, New Zealand should, because it’s part of being a good corporate global citizen. Obviously, there’s a likelihood of additional revenue gains, although according to the paper the potential gains are said to be modest.

What would represent a critical mass of countries? Well, that’s a difficult one. I guess the key country to being involved would be the United States. But as you know, they’ve always ploughed their own furrow on this matter. And politics are such that the Midterm Congressional elections may mean that the Republicans are able to block change on this. Like we’ve said in the last couple of weeks when discussing possible wealth taxes, it all comes down to politics. But certainly, if the majority of the 130 countries that have endorsed it do sign up, you’d think that we would want to go ahead even if the United States didn’t. But it would be disappointing, obviously, if America did not.

And then about the timing of these rules this is actually quite tight. Under the Pillar 2 proposals, there is an income inclusion rule which will impose the top up tax on the parent entity in a multinational group. Now under the OECD timeline that should be enacted during 2022 in order to be effective in 2023. And then there’s another part, the under-taxed profits rules, which should come into effect in 2024. I think that timeline is pretty optimistic. I would be expecting to see it slide out a bit, but who knows what the international mood is on this? Maybe progress happens much more quickly than we expect

Anyway, this is an important paper and there’s a lot to consider here. Maybe the gains might be modest, but it is part of the change in international taxation, which will have ripple effects all the way through the tax world

Issues for the recycled ‘new’ IRD CEO

Moving on, Inland Revenue has a new CEO, Mr. Peter Mersi, who has been appointed for five years with effect from 1st July. He takes over from Naomi Ferguson, who has been the CEO of Inland Revenue for the past 10 years and has seen the department through the Business Transformation project.

As it transpires, Mr. Mersi, who is currently the CEO at the Ministry of Transport was a Deputy Commissioner at Inland Revenue at the start of the Business Transformation Project back in 2012. And prior to that he also spent some time at Treasury where he was the Deputy Secretary, Regulatory and Tax Policy branch.

So, although he’s coming from a Ministry of Transport background, Inland Revenue is not unfamiliar territory for him. It will be interesting to see how the organisation develops under his direction and governance of whichever hue will want to cash in on the benefits of the Business Transformation project.

And of course, one of the areas that he and the department will be involved in will be the implementation of law changes such as the proposed GloBE rules we’ve been talking about. And one thing he will need to ensure alongside the Minister of Revenue is that the Department continues to remain adequately funded. And I point to the troubles of the United States Internal Revenue Service, which has had its problems with enforcing the controversial FATCA rules which I mentioned a couple of weeks back.

It seems from another report from the United States Treasury Inspector General for Tax Administration, that the IRS is struggling with funding and its enforcement is falling off as a result. This led the Inspector General to comment. “The trending decline in enforcement activity is likely causing growth in the overall Tax Gap as taxpayers are less likely to be subject to an examination.”

The numbers of what the IRS call examinations, what Inland Revenue terms risk reviews, have fallen by between 55% and nearly 60% in the past five fiscal years. It bears to keep in mind that our IRD is actually a very efficient organisation, which, to borrow a phrase, you mis-underestimate at your peril. But as the example of the IRS shows, if funding falls away the opportunity opens up for the unscrupulous to evade tax.

‘Consulting’ on WfF

There’s a lot going on at the moment, partly because we are in the run up to the Budget next week. Something that’s been underway is for a few weeks now is a public consultation on Working for Families tax credits. This is being handled by the Ministry of Social Development and Inland Revenue. It’s part of a government review of working for families.

It’s interesting to look at what we’re being asked here compared with a typical Inland Revenue consultation, which has a lot more detail and is quite focussed.

The basic question that’s been posted is what do you like about Working for Families? Is there anything you want, don’t want changed? How do you think it can better support low income working families, families changing hours shift, working part time hours and those with care arrangements? What concerns do you have? And if you could change one thing about working families, what would it be? Now those are a set of questions are really not directed at professionals, but I hope that it gets a lot of good buy-in from the public.

In relation to concerns which I would raise one would be about how accessible it is. As my colleague, Professor Susan St Jones has pointed out, the in-work tax credits are a problem because they’re not available to everyone. And then there is the abatement rates and the resulting very high effective marginal tax rates which people on Working for Families suffer. They actually have the highest effective marginal tax rate of any taxpayer in the country. So those are areas where I think should be the focus for improvement.

Tinkering with WfF

Speaking of Working for Families, the Budget is next week, and I expect that there will be some tinkering going on with Working for Families based around the background papers to the consultation. They seem to be pointing towards an increase in payments being announced or being implemented in the Budget. Of course, with the cost-of-living issue, the Government probably will be keen to do something on that matter.

New Zealand budgets are actually really quite boring from a tax perspective. They’re not like budgets I used to see in Britain, for example, where tax measures came out from left field and were not always very coherent in what they’re trying to do. They certainly contained a lot of tinkering which kept us on our toes.

We’re not likely to see much like that next week. Bill English was one for sneaking in quiet tax increases or changes such as imposing employee contribution superannuation tax on KiwiSaver employer contributions, or withdrawing smaller allowances that were meant for children, the so-called “Paper-boy tax”.

One tax issue which has been hammered away at in recent weeks is fact that the tax thresholds have not been increased or adjusted since 2010. Eric Crampton of the New Zealand Initiative had a look at this. He considered what had gone on with the thresholds and where as a result the average tax burden had shifted. He made some educated guesses as to where those thresholds should be now.

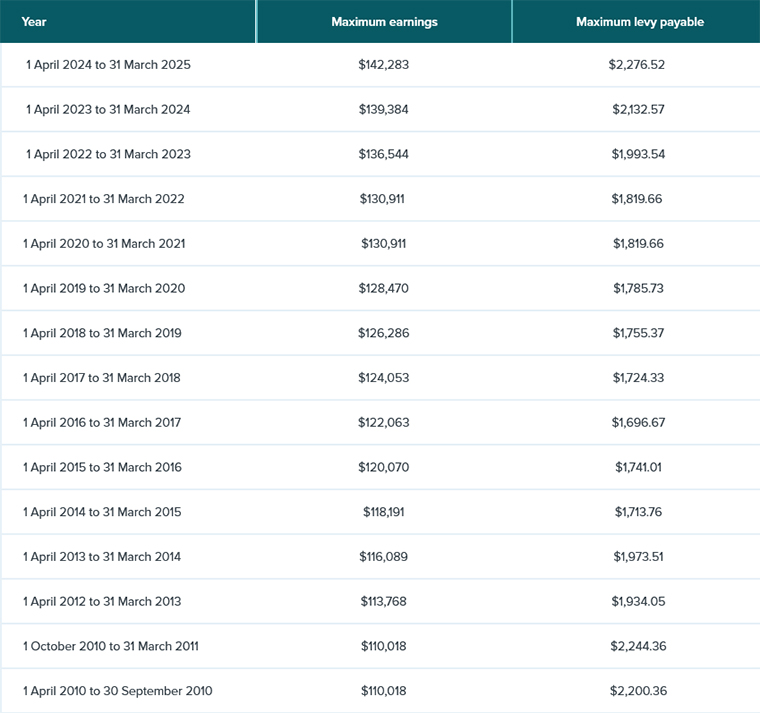

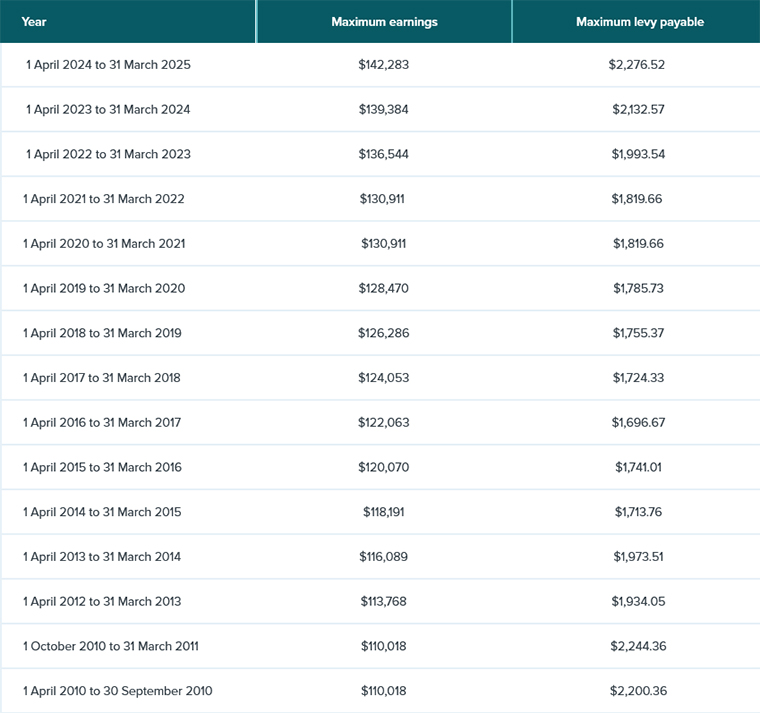

But there is actually some information floating around which would give us a more reasonable direction of what the thresholds should be if they had tracked along with inflation. These are the ACC thresholds for the upper limit of earnings on which the maximum 80% of income that may be paid out under a claim is based.

Back in 2010, when income tax rates were last adjusted, the ACC threshold was $110,018. As of 1st of April this year, it’s now $136,544. And so that increase over time over the period represents just over 24.1%.

So if you applied that 24% increase to the tax thresholds, this would be the position

| Tax rate |

Current thresholds |

Adjusted thresholds |

| 10.5% |

$0-$14,000 |

$0-$17,375 |

| 17.5% |

$14,001-$48,000 |

$17,376-$59,573 |

| 30% |

$48,001-$70,000 |

$59,574-$86,870 |

| 33% |

$70,000-$180,000 |

$86,871-$180,000 |

| 39% |

>$180,000 |

$180,000 |

(Note I’ve not adjusted the $180,000 threshold as it has only been in effect since 1 April 2021).

So that gives you some indication of what’s been going on. I think Governments of both sides have been, quite frankly, underhand in not adjusting for inflation. It isn’t just the tax thresholds, they’ve also done it in their other areas, such as Working for Families, where the threshold for abatement kicking in at $42,700, which is well below the $59,500 odd I suggested would be the upper limit to the 17.5% threshold. It will be interesting to see if anything is said or done about tax thresholds next week, but it’s a point that will certainly be addressed one way or another before next year’s election.

Talking of inflation, Inland Revenue has released a CPI adjustment to the square metre rate for dual use premises. This is where you can base a deduction for home office on a square metre rate. This has been set for the year ended 31st March 2022 at $47.85, which has been adjusted for 6.9% inflation in the 12 months to March 2022. So that’s a little useful thing to keep in mind when you’re preparing tax returns for clients who work from home or have a home office.

Rich entertainers avoiding tax

And finally, what have the Rolling Stones got to do with tax? Well, apparently this week is the 50th anniversary of the release of their magnum opus, Exile on Main Street. And the title is a deliberate reference to the fact that the Rolling Stones in 1971 decamped to the south of France because they were in trouble with UK tax authorities and facing very significant tax bills. At that stage, tax rates in the UK in some cases topped out at 98%.

So they went to France to record this album which is regarded by many as their creative peak. There’s a great story in The Guardian about what happened, including this fantastic quote ‘People took so many drugs, they forgot they played on it’.

Tax troubles and musicians go hand in hand. There are plenty of stories about various musicians and actors who’ve got themselves into terrible trouble with tax authorities and either finished up in jail, such as Wesley Snipes, or decamped elsewhere, like the Rolling Stones.

Well, that’s all for this week I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

9 May, 2022 | The Week in Tax

- Inland Revenue gets ready for tax filing season and puts recipients of COVID-19 support payments under the microscope

- Insights into the composition of the Top 0.1%

Transcript

Inland Revenue is currently gearing up to begin processing 31st March 2022 year-end tax returns and personal tax summaries. Starting later this month it will be issuing automatic income tax assessments for most New Zealanders. But in preparation for that it has been giving updates to tax intermediaries on particular matters of interest. And a couple of notifications in the latest release caught my eye.

Firstly, there is form IR833 bright-line residential property sale information return which is required to be completed whenever a transaction which is subject to the bright-line test has taken place during the tax year. What Inland Revenue is saying is the form will pop up in a client’s return if it thinks the client has made a bright-line sale. And it will also pre-populate the information on the form, including the title number, address, date of purchase and date of sale.

This illustrates something we’ve spoken about many times, the level of information that’s available to Inland Revenue. It’s actually very good, in my view, that Inland Revenue is proactively putting in this information and saying, “Well, we know this.” I am aware that a few tax agent colleagues have had some very interesting discussions with clients where this notification has popped up and it’s the first the accountant or tax agent has heard about the matter.

As of last income year, all portfolio investment entity (PIE) income must be included in individual income tax return. Inland Revenue will pre-populate returns with the relevant data but not all returns will contain all the PIE information until after the PIE reconciliation returns and filed on or before 16th May.

In the meantime, Inland Revenue has reminded tax agents about this and advised not to file March 2022 tax returns either through Inland Revenue’s myIR or other tax return software until after that date unless you know for certain that the client is not a KiwiSaver member and does not have any other PIE income. That’s something to keep in mind because I’m sure some tax agents will be under pressure from clients who think that they are due a refund but haven’t factored PIE income into the equation.

What’s also going into tax returns is details of payments received under the Wage Subsidy Scheme, Leave Support Scheme and Short-Term Absence Payments. All these are what are termed reportable income. Consequently, tax returns will be required to be filed by recipients and there is going to be an information request in relation to these as part of the tax returns. Yet again, this is another example of how MSD and Inland Revenue shared the relevant information.

Inland Revenue administers the highly successful Small Business Cashflow Scheme which gave out loans to small businesses at the start of the pandemic. The initial two-year interest free period is now expiring for some businesses so repayments will be required to start shortly.

Talking about COVID-19 support, the numbers involved were quite extraordinary: apparently MSD has so far paid out $19.28 billion in the various subsidies and leave support payments. And Inland Revenue has paid out another $3.95 billion including Resurgence Support Payments and COVID-19 Support Payments.

The Resurgence Support and COVID Support payments were paid to businesses to help them pay business costs and therefore GST output tax is required to be returned on those receipts. Where the funds are used on relevant expenditure GST input tax credits may be claimed.

Inland Revenue has started checking that those who claimed the support payments were entitled to do so and assuming they passed that hurdle, they then applied the expenditure as was intended, i.e. business expenses. And I’m hearing stories from tax agents of very thorough investigations combing through the bank accounts of the businesses and individuals who received these payments. Some have resulted in “Please explain” enquiries coming back where apparently personal expenditure has been identified such as in one case where an EFTPOS payment for McDonald’s was identified.

This is yet another warning for those who applied for COVID support payments they either weren’t entitled to or misapplied the payments that they may find themselves under the gun from Inland Revenue. So far Inland Revenue have decided to proceed with 15 criminal charges and court proceedings are already underway for seven. In addition, as a result of investigations and some self-reviews the repayments made to date to MSD are over $794 million. ,

All of this is a timely reminder that with things calming down a little bit and so coming back to a stability, Inland Revenue is now applying itself back to its core business activities of investigations and reviews. Expect to see more news of these reviews and I think we may see one or two interesting cases emerge.

What Parker means

Moving on, last week’s speech by the Minster of Revenue David Parker quite predictably caused a stir and there was plenty of politicking over whether or not the proposal would lead to the introduction of wealth tax at some point and whether the Prime Minister would stand by her comments it wasn’t going to happen, the usual politicking etc. etc.

Subsequently, last Sunday I appeared together with Jenée Tibshraeny of www.interest.co.nz on TVNZ Q&A to discuss the implications of Mr. Parker’s speech. Off-air Jenée made a point echoed by several colleagues commenting on a LinkedIn post that the Tax Principles Act, if enacted, would work both ways. It wasn’t just a tool for saying, “Well, we need to introduce a particular type of tax.” It could equally stop a government introducing changes because it contradicted the agreed principles.

It’s a very valid point and it’s actually one of the sources of disagreement with the introduction of the 39% tax rate, because it affects the integrity of the tax system and the idea of administrative efficiency. Furthermore, it could apply to the measures relating to personal services, income attribution, which also I discussed last week. The argument here is that these rules would breach potential principles of horizontal equity, in that people earning similar amounts, may pay different rates of tax because of variations in the tax treatment.

Under the microscope

Other interesting insights have emerged in the wake of the speech. The Revenue Minister pointed to the lack of information about the high wealth individuals which prompted the research project into high wealth individuals would have caused some controversy. And earlier this week journalist Thomas Coughlan in the New Zealand Herald commented on an interesting briefing note about the project he’d obtained under the Official Information Act.

The briefing note looked into the representativeness of the wealth project population, and whether the high wealth research project population effectively represented the 0.1% of the wealth distribution of the population and the economic sectors they operated.

The note explains that the group that was selected for the project was based on

…environmental scanning undertaken by Inland Revenue over the past 20 plus years. This environmental scanning involved monitoring large transactions or other indications that individuals had significant wealth holdings using both public information and the department’s tax data. …

The briefing notes the selection is non-random and it is not expected to be representative of the population of all high wealth individuals. It is therefore quite possible that there may be high wealth individuals missing from the group “and there is no way to definitively state that the selected group is representative of the top 0.1% of the wealth distribution.”

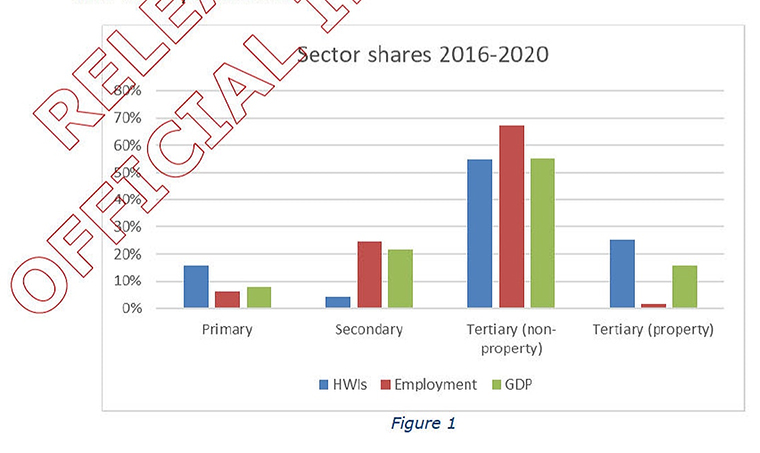

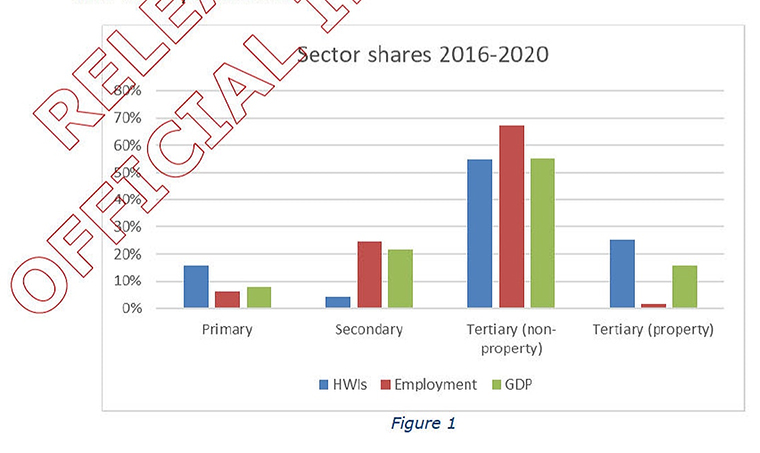

Having included that caveat, the note had some interesting analysis of what they had found so far. And it had a diagram comparing the share of GDP and employment to the main activities of high wealth individuals on the basis that you could reasonably expect the share of the industries represented by the individuals to be broadly similar to the spread of industries and activities in the New Zealand economy.

But it turns out that wasn’t the case. And in particular, relative to employment and GDP shares, the property and primary sectors are disproportionately represented in this project. The number of high wealth individuals in the primary sector is approximately 15%, even though the sector represents less than 10% of GDP. In relation to the property sector the proportion of high wealth individuals is 25%, compared with approximately 15% of GDP.

However, as the briefing note commented, there are clear reasons why there is this discrepancy “…there are certain activities (investment, property ownership) that would be expected to have greater involvement by those accumulate significant wealth….”

Incidentally, the primary sector and particularly the property sector, are sectors where existing tax rules such as the Bright-line test and the associated person rules work already to tax capital transactions. So that’s another reason why Inland Revenue may have better data on this particular group of wealthy individuals than others that work in the service economy.

Anyway, it will be interesting to see what further insights emerge from this high wealth research project. Meantime, no doubt the debate over how that data may be applied and the question of the taxation of capital and wealth will continue to rage, particularly in the run up to next year’s election.

Getting ready for tax filing season

And lastly this week, the final instalment of Provisional tax for those with a 31st March year-end is due on Monday. The key point here is taxpayers whose residual income tax liability for the year is expected to exceed $60,000, should ensure that they pay sufficient provisional tax to cover that total liability for the year. Otherwise, use of money interest, which is increasing to 7.28%, will start accruing together with potential late payment penalties.

As always, if taxpayers are struggling to meet payments in full, then either contact Inland Revenue to let them know and start to arrange an instalment plan. You will find that they are generally cooperative on this. Alternatively, consider making use of tax pooling to mitigate the potential use of money, interest and late payment penalties.

Well, that’s all for this week I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!